The widespread use of cashless payments has made it easier to pay with smartphones. However, this convenience has brought a new challenge: the reduced sense of spending compared to using cash. For children, in particular, there is a risk of misunderstanding that “anything can be bought with a smartphone,” which may lead to a shallow understanding of money as they grow up.

In addition, with the lowering of the legal adulthood age in 2022, high school students who turn 18 can now enter into credit card and loan agreements. While responsible and planned usage is essential, a lack of awareness could result in financial difficulties.

Given these circumstances, it has become increasingly important to acquire financial literacy at an early age and provide financial and economics education to children.

Developing Educational

Materials to Teach

Children About Finance

in an Enjoyable Way

Responding to the social challenges mentioned earlier, SMBC Group is actively promoting financial and economics education. Among these efforts, SMBC Consumer Finance has been conducting financial and economics education seminars since 2011. Through these initiatives, the company aims to improve consumers’ financial literacy, avoid financial troubles, and design life plans that align with their dreams and goals.

The company has taken a multifaceted approach, including organizing seminars tailored to different age groups and knowledge levels, developing educational materials, and implementing financial literacy certifications. The number of seminar participants has grown significantly, from 130,000 in FY2013 to over 280,000 annually a decade later. This increase has also expanded the participant demographic, with more university students and young professionals joining in addition to the original target audience of high school students.

On the other hand, financial and economics education presents challenges, particularly for elementary school children, as they often struggle to understand financial terminology. Explaining the meaning of these terms is a common hurdle. Shingo Kouta from the Tokyo Customer Service Plaza, who promotes the importance of financial literacy through exhibitions and educational programs, notes, “While children show interest when we engage with them directly, they generally have little initial interest in financial concepts or risks.”

This is a key challenge in introducing financial and economics education to younger audiences.

To address this challenge, the company collaborated with Sumitomo Mitsui Financial Group and Sumitomo Mitsui Banking Corporation to introduce an edutainment approach—blending education and entertainment—to make financial and economics education enjoyable and accessible for children. In March 2024, they launched the game-based learning tool Quest of Finance: The Hero’s Weapon is Financial Knowledge.

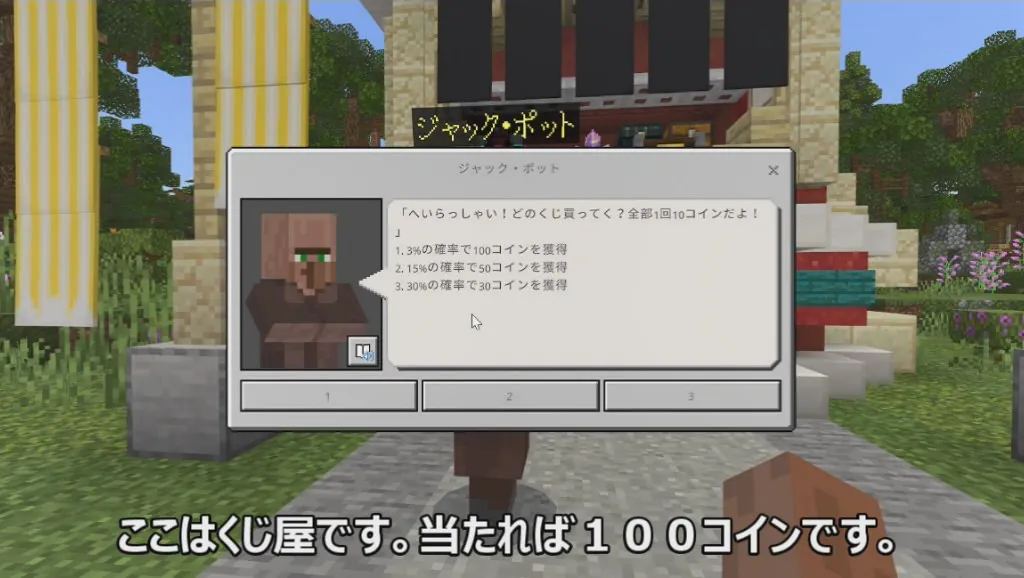

In Quest of Finance, players complete various quests to collect 100 coins and pull the legendary sword to defeat the Dark Lord. Through this storyline, children learn the basics of earning, saving, and spending money. Designed using Minecraft, a game popular among children, the tool helps them naturally develop financial literacy and an understanding of money management.

This game-based learning tool incorporates scenarios such as being offered a “guaranteed way to make money,” allowing children to experience simulated scenarios of scams and financial troubles while playing. Speaking about lessons using this tool, Kouta explains, “When we reflect on in-game challenges—like saying, ‘Remember the trouble we faced in the last quest?’—and relate them to real-world news and examples, it makes the learning experience more realistic.”

To ensure an engaging and educational game design, the development team carefully balanced learning elements with gameplay, consulting with supervisors throughout the process. Mai Shimomura from the Sustainability Development Dept. notes, “We designed the game with a difficulty level that isn’t easy to clear, encouraging players to try again. This repetition helps deepen their learning.”

As intended, many children who played the game expressed enthusiasm, frequently saying, “I want to play it again!”.

Quest of Finance has been introduced into high school classes. Kouta shares that during a seminar at a home economics teachers’ meeting, many teachers expressed concerns about teaching financial and economics education, saying, “We know it’s necessary, but we lack the knowledge and don’t know how to teach it.”

In response, Quest of Finance was proposed as a fun and engaging learning tool, leading to its adoption in classrooms.

Shimomura points out that parents also face challenges with financial and economics education for their children. “Many parents feel pressured to teach asset management, which can seem overwhelming. However, what children need to learn first is not asset management but the fundamental value and purpose of money. Money is a tool to achieve future goals, and it’s important to teach children how to plan and save strategically for those goals. We hope to expand opportunities for children to learn about money in a fun and engaging way through Quest of Finance,”

Shimomura explains.

Expanding Financial and

Economics Education to

Reach More Children

Looking ahead, a key focus is to provide financial and economics education to children who are harder to reach, such as those who are not attending school or have disabilities. This is an important challenge in ensuring financial and economics education reaches a broader audience.

Kouta, who conducts financial and economics education seminars at schools, shared his experience from a seminar for children not attending school, saying, “I was really touched when a student sent me a message saying ‘thank you’ in the chat at the end.”

In another seminar for children at a school for the deaf, he noted, “I felt they were highly engaged and interested. Teaching financial literacy to individuals who are deaf or hard of hearing is extremely important, and I deeply felt its significance.”

These reflections highlight the importance of expanding financial and economics education to include all children, regardless of their circumstances.

Minecraft’s large user base in English-speaking regions has led to requests for Quest of Finance to support multiple languages, including English. With this in mind, there are plans to use the tool as a starting point for promoting financial and economics education on a global scale in the future.

Reflecting on the initiative, Shimomura shared, “By connecting with groups we hadn’t previously engaged with allowed us to listen to needs we hadn’t noticed before and create new relationships. Through Quest of Finance, I’ve strongly felt the importance of financial and economics education and its potential for expansion.”

She added, “Learning about finance not only helps alleviate anxiety about money but is also essential for living a fulfilling and authentic life. It empowers individuals to enrich their lives. Moreover, I believe that financial institutions’ efforts in financial and economics education contribute to their own sustainable growth and enhance corporate value in the medium- to long-term perspective.”

Additional Information: Minecraft is a trademark of Microsoft Corporation. This educational tool is not endorsed by Microsoft or Mojang Studios, the developers of Minecraft, nor is it provided as an official product.