Special Content:

Key Measures to Drive SMBC Group’s Future Growth

Efforts to Achieve the Multi-Franchise Strategy

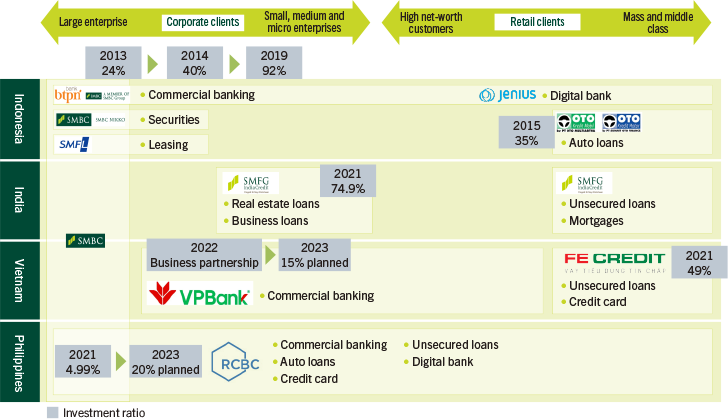

In Asia, SMBC Group has positioned Indonesia, India, Vietnam, and the Philippines as target countries for our “multi-franchise strategy.” We are aiming to create a second and third SMBC Group by developing our full-line financial business, including retail, in emerging Asian countries where high economic growth is expected.

By deepening our cooperation with our investment partners, we aim to build a more granular support system for SMBC Group customers seeking to expand their business in Asia through the provision of local branch networks and a wide range of financial services. At the same time, we are committed to contributing to the further growth of the overall Asian financial sector and reinforcing SMBC Group’s growth strategy in Asia.

In the previous Medium-Term Management Plan, we made investments and acquisitions in our partners, laying the groundwork for growth in countries targeted in our multi-franchise strategy, including India, Vietnam, and the Philippines. This has set the stage for the future platform development.

India

In November 2021, we acquired a 74.9% stake in Fullerton India, now known as SMFG India Credit Company, a non-banking entity catering to small and medium-sized enterprises and individuals. Since this investment, we have been leveraging the SMBC Group’s customer base to provide solutions such as sales finance, dealer finance, and workplace loans, particularly to companies within the manufacturing industry that have supply chains in India. In addition, SMBC Group strives to enhance its presence in India and realize synergies through the provision of funding support and sharing of expertise accumulated both domestically and abroad. Furthermore, in a country like India where financial services are yet to fully penetrate all regions, through SMFG India Credit Company, we are contributing to financial inclusion efforts by extending our services to rural areas where we have a strong presence.

Vietnam

In October 2021, we acquired a 49% stake in FE Credit, the leading local consumer finance company that offers unsecured loans, installment financing, and credit card services, through SMBC Consumer Finance, making it an equity method affiliate. Since this investment, we have been extending various local financial services to SMBC Group’s customers, broadening our product and service lineup, and fostering collaboration to stimulate further growth for FE Credit.

Moreover, we established a business partnership in May 2022, and a capital alliance in March 2023, with VPBank, a co-shareholder of FE Credit and a rapidly growing commercial bank in Vietnam. Through our partnership with VPBank, we aim to further solidify our business foundation in Vietnam. This will be achieved by providing services to customers who wish to expand their business in Vietnam, as well as by leveraging the SMBC Group’s expertise in areas such as trade finance, green finance, and credit cards.

The Philippines

In June 2021, we executed a 4.99% investment in RCBC, the sixth largest local commercial bank in the Philippines in terms of asset size. Since the investment, we have been actively exploring opportunities for collaboration with RCBC across a diverse range of business areas. Through our partnership with RCBC, we aim to enhance the convenience of local banking transactions for SMBC Group customers and bolster our product and service offerings. These include sustainable finance and project finance for our wholesale customers, and wealth management as well as mass market loans for our retail customers. Additionally, we have initiated collaborations on a broad spectrum of topics, such as improving operational efficiency and leveraging digital technologies. In order to further expedite these initiatives, we signed an additional investment agreement in November 2022 with the intention of acquiring up to a 20% stake in the company.

Further Collaboration and Synergy Creation

In Indonesia, we made the local commercial bank, Bank BTPN, an equity method associate in 2013, which was later consolidated and merged with PT Bank Sumitomo Mitsui Indonesia in 2019 to acquire a full-line commercial banking platform.

We plan to expedite the realization of our multi-franchise strategy in India, Vietnam, and the Philippines by fully utilizing the expertise we have cultivated through managing Bank BTPN and establishing a framework for group collaboration.

Beyond the one-on-one collaborations and synergies between SMBC Group and its investment companies, we are also building a network and cooperative structure that includes our investee companies, aiming to create further synergies.

More specifically, we are implementing various measures to reinforce SMBC Group’s platform in Asia. These include convening meetings with the CEOs and key executives of each of our Asian investee companies and establishing the ‘SMBC Asia Rising Fund’, a corporate venture capital entity that makes FinTech investments to further strengthen the businesses of our partner companies.

Initiatives to Strengthen Collaboration with Investee Companies

SMBC Group is promoting collaboration among its investee companies with the aim of generating even greater synergies. In November 2022, we held the Asia Partners Executive Summit (APES) to facilitate mutual understanding and spark discussions about potential collaborations among these companies.

At APES, top management from Bank BTPN, SMFG India Credit Company, FE Credit, and RCBC convened at the SMBC’s head office. They engaged in discussions with SMBC Group management to deepen their understanding of the group’s vision, business strategy, ESG initiatives, and governance policies.

Further, the companies were able to enhance their mutual understanding by sharing information about their individual business environments, growth strategies, and initiatives in the digital domain. In the consumer finance sector, a common area of operation for all these companies, Sumitomo Mitsui Card Company and SMBC Consumer Finance presented their initiatives and provided an opportunity for the investee companies to meet and discuss specific collaborative measures. Following APES, knowledge sharing has advanced across various domains, and the pace of collaboration has accelerated, both between SMBC Group and its investee companies, and among the investee companies themselves.

Strengthening Our Overseas Securities Business

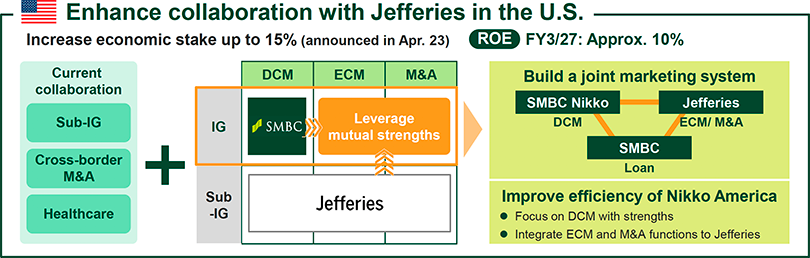

One of SMBC Group’s key focus areas is “strengthening Global CIB and Global S&T,” with a particular emphasis on reinforcing our securities and investment banking business in the U.S., home to the world’s largest capital markets and M&A businesses.

In July 2021, we entered into a strategic capital and business partnership agreement with Jefferies, a leading U.S. based full-service investment bank and capital markets firm. In April 2023, we announced plans to acquire an additional economic stake of up to 15% in Jefferies. Under an appropriate information management and governance framework, both firms will jointly work to propose financial solutions to clients. These efforts will take place under the co-branding of both firms. In addition to existing areas of collaboration, we aim to further our partnerships in M&A advisory, as well as equity and debt capital markets, primarily catering to large investment-grade corporations in the U.S.

We aim to deliver industry-leading financial services by integrating SMBC Group’s global customer base, lending, and debt capital markets capabilities with Jefferies’ exceptional industry insight, M&A advisory and equity capital markets capabilities.

SMBC Group’s Inorganic Strategy

Investment Target

We have set two axes: “investment to create a business platform for medium to long-term growth” and “high asset and capital efficiency investment that can be expected to contribute to profits in the short term.”

Investment Criteria and Discipline

Based on our basic capital policy, premised on ensuring soundness, of allocating capital in a way that balances shareholder returns and investment for growth, the three investment criteria are: (1) alignment with SMBC Group’s strategy, (2) an expected ROCET1 of 9.5% or more, and (3) manageable risk. Moreover, we consider investment opportunities upon discussion with outside directors and the CxO department, and adhere to strict discipline. In addition, we consider selling or replacing unprofitable assets or those whose strategic importance has declined. In the previous mid-term business plan, we terminated our partnership with Eximbank in Vietnam and began a partnership with VPBank. We conduct flexible reviews of our portfolio, and aim for more capital-efficient investments.