Message from the Group CFO

FY2020 was a year in which the world was compelled to address the various social issues that arose due to the COVID-19 pandemic, the resulting changes in peoples’ mindsets and behavior, and fluctuations in financial markets. We at SMBC Group placed the highest priority on supporting customers, from both financial and non-financial perspectives, while at the same time taking the necessary steps to safeguard the wellbeing of our employees. Given this backdrop, as the Group CFO and Group CSO I paid close attention to the progress we were making in the implementation of the various initiatives established under the Medium-Term Management Plan which commenced in April 2020. In other words, I was attempting to determine whether the results we initially anticipated could be produced by the seven key strategies that were established under the core policies of “Transformation and Growth,” the cost control-related initiatives that were meant to expand our competitive edge in cost efficiency, and the leveraging of our strong capital base to pursue inorganic growth opportunities by measuring our progress according to the pace expected under the very challenging business environment brought about by the COVID-19 pandemic. The impact the COVID-19 pandemic had on our businesses became clear following our FY2020 financial results. While it was difficult to determine the impact that the Medium-Term Management Plan’s initiatives were having in terms of actual figures given the negative impact of the COVID-19 pandemic, FY2020 was a year in which we were able to strengthen the profitability of our businesses, the underlying goal of many of our efforts. It is very encouraging to see that SMBC Group was able to carry out its initiatives in a consistent manner, regardless of the challenging business environment, and produce concrete results. Accelerating this trend and proactively transforming the various changes brought about by the COVID-19 pandemic into business opportunities will allow us to not only further enhance our earning capabilities in a more robust manner in FY2021; it will also position us to accomplish the goals we have set out under the Medium-Term Management Plan in FY2022, the final year of the plan.

Current Business Environment

(1) Overview of FY2020 Financial Results

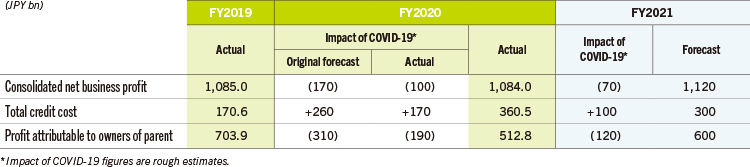

Although we calculated that the COVID-19 pandemic reduced consolidated net business profit by ¥100 billion, we were still able to generate consolidated net business profit of ¥1.084 trillion, a result similar to that of FY2019. As we had anticipated at the start of the fiscal year, business sectors which we consider our strengths, namely credit cards, consumer finance, and aircraft leasing suffered due to the COVID-19 pandemic. However, in addition to the strong performance of our wealth management business and our overseas securities business due to heightened bond issuance needs, we also benefited from a fall in expenses which we had not initially foreseen. As such, the actual impact of the COVID-19 pandemic on consolidated net business profit was substantially lower than the originally forecasted amount of ¥170 billion.

While credit cost increased in both domestic and overseas markets, thanks to the government support and liquidity support from banks, SMBC Group’s credit cost was ¥360.5 billion, approximately ¥90 billion lower than originally anticipated.

As a result, we were able to achieve profit attributable to owners of parent of ¥512.8 billion although we proactively took steps to address future risks, for example, recording provision for losses on interest repayments of our consumer finance business. Once again, the COVID-19 pandemic’s actual negative impact of ¥190 billion was substantially lower than the initially anticipated amount of ¥310 billion.

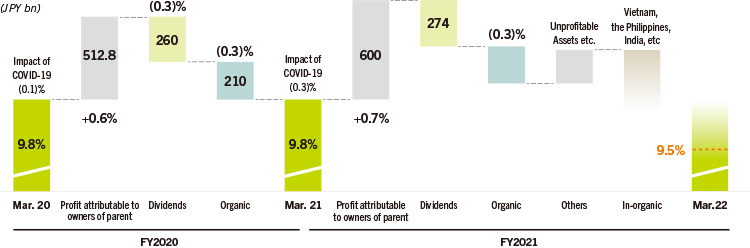

(2) Progress of the Medium-Term Management Plan

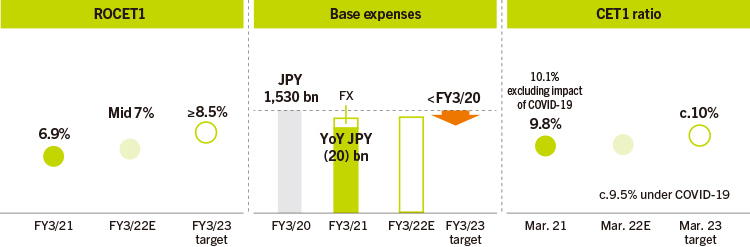

SMBC Group focuses on business efficiency when conducting our business operations, and we selected profitability, efficiency, and financial soundness as three financial targets of the current Medium-Term Management Plan. In FY2020, although we had established a target of 8.5% for ROCET1, a metric we use to measure profitability, we were only able to achieve a ROCET1 of 6.9% due to a substantial decrease in profit attributable to owners of parent. On the other hand, we were able to decrease base expenses*1, a metric we use to measure efficiency, by ¥20 billion on a year-on-year basis due to cost reduction measures and restrictions placed upon our business activities due to the COVID-19 pandemic. Our CET1 ratio*2, a metric we use to measure financial soundness, for FY2020 was 9.8%, a figure which falls within the 9.5% (± 0.5%) range we established in response to the impact of the COVID-19 pandemic.

- *1G&A expenses excluding cost related to investment for future growth, revenue-linked variable cost, and others.

- *2Post Basel Ⅲ reforms basis, excludes OCI

Financial Targets

In regards of initiatives, we focused on those related to the seven key strategies and cost control. Our profit attributable to owners of parent for FY2020 was ¥700 billion if we exclude the negative impact of the COVID-19 pandemic which has been calculated at ¥190 billion. This figure is very close to the target we originally set for the first year of the Medium-Term Management Plan and illustrates that we have been able to enhance the profitability of our businesses by successfully implementing the plan’s various initiatives

For example, in our wealth management business, we strengthened our business with high net-worth individuals by integrating the related capabilities of SMBC Nikko Securities, SMBC Trust Bank, and Sumitomo Mitsui Banking Corporation. We were also able to grow our payment business at an exponential rate due to the global health crisis accelerating the trend toward cashless payments. Furthermore, we enhanced our Sales & Trading and asset management businesses as part of efforts to increase capital efficiency while we strengthened our Asia franchise as we strive to capture the region’s growth. As you can see, in the first year of the current Medium-Term Management Plan we made a solid first step toward achieving the various goals and targets that have been established under the plan.

Of course, there have also been instances when issues which we must address became even more evident due to changes in the business environment resulting from the COVID-19 pandemic and other factors. Specifically speaking, while we strive to strengthen and expand our overseas CIB business in order to grow non-interest income the gap in this business sector with our competitors increased in spite of favorable overseas bond markets.

We will make the necessary adjustments to our initiatives to reflect such changes so that we can achieve our target of increasing consolidated net business profit by ¥100 billion in the final year of the Medium-Term Management Plan.

(3) Cost Control

Our high cost-efficiency is an advantage we have over our competitors. In order to further enhance this advantage, we committed to reducing base expenses by ¥100 billion during the Medium-Term Management Plan by following three key initiatives: “Reform of domestic businesses,” “Retail branch reorganization,” and “Integration of Group operations.”

While we witnessed delays in certain initiatives in FY2020 due to the COVID-19 pandemic, there were also positive developments, for example the accelerated digital shift and an unexpected fall in expenses resulting from the various constraints placed upon our business activities. Furthermore, our efforts to enhance operational efficiency lowered headcount requirements. As such, we were able to decrease base expenses by ¥35 billion. We aim to decrease base expenses by an additional ¥10 billion to ¥20 billion, on top of our original target of ¥100 billion by further accelerating digitalization and transforming our various business models.

In addition, we will reduce costs and enhance operational efficiency by using the CEO Budget for IT-Related Investments to introduce an integrated accounting system for SMBC Group so that we can consolidate/standardize the accounting operations of SMBC Group companies over the medium-term. We will maintain a strong commitment to reaching our various targets, including the ones which were newly added, as the entire SMBC Group engages in cost control efforts.

Capital Policy

(1) Management of Capital under the COVID-19 Pandemic

We have set our target CET1 ratio at c.10%. The CET1 ratio is calculated taking into account the full implementation of Basel Ⅲ reforms and excludes unrealized gains on securities. However, as we have placed the highest priority on supporting the liquidity needs of customers in and outside of Japan who have been adversely affected by the COVID-19 pandemic, for the foreseeable future we will manage our CET1 ratio within the range of 9.5%. (± 0.5%). While our total balance of COVID-19 associated credit peaked at ¥10 trillion in July 2020, a recovery in bond markets allowed obligors, especially overseas obligors, to proceed with repayments. As such, by the end of FY2020 risk weighted assets fell back within the range established at the start of the fiscal year, and we were able to achieve a CET1 ratio of 9.8% for FY2020, a figure which includes a 0.3% decrease due to COVID-19 associated credit. This result is on the high side of our range and substantially exceeds the required level of 8% per current regulations.

I believe we have succeeded in maintaining our financial soundness during the COVID-19 pandemic while at the same time securing sufficient funds for shareholder returns and investment for growth, two topics which I will address shortly. Having said this, we will continue to pay careful attention to the impact of the COVID-19 pandemic and gradually move our CET1 ratio target back to the original target of c.10%.

Capital Allocation of FY2020 and FY2021

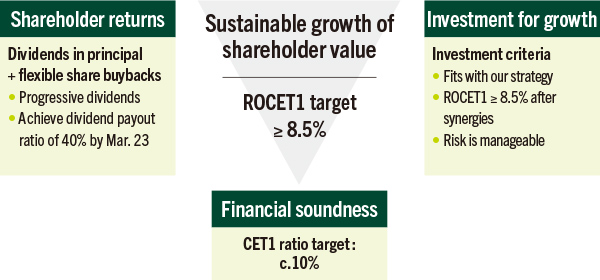

(2) Enhancing Shareholder Returns

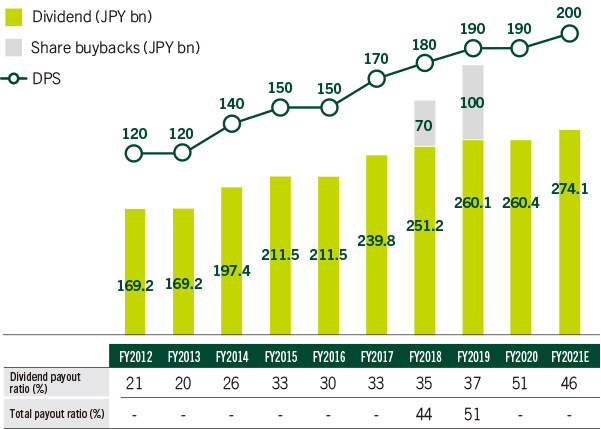

Dividends are our principal approach to shareholder returns, and we will continue to pursue a progressive dividend policy, meaning that we will at least maintain, if not increase, dividend payments. Furthermore, in FY2022, the final year of our Medium-Term Management Plan, we aim to achieve a dividend payout ratio of 40%. In FY2020, due to a decrease in profit attributable to owners of parent resulting from the COVID-19 pandemic, our dividend payout ratio increased to 51%. Please be assured that we will by no means view this as having reached our target dividend payout ratio of 40%. I would like to clarify that our goal is to realize a dividend payout ratio of 40% in FY2022 while at the same time reaching our target profit attributable to owners of parent of ¥700 billion. As a step toward this goal, we increased our dividend payout for FY2021 by ¥10 to ¥200.

On the other hand, we decided not to announce share buybacks when we released our FY2020 financial results in May given the ongoing uncertainties in the business environment due to the COVID-19 pandemic which included, but were not limited to, delays in domestic vaccinations leading to the spread of mutant strains and the repeated extension of Japan’s state of emergency. I was well aware of investor expectations at that time in regard to share buybacks given movements in our share price, and if we were to only look at our capital level, I believe that committing to share buybacks in May was possible. We will continue to pay close attention to the impact of the COVID-19 pandemic and the recovery of Japan’s economy as we consider the execution of flexible share buybacks during the remainder of the fiscal year.

Shareholder returns

(3) Investment for Growth

“Growth” is a core policy of the current Medium-Term Management Plan, and we will pursue SMBC Group’s sustainable growth by ensuring that adequate funds are allocated to growth areas from both organic and inorganic perspectives.

In terms of inorganic growth, while maintaining financial soundness, we will select potential M&A opportunities in strict accordance with our three investment criteria: “Fits with our strategy,” “ROCET1 ≥ 8.5%,” and “Risk is manageable.” Of course, opportunities must also contribute to SMBC Group’s sustainable growth.

We are seeing attractive M&A opportunities that fall under one or more of our seven key strategies due to the COVID-19 pandemic giving rise to a global trend of industrial reorganization and the reconsideration by companies of the current state of their businesses. Our pursuit of inorganic growth opportunities will be flexible in the short-term while in the medium- to long-term we will strike a balance with share buybacks.

The focus of our investments will be: “assets that promptly raise our ROCET1” and “investments for the future.” The former refers to areas in which SMBC Group possesses global strengths, with some past examples being investments in aircraft leasing and middle market LBO financing assets. The latter refers to investments in Asia, securities businesses, asset management, and digital businesses.

In terms of asset management, we pursued the realization of one of the Medium-Term Management Plan’s seven key strategies “Enhance asset-light business on a global basis” by partnering with domestic and overseas asset management companies that adhere to distinct operational strategies. Some examples are our capital and business alliance with Affirmative Investment Management Partners Limited, a UK firm that specializes in impact bond investments, and our acquisition of a majority stake in Alternative Investment Capital Limited, a specialist PE fund investor. Sumitomo Mitsui Finance and Leasing also strengthened its real estate business through subsidiarization of the real estate asset management firm Kenedix.

In Asia, we continued implementing our Multi-franchise strategy as we strive to establish a second and third SMBC Group. Up to this point our efforts have focused on Indonesia. In 2021, we announced investments in VPBank Finance Company Limited, a major player in Vietnam’s consumer finance market; in Rizal Commercial Banking Corporation, a commercial bank in the Philippines; and in Fullerton India Credit Company Limited, a nonbank in India. By combining our new presence in the retail and SME business sector with our existing business with large corporates that we conduct through SMBC branches and existing investee companies, we moved one step closer to establishing a full-banking business platform as we strive to expand our Asia franchise as stated in our Medium-Term Management Plan.

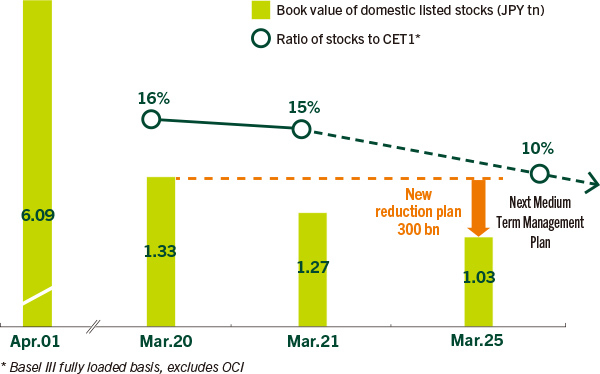

(4) Reducing Strategic Shareholdings

After exceeding our target of reducing strategic shareholdings by ¥500 billion over a five-year period which was announced in September 2015, we announced a new plan to further reduce strategic shareholdings by ¥300 billion over a five-year period starting FY2020. In FY2020, the first year of the plan, we reduced our strategic shareholdings by ¥55 billion. Furthermore, given that we are holding unsold shares valued at ¥54 billion for which we have already obtained customers’ consent to sell, as of the end of March 2021 we have sold or have obtained consent to sell ¥109 billion worth of our strategic shareholdings.

The reduction of strategic shareholdings is also a very important facet of our capital policy as it not only reduces stock price fluctuation risk, it also has a material impact on controlling the increase in mandatory capital requirements resulting from full Basel III reform implementation. We also expect an increasing number of customers to reduce their strategic shareholdings given the increasingly vocal positions adopted by proxy advisory firms, the Tokyo Stock Exchange’s planned realignment of its trading markets, and the revision to Japan’s Corporate Governance Code. Given this backdrop, we will do our best to further reduce our strategic shareholdings while ensuring that we continue to engage in close communications with customers.

Communicating with Our Stakeholders

In order to obtain our stakeholders’ understanding of SMBC Group’s strategies and overall status, we must disclose information in a timely and proactive manner given ongoing changes in the business environment and diversification of our operations. In FY2020, a different approach to communication was required given the impact of the COVID-19 pandemic. Regardless of such a backdrop, I believe that conducting multiple small meetings and conferences online with both domestic and overseas investors allowed us to realize the timely and necessary disclosure of information at a level which exceeded that of previous years.

Such discussions provided us with important opportunities to learn and recognize matters that had previously escaped our attention. Given investors’ heightened interest in ESG and the SDGs, SMBC Group for the first time held an investors meeting that addressed our ESG-related efforts. We also understand the strong expectations in regard to shareholder returns, and we will reflect the feedback we received in the determination of future dividend and capital policies.

In a repeat performance of FY2019, SMBC Group was selected for the top award in the banking category of the 2020 Award for Excellence in Corporate Disclosure presented by the Securities Analysis Association of Japan. Furthermore, for the first time SMBC Group was selected for the top award in the individual investor category. I take great pride in the recognition we have received, and we will continue with our above efforts going forward.

Engaging in constructive discussions with investors and analysts is one of my key responsibilities as Group CFO. We at SMBC Group will continue to proactively disclose information that is useful for our shareholders and investors while pursuing sustainable growth and increasing our corporate value by engaging in interactive dialogue.

Toru Nakashima

Group CFO

Director Senior Managing Executive Officer