University research and education form the foundation of innovation and play a vital role in sustaining societal development. In particular, basic research differs from short-term profit-driven studies, as it generates knowledge and technologies that pave the way for the future from a long-term perspective. Supporting such university research and education is essential for Japan’s Regrowth.

Maintaining and developing this environment for basic research requires a stable financial base. One increasingly important funding source is university endowments, which rely on donations and other contributions. While universities primarily depend on operating grants from the government, these funds must be used within a specified period, making it difficult to allocate resources to long-term research projects that may take decades to yield results. Moreover, these government grants have been steadily declining each year.

To address these challenges, Sumitomo Mitsui DS Asset Management Co., Ltd. has introduced an initiative through the Global New Era Equity Fund*. This fund is an investment trust that focuses on industries expected to grow due to structural changes, investing in companies worldwide. A portion of the fund’s profits is donated to organizations tackling social issues such as education and healthcare.

*”Global New Era Equity Fund” is a fund managed by Sumitomo Mitsui DS Asset Management (details can be found at the end of the article).

Expanding Support

Through the Integration

of Investment and

Philanthropy

The Global New Era Equity Fund was launched in July 2020 in response to the major societal transformations brought about by the COVID-19 pandemic. The fund focuses on four promising themes expected to grow due to structural changes: lifestyle, corporate strategy, healthcare & wellness, and green technology.

Initiatives driving societal change are not confined to publicly traded companies. However, a key challenge for investment trusts is their inability to directly support organizations addressing social issues. To overcome this, the fund has implemented a system where a portion of the fund management fees (trustee fees) received by Sumitomo Mitsui DS Asset Management is donated to organizations that are creating social value in areas such as healthcare and education.

A considerable amount of time was dedicated to selecting suitable donation recipients. Kaori Takao, Chief of the Product Administration Team, Product Planning Dept., Sumitomo Mitsui DS Asset Management, explains the selection process:

“Many organizations engage in socially valuable activities. We carefully researched each one, prioritizing transparency and credibility, to ensure alignment with the fund’s concept and identify the most suitable recipients.”

One of the chosen donation recipients is the UTokyo NEXT150, an initiative by The University of Tokyo. Established to enhance basic research and creative educational activities, this fund plays a crucial role in financing new social value creation at The University of Tokyo.

One of the key challenges facing The University of Tokyo is its relatively small endowment, which makes it difficult to allocate funds swiftly to research and education. Furthermore, with the reduction in operational grants from the government, how to manage its financial resources has become an urgent issue.

“The University of Tokyo endowment stands at approximately 29.9 billion yen, whereas top U.S. universities manage funds exceeding trillions of yen, using investment returns to support research. This overwhelming difference in scale, along with a lack of expertise in fund management, is a major challenge for Japanese universities as a whole,”

points out Takeru Inoue, General Manager, Corporate Sustainability, Sumitomo Mitsui DS Asset Management.

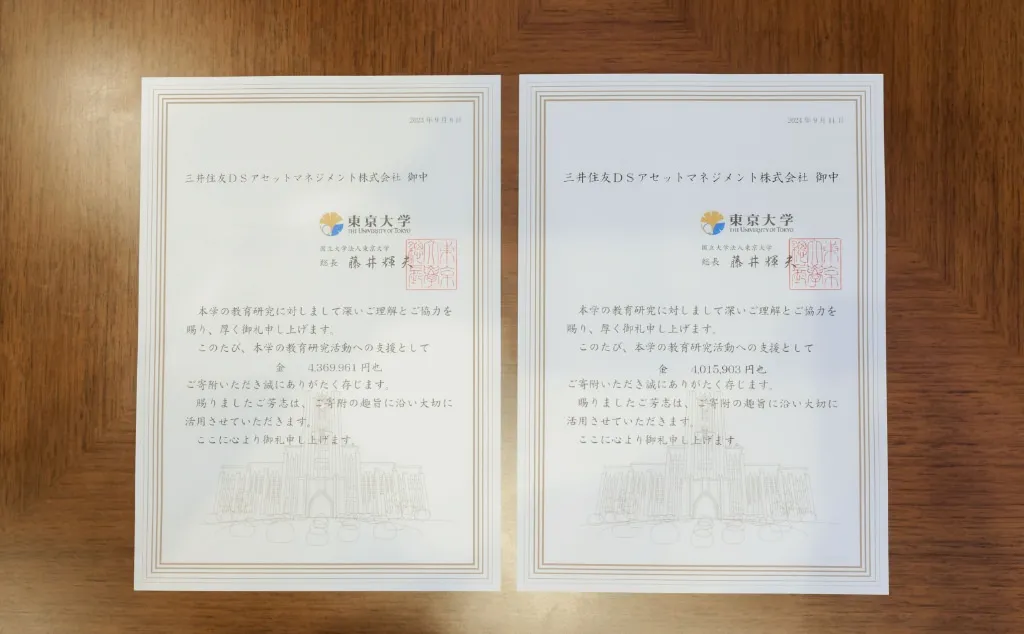

To overcome these challenges, it is essential to strengthen the financial foundation of university endowments. As part of this effort, the Global New Era Equity Fund donated approximately 4 million yen to the UTokyo Foundation in September 2024. Representatives of the fund meet annually with The University of Tokyo to discuss how donations are allocated and to plan future initiatives.

Takao explains, “The UTokyo Foundation is not just receiving donations but is also enhancing fund management, growing its assets, and building a system that enables timely allocation of funds to research and education. The university is actively working to improve organizational structure and strengthen endowment management.”

She expressed deep appreciation for this proactive approach.

The UTokyo Foundation Office, which received the donation, also recognized its significance, stating,

“This contribution plays a vital role in strengthening the foundation of basic research and educational activities. The funds are allocated to a wide range of initiatives, including scholarships and emergency financial aid for unexpected situations.”

Certificate of Appreciation from the University of Tokyo

“Dual Value Creation”

Through Investment

and Philanthropy

Since the launch of the fund with a donation scheme, many organizations have expressed interest in becoming recipients. Takao reflects on this response:

“When managing an investment trust, the focus is often on financial markets. However, through this fund’s management, we have recognized the large number of organizations working to create social value.”

Moving forward, the primary focus remains on improving fund performance. At the same time, expanding the number of donation recipients will be considered in line with the fund’s growth. In addition, efforts to share information on the social value generated through donations are being explored to foster broader understanding and support.

Through these initiatives, the fund seeks to enhance the appeal of investment trusts while fostering “dual value creation”: generating economic value through fund management and social value through donations.

With the Global New Era Equity Fund, Sumitomo Mitsui DS Asset Management also envisions a path for Japan’s Regrowth. Inoue explains, “By improving fund performance and raising awareness of our active management approach, we aim to expand the fund’s scale, thereby increasing donation amounts. This creates a mutually beneficial relationship among investors, universities, and our firm. Furthermore, as we strengthen collaboration with universities through donations, our role extends beyond funding research and development. By contributing to the advancement of university endowment management, we can create a stable environment for sustaining basic research. Supporting this long-term academic foundation is essential for the continued growth of universities and, ultimately, for Japan’s Regrowth.”

For more information on the funds mentioned in this document, please refer to the links below:

① Global New Era Equity Fund (Property Growth Type)

Fund Overview ▶ https://www.smd-am.co.jp/fund/183102/

Investment Risks and Costs (Prospectus) ▶ https://www.smd-am.co.jp/fund/pdf/183102k.pdf

② Global New Era Equity Fund (Monthly Dividend Type)

Fund Overview ▶ https://www.smd-am.co.jp/fund/183002/

Investment Risks and Costs (Prospectus) ▶ https://www.smd-am.co.jp/fund/pdf/183002k.pdf