Special Contents:

Our Inorganic Strategy to Realize Sustainable Growth

Inorganic Strategy Overview

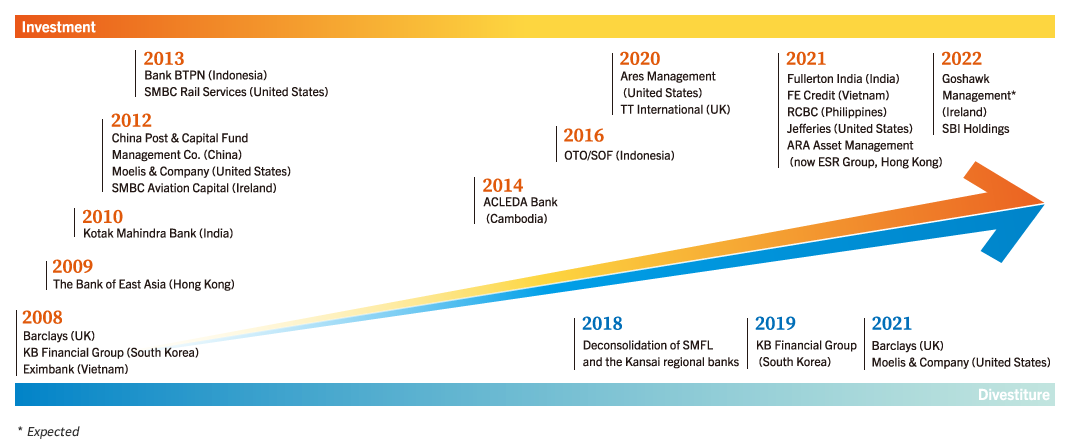

SMBC Group has positioned its inorganic strategy as one of its key strategies to accelerate further growth of the Group’s businesses, as well as the creation of new businesses for the next generation. We have been working to increase corporate value and strengthen the services offered to our customers through investments and acquisitions. Going forward, we are aiming to make more strategic and effective use of investments and acquisitions to achieve sustainable growth even in the VUCA era characterized by changing global economic trends and customer needs, responses to climate change and an intensifying competitive environment. The Business Development Department was established in 2020 with the aim of enhancing M&A process and executing consistent strategy through the accumulation of highly specialized knowledge, and consolidating the functions required for advancing an inorganic strategy that were previously scattered across SMBC Group.

Investment Targets

When considering investments, we look at two main targets: “investments for creating future platform” and “investments with high asset and capital efficiency that is expected to promptly contribute to profits.” In FY2021, we have executed projects that will contribute to building a business platform for medium- to long-term growth, including our retail business in Asia and our securities business in the United States. In May 2022, SMBC Aviation Capital announced the acquisition of Goshawk Management (Ireland) which applies to our second investment target.

Investment Criteria and Disciplines

Under the Group’s basic capital policy of balancing the allocation of capital between shareholder returns and investment for growth premised on ensuring financial soundness, we have established three criteria for investment: (1) Fits with our strategy, (2) ROCET1 ≥ 8.5%, and (3) Risk is manageable. We strive to take a disciplined approach to identify and scrutinize investment opportunities following thorough discussions with outside directors and the CxO department.

Post-investment Initiatives

The success or failure of inorganic strategy is determined by how quickly plans drawn up at the time of investment can be put in place once the investment is made. While making maximal use of strengths and unique characteristics of the investee, we work to further enhance corporate value through synergies with SMBC Group.

Expansion of Our Multi-franchise Strategy in Asia

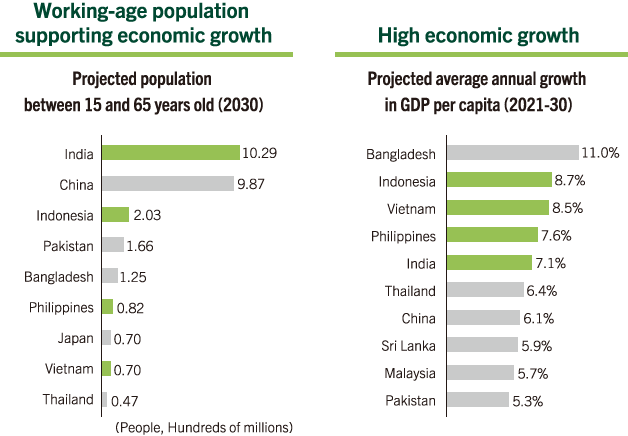

Since 2013, under the slogan “Asia-centric,” SMBC Group has strengthened its Asia business as a key strategy. Through entry into full banking operations, including retail banking, and business rooted in local economies, we have been pursuing multi-franchise strategy to create a second and third SMBC Group.

In Indonesia, one of the main target countries of this strategy, we invested in Bank BTPN, a local commercial bank, in 2013, and in 2019, we made it a consolidated subsidiary and merged with PT Bank Sumitomo Mitsui Indonesia to transform it into a full-line commercial bank. With Bank BTPN at its core, it provides a wide range of one-stop financial services, from services to retail customers to SMEs and large enterprises.

Subsequent business development efforts in the Asia region following Indonesia are India, Vietnam and the Philippines, countries which are expected to have a high potential for economic growth, and which are targets for the Group’s multi-franchise strategy. In these countries, in addition to existing transactions with large corporations, we have made investments in local financial institutions that can serve as a foundation for SME and retail-oriented business in the past fiscal year. Together with the trusted local investees, SMBC Group aims to contribute to the regional economy through the expansion of its business platform in each of the markets in Asia.

In India, we acquired a 74.9% equity stake in Fullerton India, a major local non-bank with a customer base composed of mainly SMEs, business owners, and middle class individuals, and made it a consolidated subsidiary in November 2021.

With approximately 10,000 non-banks competing in India, the market for SME and retail-oriented business is at a high level in terms of size, profitability, and growth potential. In this market, Fullerton India is one of the top-ranked firms in terms of scale of assets, maintaining a network of more than 650 offices throughout the country.

It provides services tailored to each four segments; urban, rural, digital, and housing finance. It has strength in customer acquisition, especially in rural areas.

Going forward, we intend to increase corporate value through the creation of synergies, such as increasing loan balances by leveraging SMBC Group’s customer base, strengthening its fund-raising capabilities, sharing insights and improving operational efficiency, as well as further strengthening SMBC Group’s Indian business and pursuing growth of its profits.

Message from CEO

A Long-Term Growth Story Together with SMBC Group

I strongly believe that successful businesses are built on a foundation of strong vision and values. Fullerton India’s vision and values, over the years, have been strikingly similar to that of SMBC Group.

Over the last 16 years, our India franchise has grown to serve customers in the underserved towns and villages, displaying highest levels of integrity, committed to excellence and agility.

SMBC Group’s investment is timely and opportune, as the Indian economy and our business has made a strong recovery from the pandemic. We have a great opportunity to partner in India’s long-term growth story in consumer and MSME lending, leveraging off SMBC Group’s global banking expertise. We are committed to growing our franchise stronger and deeper, serving mass-market and MSME customers in our Urban, Rural, Digital and Home Finance businesses.

Shantanu Mitra, CEO of Fullerton India

In Vietnam, SMBC Consumer Finance acquired a 49.0% equity stake in FE Credit in October 2021, making it an equity method affiliate.

FE Credit is the largest consumer finance company in the industry, with a network of more than 20,000 locations in Vietnam, offering unsecured loans and credit cards. With a market share of approximately 50%, the company has an overwhelming customer base and is a well-recognized brand in Vietnam.

UBank, launched in 2020, is a mobile application that allows one-stop financial transactions on a smartphone. The company has also demonstrated its strength in the digital field by acquiring a broad customer base by meeting the need to avoid in-person interactions due to the COVID-19 pandemic. FE Credit is further accelerating the expansion of its business areas through customer referrals from its service partners and through cross-selling.

Going forward, through partnership with FE Credit, we are examining the provision of a variety of financial services, including sales finance, in cooperation with Japanese corporate clients who are expanding into Vietnam or who are planning to do so.

SMBC Consumer Finance and FE Credit, top players in consumer finance in Japan and Vietnam respectively, will furthermore share and utilize each other’s insight to further strengthen their businesses.

Message from CEO

Working with SMBC Group to Innovate Financial Markets through Digitalization

Vietnam is a promising market in which personal financial services are expected to expand on the back of a growing working population and an expanding middle class with a strong willingness to spend.

We use digital technology to provide safe, low cost and universal financial services, with a focus on personal and retail markets. Through collaboration with SMBC Group, we will continue to offer innovative solutions to Japanese customers operating in Vietnam, and as a market leader, we will also focus on financial education to achieve sustainable business growth and to contribute to society.

Kalidas Ghose, CEO of FE Credit

In the Philippines, we acquired 4.9% equity stake in a major local bank RCBC in June 2021, starting a new partnership.

RCBC is a local commercial bank established in 1960, and as of 2021, ranks 6th in terms of scale of assets among private banks in the country. The bank also actively transacts with Japanese companies, and has the largest Japan Desk of any local bank, creating an environment conducive to collaboration.

In recent years, it has received strong evaluations from external evaluators for its proactive initiatives in advanced fields such as digital banking services for customers without bank accounts and digitalization of branches in its retail business, and issuance of ESG bonds and the Philippines’ first “green deposits” in its wholesale business.

In addition to its commercial banking business, RCBC also has functions and services including securities, leasing, and credit cards as a group, and we plan to collaborate with RCBC in a wide range of areas. By providing business insight cultivated in Japan and creating synergies with other Asian investees, we will support RCBC’s growth and create new growth areas for SMBC Group.

Message from CEO

Enhancing Financial Services through Partnership with SMBC Group

We welcome SMBC Group as our new shareholder at a pivotal moment in our bank’s history. These are extraordinary times, and we are happy to have SMBC Group as a partner in providing financial services to key customer segments–Top corporations, Japanese corporations, SMEs, and the mass affluent retail market.

The partnership with SMBC Group will accelerate RCBC’s plans to provide the best customer experience in retail banking, consumer finance and digital banking. Collaboration efforts between our two banks have already started with value creation expected in the coming year, using new and innovative business models.

Equally important to us is the shared commitment to contributing to the future generations with our joint focus on sustainable finance.

Eugene S. Acevedo, CEO of RCBC

Accelerating the Strengthening of

Our Overseas Securities Business

The Medium-Term Management Plan sets out “Enhance overseas CIB business to improve asset/capital efficiency” as a key strategy. One of our top priorities has been to strengthen our overseas securities business, with a focus on initiatives to strengthen our business organically.

Against this backdrop, in July 2021 SMBC Group entered a strategic capital and business alliance with Jefferies, the largest independent securities firm in the United States, and is working to strengthen its securities and investment banking business in the world’s largest capital market, the United States.

Jefferies is one of the leading securities firms in the United States, offering a wide range of services from securities and investment banking services to wealth management and asset management. In particular, the firm has a strong track record in cross-border M&A, equity underwriting in the United States and Europe, and leveraged loans in the United States, as well as a global trading franchise and a diversified alternative asset management platform.

Combining Jefferies’ advanced solutions and advisory capabilities in the capital markets with SMBC Group’s long-standing customer network and financing capabilities, we have entered into partnership in three areas to meet the sophisticated financial needs of both company’s customers in a timely manner.

The first area of partnership is business for sub-investment grade (Sub-IG) companies in the U.S. By leveraging Jefferies’ strength in its Sub-IG corporate client base, we will expand transactions with customers that SMBC Group could not access on its own through joint underwriting of leveraged loans and collaboration in ECM and DCM deals.

The second is cross-border M&A business. We aim to provide higher value-added solutions by combining Jefferies’ global investment banking services with SMBC Group’s customer base and knowledge of the Japanese market.

The third is “business for the U.S. healthcare sector.” We aim to capture investment banking deals which we could not in the past by combining Jefferies’ strength in industry-leading coverage with SMBC Group’s customer base and balance sheet.

We have already built up a track record of joint underwriting leveraged loans in business for Sub-IG companies, and are steadily advancing our collaboration in cross-border M&A and healthcare.

Going forward, we will continue to expand our collaboration in areas where we can leverage our respective strengths, and provide financial services that contribute to the growth of our customers’ global businesses as a global solutions provider.

Expansion of Aircraft Leasing Business

SMBC Group has positioned the aircraft leasing business, with its high asset and capital efficiency, as a growth area against the backdrop of increasing global air passenger traffic. In 2012, we acquired our aircraft leasing business from The Royal Bank of Scotland, a major U.K. financial institution, and established SMBC Aviation Capital under the umbrella of Sumitomo Mitsui Finance and Leasing.

Through the subsequent integration of the Sumitomo Mitsui Finance and Leasing and Sumitomo Corporation joint venture in the aircraft leasing business and the Sumitomo Corporation aircraft leasing subsidiary, we have leveraged the strengths of SMBC Group and Sumitomo Corporation Group to establish ourselves as a market leader in the market.

In May 2022, we reached an agreement with the existing shareholders of Goshawk Management (Ireland), an aircraft leasing company headquartered in Ireland, for the company’s acquisition. In so doing, SMBC Aviation Capital will establish an operating structure of 1,000 aircraft, including aircraft on order, and is expected to leapfrog to the second largest player in the industry.

With the worst of the COVID-19 pandemic now having passed, both demand for domestic flights in Europe and the U.S. and demand for international flights are on the road to recovery. In the long term, passenger demand is expected to continue to grow as a result of growing disposable incomes associated with GDP growth in countries around the world.

Through this transaction, we will provide a wider range of airline companies and domestic and international aircraft investors with more investment opportunities than ever by taking advantage of aircraft leasing and economies of scale to achieve sustainable growth of the aircraft leasing business and to improve asset and capital efficiency.

Strengthening the Asset Management Business

The asset management business is at the core of one of the seven key strategies in our Medium-Term Management Plan, “Enhance asset-light business on a global basis.”

Against a backdrop of rising asset-building awareness among individual investors and the difficulties faced by institutional investors in managing their assets, investors’ investment needs are increasing every year.

In Japan, two of the Group’s asset management companies were merged in 2019 to form Sumitomo Mitsui DS Asset Management Company. By bringing together the management insights of the previous companies and consolidating the Group’s management functions, we are building a system that can accommodate customer needs in a timely manner. In 2021, SMFL MIRAI Partners, a subsidiary of Sumitomo Mitsui Finance and Leasing, made Kenedix, a real estate asset management company, its subsidiary.

As a foothold for overseas expansion, in 2020 we made TT International, an asset management company in the U.K. with an established reputation for managing emerging market equities, a consolidated subsidiary. In addition, with the aim of acquiring knowledge of alternative asset management, a rapidly growing market, we invested in Ares Management Corporation, a top global player in private debt management in 2020, and ARA Asset Management (now ESR Group), a leading player in real estate asset management in Asia in 2021, to expand the investment management and product capabilities of the group as a business partner.

Through collaboration between Sumitomo Mitsui DS Asset Management Company and investees, we will provide optimized, professional investment management solutions, in tune with our customers’ ever-changing investment needs.