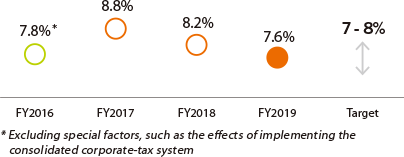

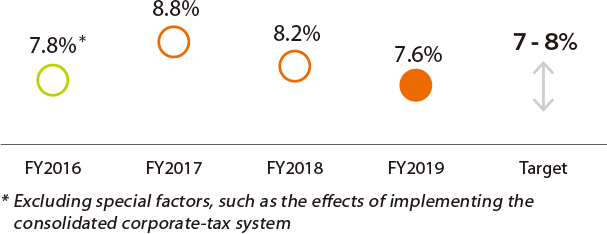

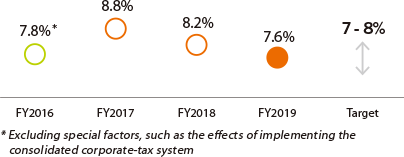

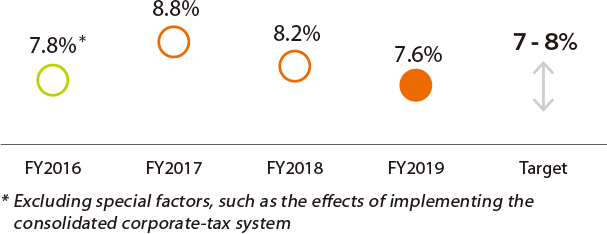

ROE*

Last year, the first year I was responsible for both the Group CFO and CSO roles, was the year we worked on creating the new Medium-Term Management Plan (“the New Plan”).

In last year’s message, I shared my belief that in the context of management, financial and business strategies are two sides of the same coin, and I witnessed firsthand the benefits of the current management framework as I was able to consistently plan and verify initiatives from the perspectives of the Group CFO and CSO, positions that are responsible for SMBC Group’s financial and business strategies.

We have now entered the execution phase of the New Plan, and I will continue to leverage our management framework’s strengths to ensure the New Plan’s strategies are carried out in a comprehensive and speedy manner.

SMBC Group strives to conduct a resilient, first class group management by focusing on enhancing our capital, asset, and cost efficiencies.

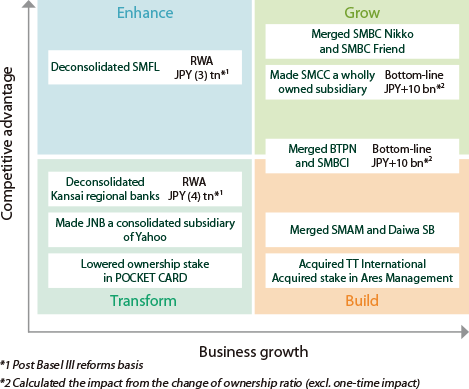

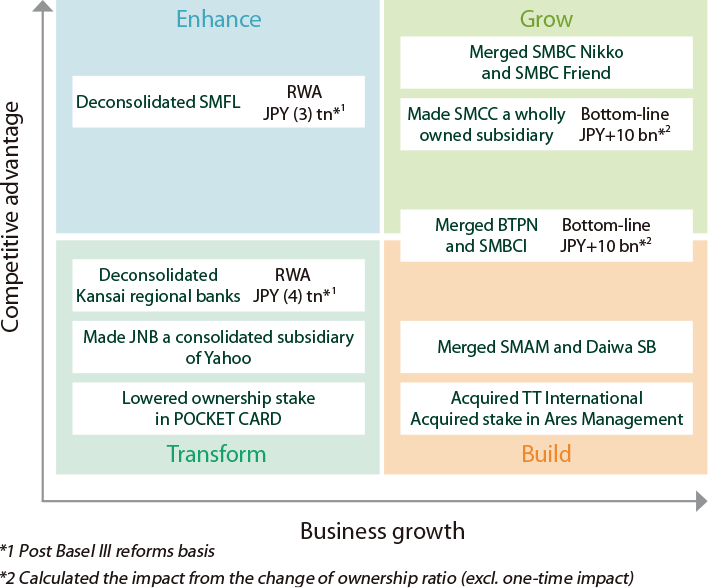

In the previous Medium-Term Management Plan (“the Previous Plan”), SMBC Group categorized its business portfolio into four quadrants based on our competitive advantage and future potential. Through this categorization we swiftly reorganized our Group’s businesses in order to optimize our Group structure and improve capital and assets efficiencies.

For the “Transform” and “Enhance” quadrants we deconsolidated the Kansai regional banks and SMFL in order to enhance capital and asset efficiencies by reducing our risk weighted assets. On the other hand, for our asset management business, which is positioned in the “Build” quadrant given its potential for future growth combined with our current lack of competitive advantage, we started proactively allocating management resources to build up our overseas presence, as illustrated by our acquisition of TT International and our investment in Ares Management.

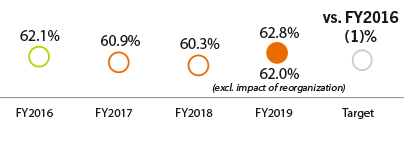

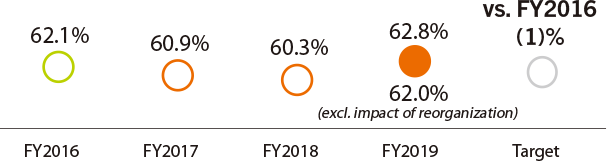

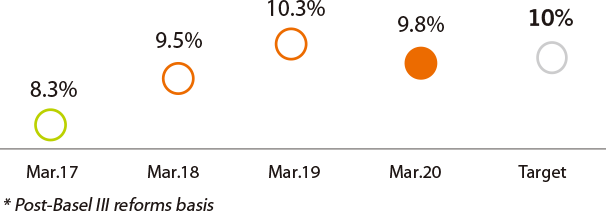

For financial targets, ROE, OHR, and CET1 ratio were selected as the metrics for profitability, efficiency, and financial soundness. Although we were unable to reach our FY2019 OHR target due to COVID-19 reducing our topline revenues, we were able to reach our targets for ROE and CET1 ratio.

In the New Plan there is no change to our commitment to conducting business management with the focus on enhancing efficiencies. As Mr. Ohta stated in the Group CEO Message, through our core policy of Transformation, we will increase profit by drastic optimization and remodeling businesses, while at the same time leveraging our capital base to pursue further growth through our core policy of Growth.

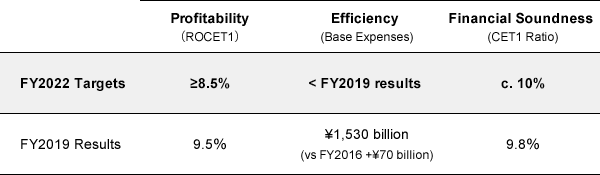

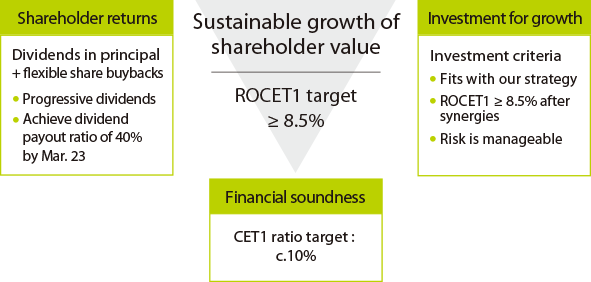

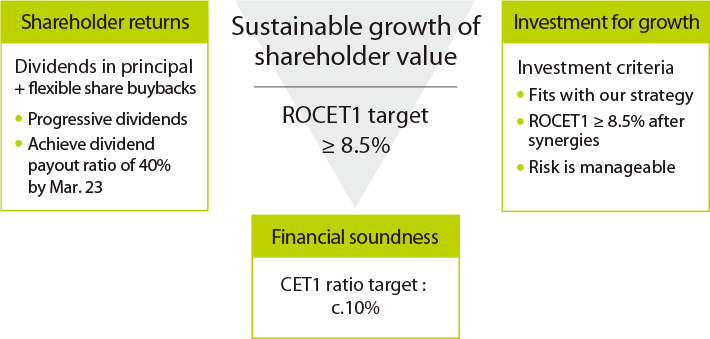

As in the Previous Plan, we have set three metrics of profitability, efficiency, and financial soundness as financial targets. However, for profitability we changed the metric from ROE to ROCET1, while for efficiency we changed the metric from OHR to controlling base expenses.

A target of 8.5% or higher has been set for ROCET1. ROCET1 is calculated using CET1 as the denominator with CET1 being a valuable metric that we use in determining financial soundness. The ROE target of 7-8% set under the Previous Plan is currently equivalent to an ROCET1 of 8-9%. As such, our new target reflects practically raising the minimum level by 0.5%.

As for efficiency, we introduced a new concept, “base expenses,” in order to achieve a balanced approach to cost control and investment for growth. Our goal is to realize base expenses that are lower than FY2019 levels. I will explain the definition of base expenses further below.

As for financial soundness, consistent with the Previous Plan, we aim to secure a CET1 ratio of c.10% on a post-Basel III reforms basis and excluding unrealized gains on securities.

Base expenses, our new efficiency metric, is comprised of G&A expenses net of expenses related to investments for future growth, revenue linked variable costs, and one-off expenses. This new metric was introduced in response to feedback during the Previous Plan that cost management based on OHR tends to fall into a shrinking equilibrium and leads to a lack of investment for growth. This change is by no means an attempt to loosen controls on cost. Given that approximately 90% of G&A expenses fall under base expenses, we believe that it is fully possible to enhance efficiency by carefully controlling base expenses.

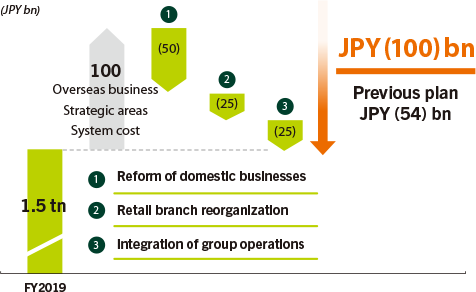

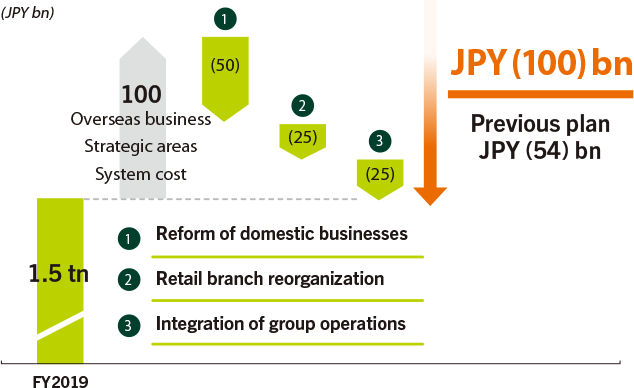

In the Previous Plan, we succeeded in reducing costs by ¥54 billion, exceeding our target of ¥50 billion, through the following key initiatives: business reforms to improve efficiency, retail branch reorganization, and reorganization of Group companies. However, base expenses rose by ¥70 billion over the same period due to expenses related to strengthening our overseas businesses and IT systems.

Although we expect expenses related to overseas businesses and IT systems to increase by a little under ¥100 billion during the New Plan, we will further enhance cost control measures so that there is no increase in base expenses. Specifically, we will cut costs by ¥100 billion, a figure that is double the Previous Plan’s achievement, through the three key initiatives: reform of domestic businesses, retail branch reorganization, and integration of Group operations.

In the New Plan, we will continue to take a balanced approach to securing financial soundness, enhancing shareholder returns, and investing for growth.

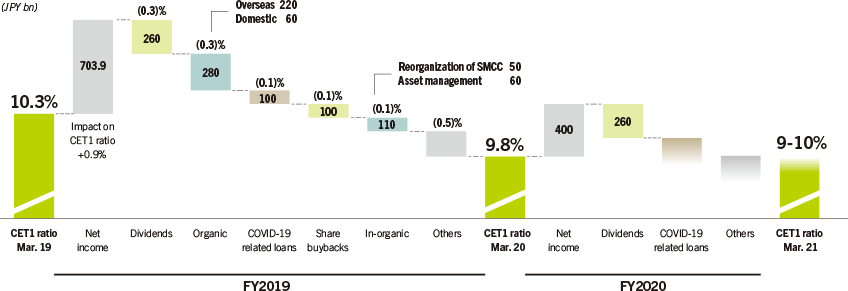

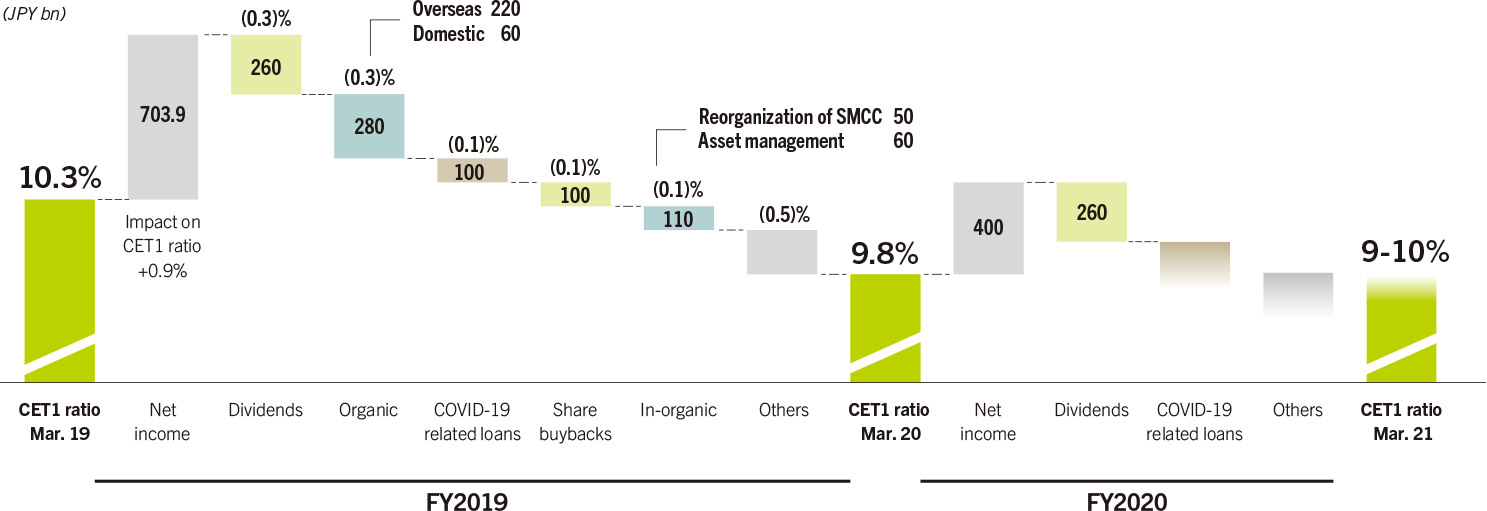

We were able to reach our CET1 ratio target of c.10% as a result of accumulating capital over the course of the Previous Plan. The CET1 ratio target was calculated taking into account the impact of the Basel III reforms which will gradually take place from 2023 to 2028 and excludes unrealized gains on securities. Also, based on the Basel III fully-loaded basis, which is currently required by regulators, our CET1 ratio as of the end of FY2019 was 15.5%, greatly exceeding the required level of 8%.

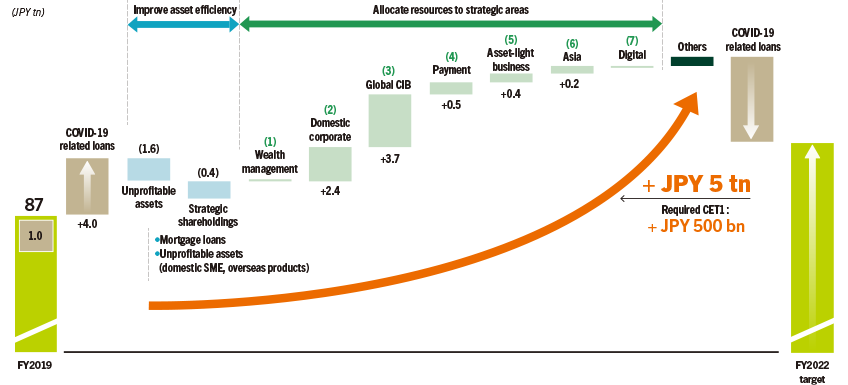

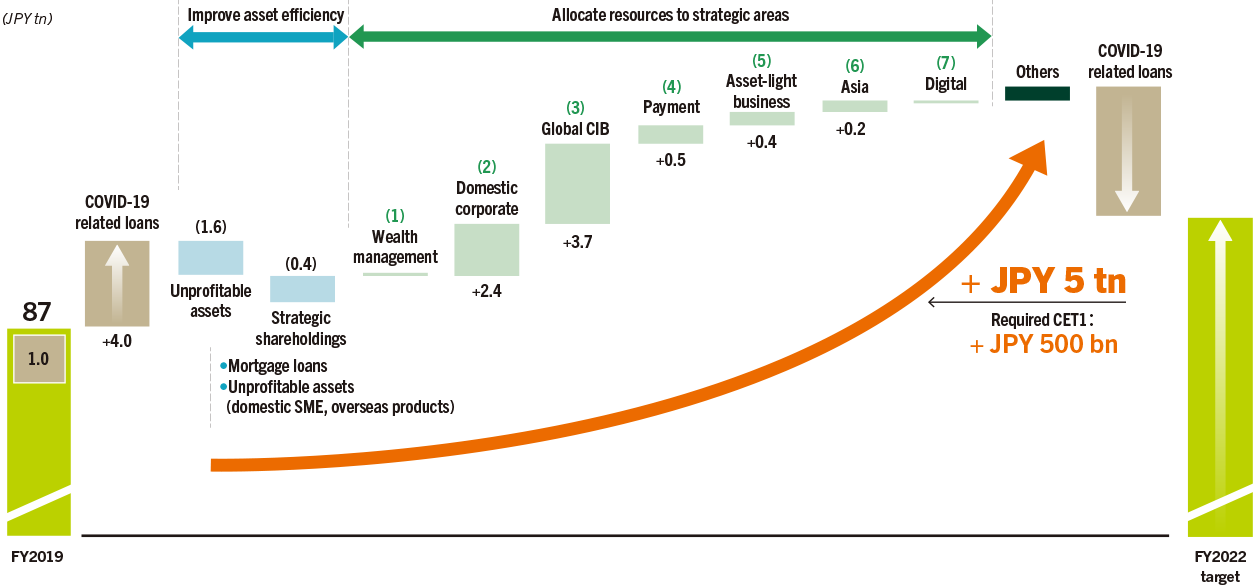

Our financial soundness can be a formidable competitive advantage during times of crisis, such as the one we are currently facing. First, we will provide financial support to customers both in and outside of Japan who are being affected by COVID-19. As such, risk weighted assets are expected to exceed our original target for FY2020, the first year of the New Plan, by ¥5 trillion which equals a 0.5% decrease in our CET1 ratio. Therefore, for the foreseeable future we will manage our CET1 ratio at c.9.5%, 0.5% less than the target set under the New Plan, in order to reflect the impact of COVID-19 associated loans.

It is this robust capital base that will allow us to proactively enhance shareholder returns and pursue attractive growth opportunities.

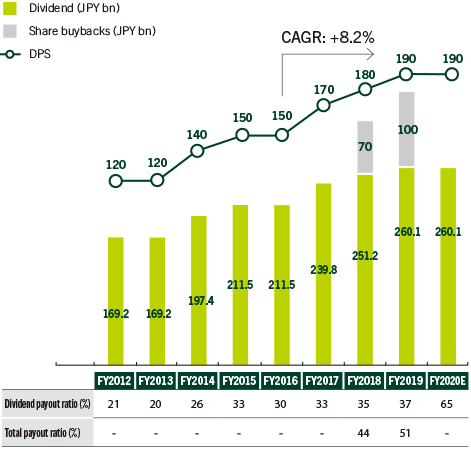

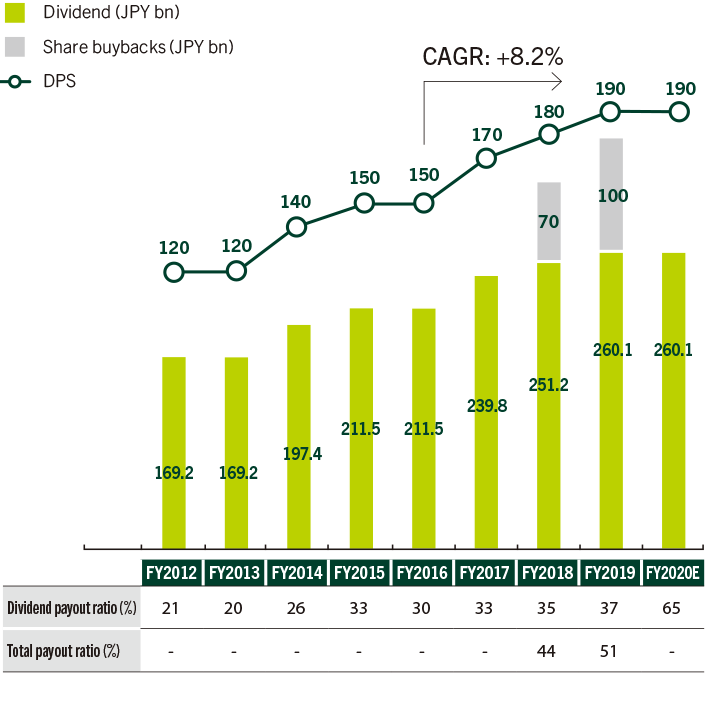

In the Previous Plan, we increased dividends throughout all three years (a total of ¥40 per share) while carrying out share buybacks totaling ¥170 billion. In the New Plan there is no change to our shareholder return policy of dividends being our principal approach while conducting flexible share buybacks. We will continue to pursue a progressive dividend policy, meaning that we will at least maintain, if not increase, dividend payments, and aim to achieve a dividend payout ratio of 40% by FY2022.

We increased our dividends for FY2019 by ¥10 to ¥190 per share as we exceeded our ¥700 billion target for profit attributable to owners of parent and took steps towards achieving a dividend payout ratio of 40%. For FY2020, we will maintain our dividend payout of ¥190 per share based on our progressive dividend policy despite a significant reduction in forecasted net income, which will raise our dividend payout ratio to 65%. Please be assured however, that we will by no means view this as reaching our target dividend payout ratio of 40%. While we must continue to operate in a challenging business environment, we will aim to increase profit attributable to owners of parent during the three years covered under the New Plan and further increase our dividends so that we realize a 40% dividend payout ratio based on these figures.

We decided not to announce share buybacks in May 2020. We recognize our share price is currently at a very low level and understand that there are expectations for share buybacks from investors. However, at this time, we have concluded that we must focus on providing financial support to our customers and that more time is required to assess the real impact of COVID-19.

Unlike the Previous Plan during which we focused on capital accumulation, given that we have reached our CET1 Ratio target, the New Plan represents a new stage in which we leverage our capital base to pursue growth opportunities. While asset efficiency will remain a key focus and we will continue reducing unprofitable assets and strategic shareholdings, we will allocate capital to increase risk weighted assets to growth areas. As illustrated in the below chart, over the three years covered by the New Plan we will allocate a net of ¥500 billion of capital and increase risk weighted assets by a net of ¥5 trillion through our seven key strategies.

We expect that risk weighted assets associated with COVID-19 related loans will be fully repaid by the end of FY2022 and therefore have no impact on the New Plan’s targets.

We will pursue inorganic growth through strategic M&A while maintaining financial soundness and disciplined investment criteria. There will be no change in the focus of our investments: “assets that promptly raise our ROCET1” and “investments for the future.” The former refers to areas in which SMBC Group possesses global strengths, with past examples being investments in aircraft leasing, middle-market LBO, and asset management businesses. The latter refers to investments in the Asian commercial banking business, securities business, trust banking, and digital businesses.

SMBC Group purchased the aircraft leasing businesses of a European bank (currently SMBC Aviation Capital) following the Financial crisis, and the current market environment may bring opportunities to acquire quality assets at discounted prices. Of course, any investment will be made following our disciplined investment criteria.

The chart below shows the use of capital for FY2019 and FY2020. As for FY2020, the forecast of profit attributable to owners of parent is ¥400 billion. ¥260 billion will be allocated to dividends and we will extend loans to our overseas and domestic customers who are suffering from the adverse effects of COVID-19. Then we will consider how to best deploy our remaining capital.

*Scroll horizontally to view the following table. →

*Scroll horizontally to view the following table. →

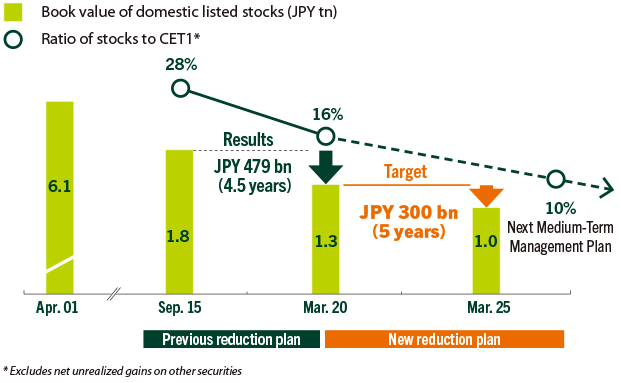

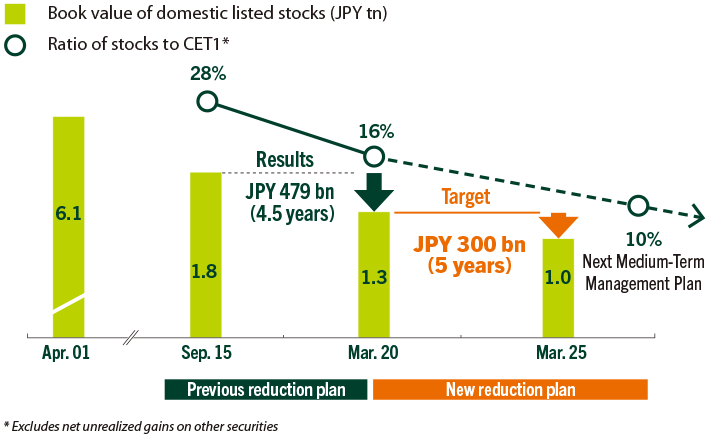

Over a five-year period starting October 2015, we set a plan to reduce our strategic shareholdings by ¥500 billion (book value basis). As of March 2020, six months before our deadline, we succeeded in reducing our strategic shareholdings by ¥480 billion, in addition to obtaining customers’ consent to sell another ¥70 billion worth of strategic shareholdings. As such, we are highly confident that we will reach our target.

We have established a new reduction plan in which we will reduce strategic shareholdings by ¥300 billion over a five year period starting April 2020 together with the launch of the New Plan.

While we have made steady progress in reducing our strategic shareholdings, the pace of reductions going forward will be slower than the previous reduction plan, as the remaining stocks include those of customers who are not open to the idea of having SMBC Group reduce our ownership of their shares. However, there has been no change in our policy to reduce strategic shareholdings over the medium- to long-term, and we will continue to work hard to reduce them.

Creating opportunities to engage in constructive discussions with investors and analysts is one of my key responsibilities as Group CFO.

During FY2019, in addition to individual and small meetings led by senior management with investors and IR day presentations by the heads of our respective business units, we also held seminars regarding our cashless payment strategy given the strong interest in our efforts in this area. I believe that incorporating the views and opinions we receive in such meetings allowed us to prepare a higher quality Medium-Term Management Plan and capital policy.

Furthermore, in April 2019 SMBC Group become the first global financial institution to calculate and release the financial impact of climate change in response to recommendations made by the Task Force on Climate-Related Financial Disclosures (“TCFD”). Initially, only physical risks related to climate change were calculated and disclosed. However, we tirelessly worked to enhance our analytical capabilities, and in February 2020 we disclosed the transition risks associated with climate change.

I am very happy that such efforts have received proper recognition, with SMBC Group being selected for the top award in the banking category of the 2019 Award for Corporate Disclosure presented by the Securities Analysts Association of Japan and the 2019 Best IR Award presented by the Japan Investor Relations Association.

A different approach to investor communication is required due to COVID-19. For example, our FY2020 Investors Meeting was conducted online and individual investor meetings are being conducted either online or via teleconference. However, it is during times such as these that as Group CFO I must safeguard the continuation of high-quality and timely communication. We will ensure any changes to our business environment or earnings forecasts due to COVID 19 are disclosed in a timely manner. Furthermore, we will place an even greater focus on disclosing non-financial and ESG-related information. For the first time in our history, on June 2020 we held an ESG-themed investor meeting.

SMBC Group will continue to proactively disclose information that is useful to our stakeholders and incorporate these measures into our efforts to realize sustainable growth and increase corporate value.

Toru NakashimaGroup CFO

Director Senior Managing Corporate Executive Officer