SMBC Covered Bond

Sumitomo Mitsui Banking Corporation (SMBC) has issued covered bonds in overseas markets.

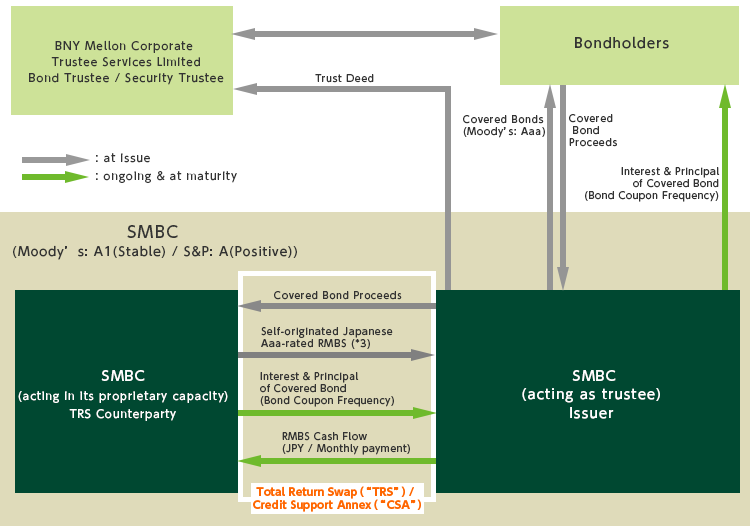

Overview of SMBC Covered Bond Programme

| Issuer / Status of the Bonds |

|

| Dual Recourse |

|

| Total Return Swap (“TRS”) / Credit Support Annex (“CSA”) |

|

| Over Collateralisation |

|

| Cover Pool |

|

- *1 SMBC, licensed by Japanese FSA as financial institutions which engage in trust business, acting as trustee on behalf of a specified money trust(tokutei kinsen shintaku) No. 0010-377600-0001 (the “Trust”)

- *2 TRS Counterparty may amend Minimum OC Percentage in order to maintain the current rating of Covered Bonds, subject to a minimum of 25%

- *3 Cover pool assets may include senior tranches Aa-rated RMBS where higher haircut ratio of 20% is applied, JGB and cash

SMBC Covered Bond List

| Series | ISIN | Notional | Issue Date | Maturity Date | Coupon |

|---|---|---|---|---|---|

| 2019-1 | XS2008801297 | EUR500,000,000 | June 18, 2019 | June 18, 2026 | 0.267% |

| 2019-3 | XS2066652897 | EUR750,000,000 | November 7, 2019 | November 7, 2029 | 0.409% |

| 2023-1 | XS2547591474 | EUR750,000,000 | February 16, 2023 | February 16, 2026 | 3.602% |

| 2025-1 | XS2984119896 | EUR 500,000,000 | February 18, 2025 | February 18, 2030 | 2.737% |

SMBC Covered Bond Valuation Investor Report

| As of | Disclosure date | Valuation Investor Report |

|---|---|---|

| November 18, 2025 | December 1, 2025 | Valuation Investor Report Nov 2025 (258KB) |

| August 18, 2025 | September 10, 2025 | Valuation Investor Report Aug 2025 (268KB) |

| May 20, 2025 | June 2, 2025 | Valuation Investor Report May 2025 (269KB) |

| February 18, 2025 | March 4, 2025 | Valuation Investor Report Feb 2025 (264KB) |

| November 18, 2024 | December 2, 2024 | Valuation Investor Report Nov 2024 (264KB) |

| August 16, 2024 | September 5, 2024 | Valuation Investor Report Aug 2024 (264KB) |

| May 20, 2024 | June 3, 2024 | Valuation Investor Report May 2024 (353KB) |

| February 16, 2024 | March 5, 2024 | Valuation Investor Report Feb 2024 (277KB) |

| Nov 16, 2023 | Dec 4, 2023 | Valuation Investor Report Nov 2023 (507KB) |

| Aug 16, 2023 | Sep 5, 2023 | Valuation Investor Report Aug 2023 (348KB) |

| May 22, 2023 | June 2, 2023 | Valuation Investor Report May 2023 (352KB) |

| February 15, 2023 | March 1, 2023 | Valuation Investor Report Feb 2023 (347KB) |

| November 16, 2022 | November 30, 2022 | Valuation Investor Report Nov 2022 (346KB) |

| August 16, 2022 | August 30, 2022 | Valuation Investor Report Aug 2022 (347KB) |

| May 19, 2022 | June 2, 2022 | Valuation Investor Report May 2022 (347KB) |

| February 16, 2022 | March 2 ,2022 | Valuation Investor Report Feb 2022 (262KB) |

| November 16 ,2021 | November 30, 2021 | Valuation Investor Report Nov 2021 (268KB) |

| August 17, 2021 | August 31, 2021 | Valuation Investor Report Aug 2021 (263KB) |

| May 20, 2021 | June 2, 2021 | Valuation Investor Report May 2021 (259KB) |

| February 16, 2021 | March 1, 2021 | Valuation Investor Report Feb 2021 (259KB) |

| November 17 ,2020 | December 4, 2020 | Valuation Investor Report Nov 2020 (268KB) |

| August 18, 2020 | September 3,2020 | Valuation Investor Report Aug 2020 (263KB) |

| May 21, 2020 | June 5, 2020 | Valuation Investor Report May 2020 (264KB) |

| February 18, 2020 | March 2, 2020 | Valuation Investor Report Feb 2020 (264KB) |

| November 18 ,2019 | November 29, 2019 | Valuation Investor Report Nov 2019 (263KB) |

| August 16, 2019 | August 30, 2019 | Valuation Investor Report Aug 2019 (255KB) |

| May 21, 2019 | May 29, 2019 | Valuation Investor Report May 2019 (246KB) |

| February 18, 2019 | March 4, 2019 | Valuation Investor Report Feb 2019 (246KB) |