Special Content:

Key Measures to Drive SMBC Group’s Future Growth

Aiming to open the most accounts in Japan with Olive,

a world-first using Visa’s new payment function

A roundtable discussion was held with members involved in the development of Olive,

an integrated financial service for retail customers.

-

Ryosuke Ito

Marketing Division

Sumitomo Mitsui Card Company (SMCC)

As project leader of “Olive,” oversees all aspects of development, product planning, and promotion.

-

Takuya Ogawa

Product Planning and

Development Department

Sumitomo Mitsui Card Company (SMCC)

Engaged in product development for Flexible Pay, Olive’s payment function, as well as card design and UI/UX development of the application interface.

-

Aisa Ikemoto

Retail IT Strategy Department

Sumitomo Mitsui Banking

Corporation (SMBC)

Engaged in planning and UI/UX development of the SMBC App that features Olive.

-

Rie Sato

Retail Marketing Department

Sumitomo Mitsui Banking

Corporation (SMBC)

Engaged in product design, planning and development for Olive bank account benefits.

-

Masaaki Kido

Corporate Planning Department

SBI Securities

Oversees progress management, promotions etc., relating to Olive’s development on the SBI Securities side.

-

Christopher Bishop

Head of Consulting & Analytics

Visa Worldwide Japan (Visa)

Oversees coordination with the global development team for the delivery of the new Visa-developed payment functionality, including definition of requirements and progress management.

Ito, SMCC:

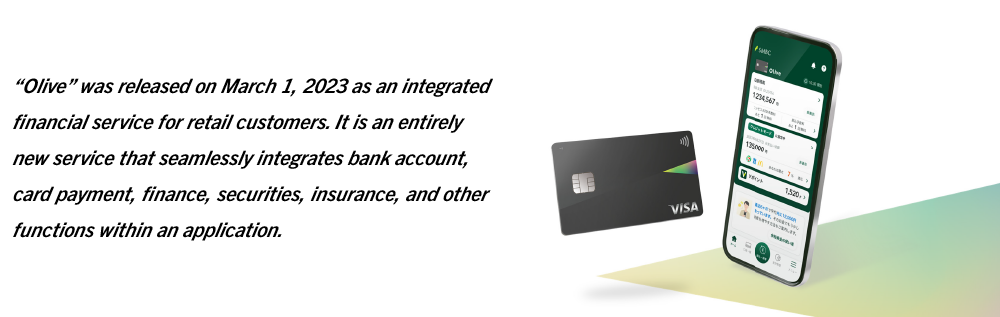

It brings me great pleasure to welcome all of you who have contributed to the development of Olive, which launched in March 2023. Thank you all very much. The Olive project began about two and a half years ago, based on the concept of offering SMBC and SMCC products together in a single package, and the two companies have worked together on the question of how to make this a reality.

The background to this project’s inception was the rapid digitization of banking transactions. Whereas 90% of account openings were once handled in branches, in the past few years the percentage of accounts opened digitally has increased to more than 50%. To compete with online banks, which are rapidly expanding their market share, Olive was born from the idea of offering a comprehensive range of services from group companies and strong partner companies, with mobile transactions as a core premise.

We have been working with SBI Securities since 2021 on projects such as “Sumitomo Mitsui Card Tsumitate-Investment,”* which is used by a large number of our customers. In order to develop this into “Olive,” we asked them to participate as the main digital brokerage.

- *SBI Securities’ service to build mutual funds with Sumitomo Mitsui Card Company.

Kido, SBI Securities:

SBI Group and SMBC Group signed a basic agreement on strategic capital and a business partnership in April 2020. As part of this effort, we have been providing partner services with SMCC since June 2021, to offer credit cards, V-points, and the Vpass App, with steady results. In June 2022, a comprehensive capital and business partnership was announced between the two groups, and SBI Securities has given their full participation to the “Olive” project. Despite being only about six months away from launch, we were conscious that this project was symbolic as an integrated capital and business partnership, which was a sobering thought.

Chris, Visa:

For Visa, the challenge was how to improve the customer experience and make cashless transactions safer and more convenient in Japan, which has a low cashless payment ratio among developed economies. Since we do not have direct contact with end-users, we believe the most effective way for us to get over our challenges is to work together with our clients to drive the change. This project was of great significance for Visa because we had the opportunity to contribute to Flexible Pay, an innovative service offered by SMBC and SMCC, our important clients even on the global level.

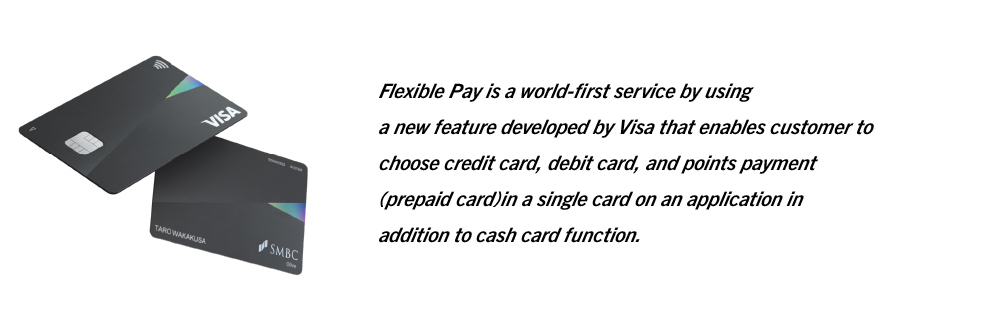

Ito, SMCC:

“Flexible Pay” is a world-first service in that it incorporates new payment functions developed by Visa, and we believe that competitors will not easily be able to follow suit. We are moreover confident in both our technology and our service, as the application integrates with SBI Securities, the number one online securities firm and our superb lineup of insurance products. In terms of promotions, SMCC already acquires the majority of its members online, and is using the know-how it has accumulated there to develop a combination of mass-media and digital advertising. With strengths in both merchandising and promotion, the odds are in our favor.

Sato, SMBC:

As a megabank group, we have earned the trust of our customers over many years, and we also have a system in place that allows customers to easily consult with us at our branch counters, call centers, and chat rooms if they encounter problems, which I think is an advantage that online-only banks cannot offer.

Ikemoto, SMBC:

That’s right. It’s important to be close to our customers, and we have endeavored to create a design that would be comfortable for both those who mainly use the SMBC App for account transactions, and those who mainly use the Vpass App for credit card transactions.

Ogawa, SMCC:

We were also very particular about the design of the credit card. We worked with Visa’s designers, had numerous discussions with our in-house designers, and redid the design more than 30 times before it was completed. We received many highly positive comments on the design following the launch, and we feel that it has become one of our strengths.

Chris, Visa:

There were many difficult moments on the development side, but we felt a strong commitment from Mr. Ogawa and everyone at SMBC Group to make the customer experience even better. They have a spirit of taking on new challenges, and a culture of creating precedent.

Kido, SBI Securities:

The SBI Group prides itself on its corporate culture of taking on new challenges with a startup spirit, and I am very surprised that even in the huge organization that is SMBC Group, we can take on the challenge of providing such a world-first service without compromise.

Ikemoto, SMBC:

What you have both just said corresponds exactly with SMBC Group’s “Five Values,” and I am delighted that, in hearing people outside the company talk about “Speed & Quality,” “Customer First,” and “Proactive & Innovative,” our values are being conveyed.

Ito, SMCC:

Thanks to the help of many people both inside and outside the Group, we were able to launch “Olive” on schedule. For me personally, I can honestly say that I am relieved that we were able to successfully launch on schedule and that so many customers have joined so quickly. Can you tell us what your thoughts were about this project?

Ogawa, SMCC:

I have been involved in the launch of credit, debit, and prepaid products, so I was conscious that Flexible Pay, which integrates these products into one, is the culmination of my career. I think it was this strong desire to ensure a good product that allowed us to stick to our commitment to the product and its design right until the very end.

Sato, SMBC:

With the help of the project’s members, my desire to absolutely succeed together, and to deliver “Olive” to our customers as soon as possible, grew stronger each day. We were truly delighted with the great response following the launch, and we will continue to listen to our customers and improve our products so that customers will continue to use them.

Ikemoto, SMBC:

I’m pleased that through this project, we have been able to add even more superb services to the “SMBC App” and “Vpass App.” We will continue to make improvements, brining useful functions and great design to even more people.

Kido, SBI Securities:

“Olive” is a project that symbolizes the alliance between our group and SMBC group, so we were under a lot of pressure to make it a success. The “Olive” project has been the biggest project in my career, so I was quite nervous. Like Mr. Ito, I feel a great sense of relief now that the project is completed.

Chris, Visa:

This was certainly a very memorable project, both for Visa and for me personally, as it is the first Visa product from Japan, and Flexible Pay is the world’s first solution using Visa’s new payment function.

Ogawa, SMCC:

It is truly amazing that we have been able to bring forth a world first from Japan to the world of finance. We could not have done it without the help of Visa. We are truly grateful for the countless times you have listened to our requests for help while you worked not only on this project, but on so many other projects around the world.

Ito, SMCC:

Looking back, as the launch date drew closer, challenges appeared one after another, and at times I wondered if the project was even possible. Yet I believe that one major factor in our successful launch was everyone’s positive attitude, that everyone demonstrated great professionalism in their respective roles as members of the same team, even when working for different companies.

Kido, SBI Securities:

The culture in meetings did not stand on hierarchy: we could exchange frank opinions with one other, saying things like, “this is okay, this is impossible,” and those discussions moved ahead smoothly. It was so hard to believe we were from different companies.

Chris, Visa:

I always felt like we were working as one team. I’ve been involved in a range of projects in the past, but I think the sense of unity we had as a team on this project was remarkable.

Sato, SMBC:

Absolutely. During meetings, there was always an attitude of discussing “how we can do it,” and I think the fact that each company was able to maintain this mindset was a key factor in the success of this project.

Ikemoto, SMBC:

There were many different opinions on the design and text of the application, and many things were not decided until the last minute. However, we were able to maintain our commitment, without compromise, because the “Customer First” concept of valuing customers was embodied in every team member, and I believe we were able to create a product that delights our customers as a result.

Ito, SMCC:

Finally, I would like to talk about what “Olive” is aiming for going forward. The “O” in “Olive” symbolizes “circulation,” while “live” expresses our customer’s lives. The name “Olive” embodies the idea that our customers’ lives will flow more smoothly by using this product. Olives are green, like SMBC’s company color, and the design also incorporates our desire to become a new company, while preserving SMBC’s traditions and the relationship of trust with our customers. As for numerical targets, we have set the goal of acquiring 12 million “Olive” accounts, and 5 million new cardholders per year, over the next five years. This target is premised on achieving top place for the number of accounts opened in Japan. Could you all talk about your efforts to achieve this goal?

Chris, Visa:

Going forward, we intend to develop functionality based on customer feedback and needs, so that we can take SMBC Group’s “Flexible Pay” to the next level.

Kido, SBI Securities:

We have succeeded in creating a system that allows customers to easily create an SBI Securities account by opening an SMCC credit card or “Olive” account, but we will continue to develop the system to make it more seamless. We will also review the UI so that SMBC Group customers feel more familiar with asset management, such as by providing guidance on opening an SBI Securities account together with promoting “Olive” in SMBC storefronts.

Sato, SMBC:

We will listen carefully to customer feedback at our branches, call centers, and on social media, as well as to requests from our branch employees, and reliably respond to those requests.

Ikemoto, SMBC:

I check responses on social media and respond to app store comments. We receive many comments such as “it would be easier to read if the font size on the screen were a little larger.” We will continue to improve the application closely reflecting customer feedback.

Ogawa, SMCC:

Even now, we are planning new services with the same volume as that of the initial launch. We will continue to improve “Olive” by shortening the cycle with which we reflect customer feedback.

Ito, SMCC:

As everyone has said, there are many small improvements, and we have received customer feedback, so we would like to steadily reflect those improvements to make the product even better. We are planning to launch new services during FY2023, and I thank everyone for their continued support.