Smarter Banking, Richer Life: The Vision of Jenius Bank

Jenius Bank, the digital banking division of SMBC MANUBANK in the U.S., a member of SMBC Group, launched personal loans and savings products for residents in the U.S. in 2023. As a digital retail bank with no physical branches, it has steadily grown its presence in the U.S., with loans and deposits already topping $1 billion.

But Jenius Bank’s current service and product offering is just the start of its vision. The bank has plans to release new features and services through 2025, plus is exploring ways to reach new audiences and solidify itself as a well-known brand.

We sat down with leaders from Jenius Bank’s Product, Design, Marketing, and Research teams to discuss the bank’s vision.

SERIES: Digital Banking in the U.S.

- Establishment of Jenius Bank : Why SMBC Group Is Tackling Digital Banking in the U.S.

- Creating New History of SMBC Group in America : An Inside Look at the People Taking On the Digital Banking Business

- Smarter Banking, Richer Life: The Vision of Jenius Bank

Top talent forge a new customer-centric digital bank

Could you tell us about Jenius Bank’s current organizational structure, workforce size, and work style?

Since our inception nearly four years ago, Jenius Bank has experienced remarkable growth, with our workforce now topping 450 employees.

While we largely work remotely, teams occasionally get together in person for relationship-building and project-specific working sessions. We pride ourselves on being a professional organization of small, elite teams that work across departmental boundaries, taking on any task with the utmost effort to create a better digital bank.

What products does Jenius Bank offer at the end of 2024?

We currently provide personal loans and high yield savings, with a focus on sustainable growth, optimizing our existing offerings while planning for the future. Looking ahead, we have ambitious goals for 2025 and are dedicated to ensuring that our products are fully aligned with our customers’ financial wellbeing and long-term success.

In the coming years, we plan to also provide financial products and services such as credit cards and Certificates of Deposit (CDs), aiming to become a full-service digital bank that tailors customer experience based on specific life goals.

One-stop financial asset tracking and personal finance management at Jenius Bank

Could you tell us about the new features you implemented at the end of 2024?

I should first say that our aim is to evolve banking functionality itself. Most people aren’t looking to just deposit money into their accounts – they want to save for a whole range of life goals, like a vacation, a wedding, or a home. We focus on our customers’ needs and support them in realizing what they really want to save for – their life goals.

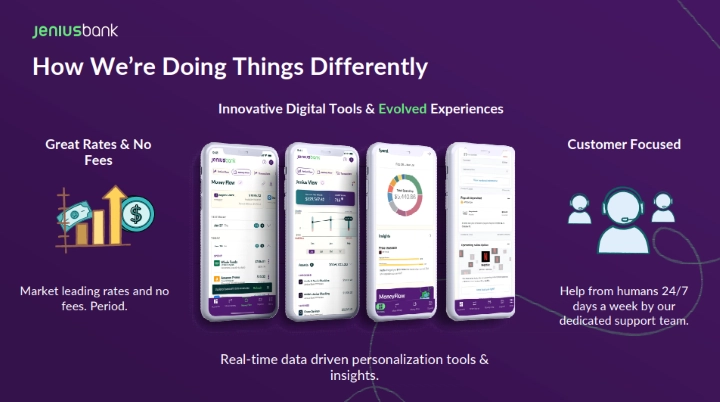

At the end of 2024, we launched a set of next generation digital features which help customers track their financial assets across different institutions, providing insights on spending and savings. By supporting customers in planning their financial future, we aim to help them feel more secure and make smarter money choices. These features are still in their early stages, and we plan to continuously evolve and expand upon them in the future.

What customer needs spurred these new features?

To develop the new features, we used various qualitative and quantitative research methods to really drill down consumer digital banking needs. We’ve identified our early target audience as the “HENRY” subset -High Earners, Not Rich Yet- individuals who are looking to build for the future.

From the research, we found that our target customer wants to be more proactive in making financial decisions, developing detailed financial plans, and learning more about finance. They also want a trustworthy, customer-centric bank that supports their growth and offers year-round 24/7 support. We developed the new features concept to respond to these needs.

Where would you say Jenius Bank outdoes its competition in terms of design and features?

Even during the concepting stage, Jenius Bank has designed its UI and UX to enable the seamless aggregation of multiple accounts, including accounts from other financial institutions. Most traditional banks don’t put much effort into account aggregation. By linking all their bank accounts on the Jenius Bank platform, customers may get a clear overview of their financial assets, which, coupled with the insights they receive from Jenius Bank, will help empower them to make smarter asset and personal finance choices.

We also heard that customers have a hard time identifying and accessing digital tools with other banks. Jenius Bank aims to be a customer-first bank that meets the customer where they are in their financial journey. Proactively offering necessary information and personalized insights without hassle. We want to create a new customer experience that’s like having a banker in your pocket to provide financial information whenever you need it.

A crucial part of developing these services is having an in-house system development team. The greater development freedom this allows means that services we’ve planned and designed internally can be developed and rolled out to customers much faster than would otherwise have been the case. Additionally, this freedom allows us to provide truly curated insights and information instead of the generic dashboard that you tend to see with traditional banks.

Any other competitive advantages?

First and foremost, our savings and personal loan products offer competitive rates and are specifically designed to help our customers achieve long-term financial wellness.

In 2025, we are focusing on growing Jenius Bank’s brand recognition in the United States. We want to reach even more people with the message that we’re a digital bank that doesn’t just offer financial products but also provide support to help customers realize their goals.

Identifying essential needs and continuing to develop new services

I imagine communication among different teams is crucial for creating great services. What’s your focus in that regard?

This project has been a best-in-class example of why cross-departmental collaboration is important and how to do it effectively. From the initial stages of this project, we’ve promoted collaboration across many different functional groups. This structure has supported the flow of high-quality ideas and prevented us from overlooking critical points. Our project slogan was, “Teamwork makes the dream work,” and while it wasn’t always easy, we shared a common goal and have deep respect for each other.

What are you doing to build long-term relationships with customers?

Jenius Bank is focused on helping to solve essential customer needs, so research is crucial. We are always listening to our customers and learning from their feedback. Providing customers with valuable products and services and appropriate insights will help give them more confidence in financial matters. We believe creating that kind of environment will lead to long-term customer relationships.

It’s simple, really: People want to do business with organizations they trust. We can build trust by prioritizing consistent customer support, providing clear organizational communication, and investing in technology that improves the customer experience. By taking this human-first approach, we position ourselves well for building a solid foundation of customer advocates and growing those relationships.

How do you see the road forward for the latest features?

We’ll release these new features in the Jenius Bank mobile app during the first half of 2025, followed by a credit score display feature. This will soon be followed by a feature that will not only display credit scores but also highlight the factors influencing those scores. Moving forward, we will continue building features aimed at helping users set savings goals, managing payments and subscriptions, and analyzing cash flow.

We’ll also continue to improve and evolve these new services based on customer feedback. We have incredibly exciting initiatives planned for this year and beyond, so stay tuned for what’s to come!

Jenius Bank™ is a division of SMBC MANUBANK. Member FDIC.

Data rates and fees from your service provider may apply.

The features, charts and graphics displayed as examples of personalized information within the Jenius Bank mobile app and online banking experience are for illustrative purposes only. Not all features will be available and will depend upon your individual finances and the external accounts you choose to link. Third-party marks are owned by their respective owners and are not sponsored or endorsed by or otherwise affiliated with Jenius Bank, a division of SMBC MANUBANK.

SERIES: Digital Banking in the U.S.

- Establishment of Jenius Bank : Why SMBC Group Is Tackling Digital Banking in the U.S.

- Creating New History of SMBC Group in America : An Inside Look at the People Taking On the Digital Banking Business

- Smarter Banking, Richer Life: The Vision of Jenius Bank

-

Associate, Product Marketing

Abbey Austin

Leading Product Marketing at Jenius Bank, focusing on setting strategic positioning and messaging for Jenius Bank products that fuel cross-channel marketing plans and extend across storefront, paid digital, social media, and public relations. Abbey’s background spans industries and types of organizations, including renowned media agencies, family business, and well-known corporations. Before Jenius Bank, she managed a major product for one of Capital One’s iconic credit cards and graduated from Northwestern’s Kellogg School of Management with a degree in Marketing. Abbey seeks to build product messaging that simplifies, educates, and actually resonates with real people, not just executives. She believes that brands have the power to change both customer and business outcomes for the better.

-

Executive Director, Head of Digital and Evolved Banking

Dan Struble

Career spans 20+ years in product management at various financial services companies such as ING DIRECT, Capital One, Simple and Barclays US. At Jenius Bank he focuses on providing experiences that empower customers to achieve their financial goals. Passionate about innovation in the online & mobile space, with a strong background in various discovery methodologies (design thinking, JTBD, continuous discovery) and delivery processes (Agile, Kanban).

-

VP , UX & Creative Design

Dean Valentin

Leading a talented team of designers dedicated to advancing the bank's product, marketing, and operational initiatives. With nearly a decade of experience in creative space, Dean began his career in the non-profit sector and transitioned through various UX & creative roles in fintech, ultimately making a splash in the banking world. Passionate about the arts, Dean has a keen interest in how design narrates human experience and tackles complex challenges. Whether through grand architectural structures or the digital world in our pockets, Dean views design as a convergence of creativity, constraints, and innovation. Championing design thinking methodologies with a focus on customer empathy, he and his team are committed to delivering on Jenius Bank's mission to humanize digital banking and empowering customers to live richer lives.

-

VP, Research

Drew Hopkins

A seasoned leader in user research and innovation, currently driving strategic initiatives to elevate the user experience at Jenius Bank by SMBC. Previously, Drew led design and research at Cirium and FIS Financial Services, contributing to significant improvements in product architecture and user engagement. A former U.S. Army Operations Manager, Drew combines a strong leadership foundation with expertise in design thinking, quantitative and qualitative research, and advanced UX tools, holding a BA in Philosophy with a minor in Psychology from West Chester University.