[Interview with Group CDIO: Part 1] “Our digital strategy is - having no digital strategy”

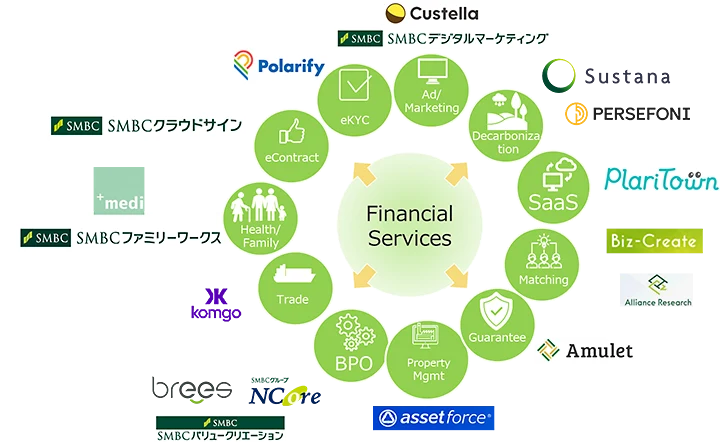

SMBC Group has led the way even among mega-banks in introducing IT and digital technologies into management. Reaching beyond financial services to develop a string of digital services responding to customer needs, the Group is evolving from a financial institution into a global solutions provider, with a dozen non-financial digital subsidiaries already in its portfolio.

What enables SMBC Group to continually generate new business? We asked Katsunori Tanizaki, Sumitomo Mitsui Banking Corporation Senior Managing Executive Officer, SMBC Group Chief Digital Innovation Officer, and winner of CDO Club Japan’s “Japan CDO of The Year 2022” award. In the first part of the interview, we looked at SMBC Group’s digitalization history, interesting digital subsidiaries, and changes being made to the Group’s environment and culture to promote the generation of innovative business.

SERIES: Interview with Group CDIO Katsunori Tanizaki

- [Interview with Group CDIO: Part 1] “Our digital strategy is - having no digital strategy”

- [Interview with Group CDIO: Part 2] “Beyond & Connect”- Supporting the rapid commercialization of new digital businesses

Multiple new digital subsidiaries emerging in the non-financial sphere

Could you give us a brief history of SMBC Group’s digital strategy?

It all started back in 2012. So as to keep pace with the changing times, we set up the IT/Internet Strategy Task Force and launched the creation of a future vision for a financial world that would likely be transformed by the latest technologies. Subsequently, startup companies began offering services that combined finance and technology, with the term “fintech” coming into the spotlight. From our long experience in finance, though, we knew that this wasn’t the first marriage of finance and technology. In fact, financial computerization dates back to 1965, the year after the Tokyo Olympics, when an online system for savings accounts was built. As a financial institution that had already been using computers for almost 60 years, we were sure that we could use technology to provide new services, and in 2015 we created the IT Innovation Department.

SMBC Group established the post of Group Chief Digital Innovation Officer (CDIO) in 2017, and our first CDIO was the current Group CEO Jun Ohta. Technological advance had gradually blurred the boundary between finance and non-finance, so we decided that SMBC Group too would sally forth into non-financial fields and launch new businesses and services.

These days, our many digital subsidiaries and digital services include Polarify, which provides eKYC (electronic Know Your Customer) and biometric authentication services, and SMBC CLOUDSIGN, which offers electronic contract services, and we have been working on a range of initiatives to grow these businesses.

No digital strategy

SMBC Group has generated a whole spectrum of digital subsidiaries and services. Did you have a clear digital strategy from the outset?

As Group CEO Ohta always says, the Group has no digital strategy. The various digital services that we can provide today are the result of us identifying actions immediately required while also looking ahead to future changes and then taking action with a view to resolving customer issues with technology. All our Group companies and all our business departments are engaged with digitalization. In other words, because all business now has a digital component, while we don’t have a digital strategy per se, there is a digital element in all our strategies. The Digital Strategy Department that we set up in 2020 is in charge of digital strategy promotion for the whole SMBC Group, looking into cutting-edge and other new business that lies outside the remit of other Group companies and business departments.

So banks have been using technology for a while now, but how is the relationship between banks and technology changing?

While financial institutions introduced computers in the 1960s, the initial focus was on how these machines could help us to reduce costs and operate with fewer personnel. That focus is now undergoing a major shift toward how technology can be used to transform the customer relationship. I think the switch to an emphasis on providing better services to customers that has occurred over the last decade or so represents a massive turnaround.

What are the strengths of SMBC Group’s strategy compared to other companies?

Around when the IT Innovation Department was created in 2015, we kept very close track of what other mega-banks were doing. We were obsessed with relative evaluation—in other words, if a rival was doing something, should SMBC Group not be doing the same? At some point, however, we started to question that approach. It’s pointless simply following suit when you’re not pleasing customers. Once you become customer-driven, you stop caring as much about what other companies are doing. When you focus on the direction society is taking, how technology is evolving, and how customer needs might change, your course becomes apparent.

We’re not competing with other mega-banks but rather with digital service providers in other lines of business. With the rapid advance of communications and e-commerce businesses into fields close to finance, we have a range of strategic options, from competition to co-creation. We’re also pursuing formats like tie-ups as the occasion demands.

Did the COVID-19 pandemic also have an influence on SMBC Group’s entry into non-financial business?

We were engaged in the non-financial sector prior to COVID-19, but a number of our services certainly saw their market share rise exponentially due to the pandemic. The electronic contract services offered by SMBC CLOUDSIGN grew out of a question over the ongoing viability of paper contracts given the sheer number of contracts that we handle. E-contracts remove the need for using a seal and boost productivity, so we set up SMBC CLOUDSIGN with the venture company Bengo4.com. We thought that e-contract services were inevitable regardless, but the pandemic did in fact have a huge effect on uptake.

Producing new CEOs by selecting junior talents to head digital subsidiaries

Please give us some more examples aside from SMBC CLOUDSIGN of interesting non-financial services and services with strong growth prospects.

PAYSLE is a smartphone-based bill payment service provided at convenience stores. Customers can pay their public utility and e-commerce bills by presenting the bill barcodes on their phones at the cash register for scanning. The recent popularity of Buy Now Pay Later (BNPL) services has seen PAYSLE usage really take off. Another interesting service is Polarify’s biometric authentication, which employs the eKYC smartphone verification mechanism. The total number of users per annum has reached around 15 million, drawn not just from finance but also, for example, telecommunications and securities.

With so many new business companies being launched, some are obviously going to fizzle, but our aim is to foster success stories that will serve as role models. SMBC Group has a “Producing new CEOs” initiative for selecting junior talents with great business ideas to head new subsidiaries. As a result, we’re gradually seeing more and more employees with this new mindset appear across the Group.

Financial institutions have traditionally been viewed as conservative, but SMBC Group is clearly proactively pursuing challenging initiatives like your “Producing new CEOs.”

You can’t just throw a massive budget and resources at an unknown domain, so we start small, injecting the bare minimum of resources. Decisions are made early, including decisions on failures! We don’t know which businesses will succeed, so we launch numerous small projects and then grow the successes. This is a very novel method for a financial institution.

The old “look before you leap” approach of spending years on preliminary investigations before securing personnel and a budget just doesn’t fly these days. The time spent on investigations is far better spent on getting the project off the ground. The important thing is to give something a go even if you don’t know whether it will succeed. We’re gradually building up the knowhow to move quickly and economically, put funds into the projects that show signs of success, and then, if they go well, set them up separately as subsidiaries and give their presidents the freedom to do as they will.

So it’s the kind of environment where employees feel comfortable putting forward their ideas?

If an employee presents us with a business idea that they want to develop, our corporate culture is unstinting in its support for realizing that idea. I would like more employees to realize that. One employee became president of a subsidiary only 13 years into their career, and a women president have also emerged. Naturally, we set a high bar in terms of results. Those presidents have to be ready to throw themselves just as fully into their business as the presidents of other startups. If more employees take up that challenge, it will have a positive impact on the original functions of the financial business. We also believe that employees should have that early experience of taking and managing risks as a company president.

Has the emergence of new challenges in the Group caused major changes in your corporate culture?

We haven’t conducted specific surveys, but there are definitely signs of change. A lot of employees are visiting the DX-link page, so management messages are getting through, I think. But looking across the whole SMBC Group, clearly we don’t have the kind of organizational scale where a culture can change overnight, and particularly given our strong management foundations, cultural transformation will take a bit more time. We need personnel from our Digital Strategy Department and our digital subsidiaries who have absorbed an innovative mindset to go out to other business departments and business companies and spread the same kind of culture there. That’s why I don’t want my team to stay in the same place for years on end. I want them to go out to other organizations and act as “parent cell” influencers. If 10 people from my team go out and influence 10 times as many people, that’s 100 people, and 10 times that is 1,000 people. That’s how I want us to spread a culture of proactive engagement with new challenges.

SERIES: Interview with Group CDIO Katsunori Tanizaki

- [Interview with Group CDIO: Part 1] “Our digital strategy is - having no digital strategy”

- [Interview with Group CDIO: Part 2] “Beyond & Connect”- Supporting the rapid commercialization of new digital businesses

-

Sumitomo Mitsui Banking Corporation Senior Managing Executive Officer and Group Chief Digital Innovation Officer

Katsunori Tanizaki

Graduated from The University of Tokyo Faculty of Law in 1982 and joined The Sumitomo Bank, Limited (now SMBC). Served as General Manager of the Global Investment Department and the IT Planning Department before becoming Group CIO in 2017 and then Group CDIO in 2018, driving digital strategy promotion for SMBC Group as a whole.

Selected in 2022 as “Japan CDO of The Year 2022” by the CDO Club, a global community of C-suite digital leaders.