Message from Group CFO

I became Group CFO and Group CSO in April 2025. Holding both the Group CFO and CSO positions highlights our group’s uniqueness. Since financial strategy and operational strategy are inseparable, I will work to further enhance our ROE through the optimal allocation of management resources as Group CFO, while I will work to increase our expected growth rate and PER through the formulation and execution of key strategies as Group CSO.

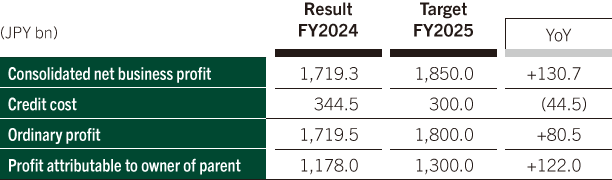

Overview of FY2024

FY2024 started off on a positive note with the discontinuation of the negative interest rate regime, the yen’s depreciation, rising stock markets, and interest rates in the U.S. remaining elevated. We decided to pursue profit attributable to owners of parent of ¥1 trillion, a historical record for SMBC Group, by accelerating the Medium-Term Management Plan’s initiatives and proactively pursuing upside opportunities. We produced positive results in our core businesses with Olive allowing us to expand our domestic customer base while also capturing opportunities arising from the funding needs resulting from revitalized corporate activities. Outside of Japan, we steadily carried out our Multi-Franchise Strategy in Asia and strengthened our CIB business via our collaboration with Jefferies.

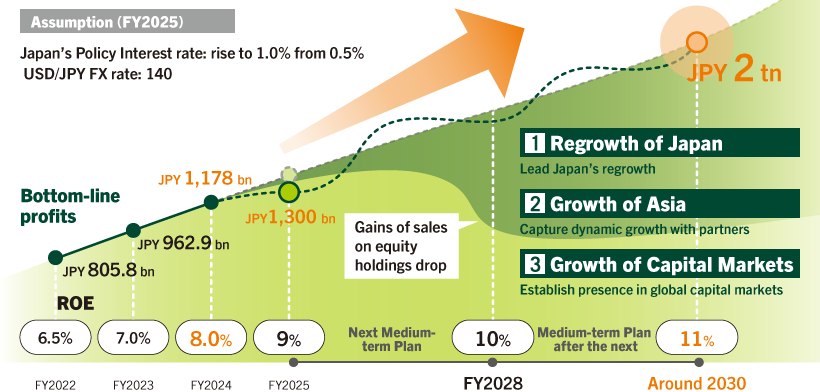

We carried out preparations to improve our future profitability with a significant increase in anticipated profit from the sale of equity holdings allowing us to divest low profit assets and fundamentally address the issue of interest repayment. At the end of FY2024, we set aside provisions in preparation for the impact of the U.S. tariff policy. However, we were able to generate consolidated net business profit of ¥1.7193 trillion, a year-on-year increase of ¥159.1 billion and profit attributable to owners of parent of ¥1.178 trillion, a year-on-year increase of ¥215 billion, both record figures for SMBC Group. We were also able to achieve our ROE target of 8% one year ahead of schedule.

Financial Targets for FY2025

Our FY2025 targets for consolidated net business profit and profit attributable to owners of parent are ¥1.85 trillion and ¥1.3 trillion, respectively. These figures were decided based on extensive discussions by the leadership team which continued right up until we announced our financial results. It goes without saying that these discussions took place in a very volatile and uncertain environment following the announcement of the U.S. tariff policy. In addition to revising our assumptions about interest rates, currency exchange rates, and share prices, we carefully analyzed the impact on our business flow. As such, our targets for consolidated net business profit and profit attributable to owners of parent both have a negative ¥100 billion adjustment. While the environment remains uncertain, we will strive to bring our initiatives to a strong conclusion with FY2025 being the final year of the current Medium-Term Management Plan and generate year-on-year profit growth of at least 10%.

If we are able to achieve these targets, we will be able to secure an EPS growth rate of more than 19%, more than 13% if we exclude the gains from the sale of equity holdings, during the current Medium-Term Management Plan. We will increase profit and appropriately control capital as we strive to achieve further growth.

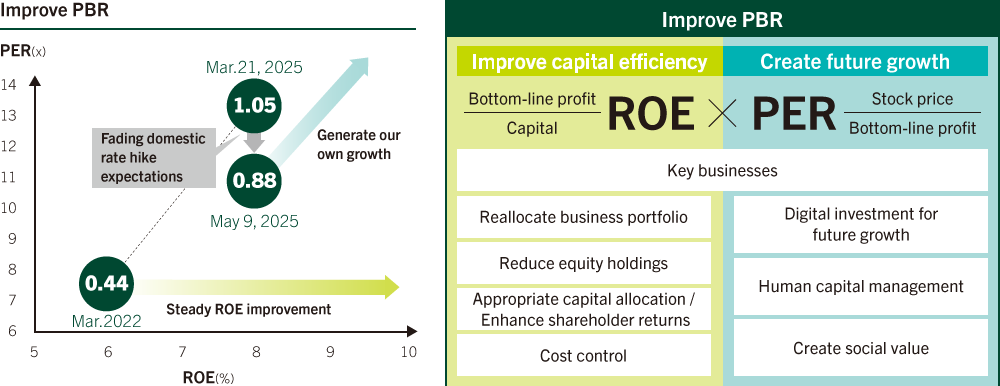

Enhancing Corporate Value

We will continue our unwavering efforts to enhance SMBC Group’s corporate value. In addition to continuously improving ROE, we will also increase PER. We will especially pay close attention to generating growth expectations that remain stable despite external factors, as the ratio of growth investors in SMBC Group steadily increases. We will further enhance our PBR by increasing both ROE and PER.

(1) ROE Focused Business Operations

Starting with the current Medium-Term Management Plan, we have set ROE targets and ROE focused business operations are spreading to all parts of our organization. As Group CFO, to further improve ROE through the optimal allocation of capital, I will drive forward efforts to reach an ROE of approximately 9% by accelerating the disposal of low profit assets and the accumulation of high profit assets.

The cornerstone of transforming our business portfolio is the reduction of low profit assets overseas. Our overseas business, while it has driven SMBC Group’s growth with the domestic market suffering from the negative interest rate environment, has at times engaged in projects with low profitability in the pursuit of topline growth. In addition to selling our U.S. freight car leasing business in FY2023, we sold low profit project finance assets at a loss in FY2024. Through such efforts, we were able to reduce RWA by ¥8.4 trillion.

The capital which has been raised through these measures will be allocated to key strategic areas. In the domestic market, our business with large corporations enjoys a high capital efficiency, and we can expect further growth with rising interest rates and revitalized corporate activity. We will capture growth opportunities in this segment while further improving capital efficiency by increasing the number of joint banking-securities personnel to strengthen the bank-securities integration model. We will increase the profitability of our retail business by strengthening our credit card business and the financing of customers’ shopping payments. We will increase the capital efficiency of our overseas CIB business by strengthening the integrated management of our primary and secondary markets businesses. This will enhance our underwriting capability and expand our products, improving capital efficiency without relying on assets.

Furthermore, cost control is critical to increasing ROE. By reforming our domestic banking branches, streamlining shared Group functions, and other cost efficiency measures, we were able to reduce costs by ¥95 billion over the past two years. Through such efforts, we plan to keep net base expenses flat over the Medium-Term Management Plan. At the same time, we will allocate the necessary investments and expenses for future growth to accelerate profit growth.

(2) Enhancing Our Expected Growth Rate and Controlling Capital Cost

In regard to enhancing our expected growth rate, a key component of PER, we will focus on businesses where we can expect medium-to long-term growth, and carefully explain the progress and results of our respective initiatives and profit level goals to investors.

We are differentiating ourselves from our competitors in our domestic business by winning opportunities arising from increasing domestic interest rates. In our retail business, the number of Olive accounts has exceeded 5.7 million and the growth rate of account balances is high, even when compared to our competitors. As a result, our Olive business became profitable in FY2024, one year ahead of schedule. We expect Olive to have earnings contribution of ¥80 billion by FY2028. We are also working with external partners to further enhance the convenience of Olive. I believe our partnership with PayPay will allow us to further grow our customer base by expanding the cashless payment market. Our partnership with SBI Securities will allow us to strengthen our asset management business targeting “digital affluent customers.”

In our wholesale business we launched “Trunk,” a new comprehensive financial service targeting SMEs. We will strengthen profitability in a world with interest rates by using digital technology to expand our client base in an efficient manner and obtaining sticky deposits.

In our overseas business, we will accelerate efforts to generate profit via our Multi-Franchise Strategy. Even though Japan has started its regrowth, we must capture Asia’s growth in order to realize a higher growth rate. However, we are well aware that our Multi-Franchise Strategy has yet to produce the anticipated financial results. Looking back, I believe one of the reasons for this issue is that our involvement in the management of our partner firms was insufficient. SMBC Group will transition to a more hands-on framework where we are more deeply involved from the planning stage of business strategies and financial goals, allowing us to manage our investees more closely. In addition, we are carrying out reforms that entail a degree of pain for our Vietnam investees. For example, changing the local leadership team and implementing stricter credit standards, to make a swift catch up to growth trend. We have especially high expectations for India’s growth and were excited to announce our 20% investment in YES BANK. While an opportunity for a foreign financial institution to invest in an Indian commercial bank is limited, I believe that we conducted a very persistent and disciplined price negotiation. We will support YES BANK’s growth while also pursuing synergies. In addition, our CIB business still has much growth potential. We have worked on more than 250 deals with Jefferies. We will establish a partnership model that brings together the strengths of SMBC Group and Jefferies and expand our collaborations to include all of our business regions.

With regard to capital cost, in order to bring it below 8% we will rebuild our corporate infrastructure, create social value, and expand our information disclosure, including non-financial information. I would like to stress that the development of a stable IT system and the promotion of human capital investments are key components to rebuilding our corporate infrastructure.

The importance of IT investment continues to increase. We will strengthen profitability through investments in Olive, Trunk, and other growth initiatives while investing in corporate infrastructure to enhance cybersecurity and governance. We increased the three-year IT investment budget of the Medium-Term Management Plan from ¥650 billion to ¥800 billion while also establishing an investment budget for Generative AI. We are seeing a number of AI use cases. Based on the understanding that AI will continue to spread, we should not only use it to enhance operational efficiency, but also adopt AI as a core pillar to transform our business model. I want to develop the necessary infrastructure and change employees’ mindsets so that we can establish SMBC Group as an AI-leading Financial Institution.

Investments in human capital for FY2025 at SMBC are expected to increase by 8% on a year-on-year basis. We will maximize our talent level by allocating resources to growth areas and securing personnel with the necessary expertise. In January 2026, SMBC is scheduled to fundamentally revise its personnel system. One of the key points is “Performance-Based”, which means we intend to break away from the seniority-based system and reward employees based on their roles and contributions. We must realize the statement in Our Mission: “We create a work environment that encourages and rewards diligent and highly motivated employees.”

Capital Policy

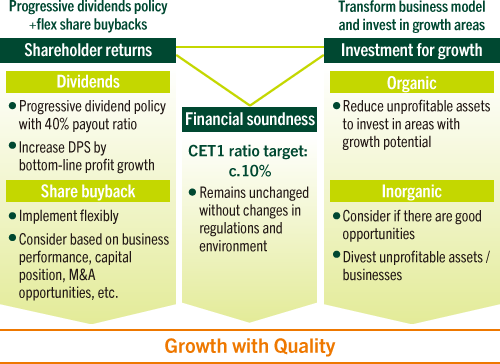

Basic Capital Policy

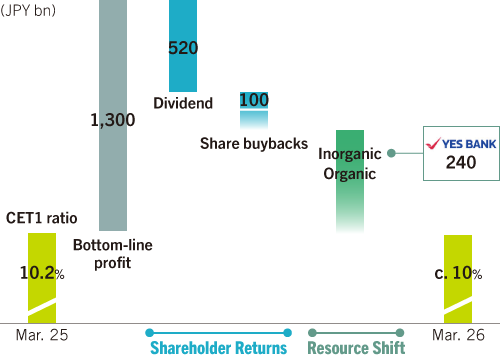

We will balance shareholder returns and investment for growth while maintaining financial soundness. Our CET1 ratio target, an indicator of financial soundness, has been set at approximately 10%. This figure has been calculated taking into account the full implementation of Basel III reforms and excludes net unrealized gains on other securities. Achieving a 10% CET1 ratio will provide us with a buffer of 2% which allows us to maintain the required 8% ratio under a variety of stress scenarios. Our CET1 ratio was 10.2% as of the end of March 2025, well within our target range. We will continue to allocate our capital in a flexible and effective manner while firmly keeping in mind our goal to improve ROE.

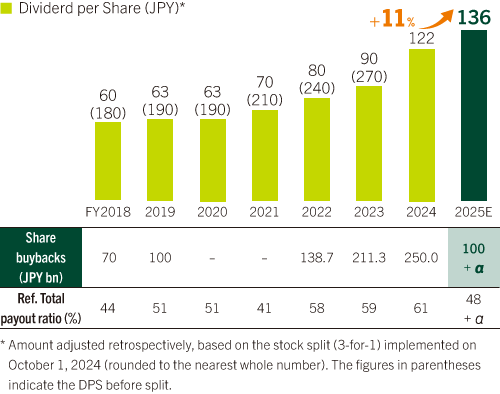

Enhancing Shareholder Returns

Dividends remain our principal approach to shareholder returns, and we will continue to pursue a progressive dividend policy, which is to increase, or at least maintain, dividend payments. We will maintain a dividend payout ratio of 40% and increase our dividend payout by growing our bottom-line profit. We raised our FY2024 dividend to ¥122 per share taking into consideration higher than expected final profit. Our dividend forecast for FY2025 is ¥136 per share, a year-on-year increase of ¥14. In May 2025, we announced a buyback program of ¥100 billion. We will consider additional buybacks during the fiscal year based on our progress towards our financial targets, the status of our capital, investment for growth opportunities, SMBC Group’s share price, and other key factors.

Investment for Growth

For investment for growth, we will pay careful attention to capital efficiency and focus on allocating assets to strategic areas which we expect to undergo high levels of growth. In our organic strategy, we will work to meet the robust demand for capital in domestic markets that is being driven by the Japan’s regrowth. There is no change in our inorganic strategy’s two investment targets: “Investments with high capital/asset efficiencies” and “Investments that contribute to the creation of a business platform to realize medium- to long-term growth.” In Asia, we obtained a key piece to our Multi-Franchise Strategy with our investment in YES BANK. Going forward, we might consider increasing existing ownership or bolt-on investments, but have no plans to expand our target countries or invest in new businesses. Our focus will be on improving the profitability of our existing investments.

Reducing Equity Holdings

Last November, we announced a plan to reduce equity holdings by ¥600 billion over a five-year period. In FY2024, we were able to complete a reduction of ¥185 billion, a reduction rate that was much higher than planned. While there is an increased risk that negotiations to reduce equity holdings will encounter difficulties with the uncertain business environment, we are committed to reducing our equity holdings by a minimum of ¥120 billion in FY2025.

We will continue our reduction efforts so that we can reduce the market value of equity holdings to consolidated net assets ratio to below 20% during the next Medium-Term Management Plan.

Financial Results to Achieve by 2030

In May 2024, we announced that we would reach an ROE of 8% during FY2025 and 9% during the next Medium-Term Management Plan. As we reached our 8% ROE target one year ahead of schedule, we updated our goals and will strive to reach an ROE of 10% during the next Medium-Term Management Plan and 11% with profit attributable to owners of parent of ¥2 trillion in the Medium-Term Management Plan that will launch in FY2029. We are currently engaging in discussions regarding the next Medium-Term Management Plan, and we have come to the conclusion that we will focus our growth efforts on three key areas: Japan, Asia, and Capital Markets. We will spend this year adding details and depth to the Plan so that we are able to realize sustainable growth.

Communicating with Stakeholders

In FY2024, SMBC Group was selected for the “Award for Excellence in Corporate Disclosure” in the banking category by the Securities Analysts Association of Japan. I am delighted that we were chosen to receive this award. As the uncertain environment continues, SMBC Group will engage in the timely and easy-to-understand disclosure of topics in which stakeholders have a high interest.

Our new Medium-Term Management Plan will launch in FY2026. Engaging in constructive discussions with investors and other stakeholders is an important mission and also offers valuable learning opportunities for me as Group CFO. The feedback we receive is shared with the Board of Directors and the leadership team. The new Medium-Term Management Plan will reflect this feedback to ensure the sustainable growth of SMBC Group.