Create Social Value / Pursue Economic Value

In major fields such as asset and wealth management business, payment and consumer finance business, we will leverage “the Group’s Comprehensive Strength,” “Advanced Services,” and “High-Quality Consulting” as our strengths to build a sustainable business portfolio through business expansion by improving customer convenience and streamlining through business process reforms.

In FY 2024, amid a continued favorable business environment, topline revenue expanded in major businesses such as asset and wealth management, payment and consumer finance, and deposits, resulting in net business profit exceeding the previous year.

In the asset and wealth management business, AM and foreign currency deposits balances increased by +¥1.6 trillion; in payment and consumer finance business, sales handled increased by +¥4.2 trillion, outpacing overall market growth; card loan balances rose +8%; and deposits balances increased by +¥1.3 trillion, steadily expanding our business scale. Progress on key measures of the Medium-Term Management Plan is also on track.

The number of Olive accounts continues to grow steadily, and we are also working on the rollout of “STOREs” and “Olive LOUNGE,” steadily building a hybrid model that integrates digital and physical channels. In addition, we have worked to enhance and streamline the Group’s business structure supporting key measures, such as the integrated group strategy combining banking,securities,and trust in the asset management business, the merger of Sumitomo Mitsui Card Company and SMBC Finance Service, and the conversion of SMBC Consumer Finance into a subsidiary of it.

In FY2025, the final year of the current Medium-Term Management Plan, uncertainty is increasing regarding the outlook of business environment, especially overseas, but in Japan, the business environment is expected to remain generally favorable, with the Japanese economy regrowing and interest rates normalizing. We will continue to actively pursue growth areas such as casheless business and business for affluent customers, while also working to strengthen profitability through expansion of the customer base via Olive, and to improve productivity by accelerating digitalization and AI utilization, aiming for further improvement in ROE.

The retail business is presented with valuable growth opportunities arising from social issues, such as promoting asset formation toward “Japan as a Leading Asset Management Center”, advancing cashless payments, and preparing for the era of 100 year lifespans. By capturing changes in society and advancing our business model, we aim to achieve both social and economic value.

For clients’ advanced management challenges, the SMBC Group as a whole provides a wide range of solutions related to fundraising, management, settlement, and more. By solving management issues, we will contribute to Japan’s regrowth and aim for sustainable growth together with our clients.

Domestic corporate clients’ management issues are becoming increasingly complex. The Wholesale Business Unit provides high-quality services leveraging the Group’s comprehensive strengths to address the diverse issues and needs of such clients.

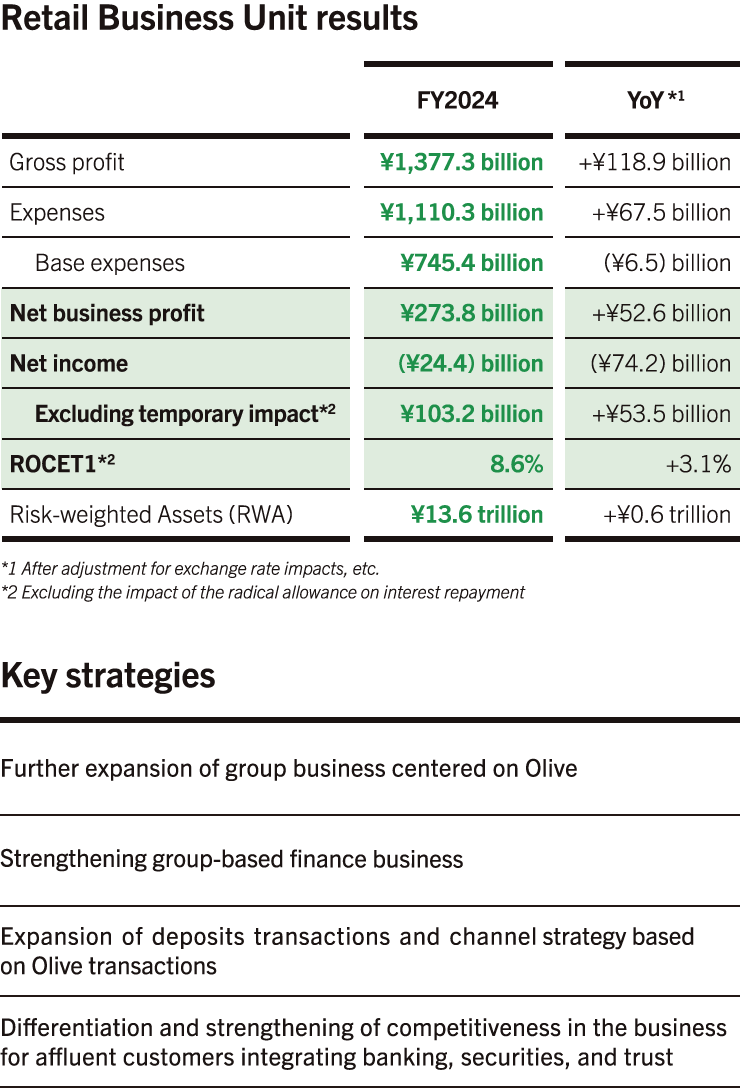

In FY2024, by responding to changes in the interest rate environment, both the balance and profit of deposits and loans increased. We also responded accurately to active corporate actions, achieved results in business lines such as PE fund and real estate, and posted profits exceeding our initial plan.

Currently, various changes are becoming apparent, including the imposition of reciprocal tariffs in the U.S. As these may affect the business flows of domestic corporations, we will respond to our clients with even greater care.

Furthermore, for sustainable growth as a financial institution, we aim to strengthen existing businesses and establish new growth drivers. Here are some of our initiatives in this regard.

The first is strengthening the solution provision system for large and mid-sized companies. For large companies with high needs for direct finance and M&A, speedy solutions through collaboration between banking and securities are required. To respond quickly to such needs, we have significantly expanded the dual-role system between Sumitomo Mitsui Banking Corporation’s front office and SMBC Nikko Securities, enhancing our responsiveness. We will continue to collaborate with Jefferies to consistently meet global needs both domestically and internationally. For mid-sized companies pursuing further growth strategies, in light of the end of transitional measures at the Tokyo Stock Exchange and the new TOPIX management, we provide appropriate solutions mainly through specialized departments of Sumitomo Mitsui Banking Corporation and SMBC Nikko Securities.

The second is the creation of new business models for small and medium-sized enterprises. With advances in digital technology and the entry of players from other industries, the environment for financial services in the corporate sector continues to change. In this context, we released the digital comprehensive financial service “Trunk” in May 2025 as a core service to solve the management issues faced by SMEs, support business growth, and aim to acquire transaction deposits that tend to remain on deposit over time. We will provide this service to a wide range of businesses and support Japan’s regrowth.

We will maximize our broad business foundation, from global CIB/Sales & Trading (S&T) business to our Multi-Franchise Strategy, and support the international business expansion of customers both in Japan and overseas as a unified Group.

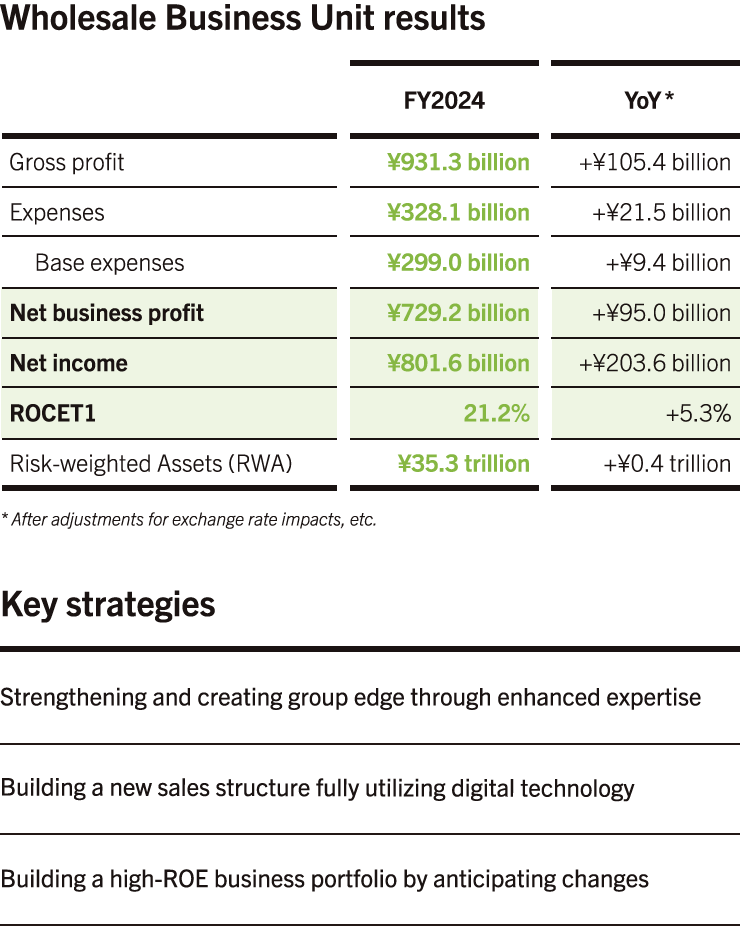

In FY2024, although gross profit increased due to strengthening fund-related businesses, expenses also increased due to upfront investments in regulatory compliance and IT infrastructure. Furthermore, to improve portfolio quality, we reduced low-profitability assets, resulting in a temporary loss and net business profit falling below the previous year, but this led to an improvement in ROCET1. In terms of initiatives, we are steadily progressing, aiming to build a business portfolio that combines profitability and growth, and in our Multi-Franchise Strategy, we have completed the construction of investment platforms in each country.

In FY2025, we will focus on building a business foundation that will drive the Group as a medium- to long-term growth driver, and, while paying close attention to the highly uncertain business environment, we will steadily address the following four priority areas.

①Accelerating resource shift: To further enhance profitability and growth, we will take more proactive measures to shift management resources from low-profit businesses to high-profit, high-growth businesses, building a high-quality business portfolio while controlling risk-weighted assets.

②Advancement of the global CIB business model: By expanding collaboration with Jefferies, we will strengthen our fee business and promote primary-secondary collaboration through the integrated efforts of the Global Business Unit and Global Markets Business Unit. Furthermore, by advancing risk-taking in areas such as fund-related businesses where high profitability is expected, we aim to improve earning power.

③Strengthening initiatives in high-growth areas: In countries targeted by our Multi-Franchise Strategy with high growth prospects (India, Indonesia, Vietnam, and the Philippines), we will advance initiatives as a unified group. In particular, in India, we have established the India Division and aim to capture high growth through integrated wholesale and retail operations.

④Enhancement of management foundation: While strengthening risk management in line with business diversification and increasing complexity, we will also invest in IT infrastructure and operations, focusing on strengthening governance and management foundations to support the acquisition of further growth opportunities and optimization of our business model.

Through these initiatives, while positioning the global CIB business that generates stable earnings as our core, we will expand high-growth areas such as Asian retail, which are expected to achieve high growth, aiming for sustainable growth with quality.

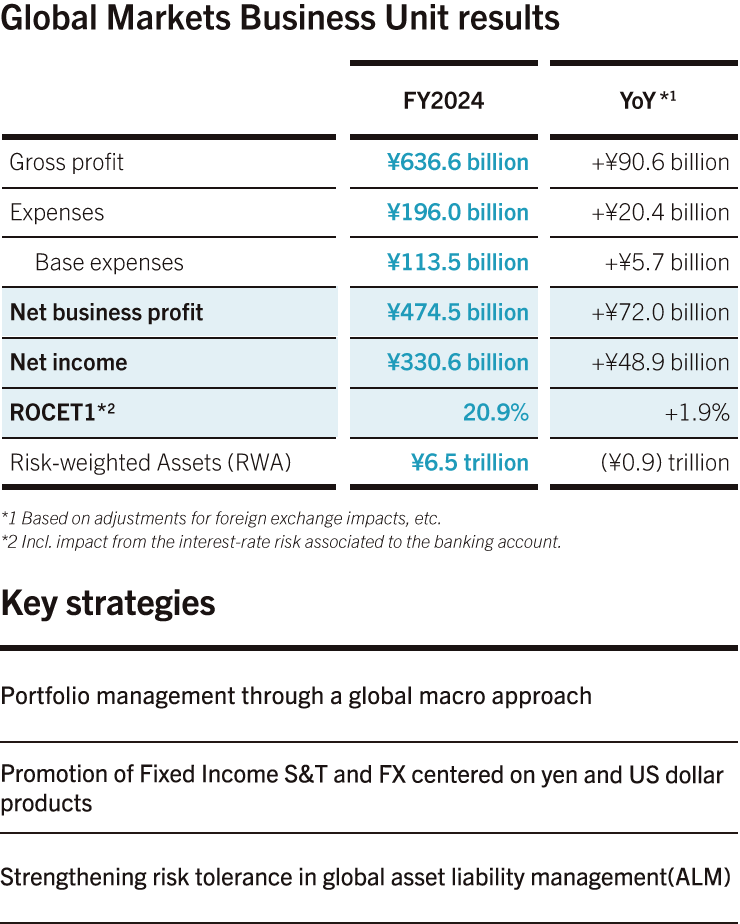

As market risk professionals, we aim to enhance our own risk-taking while continuously strive to provide customers with value added services.

The Global Markets Business Unit conducts trading of foreign exchange, derivatives, bonds, stocks, etc. and offers solutions to our customers. We are also responsible for ALM operations that comprehensively manage balance sheet liquidity risks and market risks.

In addition to the deterioration of U.S.-China relations around 2018, the COVID-19 pandemic from 2020 accelerated the transition to an era of global division. Even in Japan, which has suffered from deflation for many years, inflation has become a social issue, and the economic and financial markets have entered a phase of high inflation and high volatility, placing us in a new market environment never experienced during the era of globalization.

In such a market environment brought about by this paradigm shift, conventional thinking may no longer apply, but we have adapted and dynamically rebalanced our portfolio and accumulated earnings.

This is the result of continuously honing our trading capabilities—our strength—which is the ability to discern the underlying essence of world affairs. Each member of the business unit collects and analyzes information on various daily events using the “Three Is”—Insight, Imagination, and Intelligence—engages in thorough discussions, expresses the scenarios thus drawn as positions, and review validity of these positions. This constant cycle fosters the ability to discern the underlying essence of world affairs.

We will continue to maximize this strength, accurately capturing profit opportunities in portfolio management, and providing optimal solutions to customers’ market and funding needs.

FY2025 is the final year of the current Medium-Term Management Plan. Although the uncertainty caused by geopolitical issues continues, it is precisely at times like these that we will demonstrate our strengths and achieve our goals. We will also vigorously promote measures for further growth and breakthroughs in the next Medium-Term Management Plan and remain committed to contributing to the growth of our customers and SMBC Group.