Asset Management Strategy

-

01 Tadashi Hayakawa SMBC Trust Bank

Executive Officer

General Manager, Wealth Management Planning Dept. -

02 Ken Kobayashi SMBC Global

Investment & Consulting (SGIC)

Representative Director, President -

03 Hideyuki Omokawa Managing Executive Officer

Group Deputy CSO

General Manager, Asset & Wealth Management Strategy Dept. -

04 Junko Ikarashi SMBC Nikko Securities

Managing Executive Officer

Head of Investment Solutions Unit -

05 Tsuneto Iki Sumitomo Mitsui DS Asset Management (SMDAM)

Deputy President Executive Officer and COO -

06 Toshihiko Kato Managing Executive Officer

Deputy Head of Retail Business Unit

General Manager, Wealth Management Division

At SMBC Group, each Group company with strengths in the asset management business collaborates while leveraging their respective strengths to develop asset management strategies.

To further deepen integrated Group management, management from each company gathered to discuss the current situation and issues.

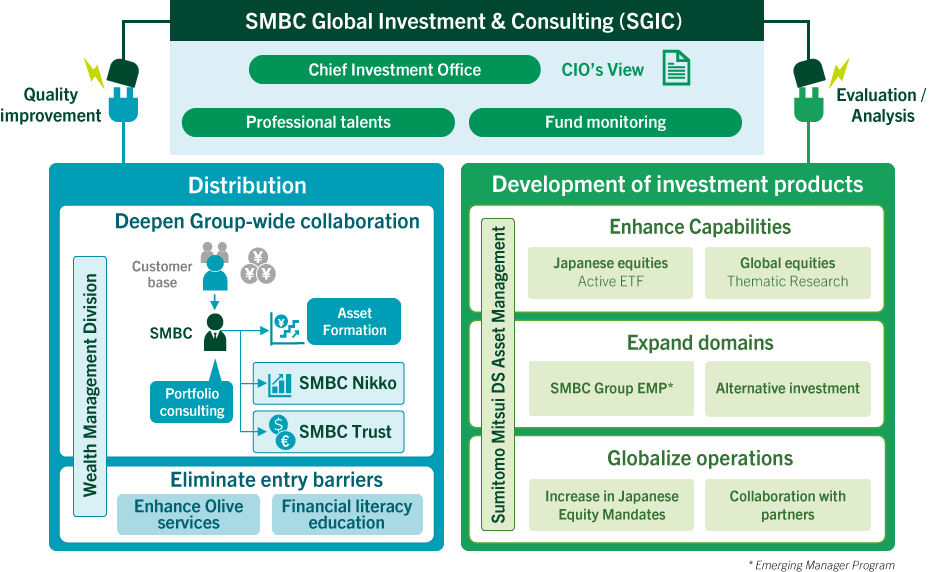

Strengthening the Group-wide asset management strategy promotion system centered on SGIC

Omokawa (Group Deputy CSO): SMBC Group aims to become the No.1 asset management solution provider that is close to each customer’s diverse needs and provides optimal asset management services. To achieve this, we have established a system in which SGIC, as the core, provides neutral advice to Group companies responsible for wealth consulting and for the formation and development of investment products, thereby improving service quality.

Kobayashi (SGIC): We are transferring necessary functions and resources to SGIC, and in the investment trust business, we consolidated fund due diligence and monitoring work. In the fund wrap business, we consolidated asset allocation and fund selection work within fiscal 2024. In addition, we welcomed about 20 members of the CIO (Chief Investment Office) team specializing in providing information to support long-term diversified investment from SMBC Nikko Securities. From April 1, 2025, we regularly publish “CIO’s View,” which features SMBC Group’s official investment outlook.

Kato (Deputy Head of Retail Business Unit): At SMBC Group, the Wealth Management Division formulates and promotes comprehensive strategies so that customers can receive integrated consulting from SMBC, SMBC Nikko Securities, and SMBC Trust Bank. We have established the optimal sales structure to meet customer needs and are continuously working on portfolio consulting.

Ikarashi (SMBC Nikko Securities): SGIC has advanced fund research functions and high expertise and know-how in asset allocation. By utilizing the “CIO’s View,” which reflects this from a neutral standpoint, throughout the Group, we hope to provide higher-quality consulting.

Hayakawa (SMBC Trust Bank): Currently, SMBC Trust Bank mainly handles foreign investment trusts, and we hope to utilize SGIC’s functions to further improve their quality. In addition, to be able to propose products from a neutral standpoint over the long term, regardless of market themes at any given time, we will work with SGIC to build the optimal lineup.

Iki (SMDAM): SMDAM’s mission is not only to manage its in-house products, but also to provide clients with access to excellent investment opportunities and managers around the world. Through years of fund wrap management, SGIC has developed strong capabilities in fund selection and in constructing portfolios that combine those funds effectively. We hope to select better funds and provide better portfolios through collaboration.

From savings to asset building

—Covering the expanding base of investors with the new NISA

Kato (Deputy Head of, Retail Business Unit): For beginners starting to invest, there are hurdles such as lack of knowledge or funds, and anxiety about investment and risk. To resolve these matters and support customers’ asset formation, we conduct financial literacy education through outreach classes and seminars. Additionally, in January 2025, we released a financial literacy education game that allows users to easily learn about finance. Furthermore, with the launch of the new NISA in January 2024, “Olive” has taken the lead, and the base of investors is beginning to expand, especially among the younger generation with a high interest in digital tools and services. The number of NISA accounts increased by 370,000 across SMBC Group in the past year, including SBI Securities intermediary accounts via Sumitomo Mitsui Banking Corporation and Sumitomo Mitsui Card Company, with a 20% year-on-year increase. In particular accounts opened via “Olive” accounted for a large proportion.

Ikarashi (SMBC Nikko Securities): At SMBC Nikko Securities, we are focusing on total asset consulting, handling all of our customers’ assets so that they can steadily increase their assets through medium- to long-term diversified investments. We believe our strength lies in being able to maintain long-term relationships with customers through follow-ups via life plan hearings, proposals, and reviews.

Hayakawa (SMBC Trust Bank): SMBC Trust Bank has strengths in foreign currency-denominated investment trusts and settlement services, and the Visa debit card “Global Pass,” which allows settlement in foreign currencies, is widely used by Japanese global company expatriates and business owners who frequently travel overseas. In addition, we propose reviews of total asset portfolios based on non-financial needs, including real estate, and customers’ potential needs, and differentiate ourselves by supporting not only wealth management but also loans, real estate brokerage, and the smooth succession of company shares.

Leveraging human resources and uniting the Group’s asset management skills

Iki (SMDAM): SMDAM upholds “Be Active.” and focuses on active management. Recognizing that people are the source of enhancing our asset management capabilities, we are proactively leveraging the Group’s diverse talent pool to expand our lineup of investment products. For example, we welcomed asset management personnel from the Global Markets and Treasury Unit of Sumitomo Mitsui Banking Corporation, combining the asset management skills of both companies, and launched a global macro strategy fund in 2023. On the other hand, many experienced asset management talents, including fund managers, have transferred from our company to Group companies, engaging in fund selection, evaluation of asset management companies, and asset management advisory operations. As personnel exchanges within the Group continue to progress, I strongly feel that opportunities for professionals in asset management will also expand.

Omokawa (Group Deputy CSO): In terms of strengthening asset management capabilities, we have also begun efforts to actively welcome new managers and incorporate excellent investment strategies to offer to customers, and via the “Emerging Manager Program,” we have set a medium-term goal of investing a total of ¥50 billion. SMDAM also provides functions such as this fund scheme and due diligence on emerging managers. Going forward, we hope to utilize the diverse functions of SMBC Group to promote collaboration with distinctive emerging managers.

With fiduciary duty at heart, becoming the choice of customers

Iki (SMDAM): I believe that the most important concept in the asset management business is fiduciary duty. In order to fulfill a higher level of fiduciary duty, a deeper understanding of asset management is essential. In recent years, as investment areas such as alternative investments have expanded, leadership with product governance, transparency, broad experience, and deep insight has become indispensable. Our management team is composed of talents who have accumulated many years of experience in this industry, and it emphasizes extensive experience, knowledge, and insight in the asset management industry.

Kobayashi (SGIC): SGIC stands between the two functions of asset management and wealth consulting within the Group and evaluates products from a neutral standpoint. Upon becoming president, I have always considered how to balance fiduciary duty with collaboration within the Group. I believe the answer is for each affiliated company to become an even more professional organization. The ultimate goal is to provide high-quality services and make people want to actively use SGIC’s products and services.

Omokawa (Group Deputy CSO): As we move toward becoming a top class asset management solution provider, let’s continue to work closely together, aiming to be a presence that supports and stands by our customers throughout their lives.