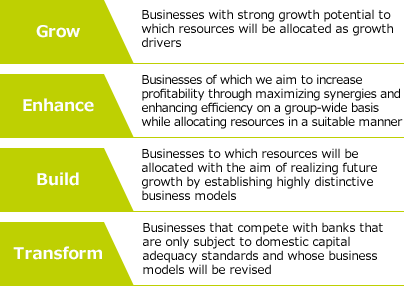

In accordance with the Medium-Term Management Plan, “SMBC Group Next Stage”, SMBC Group has categorized its current business portfolio into the four quadrants detailed to the right.

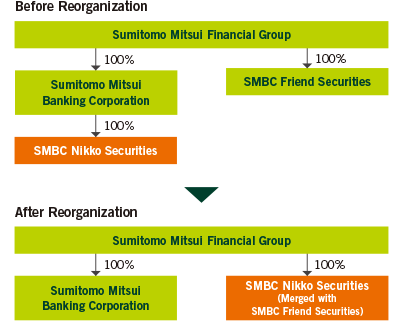

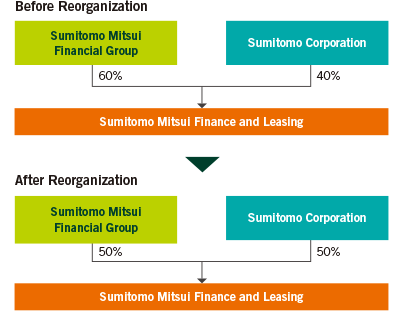

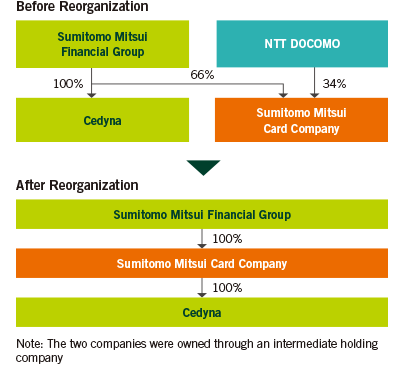

Based on these quadrants, we are undertaking swift reorganizations of the Group’s businesses in order to optimize our Group structure while pursuing improvements in capital and asset efficiency.