(conducted by a subsidiary of the Financial Times)

The economy and society are in the process of undergoing major change due to the spread of digitalization. Technology is progressing at an astonishing speed, and SMBC Group is faced with a situation in which its business model may undergo change of such a scale that it could be seen as a paradigm shift. There is no doubt that this is a substantial challenge for us. However, I believe that there is much potential for us to evolve by absorbing and adopting these technological advances. In addition, we will collaborate with external partners to create new business opportunities, which would not have been possible based solely on the resources and expertise of SMBC Group.

In our current Medium-Term Management Plan “SMBC Group Next Stage,” we have positioned digitalization as a pillar which penetrates all Seven Core Business Areas. More specifically, we will spread digitalization by leveraging new technology, such as blockchain and AI, in all business areas with the goal of increasing customer convenience, creating new businesses, increasing productivity and efficiency, and enhancing our business infrastructure.

For example, in the cashless payment sector we are in the midst of creating a next-generation payment platform with the aim of providing hybrid payment solutions that fuse together finance, IT, and marketing. Furthermore, by using data which is accumulated through activities such as payments, we are working to develop and provide advanced financial products using high-quality risk analysis and realize a more personalized approach to marketing. New business models which leverage data, such as the information bank business model, are being developed, and I believe there is the possibility that in the future SMBC Group will gradually move from the financial sector to the information sector.

In order to implement our digitalization initiatives in a speedy and efficient manner, we must engage in open innovation that brings together the data, technology, and expertise of not only SMBC Group companies, but also of partner companies, which include start-ups, and our customers. We will no longer rely on our traditional principle of self-sufficiency; rather, we will focus on developing business opportunities by collaborating with partners, including the use of application programming interface (“API”s.)

In regards to the digitalization of SMBC Group, I believe it is important that innovation is not undertaken by a small group of personnel or divisions with specialized skill sets. Digitalization must involve all parties within SMBC Group. In order to make this vision a reality, we need to create an environment in which all SMBC Group employees, especially our younger employees, can pursue new challenges without fear of failure. At the same time as CDIO, I will become SMBC Group’s disruptor and spearhead efforts to drive forward initiatives that are not bound by traditional frameworks.

We will create high-quality, appealing services by focusing equally on accelerating the reinvention of SMBC Group’s business culture, for example marketing style and the workstyle of head office employees, and pursuing new opportunities. All of our customers will be offered these services, regardless of whether they are wholesale or retail customers.

A company’s IT strategy is a key business strategy given

the rapid digitalization of our world. SMBC Group has positioned

digitalization as an initiative that will encompass all Seven Core Business

Areas and will promote digitalization from both defensive and

offensive perspectives.

I would now like to share with you a few examples of SMBC Group’s digitalization related initiatives.

SMBC BREWERY, a workshop in which SMBC Group companies collaborate with non-financial sector partners to develop new ideas, kicked-off in April 2018. SMBC Group companies spend half a day working with companies, including start-ups, from outside the financial sector to discuss ideas on which they could collaborate.

Through the workshop, SMBC Nikko and HEROZ, inc., a firm with considerable expertise in AI, partnered together to develop an investment information service “AI Portfolio Diagnosis*,” a service which has been successfully commercialized and is available to customers.

The AI program compiles a suggested portfolio with a high expected rate of return by forecasting companies’ profitability one month in the future based on an analysis of factors such as stock price and earnings.

The SMFG Silicon Valley Digital Innovation Laboratory was established in Silicon Valley and is in charge of discovering high-potential local start-ups. For example, SMBC Group adopted Trifacta Wrangler Enterprise, software which dramatically accelerates data analysis, starting March 2019. Traifcacta, the company which developed the software, was discovered by the SMFG Silicon Valley Digital Innovation Laboratory.

SMBC Group has established the Advanced Technology Laboratory at The Japan Research Institute, and through the laboratory we conduct research/studies into basic and advanced technology in collaboration with IT companies and research institutes.

The efficiency of the screening process targeting suspicious transactions has greatly increased following the application of AI.

We are proactively marketing commercialized systems such as the SMBC Chatbot, an AI-based automatic response system developed to deal with internal inquiries, to customers.

A system that detects changes in a company’s financial conditions which was developed in partnership with JSOL*, a company that engages in IT consulting and systems development, uses AI to analyze movements in the target company’s bank account to recognize changes in the company’s financial conditions in a timely manner. The system is already in use at SMBC and SMBC Group is planning to market the system to customers with the initial focus being Japanese regional banks.

JSOL is a subsidiary of NTT Data and an equity-method affiliate of SMBC Group.

BrainCell, Inc., which was established in partnership with Yahoo! JAPAN, is classified as a business that will contribute to the sophistication of the banking industry under Japan’s Amended Banking Act. We will initially focus on pushing forward SMBC Group’s digital marketing initiatives leveraging the search knowledge of Yahoo! JAPAN.

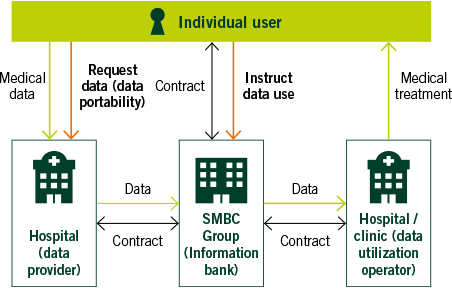

SMBC and The Japan Research Institute have been commissioned by the Ministry of Internal Affairs and Communications to conduct verification exercises regarding the data bank business model. We are working to enhance the convenience of patients by facilitating the sharing of information regarding medical examinations/check-ups and prescriptions between hospitals and pharmacies.

While cashless payments are increasing in popularity all over the world, cashless payments account for only about 20% of payments made in Japan. Having said this, interest in cashless payments in Japan has been rapidly increasing in recent years. The Japanese government has set a target to increase the ratio of cashless payments to 40% by 2025. A variety of measures to promote cashless payments, for example a points reward program for consumers and subsidies for fees associated with cashless payment terminals, are scheduled to be introduced to coincide with the scheduled 2019 consumption tax rise.

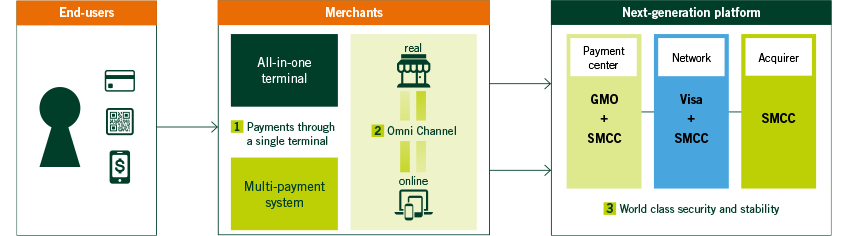

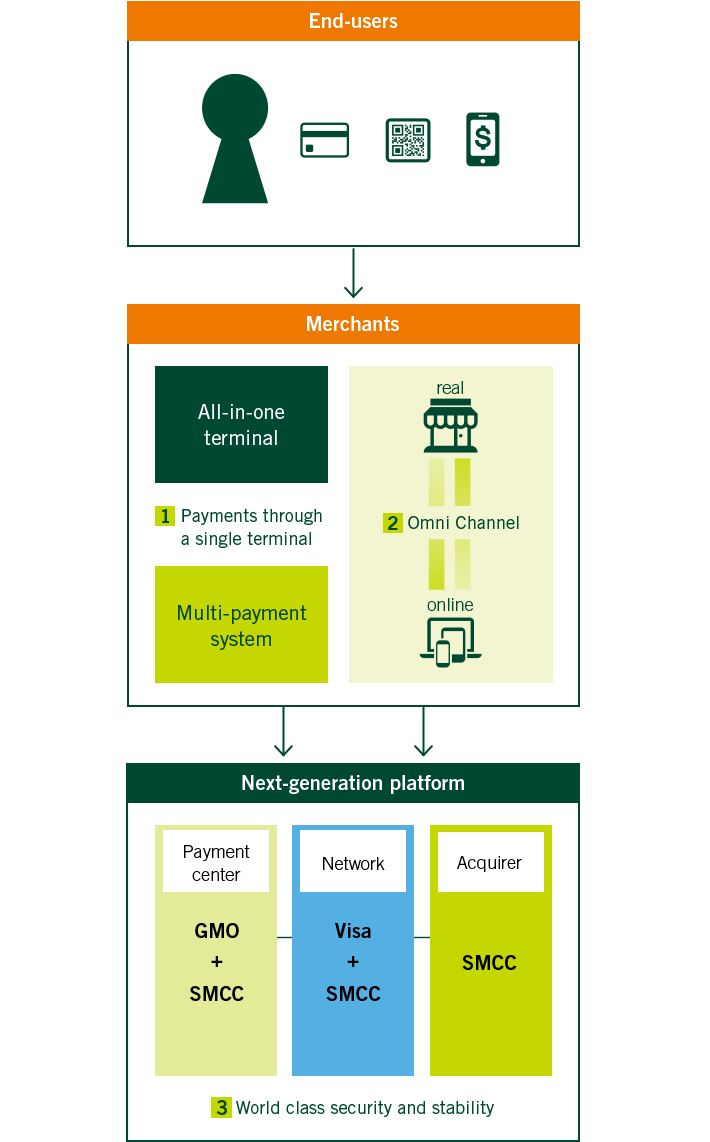

Japan’s cashless payments market has grown while also becoming more diverse and complicated with new payment methods, such as mobile payments and QR codes, joining the more traditional methods of credit cards, debit cards, and e-money. In order to accelerate the spread of cashless payments in Japan, it is not enough to merely offer new payment methods. Rather, we believe that the best strategy is to create an open payment platform which can address the needs of both merchants and end-users in a flexible and speedy manner.

SMBC Group has Sumitomo Mitsui Card Company and Cedyna, two credit card companies that have long led Japan’s cashless payment market, amongst its Group companies. From April 2019 we started to manage, in practice, the two firms as a single business entity, an entity which forms the cornerstone of SMBC Group’s cashless payment strategy. SMBC Group will drive the spread of cashless payments in Japan by implementing a highly efficient and up-tempo strategy that brings together the wide-ranging strengths of our business partners, the expertise accumulated by Sumitomo Mitsui Card Company and Cedyna, and the client base of SMBC.

The reason for the slow spread of cashless payments in Japan is the convenience offered by Japan’s extensive ATM network and the ease which cash can be obtained, for example consumers feeling safe carrying cash due to Japan’s low crime rate. Having said this, there are a number of positive factors that will arise from the spread of cashless payments, such as increased liquidity, less manpower required to processes payments, and stimulating consumption via the use of payment data.

We believe that the key aspects to spreading cashless payments in Japan are not merely convenience and rationality. Carrying “safety” which also results in carrying “peace of mind and freedom” are also key aspects of spreading cashless payments in Japan.

A society in which anybody can spend their days in a carefree manner. A society in which each day is free and welcoming.

Sumitomo Mitsui Card Company has adopted the motto “Have a good Cashless” to reflect these values.

Visa, the company that possesses the world’s largest payment network, joined Sumitomo Mitsui Card Company and GMO Payment Gateway in establishing a next-generation payment platform. In February 2019, the three companies came to an agreement to develop an even stronger payment platform by bringing together each company’s respective skills and expertise.

Our goal is to build a payment platform which satisfies the following criteria: 1) The terminal must be compatible with the large number of cashless payment options which exist in the domestic market, a situation which can be said to be unique to Japan, 2) The platform must seamlessly merge the online and real worlds, and 3) The platform must provide new high-value added services while offering world-class security. We are aiming to launch the new platform during FY2019.

Lately, we are seeing an increasing number of non-financial companies introduce their own, unique payment service with the aim of obtaining and using customers’ payment data. We at SMBC Group have also identified the successful use of data obtained from payments as a key part of our cashless payment strategy. SMBC Group possesses one of Japan’s largest cashless payment foundations, processing payments worth ¥30 trillion. SMBC Group will develop/enhance our ability to support businesses’ marketing needs and produce competitive services while increasing the added value we derive from our payment data by fully leveraging this foundation so that our next-generation payment platform is used by as many merchants and end-users as possible.

By promoting the adoption of Square, a credit card payment system for medium/small size merchants and sole proprietors, and keeping in mind the Japanese government’s Point Reward Project for Consumers using Cashless Payment that will come into effect in October 2019, we will accelerate growth in the number of stores which have installed Square. Square can be acquired at all domestic SMBC branches.

SMBC Group will realize a new cashless payment experience with convenience, safety/peace of mind, and good value as the three key pillars. We renewed the mobile application of SMBC/Sumitomo Mitsui Card Company in FY2018 and added a number of new features, such as a payment limit for debit cards and an asset management function which reflects funds held in banks other than SMBC.