Finance Digital Transformation Accelerated by Strengthening “Embedded Finance” in Asia

In recent years, we have started to hear the term “embedded finance.” As the name implies, embedded finance is spreading as a framework in which bank functions are provided embedded into the services of non-financial companies. By replacing paper-based bank transactions with digital, it has become possible to develop business seamlessly and with overwhelming speed.

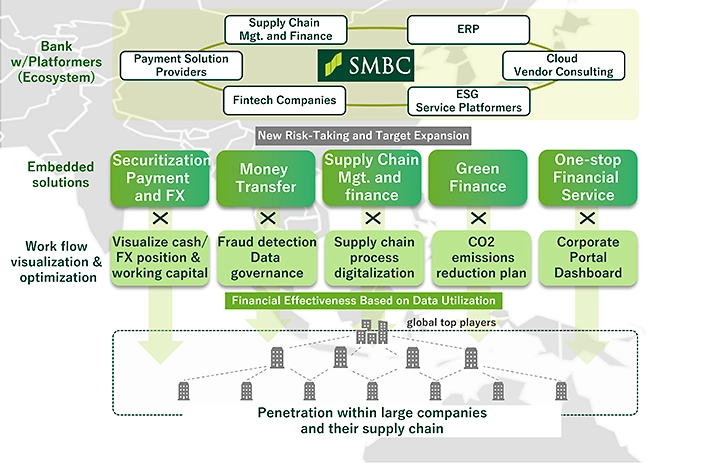

At SMBC Group, we are focusing on embedded finance under the vision of “a trusted global solution provider committed to the growth of our customers and advancement of society” put forth in our medium-term management plan, and we are presently providing and expanding services from our base in Singapore.

This time we asked Mayoran Rajendra of the SMBC Asia Innovation Center (Asia Pacific Strategy Division), which is advancing B2B embedded finance in Asian countries, about the ABCs of embedded finance and the future outlook.

Embedding bank functions inside the supply chain so financial functions can be used without being aware of them

Please give us an outline of embedded finance.

The term “embedded finance” is being used for a wide range of meanings. I am going to divide this into the definition that is generally used in society and the solutions that we are focusing on within that.

Explaining this from the perspective of consumers, when people purchase goods using electronic commerce, they do not think much about the settlement. If the bank account or credit card information is registered the first time, thereafter the charges are deducted automatically. These days, when bank accounts are linked to wallet apps, users can enjoy various shopping and services with the apps. The term “embedded finance” is being used in that sense as well.

Meanwhile, in SMBC’s digital strategy, “embedded finance” is used for the purpose of embedding financial functions to make transactions seamless for customers including corporations. This time I will explain about embedded finance for B2B as one of the solutions we provide to corporate customers.

In the case of B2B, for example, for a manufacturing company, there is a series of processes in which the company orders materials and parts from suppliers to make its products, inspects the materials that are delivered, and renders payments when the invoices arrive. We make the processes—which previously proceeded on a paper basis—digital and construct a system linking the company placing orders, the suppliers, and the bank. When the company placing the orders uses the system to request that payment be made to a supplier, the bank makes the payment upon receiving those instructions. The series of transactions is completed digitally, without the exchange of paper documents. This is the simplest form of embedded finance.

Then, what other types of embedded finance are there?

There is the supplier finance method in which the bank makes deposits to suppliers without waiting for the payment term. For example, when a transaction is made with the payment term of 90 days and a supplier requires funds sooner than that, the bank pays the supplier in advance in place of the company placing the order, and once 90 days have passed the company placing the order pays the bank. Under this framework, the series of transactions is all conducted digitally.

As an issue for suppliers, they sometimes need funds before they manufacture products and ship them after receiving orders. In this case, looking at the transaction terms, if credit can be provided to the company placing the order, there is the format of pre-shipment finance in which funds are transferred before shipment.

If the bank can digitally grasp the data about “what is delivered to whom by when,” it can judge from that whether a financial transaction is possible. When it can do that, the flow of goods, money, and information between the company placing the order and the supplier becomes completely synchronized.

SMBC has also begun providing tools in collaboration with partner companies to support the digitalization of customers’ order process and receivables and payables management. We believe that going beyond the digitalization of transactions between customers and the bank and going a step forward to provide digital solutions to advance customers’ digital transformation (DX) can become one form of embedded finance.

From another perspective, regarding sustainability, which has been attracting a lot of attention recently, SMBC has begun providing digital tools that enable the quantification and visualization of the carbon footprint (CO2 emissions volume) in the supply chain. We are thus supporting CO2 reduction in the supply chain, even with a view to providing sustainability supply chain finance as a financial incentive to promote that approach.

If the bank can digitally grasp the interactions between companies placing orders and their suppliers, that is, supply chain information, it will become possible to make more optimal proposals to customers for finance, settlement, foreign exchange, etc. By completely embedding bank functions in companies’ supply chains, we will enable customers to digitally use financial functions without being aware of them. That is the embedded finance we are aiming at.

Giving speedy support to businesses in countries with outstanding economic growth from our base in Singapore

Please tell us the reasons why SMBC is promoting embedded finance primarily in Asia.

While there are several reasons why we are targeting the Asia-Pacific region, first of all, amid the globalization of the supply chain, detailed separation by country is not very meaningful. Especially in countries with outstanding growth such as India and the ASEAN countries, there is the aspect that advancing digitalization contributes to the country’s growth even more than fostering human resources. After all, we view the needs for managing supply chains digitally as being very high in Asian countries. In fact, in the B2B field, the active use of digital tools is advancing not only at large enterprises but also at small and medium enterprises.

Another reason is that the funds procurement needs for supplier finance and other methods are greater than those for regular loans. For example, when a buyer in an emerging economy purchases products from a Japanese company, what everyone is concerned about is the credit risk of the company in the emerging economy of “whether the payment can be properly collected.” So, there are the needs for trade finance in which products are sold to local companies by having local banks in the emerging economies provide guarantees in their place.

However, for example, cases where it takes several weeks for the local bank to screen credit and send documents to SMBC in Japan and for SMBC to process those documents and remit the funds are not uncommon. Nevertheless, in many cases companies in emerging economies require funds to manufacture the products to be shipped, and speed is needed. So, the needs for digitalization are deemed to be comparatively high. SMBC positions Asia as a growth market, and accordingly we are promoting embedded finance solutions centered on Asia.

The point that funds are needed to ship products gives the impression of barely keeping a business going, but are you saying this does not necessarily have negative implications?

After all, these economies are growing in a good sense, so there are many companies that are working to expand their business more and more. Using fast fashion as an example, it is said that it takes around two weeks to design clothes, have them sewn in factories in Bangladesh or Vietnam, and have them lined up in showrooms in Tokyo, Paris, or New York. You can’t run a business if it takes two weeks from applying for trade financing until funds are remitted from the bank. Because the time for products to be brought to market is becoming shorter and shorter, the issue is how banks can respond.

Along with this, consumer tastes and preferences are also diversifying. When the products to be shipped diversify, the materials and components that companies purchase also diversify, the number of sources becomes multiple, and the production processes become more complex. In short, the supply chain becomes complicated. So, when introducing digital and working to optimize supply chains, having the act of applying to banks for financing become the sole bottleneck must be avoided. That is becoming the driving force for advancing embedded finance.

What kinds of merits are there to being based in Singapore, which is the financial center of Asia?

I was posted to Singapore about a year and a half ago, and the greatest reason for being based in Singapore is that it is close to the customers. Singapore is located in the center of India, Malaysia, Thailand, Vietnam and other countries with growing economies. SMBC is prioritizing providing solutions swiftly while listening directly to customer opinions.

For example, if customers’ supply chains and SMBC’s system are linked seamlessly, the necessary financial transactions can take place virtually in real time, and we can also provide digital tools that carry out operations efficiently. To provide the best customer experience, being located near the customers to co-create is important.

Aiming to become a “digital solutions provider that can also conduct finance”

Specifically, what types of DX have advanced in the banking industry, which tends to have an old-fashioned image, since you were posted to Singapore?

Since I was posted to Singapore in December 2020, after advancing the plan concept and launching the project, we developed a supplier finance solution linking with customers through the cloud and had customers actually use it within half a year. In the past, with the flow from applying for a system budget through to development, this probably would not have been finished in one year. Considering that, I think the fact that we were able to achieve development through to service operation within half a year was considerably fast.

With the position of leading digital solutions for the Asia-Pacific region, what types of solutions are you planning to provide in the future?

This time I have mostly spoken about solutions for large enterprises, but there are a great many small and medium enterprises in countries that will achieve economic growth from now on including India, Indonesia, Vietnam, and the Philippines. My dreams and aspirations are to provide solutions to such companies as well.

The credit screening of small and medium enterprises differs from that for large enterprises, and the needs for digital tools are also probably completely different. In addition, because the budgets for digital tools are limited, it becomes necessary to exercise more creativity and devise unique solutions. I don’t think that SMBC can do this by itself, so we will construct an ecosystem together with our partner companies. I want to create financial digital solutions for small and medium enterprises within that ecosystem.

Are completely different business models necessary for solutions geared for small and medium enterprises?

Yes, well, I think that, to begin with, the business models will change. We speak about digital transformation, and I understand it as changing business models and specifically changing customers, sales methods, and what is sold. As for what is being transformed and changed for SMBC, our customers are changing from large enterprises to small and medium enterprises in emerging economies, our sales methods are changing from face-to-face sales to gaining customers digitally, and what we sell is shifting from traditional loans to supply chain finance and non-financial software services. We also want to take on the challenge of changing credit screening utilizing the data we acquire from those non-financial services.

So, you will be providing non-financial solutions as well, as a bank.

Yes, that’s right. We have set the extremely challenging goal of “becoming a digital solutions provider that can also conduct finance.” The pillar is finance of course, but this is not an era when it is sufficient to provide finance alone. We are aiming at constructing digital tools that can solve our customers’ problems together with our partner companies, and embedding SMBC Group’s diverse financial functions and financial solutions inside them. This is easy to say, but many issues will have to be overcome. On the other hand, listening to customer opinions, I feel a strong response, and we will continue advancing initiatives toward achieving this goal.

-

SMBC Asia Innovation Center (Asia-Pacific Strategy Division)

Mayoran Rajendra

Received master’s degree from Department of Precision Mechanical Engineering, Graduate School of Engineering, the University of Tokyo. Jointly researched surgical robots that can be used in MRI with RIKEN. Joined GE Healthcare Japan after graduating in 2009. After working at MRI research and development as a new products development engineer, he was selected for a leadership program for engineers and led manufacturing, IT, marketing, and supply chain projects. Led global development of new MRI products from Japan from 2013. Transferred to GE Japan in 2015, launched GE’s industrial IoT business in Japan, and worked at many IoT projects in the electric power, aviation, and manufacturing fields as an industry pioneer. Joined SMBC in August 2020, leading digital strategy in the Asia-Pacific region from Singapore.