APAC Digital Initiative : Becoming an Embedded Solutions Provider from Asia

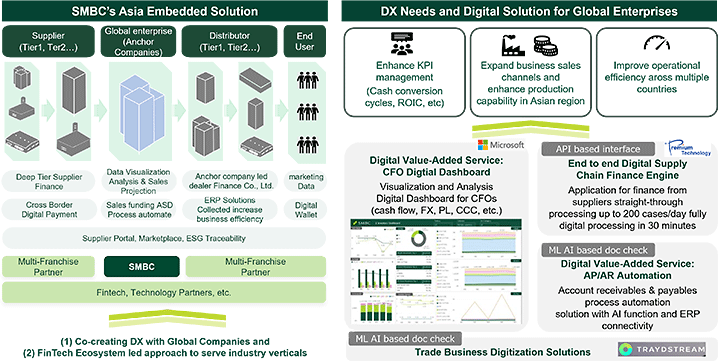

Based in Singapore, the SMBC Group’s APAC Digital Initiative develops and deploys corporate digital solutions in the Asia-Pacific (APAC) region. Since the Initiative was launched three years ago, the team has spoken with numerous corporate customers to identify the issues they face. The resulting achievements, including development of the CFO dashboard solution that consolidates and visualizes the data necessary for CFO decision-making (data on cash flow and financial matters) as well as the full digitalization of supply chain finance, are steadily boosting the Initiative’s presence in the region. By supporting corporate customers’ digital transformation (DX), the team is working to create new added value beyond the conventional definition of a bank.

We asked Keiji Matsunaga, General Manager, Asia Innovation Centre (AIC) at SMBC and his colleague Mayoran Rajendra about the progress of the Initiative till date and its goals for the future.

Interviews with hundreds of companies reveals DX needs

How did the APAC Digital Initiative come about?

Companies in the APAC region—Japanese and non-Japanese, small to large, operate within a complex web of countries, currencies, languages, and regulations, with operations ranging from procurement to production and sales. As you can imagine, this has created a huge need for digitalization, which is what prompted us to launch the APAC Digital Initiative around three years ago with the aim of developing corporate digital solutions out of APAC.

As a financial institution, one area where SMBC can offer the greatest value is optimization of global firms’ supply chain management. Global firms procure goods from suppliers from various countries and manufacture and sell products in various countries. Hence, they need to issue invoices, make and collect payments, and manage cash flow in different countries, languages and currencies. The point of departure for the APAC Digital Initiative was therefore to help customers support their DX Journey by digitizing these complex and time-consuming operations.

Can you give us a specific idea about global companies’ DX needs?

Our conversations with chief officers at hundreds of companies have revealed three major needs. The first is to upgrade the management of business indicators. For example, many Japanese companies utilize indicators such as CCC* in the performance management for the whole corporate group, but for their overseas subsidiaries, this means regularly working on manually aggregating the Excel data and then spending several days coordinating with offices in other countries. It’s a lot for companies operating on limited resources, and I often hear people saying that they wish there were a way to digitalize their PDCA cycle.

The second makings to increase sales channels and enhance production systems. With Asia continuing to grow rapidly, business leaders are constantly worrying about expanding their local sales footprint to grow their top line, locking in the top-notch suppliers to enhance their production systems, and making better use of platforms and digital technologies to achieve those objectives.

Lastly, they want to boost the operational efficiency—in other words, improve financial and accounting management process, which would also help address the first two needs.

Taking inspiration from these customer needs, we have pursued an end-to-end approach that goes well past the development of digital solutions to simultaneously digitalize operations and set in place SMBC’s infrastructure to facilitate external linkage with platform providers and partner companies.

* Cash conversion cycle. A financial indicator expressing the number of days that a company takes to convert inventory investments back into cash.

Custom-made CFO dashboards for financial tracking

Is your new CFO dashboard a one stop solution designed to address those needs?

That’s right. After identifying key customer requirements through all the interviews, we have put together a team of experts to develop the CFO dashboard concept. We talk to the customer to identify what key performance indicators they want to manage—for example, visualize and analyze monthly profit and costs, forecast monthly CCC trends, or visualize currency positions and inventory status by country. Basis their inputs, we have created a custom-made dashboard to help them manage their day-to-day business and finance operations.

Financial data visualization is a very simple function, but it was only through customer interviews that we realized its importance. We offer our CFO dashboard solution to customers who don’t have time to develop tools or put together internal data on top of their usual workload, as well as to customers who want to tackle development but don’t know where to start.

Each dashboard is created by conducting a design thinking workshop with customer’s team from the relevant departments to identify the key performance indicators that they want to visualize, their internal data structure, and their processes and then create a dashboard proposal accordingly. Using this dialogue process to develop customer tools has a major benefit for us as well, i.e. we can gain better understanding of their businesses, which is better than our regular interactions with them. In the past, most of our interactions had been with the finance team, but now we get to meet people from other departments such as procurement, sales, marketing, and systems, which is helping us understand our customer better. As a result, SMBC is able to leverage these new insights to create value added solutions as a bank for its customers. Consequently, customers in the APAC region are approaching SMBC based on the Group’s reputation as a digital frontrunner.

Right: Mayoran Rajendra, Asia Innovation Centre, Strategic Planning Department, Asia Pacific Division, Sumitomo Mitsui Banking Corporation

Could you give us a few DX examples other than the CFO dashboard?

One key initiative is the full digitalization of supply chain finance. Supply chain finance is a mechanism that helps firms supplying raw materials and components to a buyer company with early cash release based on the stronger credit rating of the latter. Until now, the process (including the exchange of documents) used to take at least four or five business days, but with full digitalization from customer’s operations to our bank operations, up to 200 requests per day can be processed in just 15 minutes. Responding quickly to suppliers’ cash needs also benefits the buyer companies by helping to lock in the best suppliers. We launched the service in Singapore, but now we also provide it in India, and the plan is to expand that offering still further, while also increasing processing capacity to around 10 times the current level.

The APAC Digital Initiative was never intended to promote just one product, but rather to utilize supply chain management as an entry point to help in customer’s DX journey by providing customized solutions in an agile manner. Fintech industry is evolving at a rapid pace which allows us partner with technology companies, offering high-added-value solutions, to build tailored solutions in an agile manner, rather than developing them inhouse. Our aim is to constantly be working ahead of our customers. For example, we have teamed up with fintech companies to digitalize trade operations, develop automation solutions for accounting operations like accounts receivable and payable processing, and introduce virtual account management services to improve cash management and boost work efficiency.

Becoming APAC’s go-to digitalization expert

We have a strong focus on customer engagement. Customers doing business in the APAC region have to chase digitalization and organizational transformation on top of their regular work. They’re looking for an advisor and facilitator who understands the challenge this poses.

Supporting customer digitalization requires an understanding of the of the customer’s industry - business and technical. We’ve hired people with backgrounds outside banking, such as manufacturing, trading, and fintech, to join our design thinking workshops with customer companies. For example, lowering cost prices from a CFO (Manufacturing company) perspective would require delving into manufacturing and distribution and pursuing efforts such as boosting procurement efficiency and improving inventory management. We’ve held these workshops at more than 200 companies so far, and have seen how this initiative helps involve people from various departments to help drive targeted value.

Unlike strategy consultants and system vendors, we work together with our customers to find solutions to their business issues. We provide CFO dashboards and other digital tools free of charge where they are needed. But our focus is on the dialogue process, through which we aim to produce higher added-value solutions as a bank.

How has the local response to the APAC Digital Initiative changed over approximately three years since launch?

Initially, our activities were not fully fathomed even within SMBC, but our multiple interactions with customers have helped forge strong relationships of trust. We’ve gradually brought customers on board by carefully explaining our goals, concept, and vision, which is much bigger than having business intelligence tools. We see those interested customers as our co-creators for APAC Digital new initiatives. The next stage, as I said earlier, was to work on the CFO dashboard concept and digitalization of supply chain finance in parallel with our design thinking workshops, gradually winning customers in the process. And proving that this approach also expands banking transactions has also enabled us to steadily build up cooperative relationships with relevant departments within SMBC.

My most gratifying experience was hearing a customer comment that SMBC always presents them with interesting digital-driven ideas. Some customers are now even taking the initiative and coming to us with their own new ideas. Until now, when customers wanted to pursue digitalization, they went to big consulting or IT firms. No one would have considered going straight to a bank! The increasing number of customers coming to us to talk about digitalization is testimony to the growing awareness of the SMBC Group’s digital initiatives in the APAC region.

Generative AI-based interactive digital dashboard for CFOs

An advanced embedded solutions platform for APAC, Japan, and the world

What kind of future is the SMBC Group aiming to create through the APAC Digital Initiative?

The APAC Digital Initiative is still a very small initiative. We’ve held a lot of design thinking workshops and delivered various solutions, but now it’s time to expand our scope. For example, with the CFO dashboard, we’ve moved past simple data visualization to begin proof-of-concept work on using generative AI to analyze data and visualize results that will assist CFOs in their decision-making, enabled in an interactive manner. And we also have many other areas to explore, such as expanding our visualization support from financial data to marketing data and operations, partnering with strategy consulting and technology firms to enhance analysis functions like demand and cash flow forecasts and provide services that help boost operational efficiency.

We’ve also begun reverse-importing digital approaches back to the headquarters of our APAC Japanese clients. At least in terms of supply chain digitalization, APAC is more advanced than Japan and hence, our plan is to expand our APAC work to Japan. We also want to reach out to main markets other than Japan—the United States and Europe, for example—with embedded solutions that offer integrated SMBC Group finance services. Our aim is to become a natural part of customers’ daily operations with seamless finance provision, with the SMBC Group becoming a platform provider for advanced embedded solutions.

As we plan to pursue agile development that also includes services other than finance, we want to proactively seek out partnerships with technology firms that share the SMBC Group’s way of thinking.

Our customers are always looking beyond the APAC region to global markets, so while 10 or so APAC countries are our current target, our goal is to expand that to the global level so that we can continue to accompany our customers in their global business.

-

General Manager, Asia Innovation Centre

Strategic Planning Department, Asia Pacific Division

Sumitomo Mitsui Banking CorporationKeiji Matsunaga

Joined SMBC in 1998. After working in management planning, wholesale banking business planning in Japan and overseas, and other departments, he became head of the Asia Innovation Centre in 2021. Aiming to reform banking operations and generate growth for SMBC in Asia, he focuses on the APAC region as he works to create business for clients and upgrade internal infrastructure utilizing digital technology. Concurrently, he also engaged in CVC management since 2023. He has graduated from the University of Tokyo and earned an MBA from Carnegie Mellon University.

-

Asia Innovation Centre

Strategic Planning Department, Asia Pacific Division

Sumitomo Mitsui Banking CorporationMayoran Rajendra

Received a master’s degree from the Department of Precision Mechanical Engineering within the University of Tokyo’s Graduate School of Engineering, where he engaged in joint research with RIKEN on surgical robots that can be used inside MRI scanners. Graduated in 2009 and joined GE Healthcare Japan. After working on MRI R&D as a product development engineer, he was selected for a leadership program for engineers and led manufacturing, IT, marketing, and supply chain related projects. He also led global development of new MRI products from Japan from 2013. Transferred to GE Japan in 2015, launched GE’s industrial IoT business in Japan and worked on numerous IoT projects in the fields of power, aviation, and manufacturing as an industry pioneer. Post joining SMBC in August 2020, he is leading digital strategy in the Asia-Pacific region from Singapore.