I was appointed as President and Group CEO of Sumitomo Mitsui Financial Group in April 2019. My key

responsibility as Group CEO is to leverage the business foundations and strengths which our predecessors built

over our long history to realize the further growth and development of SMBC Group. There is no change in our

basic principles or vision that we are pursuing together as SMBC Group. I will spearhead efforts to realize our

medium- to long-term vision: “To be a global financial group that leads growth in Japan and Asia

by earning the highest trust of our customers.”

The Future we are Facing

We are currently facing the need to evolve.

Distortions and deviations have become visible in the framework of capitalism, which has been the prerequisite for the continued growth of the global economy in the post-war era. Cracks are becoming ever more apparent in the traditional global order led by the United States. Nationalism is on the rise in the United States, and we are seeing the rapid spread of anti-globalism that is symbolized by protectionism. In Europe, which has long walked beside the United States, democracy and multiculturalism, concepts that are the basic principles of European integration, are being challenged with populism and anti-government movements gaining momentum. There is an increasing possibility that the clash between the United States and China for economic, technological, and military hegemony will continue as China, which has expanded its presence in the global economy, pursues its unique brand of state capitalism. The new era of Reiwa has ushered in a world of uncertainty and doubt where there is no clear or agreed upon global leader.

Domestically speaking, we are also moving into a new period. While we have been aware of this for quite some time, Japan is expected to face serious population decline that would accelerate the contraction of the domestic market. In 2040, about twenty years from now, while the global population is expected to increase by 20%, Japan’s working age population is expected to decrease by more than 20%. However, this can also be viewed as an excellent opportunity to break free of traditional business models. For example, it will become possible to draw out the full potential of each employee by implementing work style reform and streamlining operations. Furthermore, if the private and public sectors work together to promote innovation and improve productivity, it should reverse Japan’s decline in international competitiveness. I believe that Japan still possesses much growth potential although it is facing headwinds, such as population decline and a fall in its relative status on the global stage.

The unprecedented levels of monetary easing pursued by various countries have led to massive liquidity. The Bank of Japan’s total assets now easily exceed ¥500 trillion and for the first time in the post-war era surpassed Japan’s GDP. This number jumps to ¥1,600 trillion if we include the total assets of the US Federal Reserve and the European Central Bank. This means that the total assets held by the central banks of Japan, the US, and the EU have quadrupled during the decade following the global financial crisis. This type of liquidity may destabilize financial markets due to the increased risk of an asset bubble forming. The underlying question going forward will be whether central banks can carry-out monetary policy normalization without causing disruption given that it is an unprecedented challenge.

Digitalization has brought on a paradigm shift in various industries, including the financial sector. Changing industrial structures and advances in technology have blurred traditional boundaries that have separated businesses. Our business has not been immune to this trend with players from sectors such as logistics, telecommunications, and IT entering the financial sector. In the not too distant future, business-based categories within the financial sector, such as banking, securities, and insurance may have lost all relevance, leaving only function-based categorizations, such as loans, deposits, payments, and investments.

What is common among these structural changes is that they are irreversible and that they will have a major impact on us. In other words, issues such as Japan being our contracting “mother market” or intensifying competition due to entrants from other sectors are not cyclical issues which will eventually resolve themselves; these are unpleasant realities which we must confront head-on. If we are to realize sustainable growth we must, now more than ever before, look forward into the future and evolve relentlessly.

SMBC Group: Our Journey and Our Strengths

However, these structural changes are by no means a recent development. SMBC, SMBC Group’s core commercial banking entity, set sail in stormy waters when it was formed in 2001. Japan’s financial sector had just embarked on an age of large-scale restructuring and reorganization due to domestic non-performing loans becoming a serious problem under Japan’s prolonged deflationary environment. Shortly after we had completed paying back our public funds and turned our attention to pursuing growth, the US subprime loan crisis triggered the global financial crisis in 2008. The lessons that were learned during this period led to the tightening of international financial regulations, which was a game changer.

While these events shook our business at its very foundations, each time we succeeded in realizing quality growth by refashioning ourselves into a stronger, more tenacious financial group. As a result of such changes, we have developed three universal strengths.

First, a robust client base built upon many years of mutual trust.

SMBC Group is made up of leading corporates operating in various industries, such as banking, leasing, securities, and consumer finance. The unique combination of SMBC (a Japanese megabank) and SMBC Nikko (one of the three major Japanese securities companies) is one of our key strengths. In terms of our domestic retail business, we hold the number one position in key fields, such as credit card memberships and consumer loan balance, with 43 million customers supported by 50 thousand employees.

In regards to our global business, our traditional approach was to build a strong presence by cultivating relationships focusing on corporate clients, for example western multi-national corporations and leading companies of key ASEAN countries. However, in February 2019 we completed the merger of BTPN, a local Indonesian bank, with PT Bank Mitsui Sumitomo Indonesia, establishing a platform from which we can offer a full-line of wholesale and retail banking services in Indonesia. The post-merger bank is staffed by approximately 20 thousand employees and serves seven million customers through its digital banking business where our collaborations with BTPN commenced well before the merger.

Second, a solid business foundation which has been developed with proactive and speedy initiatives through the changing times.

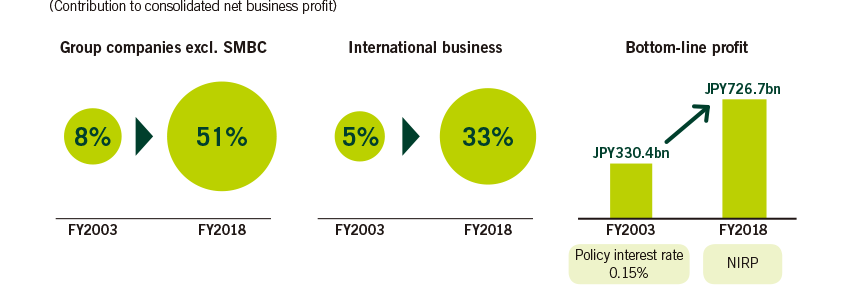

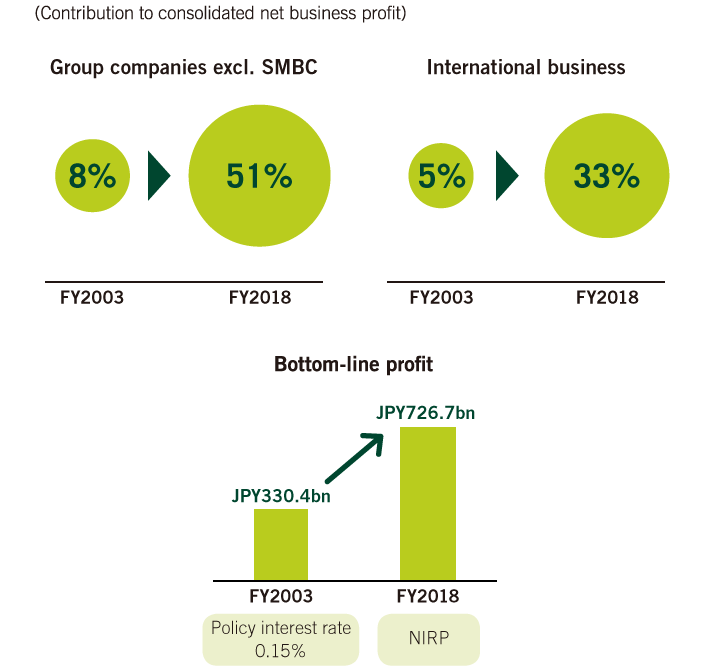

In Japan, our mother market, the business environment for commercial banks has been challenging for some time now due to low growth and low interest rates. However, by diversifying our revenue sources through the expansion of our business and regional coverage, the contribution of SMBC Group companies other than SMBC to consolidated net business profit increased significantly from 8% in FY2003 to 51% in FY2018, surpassing 50% for the first time. During this time, profit attributable to owners of parent increased from ¥330.4 billion to ¥726.7 billion, proving that we have been successful in our efforts to realize quality growth.

As a growth driver, our international business has been increasing its net business profit at an annual rate of 13% since the establishment of our Group. As a result, our international businesses’ contribution to consolidated net business profit rose from 5% in FY2003 to 33% in FY2018. We have also increased businesses that we are globally competitive in. For example, our project finance business, which a team of four employees including myself launched thirty-three years ago with the dream of one day becoming the best in the world, is now ranked number two in the world.

Furthermore, in the past few years our focus has shifted from growing our topline profit to maximizing efficiencies given the slowdown in the growth of emerging markets, the introduction of the negative interest rate policy by the Bank of Japan and tightening international financial regulations. We have been able to raise the quality of our business foundation by reorganizing our Group companies (regional banking subsidiaries, leasing business, etc.), and realizing strict cost controls through Robotic Process Automation (“RPA”) and branch reorganization.

Expand business and regional coverage

Third, top-tier employees who provide advanced and client-focused business solutions.

Employees are the most important management resource for a financial institution. The reason that we have been able to consistently maintain the highest loan spread among the Japanese megabanks and net business profit per employee at a very high level over the years is thanks to our motivated employees who possess excellent marketing capabilities and expertise providing speedy and on-target business solutions to our clients. None of our success would have been possible without the trust and knowhow accumulated by our employees.

We are also carrying out work style reform related initiatives so that our employees can perform at an even higher level. We have introduced RPA on a Group basis and have already produced world-class results. RPA is often described in the context of headcount reduction, but this is incorrect. The purpose of RPA is to leverage digital technology to free our employees from low productivity tasks and allow them to focus on high-value added tasks and corporate planning activities so that we can further enhance the quality of our products and services. Such initiatives should contribute to our growth as they lead to heightened employee motivation.

Stakeholder Themes that I will Work on Looking Ten,

Twenty Years in the Future

I will work on the following stakeholder themes looking ten, twenty years in the future, while also taking into account our unchanging universal strengths and the irreversible major changes in the external environment which I shared with you earlier.

Customers: Ensure Customer-Oriented Business Conduct and Provide New Added Value

“We grow and prosper together with our customers, by providing services of greater value to them.” This is the very first section of Our Mission. In addition, “Customer First” (always acting based on a customer-oriented mindset) has been placed at the head of our Five Values; a set of common values and behavioral guidelines which are shared among SMBC Group employees to realize Our Mission. We are working to ensure the comprehensive implementation of customer-oriented business operations based on the belief that continuously providing high quality products and services that address our clients’ needs increases business, which in turn leads to the growth of SMBC Group.

We will continue our never-ending efforts to provide clients with higher quality services and new added value. Recently, some have made the argument that banks are no longer needed. I believe that if banks are not really needed, we do not have to continue being a bank. There is no need for us to remain as a bank if the nature of finance changes due to the spread of digitalization, leading to the creation of more convenient, lower priced products and services which benefit the economy and society, and these products and services are being provided by entities other than banks. I am determined that SMBC Group will become a provider of such products and services by tirelessly reinventing ourselves.

Shareholders: Maximize Shareholder Value by Further Enhancing Shareholder Returns and Realizing Sustainable Growth

I will continue to devote our utmost efforts to maximize shareholder value by further enhancing shareholder returns and realizing sustainable growth.

The goal of our basic capital policy is to achieve a healthy balance between securing financial soundness, enhancing shareholder returns, and investing for growth. In regards to securing financial soundness, our CET1 ratio at the end of FY2018 reached the 10% target set under the Medium-Term Management Plan, one year ahead of schedule. As such, we will shift from a phase where capital accumulation was the priority to a new stage where we can focus on strengthening shareholders returns and investing for growth.

Going forward, we will strive to maximize shareholder value by further enhancing shareholder returns and realizing sustainable growth as a result of striking the right balance of allocating capital between shareholder returns and investing for growth. In terms of investing for growth, we will engage in organic investments to accelerate the growth of our domestic and global businesses, in addition to pursuing inorganic opportunities in a disciplined manner. Potential inorganic opportunities which we may pursue would be investments in global businesses and portfolios which possess high capital or asset efficiencies, and investments related to the construction of business platforms aimed at realizing future growth.

Dividends are our principal approach to shareholder returns, and we are aiming to achieve a dividend payout ratio of 40% during the next Medium-Term Management Plan. In respect to flexible share buybacks, we implemented a ¥70 billion share buyback program in May 2018 and a ¥100 billion share buyback program in May 2019. The total payout ratio for FY2019 is expected to be 50%, which means that we will return exactly half of our earnings to shareholders. We have been steadily enhancing shareholder returns with our total payout ratio increasing by 20% over the three year period covered by the current Medium-Term Management Plan.

Employees: Create a Work Environment Where Employees can Pursue Their Dreams with Confidence and Ambition.

I will create a work environment where each one of our employees can pursue their dreams with confidence and ambition.

Ever since I was appointed as Group CEO, I have been calling on employees to “Break the Mold.”

We will surely be left behind in this era of rapid change if we shut ourselves behind our molds, in other words, if our thoughts and actions are constrained by precedent and preconceptions, prohibiting us from engaging in self-improvement. Financial institutions have traditionally been considered as being conservative and as devoted followers of the so called “demerit principle.” Now we must actively pursue new challenges and determine how we can best leverage the experiences we have gained through past failures. I will create an energetic workplace in which our employees bravely pursue new challenges with their colleagues being inspired by such challenges, leading to a steady stream of new business opportunities being developed.

In addition, we will also revise our human resources framework so that our employees can carry out their responsibilities with a sense of enthusiasm and maximize their potential. For example, with the aim of encouraging employees to engage in new challenges, SMBC is in the process of revising its human resources framework based on the three concepts of Fair: A framework that fairly evaluates and rewards our employees, Challenge: A framework that encourages and rewards an employee’s desire to engage in more challenging responsibilities, and Chance: A framework under which all employees are given opportunities to demonstrate their abilities to the fullest extent. In addition, as Group CEO, I will redouble our efforts to develop next generation leaders and assign employees based on the “right person for the right position” approach. I believe that developing a culture and establishing a framework that allows employees to pursue their dreams with confidence and ambition is one of the key tasks of a business leader.

“Ever since I was appointed as Group CEO,

I have been calling on employees to ‘Break the Mold.’”

Environment and Society: Resolving Social Issues Through Our Business Operations and Our Initiatives Related to the Sustainable Development Goals (“SDGs”).

We are currently facing various environmental and social issues which need to be addressed on a global basis, for example climate change resulting from global warming and human rights violations in supply chains operating in emerging markets. Financial institutions are expected to play a substantial role in addressing such developments as our business allows us to act as a hub connecting various industries. SMBC Group will further strengthen efforts to resolve social issues through our business operations and in relation to our SDG related initiatives so that we may realize the sustainable development of society.

We at SMBC Group have positioned the sustainable development of society as a key issue and in October 2018 reorganized the CSR Committee into the Corporate Sustainability Committee to enable us to better carry out CSR-related initiatives. The committee has the strong support of top management, I serve as the Chairperson of the committee, and it will lead our efforts to promote sustainability management based on a non-financial perspective. Furthermore, we have designated Environment, Next Generation, and Community as social issues we will address over the medium- to long-term. We designated ten goals within the SDGs to focus on in order to resolve the three social issues and have incorporated them into our business units’ strategies and initiatives. Our initiatives have been highly evaluated by outside parties as illustrated by the fact that Sumitomo Mitsui Financial Group is included in many of the world’s major ESG indices. We will continue to engage in group-based efforts from the perspectives of Environment, Next Generation, and Community to resolve social issues via our business operations and to achieve the SDGs.

The Environment

We continue to engage in proactive initiatives that are ahead of our competitors. In December 2017, SMBC Group expressed its support for the Task Force on Climate-related Financial Disclosures (TCFD), a task force established by the Financial Stability Board. As a part of our efforts, in April 2019 SMBC Group became the first global financial institution to calculate the financial impact of climate-related risks and disclose the detailed results of such calculations. Furthermore, in February 2019 SMBC promptly announced its endorsement of the Principles for Responsible Banking put forward by the United Nations Environment Programme Finance Initiative.

With environmentally friendly finance drawing increasing attention, SMBC has limited the financing of new coal-fired power plants to those using ultra-supercritical or more highly efficient methods, in addition to the issuance of green bonds to fund eco-friendly projects. Furthermore, SMBC Nikko established the SDGs Finance Department in September 2018 to support clients in issuing SDG bonds, namely green bonds, and raise funds that help resolve social and environmental issues.

Society

From the standpoint of initiatives aimed at addressing social issues, SMBC Group companies, such as SMBC, SMBC Nikko, and SMBC Consumer Finance have been focusing on financial literacy education based on their respective business models. In addition, in light of Japan’s changing demographics, SMBC Group is introducing facilities and services in order to become a financial institution which all our customers, including elderly customers, customers with cognitive impairments, and customers with disabilities feel comfortable dealing with.

We will also accelerate our diversity-related initiatives to further enhance the engagement of our employees, one of SMBC Group’s strengths. The ratio of female managers is on an upward trend with SMBC announcing a new target of 25% to be achieved by the end of FY2019 as they had achieved their original target of 20% by FY2020 ahead of schedule. The ratio of locally hired General Managers is also rising, reaching 34% as of April 2019. Having said this however, our diversity-related initiatives are far from complete as long as we continue to apply categorizations such as “sex” and “locally hired.” SMBC Group will continue its efforts to construct a truly diverse workplace in which innovation is realized as a result of employees of different backgrounds and attributes, such as gender, nationality, and values engaging in open and free-spirited debate.

Governance

We realize that there is no perfect form for corporate governance structures. Accordingly, we will continue working, on both a group and global basis, toward the enhancement of corporate governance in order to realize higher levels of effectiveness. In April 2017, we instituted a new Group governance system through the introduction of group-wide business units and the CxO system. In June of the same year, we transitioned to a Company with Three Committees. Due to these changes, I feel that at our Board of Director meetings “big-picture” discussions have increased as it is now possible to engage in more intensive deliberations while leveraging the expertise of our outside directors. In June 2019, the number of directors was reduced from 17 to 15. As a result, the ratio of outside directors sitting on the Board of Directors rose to 47%. Also, in June 2019, SMBC and SMBC Nikko transformed to a company with an Audit and Supervisory Committee in order to accelerate the execution of operations and enhance the Board of Directors’ supervisory capabilities.

In August 2018, SMBC Group established the SMBC Group Global Advisory Meeting, a meeting which SMBC Group Global Advisors, a select group of experts in global political, economic, and business matters, would act in an advisory capacity to the SMBC Group Management Committee. The management committee is receiving valuable advice concerning changes in global trends and the state of various countries’ political and economic environments. We are also working to ensure the effectiveness of corporate governance-related efforts by conducting compliance surveys so that management is aware of our employees’ thoughts and concerns.

Progress of the Medium-Term Management Plan and the

Focus of Our Strategies Going Forward

I will now address the progress we have made regarding the strategic initiatives introduced under the current Medium-Term Management Plan and discuss the focus of our strategies going forward.

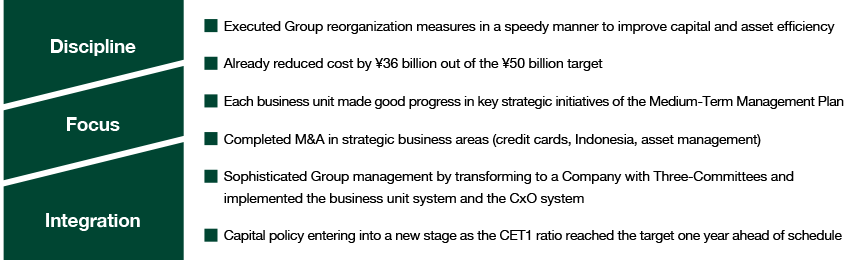

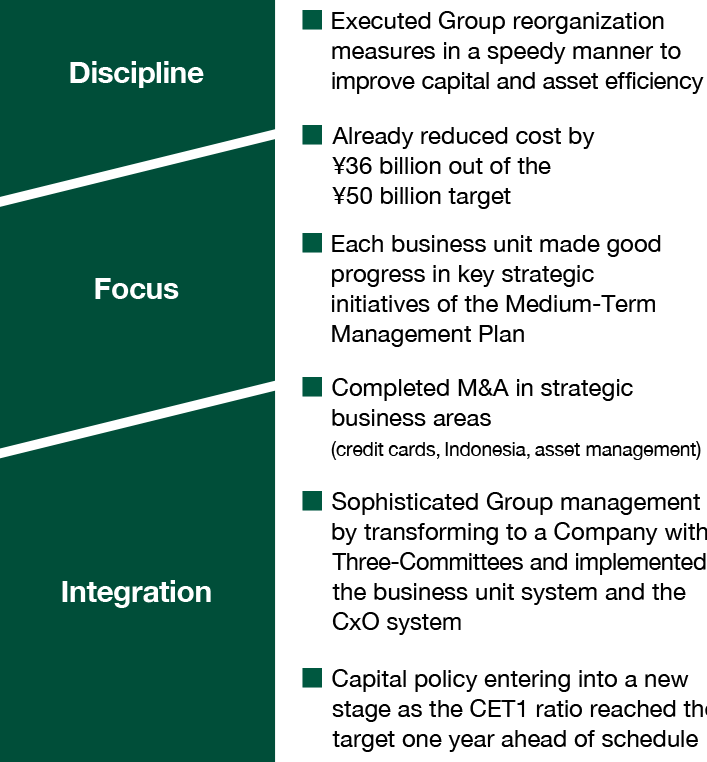

In April 2017, the Medium-Term Management Plan “SMBC Group Next Stage” was introduced under the new Group management system, and we have been engaging in various initiatives focusing on three core policies: Discipline, Focus, and Integration.

Generally speaking, we have produced solid results during the first two years in terms of implemented initiatives and financial results.

First, I will discuss the core policy of Discipline. Under the current Medium-Term Management Plan we have consistently looked to better control our costs. During the first two years we realized cost savings of ¥36 billion versus the three year target of ¥50 billion due to the success of key initiatives, such as business process reform through the application of RPA and the transformation of all of the 430 SMBC branches into smart branches (259 branches have been converted into smart branches in the first two years). We also improved asset and capital efficiencies as a result of implementing a number of measures aimed at reorganizing our Group companies, for example Sumitomo Mitsui Finance and Leasing Co., Ltd., the two Kansai regional banks, Sumitomo Mitsui Card Company, and BTPN.

For Focus, initiatives targeting each of the Seven Core Business Areas are producing steady results. Our Retail Business Unit is transforming its wealth management business into a management fee based revenue model from its original sales commission based revenue model. Our International Business Unit accelerated its Multi-Franchise Strategy by merging BTPN and PT Bank Mitsui Sumitomo Indonesia. In our asset management business, Sumitomo Mitsui Asset Management Company merged with Daiwa SB Investments in April 2019 to form Sumitomo Mitsui DS Asset Management. The new company has ¥21 trillion of assets under management, number eight in the domestic market.

For Integration, as I have discussed earlier, initiatives related to enhancing the Group management system, digitalization, and ESGs are being steadily carried out.

Key initiatives

Digitalization Initiatives

Going forward, I believe digitalization will be a key decisive factor in determining a company’s competitive advantage, regardless of the industry it is operating in. In order to realize our goals of becoming “A Group which leads the evolution of the financial sector” and “A Group that drives innovation without being bound by existing frameworks or boundaries,” we are accelerating our digitalization initiatives with cashless payment, data utilization, and generating new businesses as the key themes.

For example, cashless payment in Japan is not as popular as in other countries given that it possesses a highly developed banking system which offers a variety of services, such as account transfers, and the high level of trust placed in cash. However, we view Japan’s cashless payment market as having great growth potential over the medium- to long-term. If we take a closer look at the market, the value of credit card settlements is about ¥50 trillion while the value of cash settlement remains quite high at about ¥130 trillion. I believe that promoting cashless payments in Japan and taking over some of the market share from cash settlements will lead to substantial business opportunities. With Sumitomo Mitsui Card Company and Cedyna, SMBC Group has top-tier capabilities in both the issuing and acquiring operations in Japan. As part of efforts to further expand our competitive advantage, we entered into a strategic partnership with GMO Payment Gateway, a leading company in the electronic commerce and online payment market, and Visa, a company that possesses the world’s largest payment network, to develop a next-generation payment platform. We are also working to expand the availability of cashless payments to medium and small size merchants through collaboration with Square, a US company with which we have a capital and business partnership, by providing free of charge small terminals that process credit card payments. SMBC Group will continue to act as a front-runner in the spread of cashless payments in Japan.

In recent years, advances in digital technology have enabled the collection and analysis of large volumes of diverse data. The utilization of data, which has been called “the oil of the 21st century,” is drawing the attention of not only the financial sector but of various industries from around the world. SMBC Group companies operating in the banking, securities, and consumer finance businesses possess a tremendous volume of payment and credit information. Of course, ensuring the protection of our customers’ information and data security are key issues which must be addressed prior to the use of such data, and SMBC Group’s expertise in information management and the trust which we have accumulated over many years are significant advantages when addressing our customers’ concerns. SMBC Group already has a head start in the application of data for business purposes with SMBC developing a system which uses artificial intelligence (“AI”) to detect changes in a company’s financial conditions, while SMBC Nikko has launched an investment information service which uses AI to predict individual stock prices. With these initiatives being highly evaluated, SMBC became the only bank to be selected as a “Competitive IT Strategy Company 2019” by METI and the Tokyo Stock Exchange.

Generating new business through collaborations with other industries is also an important theme. In September 2019, SMBC Group established an innovation hub, hoops link tokyo, in Shibuya, Tokyo. As part of hoops link tokyo’s activities, we established SMBC BREWERY, a workshop program conducted by SMBC Group together with outside companies. The AI investment information service which I introduced earlier was a new business developed as a result of SMBC BREWERY bringing together HEROZ, inc., a company renowned for its Shogi (Japanese chess) AI, with SMBC Nikko.

“SMBC Group will continue to act as a front-runner

in the spread of cashless payments in Japan.”

Risk Management Initiatives

While there are an extremely diverse set of risk factors which global financial institutions must pay close attention to, AML/CFT and cybersecurity are issues which are of particular concern, along with growing geopolitical risks and prolonged monetary easing.

With the threat of terrorism rising throughout the world, international AML/CFT standards have rapidly increased in severity, and we have seen many cases in which companies have been subject to substantial fines levied by overseas regulatory authorities. Overlooking the movement of funds connected to criminal or terrorist activities can disrupt the lives of law abiding citizens as it allows criminal proceeds to reach criminal and terrorist organizations. In addition, there is the risk that international trust in Japan’s financial system will be damaged if it is deemed that related controls and frameworks put in place by Japanese financial institutions are inadequate. The onsite inspection related to the fourth round of the FATF mutual evaluation for Japan is scheduled to commence in fall 2019. Management has been driving efforts to ensure SMBC Group’s success in the mutual evaluation by launching a cross-group project team to review AML risk and client management procedures while incorporating the recommendations of third party experts, in addition to strengthening related systems and heightening employees’ awareness.

Although convenience is increasing with business and operational processes becoming digitalized, cybersecurity risk is growing at a rapid pace because every system is now connected to the internet. Finance is a key part of the economic and social infrastructure of today’s world, and it goes without saying that system failures, data breaches, and data tampering resulting from cyberattacks would not only seriously impact SMBC Group’s operations but also Japan’s economic activities and the lives of Japanese people. In fact, as a result of global networks there is the risk that such attacks would also substantially affect the systems of countries around the world. SMBC Group recognizes cyber-risk as a key management risk, and management is leading efforts to implement various measures to strengthen our cybersecurity measures based on the Declaration of Cyber Security Management issued in March 2018 to address cyber-threats which are becoming increasingly sophisticated on a daily basis. Some examples of such measures are training personnel to ensure that they have the necessary expertise and experience and establishing contingency plans aimed at realizing prompt recovery from cyber-incidents.

The Focus of Our Strategies Going Forward

FY2019 is the final year of the current Medium-Term Management Plan. Thanks to the above mentioned initiatives delivering the desired results, we have made good progress concerning the three financial targets of financial soundness, capital efficiency, and cost efficiency set under the Medium-Term Management Plan. However, we cannot deny the fact that uncertainty in the global economy’s future is increasing. Given such a backdrop, SMBC Group aims to reach its goals by focusing its resources with a keen sense of urgency to ensure that its various initiatives produce results, and we will consistently strive to be one step ahead of the times and clearly understand what our customers’ true needs are.

The new Medium-Term Management Plan will not be a mere extension of the current plan, rather, we are planning to actively debate a range of topics, including new business opportunities, without being bound by a traditional mindset. I have identified the following three points as the focus of our strategies going forward so that we can meet the true needs of our customers by taking full advantage of our competitive strength; our ability to keep-up with the changing times by transforming ourselves.

Bold Transformation

In response to the challenging earnings environment, we will focus on evolving our business model and optimizing the allocation of resources. For example, in our Retail Business Unit, we will realize sustainable growth by making further progress in our efforts to shift the business model of our wealth management business from one that relies on sales commissions generated by investment products to one that relies on management fees generated by customers’ assets under management (“AUM”) while reducing costs through branch reorganization and the promotion of digitalization. In the International Business Unit, we will shift to a growth model that does not rely on expanding our balance sheet. Furthermore, in addition to expanding our business and regional coverage by investing for growth, including through inorganic measures looking at businesses’ growth potential, profitability, and efficiency, we will continue to pursue our “select and concentrate” strategy and further strengthen our cost control initiatives.

Continuous Innovation

The spread of digitalization is changing how the financial sector operates, with SMBC Group’s role and the expectation of our customers also changing. In the face of such change, SMBC Group will engage in continuous innovation so that we not only survive but thrive in this environment. We will consistently provide new value to our customers by identifying what the next age will bring, focusing on generating new business by collaborating with other industries, utilizing data, and process automation.

Maximize Our Group Values

I feel that the Group management system centered on the holding company has steadily taken root over the past two years through group-wide business units and the CxO system. On the other hand, potential still remains in various sectors to expand Group synergies. In addition to determining how to best increase the corporate value of SMBC Group companies, for example via increased investment and allocating human resources to growth areas, we will enhance our ability to address customers’ needs by maximizing synergies as a result of further expanding collaborations among Group companies and optimizing resource allocation on an SMBC Group basis.

Building the Future of the Financial Sector

Looking back over our history, you can see that we have overcome various challenges, for example issues regarding non-performing loans and the global financial crisis, by continuously evolving. The impact of the structural changes we are currently facing equals or even exceeds that of past challenges, but I firmly believe that they present a rare opportunity for us, if we can face these changes head-on and adjust accordingly, to drive forward our competitive advantages.

I am certain that we can unlock a new era and build the future of finance, if we boldly pursue cutting-edge initiatives which are one step ahead of the times while steadily carrying-out strategies formulated under a long-term vision leveraging the various strengths of SMBC Group which I have shared with you during the course of this message. We will pursue further excellence through tireless self-reinvention.

In closing, I would like to ask for the continued support and understanding of all our stakeholders.

July 2019

Jun Ohta

Director President and Group CEO

Sumitomo Mitsui Financial Group, Inc.