The Retail Business Unit consists of the top-class companies in the banking, securities, credit card, and consumer finance industries. We are addressing the financial needs of all individual customers through services capitalizing on the Group’s comprehensive strength, striving to develop the No. 1 Japanese retail finance business chosen by customers.

-

Takashi Yamashita

Senior Managing Executive Officer

Head of Retail Business Unit

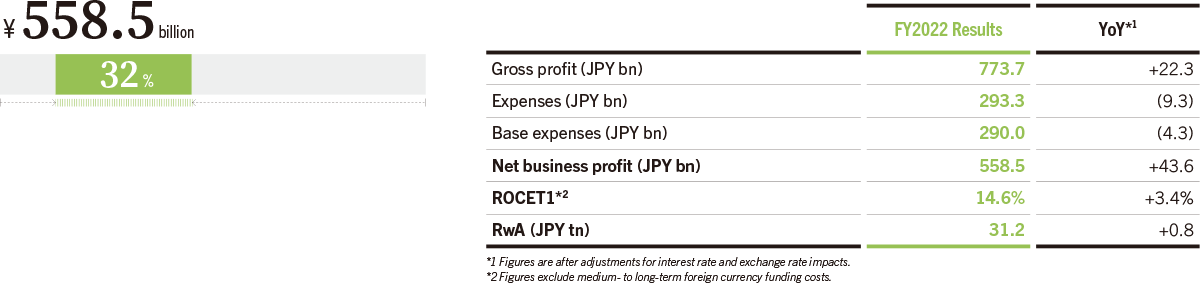

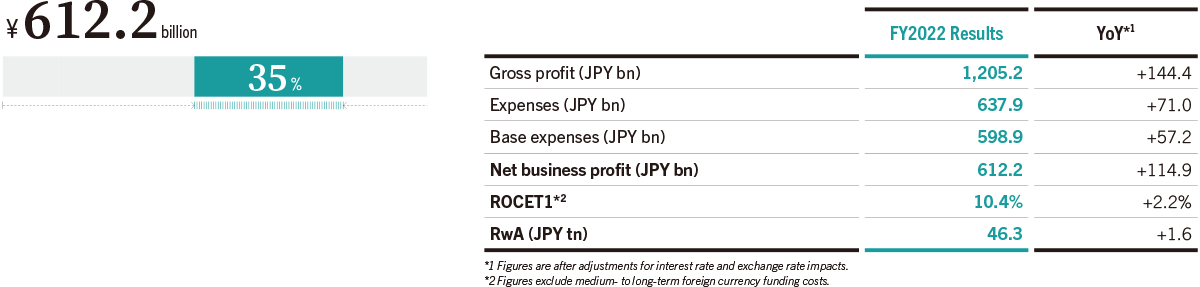

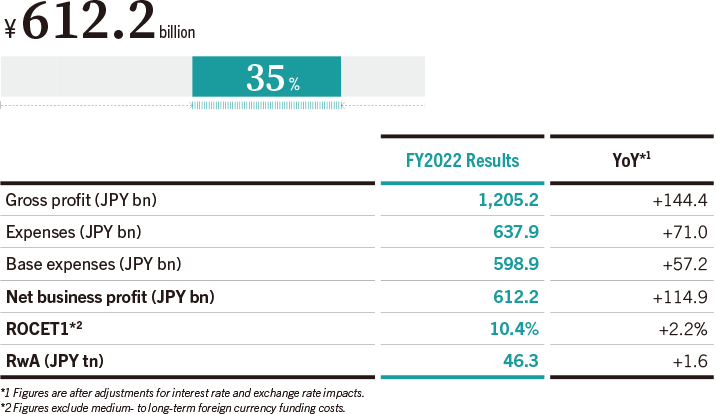

Contribution to Consolidated Net Business Profit (FY2022)

The Retail Business Unit possesses the leading business foundation in Japan in its principal business areas, including wealth management, payment service, and consumer finance, backed by high-quality in-person consulting capabilities and advanced payment and finance products and services.

Although each business was affected by the COVID-19 pandemic and other factors during the previous medium-term management plan, the asset management business saw the balance of fee-based AUM increase by ¥4 trillion more than planned, and the settlement and finance business caught up with the plan with a ¥10 trillion increase in purchase transaction volume. Card loan balances, which had declined with the effects of the COVID-19 pandemic, began to increase year-on-year in FY2022.

The retail business environment has also changed dramatically with the acceleration of cashless and digitalization, the shift from savings to investment, and the increasing need to prepare for the era of the 100-year lifespan. In this context, we have been quick to implement measures to respond to changes in the business environment, such as expanding the functions of SMBC Direct, developing branches exclusively for retail customers, and introducing the SMBC Elder Program.

Under the new medium-term management plan, we will differentiate our wealth management business by building a group-based asset management business model to strengthen our competitiveness and increase our presence in the market. Moreover, by transforming our retail business to a digital model based on Olive, we will expand our customer base nationwide and provide products and services on a group basis. We aim to become “Japan’s No. 1 retail financial group with a sustainable operating foundation” by expanding our market share in each business, and improving convenience and reducing costs through digitalization, through the development of hybrid strategies that leverage “digital” and “the human touch.”

The Wholesale Business Unit contributes to the development of the Japanese economy by providing financial solutions that respond to the diverse needs of domestic companies in relation to financing, investment management, payments, M&A advisory, leasing and real estate brokerage services through a Group-wide effort.

-

Toru Nakashima

Deputy President and Executive Officer

Co-Head of Wholesale Business Unit -

Muneo Kanamaru

Senior Managing Executive Officer

Co-Head of Wholesale Business Unit

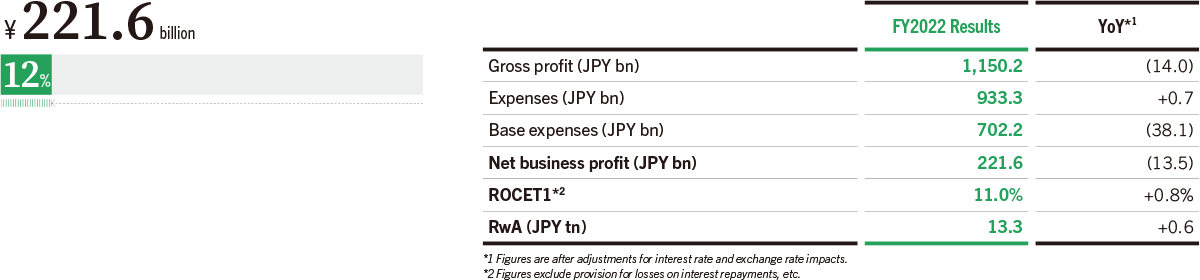

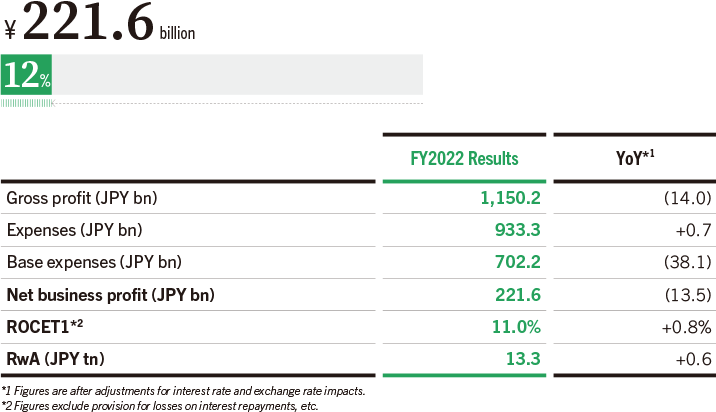

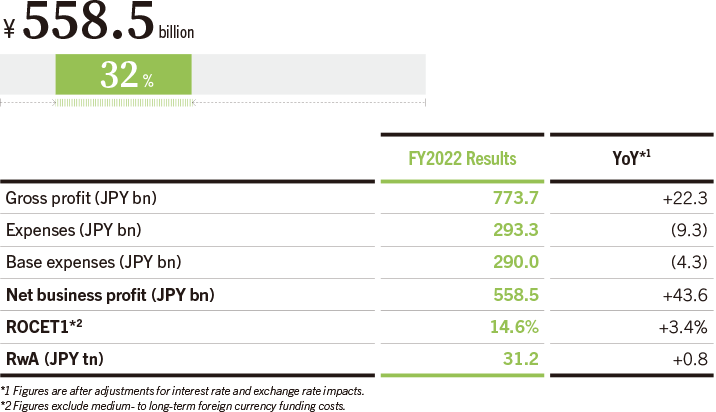

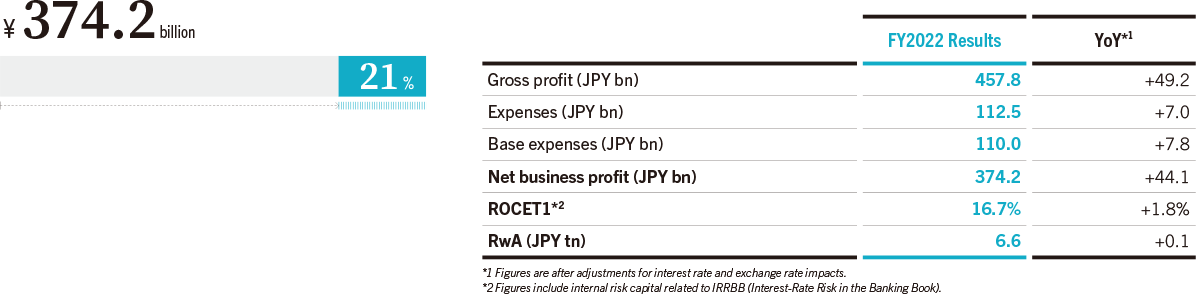

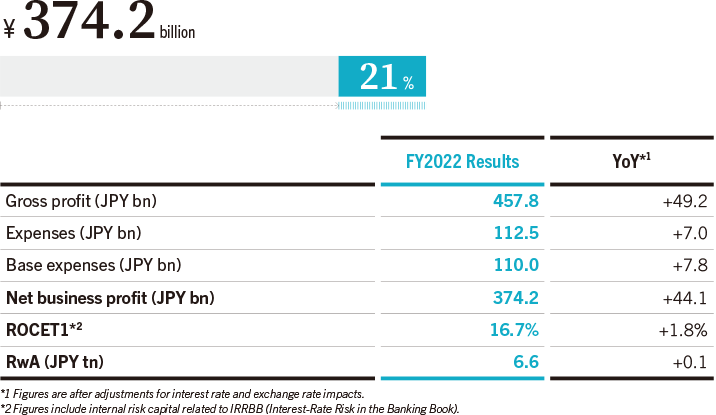

Contribution to Consolidated Net Business Profit (FY2022)

During the previous Medium-term Management Plan, amid accelerating moves toward business restructuring by customers due to the prolonged impact of the COVID-19 pandemic and heightened geopolitical risks in Russia and Ukraine, the Group as a whole aptly seized business opportunities for restructuring, etc. by proposing seasonal solutions, while taking exhaustive control of expenses, resulting in a significant increase in net business profit. Furthermore, ROCET1 also landed higher than planned due to the promotion of high value-added and highly profitable businesses such as real estate business and LBOs, as well as a year-on-year decrease in credit costs.

With the reversal of globalization, the end of global monetary easing, the acceleration of sustainability initiatives, and other paradigm-shift changes underway, it is necessary to move ahead with business transformation at an even faster pace. In the new Medium-term Management Plan, by (1) creating and honing a group edge by strengthening our expertise, and (2) establishing a sales structure that fully utilizes digital technology, we aim to (3) construct a high ROE business portfolio.

We will focus on three business areas in particular: “growth support,” which aims to capture major financial events by supporting various growth opportunities in the corporate lifecycle, such as real estate business and startup support; “transformation support,” which supports corporate transformation, including sustainability and digital transformation; and “creation of new business,” which takes on the challenges of corporate payment services and supply chain businesses through the creation of digital channels in order to develop future pillars of business from new angles.

We will contribute to the development and re-growth of the Japanese economy by solving our customers’ ever-changing and sophisticated business challenges, growing sustainably in step with them.

The Global Business Unit supports the global business operations of domestic and overseas customers by leveraging SMBC Group’s extensive global network and products and services in which we possess strengths.

-

Tetsuro Imaeda

Deputy President and Executive Officer

Co-Head of Global Business Unit -

Keiichiro Nakamura

Senior Managing Executive Officer

Co-Head of Global Business Unit

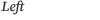

Contribution to Consolidated Net Business Profit (FY2022)

During the previous Medium-term Management Plan, despite the business environment remaining volatile due to the COVID-19 pandemic and the situation in Russia and Ukraine, we were able to significantly increase gross business profit through flexible resource management. As a result, we also significantly increased net business profit and served as a growth driver for the entire group, even as we invested to expand operations, such as strengthening our securities business and making upfront investments in our U.S. digital bank.

We are also making steady progress with initiatives aimed at mid- to long-term growth, such as strengthening our global CIB business by expanding our alliance with Jefferies, a U.S. securities firm, and increasing our investments in countries in Asia that fall within our multi-franchise strategy, and we feel that these efforts have been met with a positive response.

Under the new Medium-term Management Plan, we will enhance our systems for predicting and managing various risks, including monitoring the growing impact of policy rate hikes in various countries on the real economy and the foreign currency funding environment. In addition, we will continue to focus on new high-growth, high profitability areas such as upgrading our global CIB business, including deepening collaboration with Jefferies, creating group synergies, strengthening the multi-franchise strategy though ecosystem development, and launching a digital bank in the U.S.

To achieve this business expansion and diversification, it is also essential to construct an operating structure that makes maximum use of the knowledge of the entire group, and to upgrade the governance system to meet our stakeholders’ high expectations. In addition, alongside addressing social issues in countries around the world, as a Japanese bank we also strive to provide value to Japanese society and businesses.

Every one of us will take ownership and strive to achieve quality growth by unflinchingly facing change.

The Global Markets Business Unit offers solutions through foreign exchange, derivatives, bonds, stocks, and other marketable financial products and also undertakes asset liability management (“ALM”) operations that comprehensively control balance sheet liquidity risks and market risks.

-

Masamichi Koike

Senior Managing Executive Officer

Head of Global Markets Business Unit

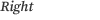

Contribution to Consolidated Net Business Profit (FY2022)

The Global Markets Business Unit is, as market risk professionals, committed to enhancing risk-taking skills for our investment portfolio while continuously supplying customers with high level of value.

To support these efforts, we are focused on analyzing the various phenomena that occur throughout the world based on the Three “I” s of Insight, Imagination, and Intelligence in order to forecast the market trends that will emerge in the future. In short, we emphasize the capacity to discern the underlying essence of world affairs.

Having risen since the second half of the previous fiscal year, inflation remained high in FY2022 against a backdrop of various factors, including global fragmentation. Interest rates in many developed countries rose sharply, particularly in the first half of FY2022, as central banks focused on curbing inflation, but temporarily fell sharply in the second half of the year due to credit concerns following the collapse of financial institutions in the U.S. It has been a year of not only high volatility, but also of transition from a world of low inflation and low interest rates to an entirely different stage.

We achieved profitability through flexible rebalancing, in combination with controlling risk in both equities and bonds. At the same time, we maintained stable foreign currency funding to meet the funding needs of customers. Meanwhile, in sales & trading, we sought to develop a full understanding of customer needs so that we could address these needs by providing optimal solutions.

The current market environment features ongoing uncertainty about the future. In addition, customer needs continue to become more diverse, as indicated by the advancement of the digitalization trend and growing interest in social issues.

In order to continue to create solutions our customers will choose, even in such an environment, under the new Medium-term Management Plan, we will maintain and enhance our DNA, our strength, while striving to evolve through challenges in new fields and constant self-reformation.