Message from Group CFO

In April 2023, I was appointed Group CFO and Group CSO. As Group CSO, I will supervise the execution of our initiatives in key strategic areas while maintaining a view of the overall strategy.

At the same time, as Group CFO I will continue to oversee the optimal allocation of our management resources to ensure sound financial and capital management. I will take great care to communicate to investors information regarding SMBC Group’s strategies and businesses from both standpoints in a comprehensible manner.

Review of the Previous Medium-Term Management Plan

In the previous Medium-Term Management Plan (“previous Plan”) we operated in a challenging and uncertain business environment due to the COVID-19 pandemic, Russia’s invasion of Ukraine, and various other unforeseen factors. However, regardless of such an environment, we steadily carried out the Seven Key Strategies established under “Transformation & Growth.” We also proactively addressed major global trends, such as “Digital” and “Green.” Recently, in the domestic market we are seeing an increase in demand for solutions to address the post-COVID-19 business environment as the corporate sector recovers from the global health crisis and becomes more active in capital investment and business reorganization. In overseas markets, we are facing an increase in capital demand from customers followed by an increase in cross-selling opportunities including securities business. Not only were we able to capture significant opportunities resulting from the growth of the cashless payment market by issuing next-generation credit cards (numberless/cardless, etc.), we also succeeded in laying down the cornerstones of our future growth. For example, we made investments in our Asia Multi-Franchise Strategy and in our overseas securities business.

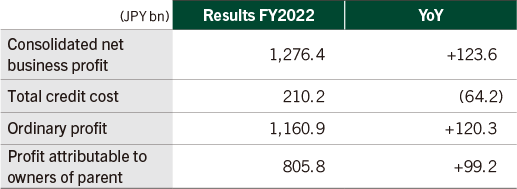

Due to the balanced increase in profits across the key businesses of each Business Unit, for the first time in SMBC Group’s history consolidated gross profit exceeded ¥3 trillion in FY2022. Even after booking the negative impact of items, such as additional impairment losses stemming from our aircraft leasing business and taking proactive measures for the future (forward-looking provisions due to uncertainties in the business environment, impairment losses stemming for our retail branches, etc.), we were able to generate profit attributable to owners of parent of ¥805.8 billion. This represents a year-on-year increase of ¥99.2 billion and is the first time to exceed ¥800 billion since FY2013. It goes without saying that we exceeded our original targets by a substantial amount.

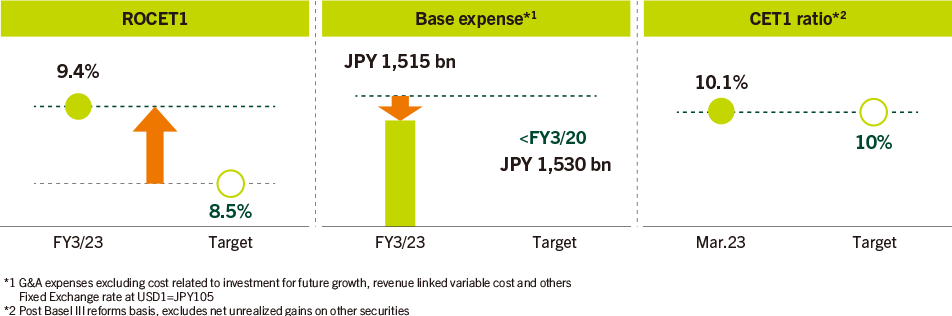

We also achieved our original financial targets for Return on Common Equity Tier1 (ROCET1), base expenses, and Common Equity Tier1(CET1) ratio. For ROCET1 we exceeded our target by close to 1%, a significant amount.

Financial Targets of the Previous Plan

New Medium-Term Management Plan

Financial Targets

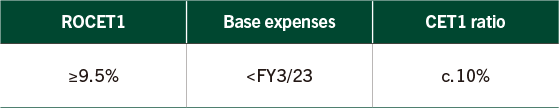

There is no change in our policy of pursuing “Growth with Quality” in the new Medium-Term Management Plan (“new Plan”). In terms of revenue, we will target bottom-line profit in excess of ¥1 trillion in the next Medium-Term Management Plan (“next Plan”) while targeting bottom-line profit of ¥900 billion in the new Plan as an interim goal. In our business operations we will continue to focus on profitability, efficiency, and financial soundness through the three financial metrics: ROCET1, base expenses, and CET1 ratio.

We will pay particularly careful attention to capital efficiency and aim to achieve a ROCET1 as close as possible to 10%, with the minimum level being 9.5%, by the end of the three years covered by the new Plan. At the same time, we will strive to achieve ROE including other comprehensive income (OCI) of 8% at the earliest possible date. My colleagues and I are aware that this is a matter in which many investors have expressed interest.

Specifically speaking, we will review our existing business portfolio and dynamically shift management resources. Continuous reduction of our exposure to low growth/unprofitable assets and assets for which the holding rationale has decreased due to changes in the business environment will take place so that we are able to allocate the required management resources to the key strategic areas established under the new Plan.

Furthermore, profit/loss and capital that had been traditionally managed by head office were allocated to our Business Units. Through such efforts, we will enhance business management on a Business Unit basis while also using the new framework to optimize our business portfolio and better verify the effectiveness of growth strategies. This will allow us to better imbed a capital efficiency focused mindset throughout SMBC Group.

Cost Control and Resilient Business Operations

In the previous Plan, we succeeded in reducing base expenses by ¥145 billion, exceeding the initial target of ¥100 billion, by executing three key initiatives: “Reform of domestic businesses,” “Retail branch reorganization,” and “Integration of Group operations.”

In the new Plan, we will continue with efforts that are of a similar level to that of the previous Plan. In other words, a reduction of base expenses of ¥130 billion and the workload equivalent to that of 7,000 full-time staff. Enhancing the efficiency of our domestic business model will particularly be focused on as we continue efforts from the previous Plan to downsize retail bank branches to establish “STORE” model branches that can be operated by fewer staff and pursue a hybrid strategy in which we combine digital services with physical bank branches.

We will realize resilient business operations by proactively reallocating the management resources we have secured through such efforts to not only the key strategic areas, but also to the strengthening of corporate infrastructure. Specifically speaking, in the new Plan more than ¥100 billion will be allocated to IT investments with the focus being on corporate infrastructure so that we are able to establish highly dependable core banking systems and governance frameworks.

Financial Targets for FY2023

We announced targets of ¥1,340 billion for consolidated net business profit and ¥820 billion for profit attributable to owners of parent. These targets have taken into account uncertainties in the market arising from the bank failures in the U.S., concerns regarding a slowdown in the global economy, and geopolitical risks. In other words, they represent the minimum figures we should achieve, even in the event these downside risks come to rise. Of course, we will pursue higher figures through the recovery of our securities business and growth of our credit card and consumer finance businesses that capture the recovery in domestic consumption.

Capital Policy

Basic Capital Policy

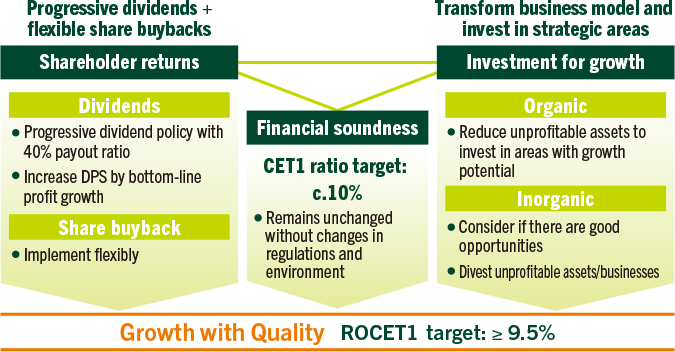

In the new Plan, there is no change to our basic capital policy which is to secure financial soundness and take a balanced approach to enhancing shareholder returns and investments for growth. Our CET1 ratio target, a metric we use to measure financial soundness, has been set at 10%. Please note that this figure is calculated taking into account the full implementation of Basel III reforms and excludes net unrealized gains on other securities. Achieving a 10% CET1 ratio would provide us with a buffer of 2%, a level that allows us to maintain the required 8% ratio under a variety of stress scenarios. We will maintain our CET1 ratio in the 10% (± 0.5%) range.

We have maintained sufficient capital level with a 10.1% CET1 ratio as of the end of March 2023. On the other hand, there is the possibility that the criteria for financial soundness may become more conservative due to the further tightening of financial regulations and changes in market conditions. We will focus on the macro-environment and discussions with financial regulators and accumulate capital when required in order to maintain financial soundness.

Enhancing Shareholder Returns

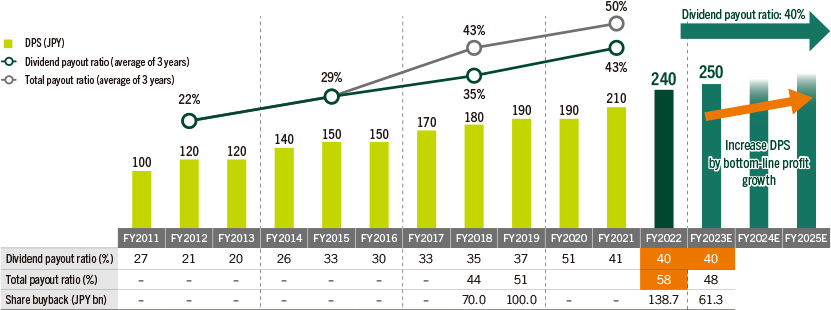

Dividends are our principal approach to shareholder returns, and we will continue to pursue a progressive dividend policy, which is to at least maintain, if not increase, dividend payments. In the previous Plan, we increased our annual dividend by ¥50, from ¥190 in FY2019 to ¥240 in FY2022, achieving our dividend payout ratio target of 40%. In the new Plan, we will maintain a dividend payout ratio of 40% and increase our dividend payout by growing our bottom-line profit while, to the extent possible, enhancing stronger resistance to economic volatility. Based on this approach, we announced ¥250 as our FY2023 dividend forecast.

Share buybacks totaling ¥200 billion were announced during the course of the previous Plan. For FY2023, given that uncertainty continues to cloud the environment surrounding financial institutions, we held off making our final decision regarding share buybacks until the announcement of our 1H FY2023 financial results, and we will continue to carefully assess the situation. In the new Plan we will pay even greater attention to achieving the optimal balance between shareholder returns and investment for growth.

Shareholder returns

Investment for Growth

Given that we had accumulated the necessary capital in preparation for the full implementation of Basel III reforms, in the previous Plan we revised our capital policy to enhance shareholder returns and investment for growth and pursued growth by allocating ample capital to both organic and inorganic growth opportunities.

Regarding our inorganic investments in Asia, we invested in local financial institutions in India, Vietnam, and the Philippines. Coupled with our existing investments in Indonesia, we were able to build the foundations of our future growth in the four target countries of our Multi-Franchise Strategy. In our overseas securities business, we entered into a strategic capital and business alliance with Jefferies, a major full-line U.S. securities firm. In April 2023, we announced the further deepening of this partnership and expanded our collaborations to include the U.S. ECM and M&A markets. In our aircraft leasing business, SMBC Aviation Capital acquired Goshawk Management (Ireland), making our fleet size the second largest in the industry. On the domestic front, we concluded capital and business partnerships with SBI Holdings and CCC Group as part of efforts to strengthen retail digital financial services.

As we executed various inorganic transactions in the previous Plan, in the new Plan we will first focus on concluding the post-merger integration of those acquisitions so that they can become new drivers of growth for SMBC Group. We will make sure that the new value generated by this growth is shared with our investors.

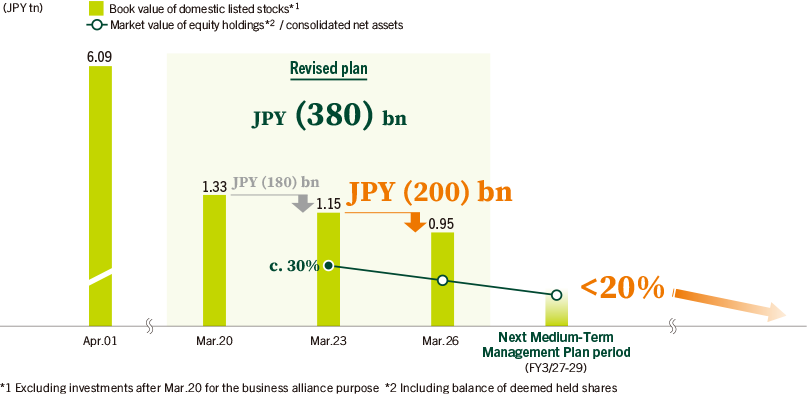

Reducing Equity Holdings

In FY2020, we established a goal to reduce our equity holdings by ¥300 billion (book value) over five years and over the past three years we succeeded in reducing them by ¥180 billion. The reduction was proceeding according to schedule, but in the three-year new Plan we accelerated the speed to ¥200 billion. Combined with the first three years of our plan, the six-year total reduction target will be ¥380 billion. Furthermore, we will aim to earn a good prospect of reducing the market value to consolidated net assets ratio to below 20% during the next Medium-Term Management Plan which covers FY2026-FY2028.

The reduction of equity holdings is a very important component of our efforts to enhance corporate governance in Japan. Furthermore, we will strive to achieve this goal ahead of schedule while ensuring that we continue to engage in close communications with clients. This will act as a tailwind to our efforts to reach our target of 8% for ROE including OCI (incorporates unrealized gains/losses of strategic shareholdings in the denominator) at the earliest possible date.

Reduction Plan of Equity Holdings

Enhancing Corporate Value

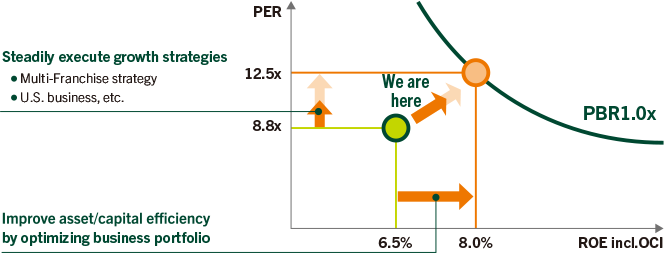

Enhancing corporate value is our most important business topic. In the new Plan, in order to reach our target of 8% for ROE including OCI at the earliest possible date, we will improve our PBR by optimizing our business portfolio and enhancing our asset and capital efficiencies. In regard to our Price Earnings Ratio (PER), we will increase our anticipated growth rate by successfully executing our Multi-Franchise Strategy, growing our U.S. business, and other growth strategies while also minimizing volatility by constructing a stable business portfolio. It is vital when operating in an uncertain business environment that we disclose information regarding areas of shareholders’ interest in a proactive and timely manner. We must also expand the information that is disclosed regarding our investments for growth and medium- to long-term initiatives to generate social value in a comprehensible manner. Through such efforts to enhance our disclosure, capital cost should be reduced by strengthening foreseeability as a result of minimizing the asymmetry of financial and non-financial information available to investors.

To improve PBR

Communicating with Investors and Analysts

Discussions with investors and analysts provide a very important opportunity to learn and to recognize matters that are of concern to our stakeholders’. The feedback we received through our regular meetings and IR events were shared with the Board of Directors and senior management team, and were integrated in the management of our daily operations and disclosures. Some examples are the disclosure of profit contribution forecasts of past investments for growth and ROE target, enhancing Business Unit-based business management, and the acceleration of our plan to reduce equity shareholdings. As you can see, the feedback has played an important part in the formulation of the new Plan.

We will realize the sustainable growth of SMBC Group’s corporate value by delivering “Growth with Quality” as a result of engaging in regular, constructive communications with investors and analysts and leveraging the feedback we receive in our initiatives.