Singapore FinTech Festival 2023 Report: SMBC Group Presents a Digital Strategy for Asia

From November 15 to 17, 2023, Singapore FinTech Festival (SFF) 2023 was held in Singapore. SFF is one of the world’s largest fintech events, organized annually since 2016 by the Monetary Authority of Singapore. Promoting “the intersection of policy, finance, and technology,” it provides a forum for showcasing cutting-edge financial technologies and solutions, along with associated initiatives aimed at solving societal issues, as well as current fintech regulation and the direction in which it is moving.

The 2023 event was the largest ever, with more than 66,000 participants from 150 countries. The theme this year was “The Applications of AI in Financial Services.” In addition to presentations and panel discussions involving more than 970 speakers over the three days, global companies from all over the world set up exhibition booths at the venue, resulting in a wide range of interaction involving both the public and private sectors at the worldwide level.

SMBC Group has sponsored SFF since the festival’s inception in 2016, and this year we participated as a platinum sponsor. Seeking to advance our digital strategy in the Asia region, SMBC Group set up the Asia Innovation Centre in Singapore and India, and we have been collaborating with fintech companies to develop digital solutions focused on optimizing supply chain management and to pursue our own internal digitalization. In May 2023, we sought to accelerate such digital and fintech-related collaboration by setting up SMBC Asia Rising Fund, a corporate venture capital fund for investing in startups in the Asia region.

Keiji Matsunaga, General Manager of the Asia Innovation Centre, described the background to the Group’s digital strategy as follows: “Our digital strategy overseas as a global bank is still very much in its early stages. As the digitalization of finance accelerates in the Asia region in particular, we can look forward to great opportunities. At the same time, however, failure to adapt appropriately could leave us unable to meet the needs of our customers in the near future, so our current initiatives are imbued with a sense of urgency.” He adds that he regards the Group’s continued participation in SFF as “an undertaking that demonstrates to our customers, partners, and a wide range of other stakeholders the results already achieved through SMBC Group’s digital strategy in the Asia region, as well as its vision and commitment going forward.”

This article describes SMBC Group’s contributions during the SFF event.

Implementation of ESG-Related Initiatives by Financial Institutions

Tetsuro Imaeda, Deputy President and Representative Executive Officer of Sumitomo Mitsui Financial Group served as a panelist in the panel discussion entitled “Tech Infrastructure for ESG: Global leaders assessment,” which addressed the role of technology in the implementation of ESG-related initiatives. At the start of the discussion, the moderator asked the panelists what ESG-related tech infrastructure is currently lacking. Imaeda replied by emphasizing that sustainable ESG-related action requires not only AI and data analysis for planning, but also specific measures including development and utilization of core technologies that contribute to reducing CO2 emissions.

In addition, Imaeda commented on the governance element of ESG from the perspective of a financial institution. Asked what key ESG challenges society would face over the next five years, and what effects these would have on financial institutions, he replied, “For banks, governance including transparency regarding the use and transfer of funds is of critical importance. As regulations become increasingly stringent, it seems that they tend to regard compliance with governance requirements as an increased burden. However, I am convinced that harnessing digital technology to make corporate governance both efficient and effective could yield competitive advantages for financial institutions and other companies.”

Imaeda wound up his comments by saying, “We set up a $200 million fund for investing in startups in the Asia-Pacific region to solve key issues including ESG challenges. We are committed to this region, and will continue to create social value here.”

Generative AI-Based Solution for Corporate Clients

Sumitomo Mitsui Financial Group’s Group CDIO and Senior Managing Executive Officer, Akio Isowa, took part in the panel discussion entitled “Generative AI Unleashed: Revolutionizing Finance with Pioneering Use Cases,” at which panelists exchanged views on the use of generative AI in financial institutions.

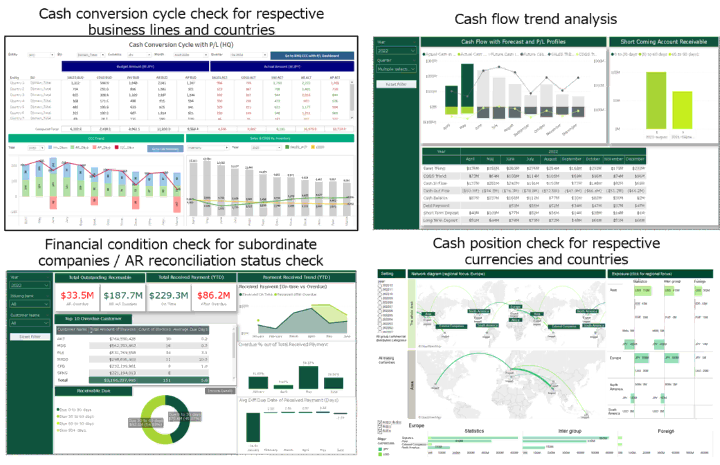

Isowa presented one of SMBC Group’s initiatives to leverage AI in the form of a solution utilizing generative AI that the Group is currently developing for corporate clients. He pointed out that for the corporate CFOs targeted as potential users of this solution, “the greatest challenge, and one of the biggest headaches, is organizing and processing data to obtain the meaningful insights necessary for decision-making.” He explained the significance of the service offered by SMBC as follows: “We are designing generative AI-enabled dashboards that assist with analysis and visualization of data to enable CFOs to make decisions based on sufficient information.”

When other panelists expressed the opinion that, in general, use of AI should focus on provision of standardized services in order to improve efficiency and broaden the customer base, Isowa countered by pointing out that generative AI in particular has the flexibility for customization. Stating his belief that generative AI would have the potential to “automate the customization,” he went on to describe his vision for AI that—precisely because it would be generative—could transcend standardized services to provide customization delivering optimal solutions for each individual customer’s needs.

Asked what to expect over the next five years, and what important roles generative AI would play in financial services, Isowa explained that SMBC Group intended to improve the efficiency of its internal banking processes and pursue greater financial inclusion and sustainability. He also reiterated the Group’s aspiration to develop its business in Asia, saying “SMBC Group is committed to Asia, and will continue leveraging technologies of all kinds to create social value as well as economic value.”

New Generative AI-Based Service Facilitates CFOs’ Decision-Making

On the Founders Peak Stage (the stage for presentation of new concepts), we demonstrated a prototype of a generative AI-based interactive digital dashboard for corporate CFOs, as described by Isowa during his panel discussion.

For the past three years, the Asia Innovation Centre has offered a dashboard solution that consolidates and visualizes the data dispersed throughout customer companies, including that relating to cash flows and financial matters. Although all such information can be described as “internal data,” its consolidation alone is a challenge for companies due to variations in formatting, and the different national languages and regulations involved when businesses operate in more than one country. Our demonstration during SFF featured a service that utilizes AI to offer the analysis of trends and contributory factors necessary for CFO decision-making via an interactive user interface, in addition to consolidating and visualizing data or information that takes a long time to process. For example, if data visualization revealed that cash flows had deteriorated, the service would deduce the factors behind this and recommend the next steps to be taken from the CFO’s perspective. Development of this system is currently progressing and we are improving its precision with a view to putting it to practical use.

Feedback from SFF attendees who actually saw the demonstration included comments such as, “Using this could make data analysis faster, enabling me to focus on more productive work” and “Although it was a prototype, it was set up to demonstrate realistic potential scenarios, and I thought it seemed extremely useful.”

Accelerating SMBC Group’s Digital Strategy in the Asia Region

As a platinum sponsor, we set up an SMBC Group exhibition booth in the exhibition hall. Having decided on “SMBC x Tomorrow for Creating Social Value” as the overall concept of the booth, we showcased ideas in line with three themes: Optimize Industry Value Chain, Better Finance for Everyone, and Asia Franchise. We addressed the first theme, Optimize Industry Value Chain, by highlighting SMBC Group’s initiatives for corporate clients in Asia aimed at supporting digital transformation of the industrial value chain. On the second theme, Better Finance for Everyone, we presented examples of our partnerships with fintech companies providing new forms of financial value such as financial inclusion and gamification. For the third theme, Asia Franchise, we described action taken by SMBC Group’s partners under its multi-franchise strategy (an initiative aimed at expanding business including retail banking throughout Asia—a region where growth is expected—by investing in local financial institutions in Southest Asia and India). At the booth, SMBC Group companies and corporate partners gave presentations, and an interactive touch panel provided explanations. The booth proved to be a great success, attracting more than 3,500 visitors over the three days.

Keiji Matsunaga, General Manager of the Asia Innovation Centre, expressed his enthusiasm for the Group’s digital strategy in the Asia region with the words, “I want us to continue working with our customers and fintech partners as we dedicate ourselves to extending our current digital strategy and accelerating our multi-franchise strategy through digital technology. I would like SMBC Group to build a platform that embraces digital edge technologies in the Asia region, with a view to potentially evolving this into a global platform.”

-

Deputy President and Representative Executive Officer, Sumitomo Mitsui Financial Group

Deputy President and Representative Director, Sumitomo Mitsui Banking CorporationTetsuro Imaeda

Graduated from The University of Tokyo Faculty of Law in 1986 and joined The Sumitomo Bank, Ltd. Worked in corporate affairs (large corporations), and international affairs. In 2014, he was appointed Executive Officer of Sumitomo Mitsui Banking Corporation (General Manager of SMBC Singapore Branch), and in 2016, he was appointed Managing Executive Officer (Head of Europe, Middle East and Africa Division; CEO of Sumitomo Mitsui Banking Corporation Europe Limited). In 2020, he was appointed Representative Director and Senior Managing Executive Officer (Group CCO and Senior Managing Executive Officer, Sumitomo Mitsui Financial Group), and in April 2023, he was appointed Deputy President and Representative Director, and Co-Head of Global Banking Unit (Deputy President and Representative Executive Officer, Sumitomo Mitsui Financial Group).

-

Group CDIO and Senior Managing Executive Officer, Sumitomo Mitsui Financial Group

Senior Managing Executive Officer, Sumitomo Mitsui Banking Corporation.Akio Isowa

Graduated from The University of Tokyo Faculty of Law in 1990 and joined Sumitomo Mitsui Banking Corporation. Worked in corporate banking, legal affairs, corporate planning, and human resources before setting up the Retail IT Strategy Department within the Retail Marketing Department as General Manager and handling projects such as debit card business and SMBC’s mobile banking app transformation. As the Head of Transaction Business Division, he spearheaded product and sales planning for online payment services such as Bank Pay and Cotra. In 2022, he became the Head of Digital Solution Division. He took his current position as Group CDIO and Senior Managing Executive Officer in 2023, and is driving digital innovation for SMBC Group.