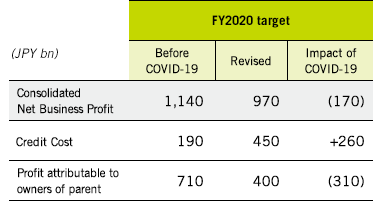

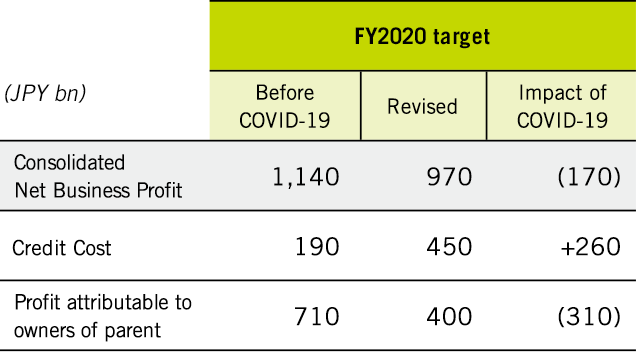

Excluding some countries and territories, the number of new COVID-19 cases has peaked-out, although we expect new infections to continue for the remainder of the year. Therefore, although the global economy is expected to bottom out in the second half of the year, we expect that negative fallout from the virus will last throughout FY2020. As such, we made major revisions to the various targets that had been originally established for the New Plan’s first year. The revised business targets we announced in May 2020 are as follows. However, we will not hesitate to make further changes to our plans and goals, even during the year, if material changes in our business environment require such adjustments.

SMBC GROUP

ANNUAL REPORT 2020

The Impact of COVID-19

As stated in the Group CEO Message, the New Medium-Term Management Plan’s (“the New Plan”) goal is to realize sustainable growth in a challenging business environment, and we have not made any changes to the New Plan’s framework in response to COVID-19. However, I will touch upon some key points given that COVID-19 will have a big impact on our FY2020 financial results.

Impact on FY2020 Earnings

Credit Cost

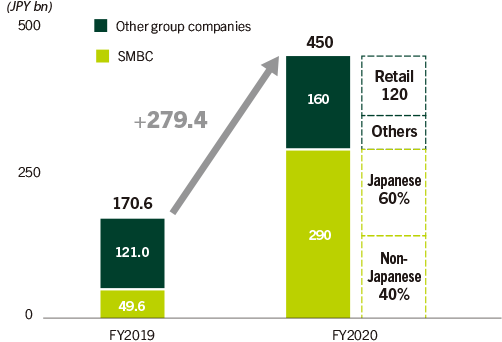

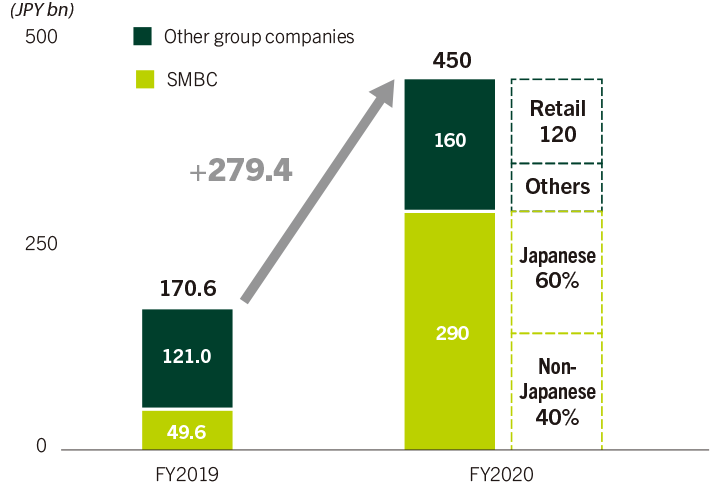

Our FY2020 forecast for credit cost is ¥450 billion on a consolidated basis, of which ¥290 billion is for SMBC, 60% for Japanese corporations and 40% for non-Japanese corporations. As for Japanese corporations, half is for large corporates and the other half is for medium-sized corporations and SMEs. As for non-Japanese corporations, we expect increased costs in the leisure industry such as hotels and casinos, oil and gas, and LBOs. As for Group companies other than SMBC, we expect credit cost of ¥160 billion, a ¥40 billion increase from FY2019, centering on retail Group companies (SMBC Consumer Finance, Sumitomo Mitsui Card Company).

While this represents a substantial increase in credit cost, we are not expecting the situation to deteriorate further than what we experienced during the Financial crisis in 2008. Although the decline in GDP is expected to exceed that of the Financial crisis, we do not forecast credit cost to increase as much. This is the result of the financial sector’s increased resilience due to more stringent international financial regulations requiring financial firms to set aside greater amounts of capital, in addition to our improved asset quality due to domestic companies’ increased internal reserves.

Aircraft Leasing Business

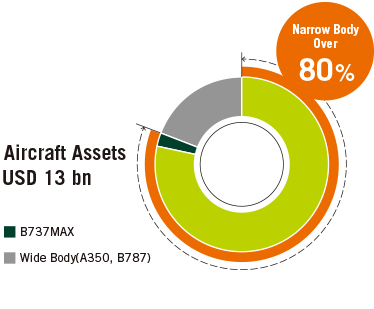

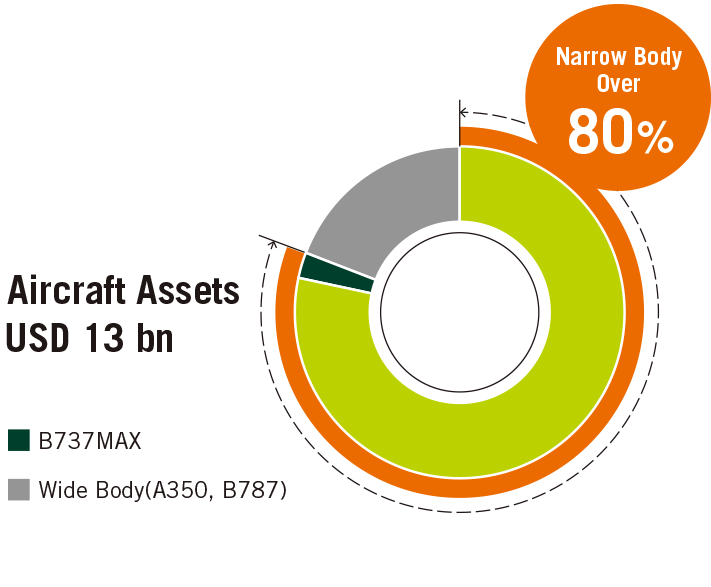

Our aircraft leasing business conducted by SMBC Aviation Capital represents a business area in which SMBC Group has a competitive advantage. However, the cash flow of airlines is deteriorating due to worldwide restrictions on travel, and some airlines are finding it difficult to pay leasing fees. Once airlines fail to pay leasing fees, leasing companies take action, for example repossessing aircrafts and re-leasing them to other airlines. In this case, if the leasing fees are reduced, leasing companies record impairment losses on leasing assets due to the reduction of future cash flow. However, we do not expect SMBC Aviation Capital to record significant impairment losses considering its highly liquid portfolio. The majority of the aircraft assets they own are young narrow body aircrafts whose price volatility is low.

Therefore, although a short-term decline in profit is inevitable, bottom-line profit for FY2020 is expected to decline only by 30 to 40% YoY. As SMBC Aviation Capital is our equity method affiliate, the negative impact on our consolidated bottom line profit, based on our ownership share, is expected to be less than ¥10 billion.

Highly liquid portfolio

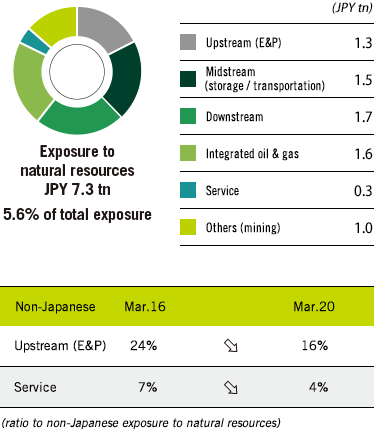

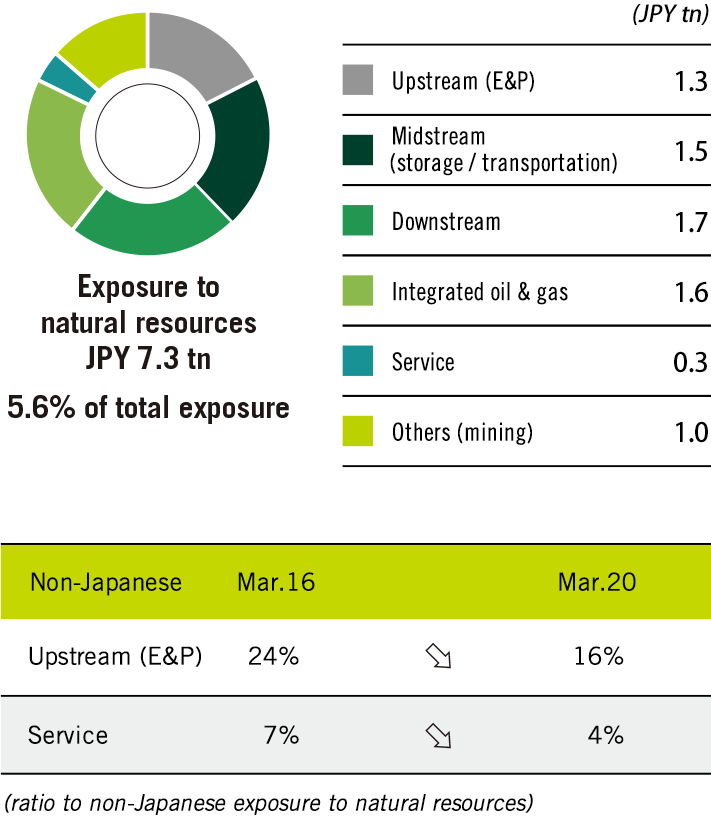

Exposure to the Natural Resources Sector

Our natural resource-related exposure is currently ¥7.3 trillion, which is equivalent to 5.6% of our consolidated total exposure, and 90% of our obligors have high internal ratings. In addition, we have a diversified portfolio by business area and geographic location. Moreover, by taking a cautious approach, we have reduced exposure of non-Japanese upstream and service transactions that are vulnerable to oil prices, which make them relatively risky. Therefore, we do not expect a significant increase of credit cost in this sector. However, considering the recent sharp decline in oil prices and revisions of demand–supply forecasts, we recorded some forward-looking provisions in FY2019 and expect a certain level of associated credit cost in FY2020.