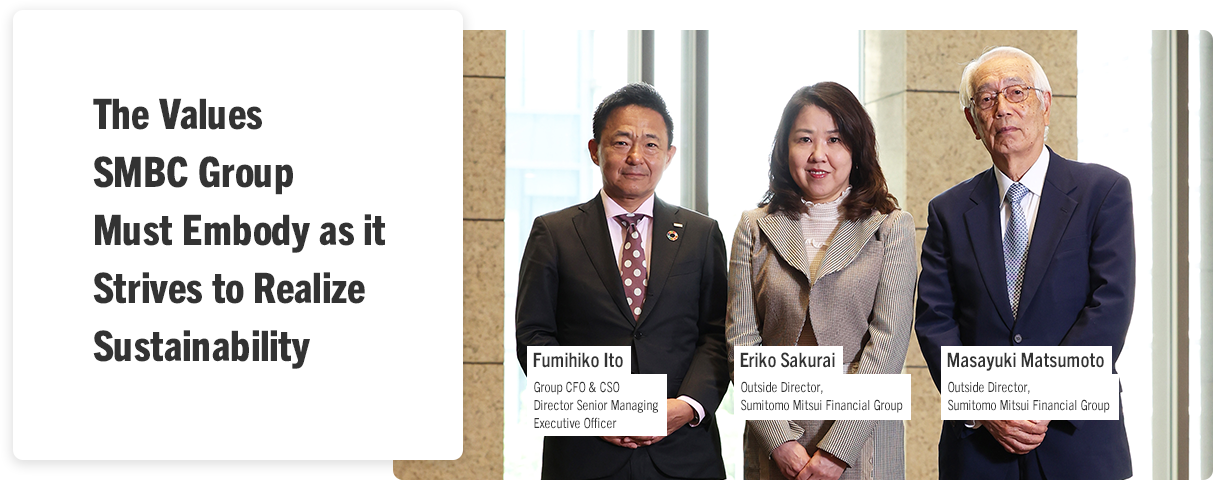

Round-Table Discussion with Outside Directors

ItoToday, I will ask Ms. Eriko Sakurai and Mr. Masayuki Matsumoto, both outside directors of Sumitomo Mitsui Financial Group, to share their expectations for SMBC Group taking into consideration the new Medium-Term Management Plan (“new Plan”) that we publicly announced in May 2023. Ms. Sakurai and Mr. Matsumoto were deeply involved in the preparation of the new Plan as repeated discussions took place during Board of Directors (“BOD”) meetings and BOD internal committee meetings over a period of approximately one year.

MatsumotoI feel that the new Plan significantly differs from past Medium-Term Management Plans in three key areas. First, a large number of SMBC Group employees of various seniority levels devoted significant time and effort to the preparation of the new Plan. As a result, the new Plan not only takes into consideration the issues and results of past Plans, it also reflects current changes in the business environment. Second, the new Plan has established “Create Social Value” as a new pillar on top of “Pursue Economic Value” and “Rebuild Corporate Infrastructure”. Third, the new Plan clearly stipulates the social issues SMBC Group will address in order to create the aforementioned social value, and its commitment to resolving those issues. As “Create Social Value” has been established as a key pillar of the new Plan, I hope to see SMBC Group tackle these social issues with a strong sense of responsibility and determination.

The new Plan has already started, and I feel that everyone in SMBC Group is pursuing the new Plan’s strategies and initiatives with much enthusiasm. I believe that SMBC Group’s organizational strengths will further increase if the new Plan is carried out with this level of enthusiasm.

SakuraiAs Mr. Matsumoto shared his thoughts regarding the new Plan in general, I would like to first share my thoughts from my position as Chairperson of the Sustainability Committee given that it was this role which allowed me to take part in the preparation of the new Plan from the draft stage. Frankly speaking, the early drafts struck me as trying to cover too many issues. It is easy to talk about wanting to solve social issues, actually reflecting this in your corporate activities via concrete initiatives is a different matter. As such, I advised that SMBC Group should narrow down and focus on selecting key issues so that each and every one of its employees must have a sense of ownership if the Group is to make concrete contributions to the resolution of social issues.

SMBC Group was already contributing to “Creating Social Value” via various initiatives, for example holding financial education seminars that have been attended by hundreds of thousands of high school students. It was under such circumstances that we engaged in repeated discussions about how SMBC Group employees could more consciously contribute to the resolution of social issues. For example, when the key phrase “Fulfilled Growth” was brought up, detailed discussions took place regarding the meaning of fulfillment and the actions that we needed to take within society in order to achieve growth. It was the first-time detailed discussions regarding such topics had taken place within SMBC Group.

In addition, as I am a member of the Compensation Committee and Nomination Committee, I took part in discussions regarding how “Creating Social Value” should be reflected in determining compensation and in the selection of leaders. I provided various suggestions with the mindset that I am speaking on behalf of SMBC Group’s numerous stakeholders so that it is able realize the theme “Create Social Value” in its many business activities.

ItoAs Ms. Sakurai just said, the Sustainability Committee was deeply involved in the preparation of the strategies established under the new Plan. This itself is proof that SMBC Group places great importance on “Creating Social Value” and embodies its commitment to placing this mindset at the center of its actions.

On the other hand, as Mr. Matsumoto stated, it is vital that SMBC Group executes and brings to a successful conclusion its initiatives with a strong sense of responsibility and determination. I want to further elaborate on the new Plan’s various initiatives while making sure that employees remain engaged.

MatsumotoI personally believe that a megabank has four key responsibilities. The first is to contribute to and take responsibility for people’s livelihoods and the Japanese economy. The second is to establish trust and credibility as the basis of all its activities. The third is to practice sound business management, including in regard to revenue and governance. The fourth is to fairly contribute to all stakeholders. All four of these responsibilities must be fulfilled. The three basic policies established under the new Plan “Create Social Value,” “Pursue Economic Value,” and “Rebuild Corporate Infrastructure” serve as the basis of SMBC Group’s unwavering commitment to pursue “Growth with Quality” by fulfilling these roles.

ItoIn regard to the third responsibility of sound business management that Mr. Matsumoto spoke about, in response to the request from the Tokyo Stock Exchange to improve our PBR, SMBC Group has publicly announced that we will pursue ROE including OCI of 8%. As a first step, we will pursue a PBR of one by focusing on asset and capital efficiencies. In addition, this will be achieved from both ROE and PER standpoints by increasing our anticipated growth rate through our Multi-Franchise Strategy, growing our U.S. business, and the transformation of our domestic retail and wholesale business models.

MatsumotoA PBR of one is a minimum goal that all corporates should strive to attain, and I believe that the actions of the companies are consistent with this. However, given the regulatory requirements applicable to the financial sector, financial companies must improve PBR while also accumulating capital. As ROE including OCI of 8% is a challenging target, SMBC Group will be required to focus on improving profitability via portfolio optimization and other concrete measures.

SakuraiHow to incorporate the Tokyo Stock Exchange’s request in the new Plan was the subject of much discussion during BOD meetings. As a financial institution, SMBC Group must operate in a highly regulated business environment, and one key point is for SMBC Group to carefully determine in which businesses it is able to grow. SMBC Group’s business operations have undergone substantial change since I became an Outside Director in 2015, and I will continue to pay close attention to how SMBC Group can successfully execute its initiatives targeting growth areas as it strives to achieve the goals set under the new Plan.

ItoThank you. Next, I would like to move on to SMBC Group’s efforts aimed at combating climate change, a theme that is of great interest to our stakeholders.

MatsumotoWhen the Sustainability Committee provides reports regarding climate change at BOD meetings, I am always impressed with the level of detail the reports provide and that the reports are the result of very thorough discussions. A long-term action plan is established for the entire SMBC Group that adheres to global standards based on a clear and accurate understanding of the discussions that have taken place in the Sustainability Committee and the current status of climate change issues. While current efforts are based on this process, I believe that SMBC Group was able to reiterate its unwavering focus on resolving sustainability-related issues by adding “Support the transition to achieve a decarbonized society” as a goal for “Environment,” a priority issue (materiality) in the new Plan. I understand that detailed action plans are being prepared by sorting out issues that arise from daily changes in the business environment while engaging in communications with clients. I feel that this reflects SMBC Group’s commitment to steadily carry out its sustainability-related plans.

SakuraiI provided very in-depth suggestions focusing on whether SMBC Group’s internal implementation framework for addressing climate change is adequate. I have spent many years at a global chemical manufacturer and it was necessary to build or upgrade factories if they were to become compatible with GHG reduction technology. A timeframe of several years is necessary to acquire the land for the factory, build the factory on that land, and then for production to finally start. I will pay close attention to whether SMBC Group is facing head-on the needs of each business sector based on a clear understanding of their issues, including issues such as the one which I just shared, which are difficult to see from the outside. Against such a backdrop, I am seeing various improvements that are being made to reflect feedback from onsite staff. For instance, in addition to communicating with clients in key sectors, SMBC Group is hiring staff who have actual experience working in those sectors. Furthermore, large corporations possess internal frameworks aimed at GHG reduction. For example, they are able to internally calculate climate change-related data. However, many SMEs do not possess the know-how required to calculate such data. SMBC Group is paying close attention to a wide variety of such needs and launched “Sustana” and other GHG reduction services to assist clients.

I am also focusing on how committed top management is to addressing climate change, and I believe that incorporating “Creating Social Value” as a non-financial indicator in determining executive compensation is a large step forward. As an Outside Director, when SMBC Group acquires a company though M&A, I also place particular importance on its vision regarding social value and whether it is consistently implementing initiatives aimed at addressing climate change.

ItoThe final topic I would like to discuss today is compliance issues such as the market manipulation incident by SMBC Nikko Securities (“SMBC Nikko”) in FY2022. In response to this incident, measures were prepared and implemented for the purpose of ensuring that such an incident would never occur again. These measures were prepared based on feedback from various parties, including from the BOD. Could you please share with us your forthright opinions regarding the incident and the progress we are making in the implementation of the preventive measures?

MatsumotoAll companies, regardless of their industry or size, have essential values that must not be lost in order for them to exist. For a securities company, protecting the fairness of the financial market is an essential value, and this incident is extremely regrettable. As part of efforts to ensure that such an incident never occurs again, in my role as Chairperson of the Audit Committee, not only did I receive reports regarding the causes of the incident and the preventative measures, I also physically went to SMBC Nikko’s head office and met face to face with their executive officers.

My involvement in the railroad sector spans many years, and in that sector the highest priority is placed on safety. As such, a “fail safe” culture, where when in doubt the safe option is selected, is firmly embedded throughout the industry. I have actually experienced situations where onsite staff protected customers’ safety and prevented major accidents by taking the appropriate actions based on this mindset.

Patience and perseverance are required to successfully instill a culture in which individuals uphold the values that are essential to the existence of their organization. I have witnessed the employees of SMBC Nikko take to heart their CEO’s message and work together to ensure that such an incident will never occur again. If such efforts continue, I believe it is possible for the required culture to take root. I have high hopes for SMBC Nikko as it is not uncommon for a better result to be produced due to pausing and thinking about matters in the process of overcoming a crisis.

SakuraiI was very grateful when I learned that Mr. Matsumoto and other members of the Audit Committee had actually met and talked with both executives and employees of SMBC Nikko. I felt that they represented the BOD very strongly in dealing with this issue. I agree that a corporate culture such as the one Mr. Matsumoto just touched upon will play a key role in ensuring that such an incident does not repeat itself. I will continue to pay close attention to the progress being made regarding this issue by putting forward very specific questions regarding important topics such as the method used to conduct employee surveys and how communications are conducted between staff and their supervisors. I will continue to monitor the situation with both warmth and strictness as, looking from within SMBC Group, I feel that SMBC Nikko is definitely changing for the better.

MatsumotoAt the start of today’s round-table discussion, I mentioned that contributing to its stakeholders is one of the key responsibilities of a megabank. As the Chairperson of the Audit Committee, I pay close attention to whether sound business management is being promoted/preserved and to various facets of SMBC Group’s governance framework, including risk management. I make sure to voice my concerns and obtain an answer if I have any doubts regarding these matters. Going forward, I will continue to put forth my opinions and suggestions aimed at ensuring the sound business management of SMBC Group so that it can meet stakeholders’ expectations.

SakuraiI directly speak with business leaders from around the world and third-party experts to keep myself informed so that I am able to reflect what I have learned in the running of SMBC Group as one of its outside directors. I will continue to devote myself to expanding my knowledge so that I can provide input that will help SMBC Group develop from the standpoints of sustainability and governance at a level that adheres to global standards.

ItoAs both Ms. Sakurai and Mr. Matsumoto pointed out, each and every one of SMBC Nikko’s employees must work to spread and embed a healthy risk culture in order for the preventive measures to succeed. We will continue to reflect the opinions we receive in our business strategies as we carry out the new Plan and strive to realize a sustainable society. Thank you for your time.