Medium-Term Management Plan

2023-2025

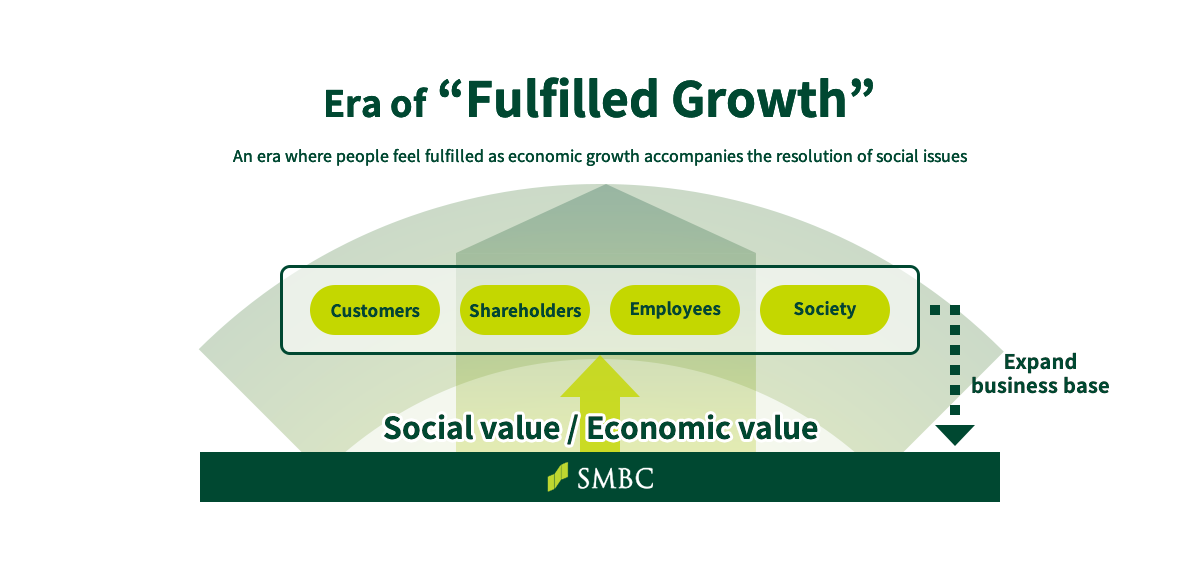

SMBC Group’s vision

A trusted global solution provider committed to

the growth of our customers and advancement of society

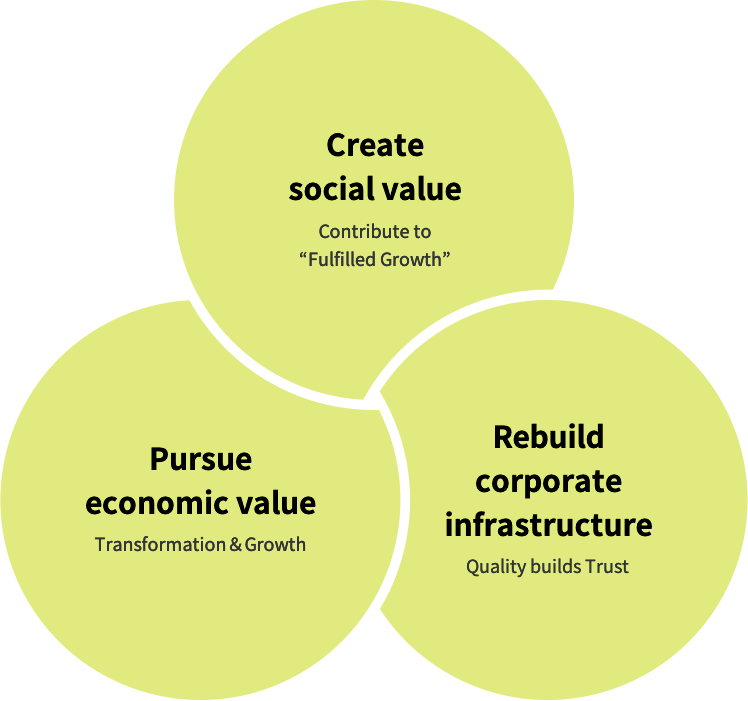

Core Policies

Growth with Quality

1Create Social Value: Contribute to “Fulfilled Growth”

In recent years, the global community has prioritized economic activities which in turn has led to the matter of social value being overlooked. This in turn has led to the rise of social issues concerning the environment, human rights, poverty/inequality, etc., and initiatives aimed at resolving such issues have become a key issue for corporate management. Creating social value has now become a prerequisite for corporations to build and maintain their competitiveness. In addition, contributing to Japan’s regrowth, given the country’s declining /aging population and low economic growth, will become even more important.

With the launch of the new Medium-term Management Plan, SMBC Group revised our priority issues, i.e., our “Materiality,” to “Environment,” “DE&I/Human Rights,” “Poverty & Inequality,” “Declining Birthrate & Aging Population,” and “Japan’s Regrowth.” With the aim of addressing these priority issues, we will further expand Group-based activities to create social value and to return the said value to society. Through such efforts, in addition to the generation of economic growth, SMBC Group will contribute to the realization of “Fulfilled Growth” where all of society and people can enjoy sustained prosperity.

SMBC Group shall further encourage the participation of its employees in the creation of social value so that they may feel pride and satisfaction in their responsibilities by proactively engaging in our priority issues.

SMBC Group’s Approach to New Priority Issues & “10 Goals”

| Priority Issues (Materiality) |

SMBC's Approach |

10 Goals |

|---|---|---|

| Environment |

|

|

| DE&I / Human Rights |

|

|

| Poverty & Inequality |

|

|

| Declining Birthrate & Aging Population |

|

|

| Japan's Regrowth |

|

|

2Pursue Economic Value: Transformation & Growth

| Point | Seven key strategic areas | |

|---|---|---|

| TransformationContinuous reform of business model GrowthEstablish franchise in key strategic areas |

|

|

3Rebuild Corporate Infrastructure: Quality builds Trust

- Improve the quality of governance and compliance

- Sophisticate human capital management

- Reinforce IT infrastructures

- Improve risk analysis and risk control capabilities

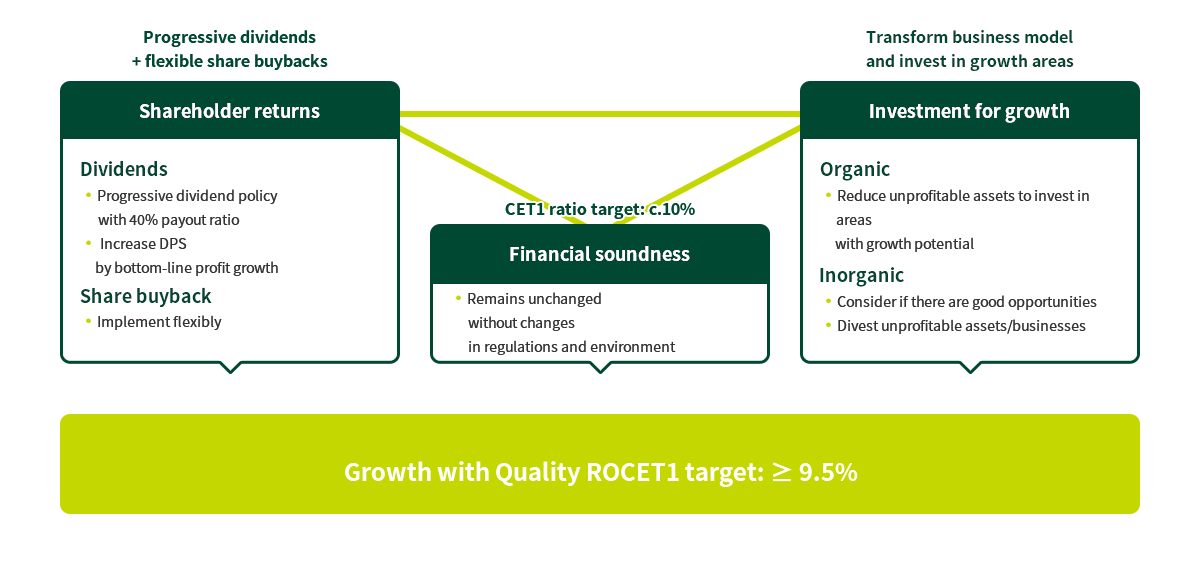

Financial Targets

SMBC Group established targets, while pursuing a bottom-line profit in excess of JPY 1 trillion in the next Medium-Term Management Plan.

FY3/26 target

- ROCET1

≥9.5% - Base expenses

< FY3/23 - CET1ratio

c.10%

Capital Policy

Progressive dividends

+ flexible share buybacks

- Shareholder returns

-

Dividends

- Progressive dividend policy with 40% payout ratio

- Increase DPS by bottom-line profit growth

Share buyback

- Implement flexibly

CET1 ratio target: c.10%

- Financial soundness

-

- Remains unchanged without changes in regulations and environment

Transform business model

and invest in growth areas

- Investment for growth

-

Organic

- Reduce unprofitable assets to invest in areas with growth potential

Inorganic

- Consider if there are good opportunities

- Divest unprofitable assets/businesses