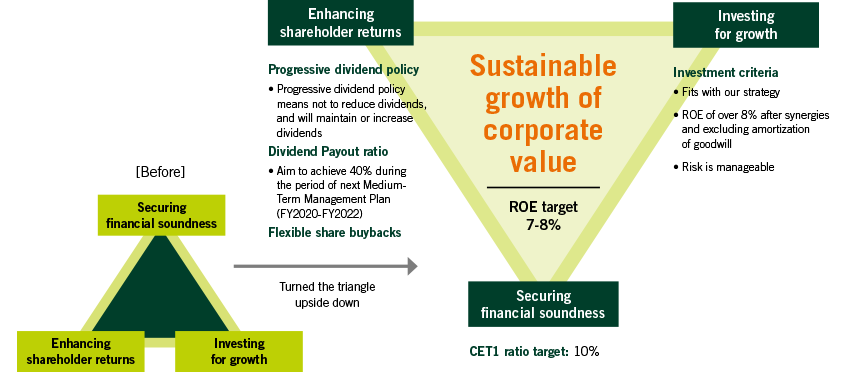

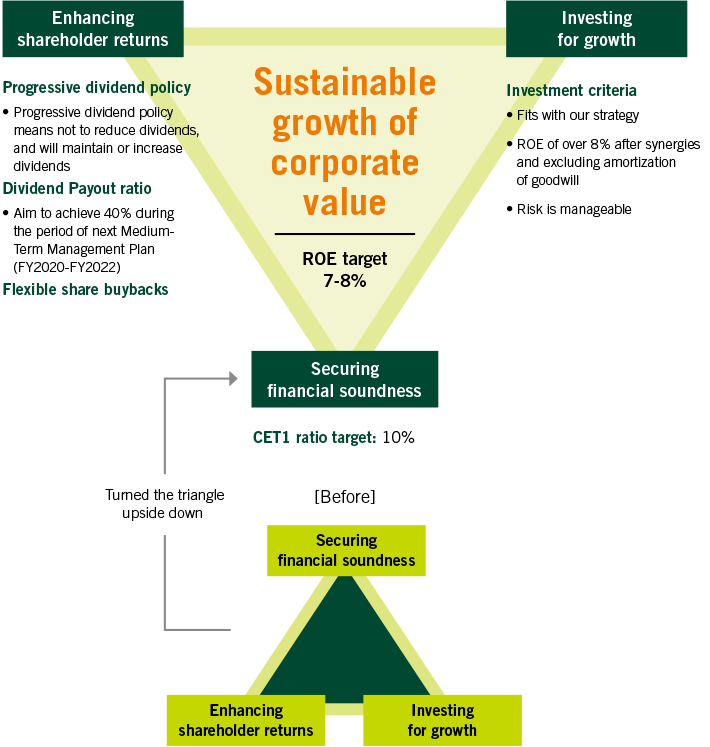

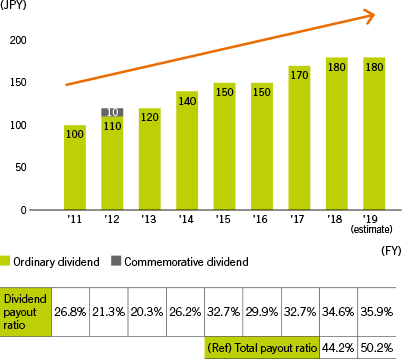

Dividends are our principal approach to shareholder returns. We will pursue a progressive dividends policy, a policy which means that we will not reduce dividends; we will maintain or increase dividends. Our goal is to achieve a payout ratio of 40% during the next Medium-Term Management Plan. In addition, we will proceed with share buybacks on a flexible basis.

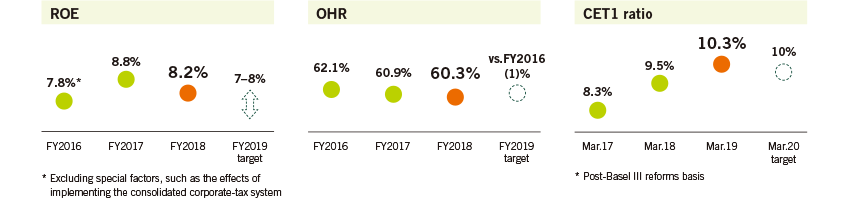

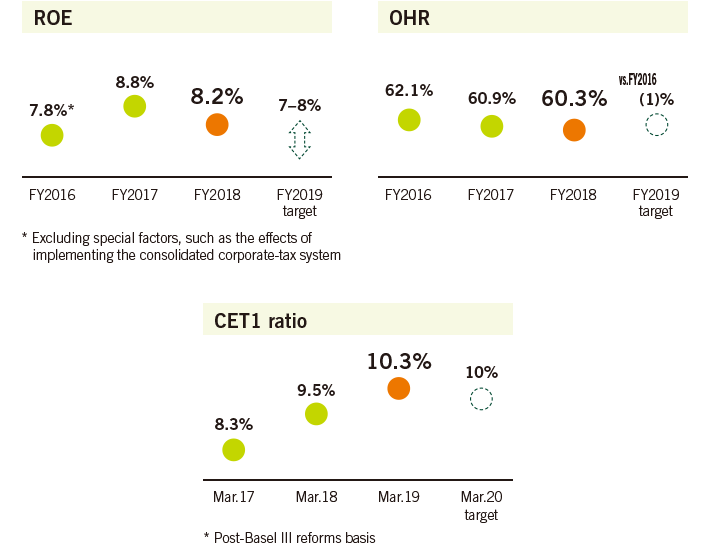

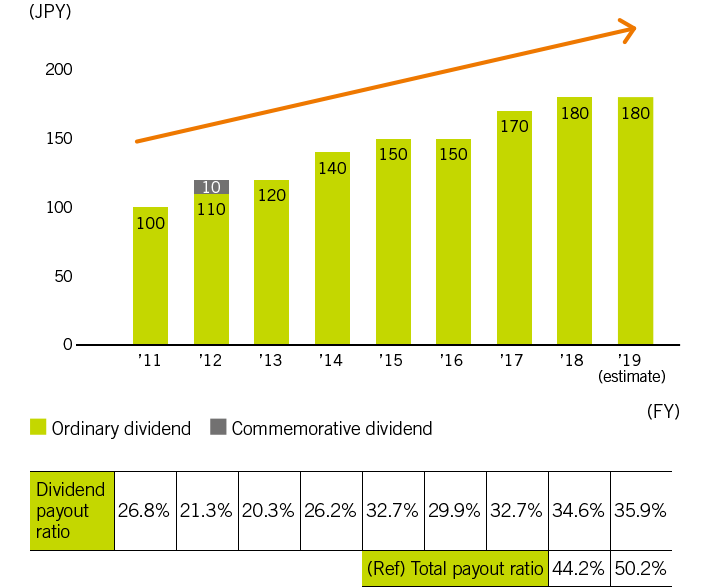

Based on this policy, we increased our dividend for FY2018 to ¥180 per share, ¥10 higher than our initial forecast, and announced a ¥100 billion share buyback program in May 2019. This was an increase of ¥30 billion from the previous year. We decided to increase the amount due to various factors, such as the fact that we had achieved our CET1 ratio target, we expect to continue to accumulate profits in FY2019, current growth investment opportunities, our stock price, and the positive impact on ROE. Among them, our low stock price was the key factor.

For FY2019, we will maintain dividends at ¥180 per share despite an expected decline in profit attributable to owners of parent as part of our efforts to meet the expectations of our shareholders and investors.