Message from Group CEO

Realizing Growth with Quality

Focusing on output that makes a lasting impression on one’s memory rather than on the record books. This was my response to a query I received during an internal seminar geared towards the preparation of the new Medium-Term Management Plan (“new Plan”). An employee wanted to know about the specific actions we needed to take for SMBC Group to realize “Growth with Quality.” A financial institution’s business is built upon customers’ trust. Trust is not won simply because of compliance. Trust is built and maintained as the result of our daily efforts, for example reliable operations and IT systems, and proposals that accurately address customers’ needs. The desired results will naturally come if we look beyond growing our financial results and focus on engaging in frank communications with customers and putting forth optimal solutions. What do we need to do in order to realize such “Growth with Quality?” I shared this question with SMBC Group employees, and we have put our heads together to come up with the answer.

In the previous Medium-Term Management Plan (“previous Plan”), we operated under a challenging and uncertain business environment, starting with COVID-19’s rapid spread throughout the world, and followed by Russia’s invasion of Ukraine, the sharp depreciation of the Japanese yen, the transition from deflation to inflation, and the failure of several western financial institutions. However, regardless of the business environment, we steadily carried out our various initiatives and succeeded in exceeding our original targets for consolidated net business profit and bottom-line profit by significant amounts. In addition, we laid down the cornerstones for sustainable future growth in our Asia Multi-Franchise Strategy and overseas securities business.

Having said this, challenges also became clear. Businesses which we had viewed as being part of our strength suffered a significant downturn during the pandemic, and we were faced with the need to transform our business portfolio into an even more resilient one. Furthermore, the enhancement of corporate infrastructure is our top priority given that compliance issues occurred as we were in the process of building a Group-based governance framework.

Our business environment continues to undergo significant change. Deglobalization and decoupling, the end of monetary easing overseas, the further acceleration of digitalization, and the mitigation of climate change are just some examples. Individual values are becoming increasingly diverse, and more people want consumption to include a story of resolving social issues. Technology continues to evolve at a remarkable speed, and AI can now be used to create complex and natural sentences. We, the users, must make sure that we are aware of the various risks when we use such technology.

No Change to Our Strategy. Ascertain the Circumstances and Revise Our Tactics

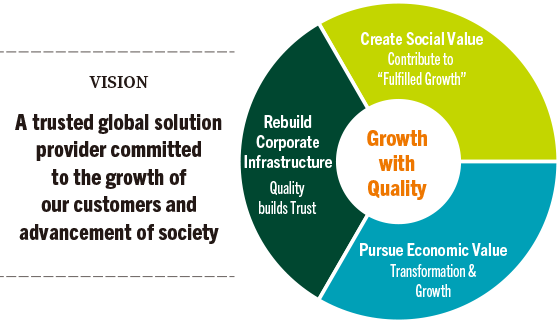

As you can see, we are in the midst of a paradigm shift. However, there is no change in the path we must follow. Our Vision, “A trusted global solution provider committed to the growth of our customers and advancement of society,” was designed to illustrate SMBC Group’s path to sustainable growth. Not only must we further develop our capabilities in the financial sector, but we must also enhance our ability to provide high-quality solutions in non-financial areas on a global basis, regardless of the changing business environment. We will take concrete steps towards the realization of our Vision.

On the other hand, the paradigm shift also offers us a chance to break free of traditional restraints and unlock a new future. Even though we are at a major turning point in history, we will continue to strongly push forward in the right direction while revising our tactics in a timely manner when required. I believe that the tenacious repetition of such efforts will allow us to realize “Growth with Quality.”

It is with this goal that SMBC Group established the new Plan: “Plan for Fulfilled Growth.” I first used the term “Fulfilled Growth” in Annual Report 2022. I believe that “Fulfilled Growth” refers to a state in which people feel happiness and fulfillment by being part of a society where we experience economic growth while also working together to address social issues. We desire to contribute to an age of “Fulfilled Growth” by fulfilling our responsibilities as a corporation and meeting our stakeholders’ expectations. “Plan for Fulfilled Growth” is a reflection of this desire.

The new Plan has three basic policies: “Create Social Value,” “Pursue Economic Value,” and “Rebuild Corporate Infrastructure.” I will go into detail regarding each basic policy.

Placing the Creation of Social Value as a Cornerstone of Our Actions

SMBC Group will contribute to the realization of “Fulfilled Growth” in our society by leading the resolution of social issues and the creation of economic growth based on the philosophy of creating social value that has been passed on from our forebears at Mitsui and Sumitomo.

“Building an Era of Fulfilled Growth.”

In Annual Report 2022, I used this phrase to describe my aspiration for the next 30 years of my life, a period which follows the first 30 years represented by “growth” as it overlapped with an era of high economic growth in Japan and the following 30 years which was represented by “stagnation” as this was a period in which Japan battled with deflation in the post-bubble economy era.

SMBC Group has established “We contribute to a sustainable society by addressing environmental and social issues” as part of our Mission, and we strive to realize our sustainability vision of “Creating a society in which today’s generation can enjoy economic prosperity and well-being and pass it on to future generations.” Based on this mindset, we have contributed to advancing the resolution of a wide range of social issues while adapting to the changing times.

However, the social issues that humanity faces keep growing, with global warming, violation of human rights, and the spread of poverty and inequality being some examples. Japan is no exception, as we have fallen into a period of extended economic stagnation, also referred to as the “Lost Three Decades,” leading to the further acceleration of falling birthrates, an aging population, and population decline.

Going forward, I believe that in addition to the pursuit of economic value, the generation of social value will gain even greater importance. Corporations that are unable to create social value will be viewed as no longer having the right to pursue economic value. Corporations that create social value are corporations that contribute to the fulfilled growth of humanity. As such, over the past year we gathered the views and opinions of our employees and engaged in repeated discussions at Management Committee meetings and Board of Director meetings regarding the actions SMBC Group must take.

We received some opinions stating that it was sufficient to create social value within the boundaries of our core businesses. However, society is what makes our business possible, and it is impossible for a corporation to realize sustainable growth if the society in which it operates does not also grow. This is why we established “Create Social Value” as a pillar of our business strategy. This reflects our commitment to anticipating future trends and to even proactively undertake activities that do not immediately lead to economic value. We established “Environment,” “DE&I/Human Rights,” “Poverty & Inequality,” “Declining Birthrate & Declining Population,” and “Japan’s Regrowth” as our new priority issues (materiality). We have set goals by which we can measure our success in resolving the priority issues and have integrated them into our business strategy.

Going forward, we will implement concrete action plans that are aimed at resolving social issues, and will create a framework in which employees that want to contribute to the improvement of society can freely take part. This will allow us to create an environment in which each and every one of our employees can enjoy high levels of job satisfaction while working towards the resolution of social issues. SMBC Group will contribute to the realization of “Fulfilled Growth” in our society by leading the resolution of social issues and the creation of economic growth based on the philosophy of creating social value that has been passed on from our forebears at Mitsui and Sumitomo.

Environment

To pass on a green earth to future generations. This is the mission and responsibility of the present generation.

SMBC Group has positioned climate change and other sustainability-related efforts as key initiatives in its business strategy. We are engaging in Group-wide efforts to support the smooth transition to a decarbonized society. In FY2023, we will establish 2030 medium-term GHG reduction targets for high GHG emitting sectors and strengthen our phase-out strategy for the coal sector. However, there is no simple, straightforward method of achieving carbon neutrality. In order to ensure a fair, orderly transition, the establishment of next-generation technology is indispensable, and we must engage in thorough discussions with customers to determine the realistic route and pace up to 2050 while paying careful attention to each country’s unique circumstances. As a proud member of the financial sector, SMBC Group will do its best to contribute to the securing of stable energy supplies and long-term decarbonization by supporting customers’ efforts to transition to a carbon neutral business model and develop new technologies.

Poverty & Inequality

Many of you may have felt that something was out of place when a financial institution such as SMBC Group established “Poverty & Inequality” as a priority issue (materiality). However, “Poverty & Inequality” is not an issue that is limited to developing countries. According to the Ministry of Health, Labour and Welfare, one in seven children in Japan are considered to be living in relative poverty. The so called “Chain of Poverty” in which the parents’ income disparity leads to their children’s income disparity is a serious problem. We must break this negative cycle. It is with this strong belief that I decided SMBC Group needed to go beyond the boundaries of our core businesses and tackle social issues, even though they do not immediately lead to economic value. SMBC Group will collaborate with Non-Profit Organizations and non-financial institutions to provide children with educational opportunities and opportunities to challenge themselves. Furthermore, in the Asian developing nations where SMBC has a presence, we will focus on promoting financial inclusion and the social independence of the poor through microfinance and consulting.

Strive to Realize Growth That Is Not Possible Via Existing Methods

In order to reach challenging targets that would not be possible only through existing methods, we will further evolve “Transformation & Growth” and pursue initiatives in the key strategic areas focusing on three perspectives.

While pursuing a bottom-line profit in excess of ¥1 trillion by the end of the next Medium-Term Management Plan (FY2028), we will target bottom-line profit of ¥900 billion in the new Plan as an interim goal in order to assert our standing as an international financial institution with a global network. As the first step, we will even more dynamically reduce our exposure to labor intensive, inefficient businesses; low growth/unprofitable assets; and assets for which the holding rationale has decreased due to changes in the business environment. We will realize resilient business operations and enhanced capital efficiency by optimizing our business portfolio as a result of proactively reallocating the management resources we have secured through the aforesaid efforts to investments for growth and strengthening corporate infrastructure. We will also pave the way to reaping the benefits of our Multi-Franchise Strategy and other investments for growth. In regard to cost control, we will focus on reducing base expense by transforming our domestic business model, consolidating domestic Group functions, and enhancing the efficiency of overseas operations.

However, this profit target does not reflect rising interest rates in Japan. If we see a material positive change in the domestic interest rate environment, we will make sure to capture the upside opportunities that arise and give serious thought to raising our target.

In order to reach challenging targets that would not be possible only through existing methods, we will further evolve “Transformation & Growth” and pursue initiatives in the key strategic areas focusing on three perspectives. First, in our domestic mass retail and small and medium-sized enterprise wholesale businesses we will expand our customer base in a more effective manner and establish a stable, efficient business model through comprehensive digitalization and the enhancement of our payment business. Second, we will transform the business model of our wholesale business targeting large foreign and domestic corporations to one that is not dependent on the expansion of balance sheet, strengthen our fee business by leveraging the capabilities of Group companies, and diversify our risk solutions line-up so that we can add value to customers while also enhancing asset efficiency. Third, in our overseas businesses we will continue efforts to optimize our portfolio and drive the growth of SMBC Group through our Multi-Franchise Strategy and the U.S. market, which is not only the largest in the world but also is expected to enjoy stable growth.

While the respective heads of our Business Units will provide details regarding individual strategies, I would like to take this opportunity to touch upon four key initiatives.

A Digital-Centric Mass Retail Strategy

We will carry-out comprehensive efforts to digitalize our mass retail business. We launched a new service called Olive in March 2023, and the application seamlessly brings together various functions, such as customers’ bank accounts, credit card settlement, loan, and securities. Olive offers users one-stop services regarding payment, receipt of salary, loan, and asset building. If customers use Olive as their main account to manage their household finances, not only will they enjoy greatly enhanced convenience, SMBC Group can hope for increased volume in deposits and usage of credit cards. Furthermore, we will strive to establish a dominant platform by growing our customer base through the merger of SMBC Group’s V Point reward program with Culture Convenience Club’s T Point reward program, which has more than 70 million members, and by expanding services through collaborations with SBI Securities, an online securities firm.

Enhancing the Global CIB Business

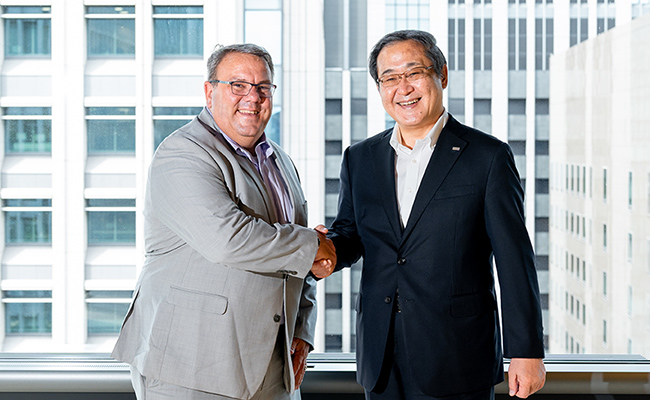

As the Global Corporate and Investment Banking (CIB) business remains a critical pillar of our wholesale operations, which targets large corporations, enhancing our overseas securities capabilities has been a significant challenge. The strategic solution to this was our alliance with Jefferies, a leading U.S.-based full-service investment bank and capital markets firm. In April 2023, we unveiled plans to enhance our strategic capital and business alliance with Jefferies. This partnership, initiated in July 2021, has now expanded into U.S. investment banking, home to the world’s largest capital markets and M&A businesses. As part of this expansion, we will integrate functions that overlap, allowing SMBC Group to focus on lending and debt capital markets, while Jefferies will focus on M&A and equity capital markets. In addition, SMBC Group and Jefferies will conduct joint marketing activities targeted at SMBC Group’s clients. Furthermore, we plan to increase our economic ownership in Jefferies to up to 15%. I am confident that both SMBC Group and Jefferies can experience growth by providing advanced financial services on a global scale and generating new business opportunities. This will be achieved by leveraging each other’s strengths in a symbiotic relationship. As true allies, we will deepen our partnership and build upon our track record of successful collaborations, standing by each other in both prosperous and challenging times, supporting one another on our shared journey towards success.

Jenius Bank ™

The launch of a U.S. digital banking unit was a strategy that came into being due to expatriates seconded to the U.S. directly approaching me regarding the matter during a business trip to New York. Employees who were passionately committed to seeing the project succeed joined together and the project team has now grown to 270 members. I am delighted that we were able to launch Jenius BankTM this year.

While there are many digital bank offerings/competitors globally, our focus is not on becoming a top player in a short period of time but on methodically implementing a flexible strategy and leverage cutting edge technology to provide a new financial experience. We will first focus on expanding our business infrastructure by developing a high-quality customer base and accumulating assets. The expansion of our business infrastructure will be accompanied by the expansion of our product line-up. We will carefully grow Jenius Bank over a ten-year period and develop it into a pillar that supports SMBC Group’s sustainable growth.

With John Rosenfeld, President of Jenius Bank

Multi-Franchise Strategy

Almost ten years have passed since we announced the Multi-Franchise Strategy in the Medium-Term Management Plan we launched in FY2014. During this time, we have undertaken concrete steps towards building a second and third SMBC Group in the four Asian countries which we expect to experience high economic growth. In the previous Plan, we made investments in India, Vietnam, and the Philippines. Combined with Bank BTPN, our consolidated subsidiary in Indonesia, we now have established the foundations of future growth in the four target countries. We are reconfirming the high potential of each respective country through the discussions we are holding with the investee companies regarding collaborations in a wide range of businesses. Going forward, we will not limit ourselves to realizing synergies with investee companies. Rather, we will also focus on realizing synergies within SMBC Group by having investee companies share their expertise with each other. The new Plan sets the stage to further enhance the results produced by past initiatives. We will strive to expand our businesses on a scale that exceeds the growth of the respective countries by working together with our trusted partners to maximize the results of collaborations.

Quality builds Trust

“Rebuild Corporate Infrastructure” has even more importance than in the past. We established “Quality builds Trust” as a keyword of this third pillar to reflect our commitment to enhancing the quality of our operations to a level that will allow us to win back the trust of stakeholders we lost as a result of the Administrative Disposition that was issued last year. First, we will make a Group-wide effort to improve compliance with our governance and compliance frameworks, which are the foundations of our business. We will also strive to realize resilient business operations by enhancing our ability to proactively address the risks that arise in the uncertain business environment by aggressively investing in IT infrastructure.

Creating a workplace in which employees can pursue their hopes and dreams with positivity and confidence is a key point in enhancing our corporate infrastructure. Regardless of how much our business environment changes, there will be no change to the fact that our people form the basis of SMBC Group’s competitiveness and are our most important management resource. Ever since I was appointed Group CEO, under the slogan “Break the Mold” I have endeavored to develop a corporate culture in which employees can transform themselves without being caught up in fixed ideas and preconceptions. I believe that an important responsibility of a business leader is to support employees proactively pursuing their hopes and aspirations and to prepare optimal conditions so that employees can reach their full potential.

“Producing new CEOs” is an initiative I started in which in-house start-ups are launched by leveraging the ideas of junior and mid-tier staff. In FY2022, the project saw the launch of Family Network Service, a business which offers family watching services though a smartphone application. A female employee in her 30s was named as CEO of the new company. I have no doubt that an era of “Fulfilled Growth” can be reached if each and every one of our employees can make a positive impact on society as a result of them breaking the mold by thinking outside of the box and pursuing their aspirations.

In addition, “DE&I (Diversity, Equity and Inclusion),” which was added as a priority issue (materiality), is a reflection of our growth strategy. SMBC Group is powered by a diverse talent pool of more than 110,000 employees spread across Japan and 38 countries and territories. Carrying out our duties based on a mindset of mutual respect leads to the competitiveness of SMBC Group, and the interaction of various values and ideas leads to innovation. In April 2023, we established the SMBC Group Talent Policy as part of efforts to realize a workplace where diverse professional talents can continue to pursue challenging goals and enjoy high levels of job satisfaction. We will enhance both our global and Group-based talent pool by creating a framework in which SMBC Group and its employees share a common mission, vision, and values while at the same time committing to each other.

Internal seminar for formulating the new Medium-Term Management Plan

Sustainable Growth of Corporate Value

Under the previous Plan, we increased our annual dividend by ¥50, achieving our dividend payout ratio target of 40%. We also carried out share buybacks totaling ¥200 billion while making inorganic investments of ¥510 billion for our future growth. I am well aware that this has led to some investors raising concerns that we were allocating a disproportionate amount of assets to investments for growth.

However, there is no change to our policy of allocating capital in a balanced manner between investments for growth and shareholder returns over the medium- to long-term based on a foundation of financial soundness. In the new Plan, dividends will continue to be our principal approach to shareholder returns. We will maintain a progressive dividend policy and a dividend payout ratio of 40%. We aim to increase dividend payouts through bottom-line profit growth. Although we postponed committing to a share buyback in May 2023, we will actively consider the matter while paying careful attention to the external environment.

Our share price continues to fall below a PBR (Price to Book Ratio) of one. This may be unavoidable as investors view Japan’s financial sector with pessimism given the long-standing economic stagnation and the ongoing negative interest rate environment. However, even against such a backdrop, it is important to clearly communicate a growth strategy and to execute that strategy. We have placed even greater focus on capital efficiency in the new Plan and will enhance our ROE by optimizing our business portfolio to improve profitability and increasing revenue by executing the Key Strategies. Furthermore, we will attempt to limit the capital cost of investors by minimizing the asymmetry of information as a result of proactively disclosing both financial and non-financial information and engaging in close communications with our stakeholders. Through such consistent efforts, we will strive to realize the sustainable growth of SMBC Group’s corporate value.

Dreams Make Our Future

“There is nothing like a dream to create the future.” These are the famous words of the French writer, Victor Hugo, and I feel that they make a particularly strong impression as our world suffers from increasing uncertainty.

As I stated at the start of my message, we continue to experience great volatility. In my New Year message to SMBC Group, I said I wanted each and every one of our employees to strive to realize their dreams and hopes based on a clear understanding that they are responsible for shaping the future. I do not want our employees to adopt a passive attitude because of the current business environment. Bigger dreams may very well lead to bigger challenges or more complex issues. Even when faced with such challenges, not giving up on one’s dreams and working with colleagues to overcome those challenges will allow SMBC Group to become even bigger and even stronger. I strongly believe that the future that lies at the end of this process will be one of “Fulfilled Growth.”

To transform SMBC Group into such an organization is both my dream and responsibility as Group CEO. I will fulfill this responsibility by standing at the forefront of SMBC Group’s 110,000 employees as we carry out our “Plan for Fulfilled Growth.” I would like to ask for the continued support and understanding of our stakeholders.

Jun Ohta

Director President and Group CEO

※Passed away on November 25,2023