[Interview with Group CDIO: Part 2] “Beyond & Connect”- Supporting the rapid commercialization of new digital businesses

SMBC Group has led the way even among mega-banks in introducing IT and digital technologies into management.

Reaching beyond financial services to develop a string of digital services responding to customer needs, the Group is evolving from a financial institution into a global solutions provider, with a dozen non-financial digital subsidiaries already in its portfolio.

What enables SMBC Group to continually generate new business? We asked Katsunori Tanizaki, Sumitomo Mitsui Banking Corporation Senior Managing Executive Officer, SMBC Group Chief Digital Innovation Officer, and winner of CDO Club Japan’s “Japan CDO of The Year 2022” award. In the second part of the interview, we turned to SMBC Group’s mechanisms for the ongoing generation of new innovation, Tanizaki’s goals as Group CDIO, and the future of the Group’s digital strategy.

SERIES: Interview with Group CDIO Katsunori Tanizaki

- [Interview with Group CDIO: Part 1] “Our digital strategy is - having no digital strategy”

- [Interview with Group CDIO: Part 2] “Beyond & Connect”- Supporting the rapid commercialization of new digital businesses

Two innovation generation mechanisms

I hear that there’s a constant rapid-fire exchange of ideas on your internal social media Midoriba, which has also been the source of various new projects. Could you please explain how Midoriba works?

Our Human Resources Department set up Midoriba to serve as a kind of internal community square. A community has developed within Midoriba for making new business proposals, and one interesting project that has emerged is a new DX service for the condominium management industry. Condominium management companies and management associations handle a huge workload, including not only the monthly exchange of documents and money but also, for example, the various procedures related to director succession. Enabling these tasks to be managed online has substantially reduced the burden on management companies, management associations, and financial institutions. The service was born out of hindrances experienced by an employee in their everyday dealings with customers. That process whereby a business grows out a problem experienced by employees and customers is really important, I feel.

Of course, while a service is easy to create, you then have to work out how to monetize it and make it sustainable as a business. Ideas in themselves are really just a dime a dozen—but can you identify what is special about one particular idea and how it might be turned into a service with a long lifespan? I just don’t believe you can gain that kind of sense simply from working at a bank.

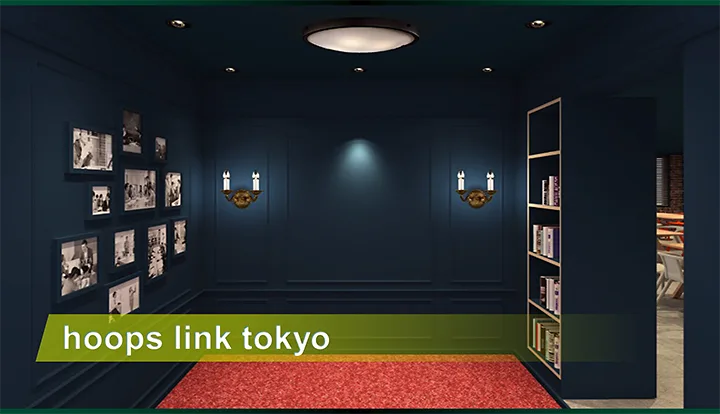

The key is to engage with people from other modes and types of business and learn how they think and operate. That’s where you get innovation. And that’s why we established SMBC Group’s “hoops link tokyo” open innovation center in Shibuya. The center attracts visitors from new business departments at major companies, as well as from venture capital, startups, universities, and elsewhere. Since the COVID-19 pandemic, there have also been more opportunities for it to function as a hub for information sharing.

What kind of projects have emerged from “hoops link tokyo”?

Our digital service subsidiary SMBC CLOUDSIGN, which offers electronic signature and contract services, originated at “hoops link tokyo.” It was sparked when someone from Bengo4.com came to visit and suggested that we tackle an interesting project together. As long as “hoops link tokyo” offers a point of intersection for people who want to take on the challenge of the new, the center will continue to produce fascinating initiatives on a regular basis.

We also hold “Executives’ Dojo” events at “hoops link tokyo,” inviting along famous executives as guests to talk about the process through to their success, difficult moments along the way, how to come up with good ideas, and how to grow a business, for example. That information is then shared across SMBC.

New businesses launched through rapid decision-making

It’s said that understanding at management level is the key to DX success. How far has management-level understanding advanced within SMBC Group in relation to digital strategy?

Our management team have a good understanding of the digital space, and ever since Group CEO Jun Ohta took up his position, he’s been calling on us all to “break the mold”—in other words, to take on new challenges without being bound by precedents, preconceptions, fixed ideas, or organizational logic. When we were just getting started with DX, we also brought in Dr. Yutaka Matsuo from The University of Tokyo, who is a fount of knowledge about AI, as well as executives with digital expertise, to provide executive training. At the same time, the younger generation have been brought up to question old, non-digital approaches, so they engage with the digital space much more naturally than we do.

How do you make decisions on investment in new business?

Since 2017, we have been holding CDIO meetings as a place to make investment decisions on new digital business. These days, they’re monthly occasions. The person who came up with the idea of the new business pitches it directly to me, Group CEO Ohta, and other members of the management team for our decision. If the idea is approved, the project gets the go-sign on the spot. With the new condominium management DX service that I mentioned earlier too, the employee who put forward the idea on the internal SNS pitched it at the CDIO meeting and we immediately decided to commercialize it. In some cases, of course, we ask the employee to rework their idea, but in that case they have the opportunity to refine it and try again.

Surely that kind of quick decision-making would traditionally have been unthinkable at a financial institution.

Well, to be honest, I think we could pick up the pace still further. The CDIO meeting process is certainly a lot faster than other internal meetings, but it needs to be even faster. I certainly don’t think we’ve reached our goal with the current situation.

No CDIO end goal

What is your goal as Group CDIO?

CDIO is the abbreviation for Chief Digital Innovation Officer, and the purpose of the CDIO is to use digital technologies to create new businesses and services. I don’t think there’s ever an end to creating something new. In interviews, I often get asked what station I think we’ve reached on the climb up the mountain, but in reality there’s no fixed goal that we’re proceeding towards. You run into various trials and tribulations along the way and the mountain just keeps getting higher; then when technological evolution changes the endpoint, the target changes as well. I can’t even say if our current direction is the right one. My position is that we need to keep driving forward in response to the changes accompanying every new era—so I don’t think my mission will ever be complete.

So the end goal keeps on changing, but am I right in thinking that your customer orientation remains your lodestar?

Well, let’s face it, you can use the most amazing technologies to create a service, but that means nothing if the customer doesn’t take up the service. For SMBC Group, DX and our digital strategy are just means to an end, with the emphasis firmly on using digital technologies to serve customers—“by digital” rather than “for digital,” as it were.

An era of redefinition for the financial industry

How do you see SMBC Group’s digital strategy evolving in the coming years?

That’s a really difficult question. Even casting ahead long-term, it’s not as though we can predict a certain future. Bill Gates once said that “Banking is necessary; banks are not.” Digital technologies are likely to drive both the integration and separation of banking functions, with the traditional role of financial groups too changing. We are entering an era of redefinition. It would be wise to abandon the fixed view that because the present is a certain way, the future will continue along the same trajectory. As deregulation proceeds and customer needs change, the financial industry too will change as fluidly as an amoeba. We will need to create mechanisms that can respond to these changes even a few steps faster.

So conventional approaches won’t make the grade in an era of uncertainty?

If you take a global perspective, there’s so much that could still be done overseas beyond Japan. Things that would be difficult to achieve in Japan can be worked up overseas and then reverse-imported. Existing mechanisms in Japan are amalgams of discrete parts, so it’s hard to topple the whole mechanism. Even if you propose a new mechanism, no one is motivated to make changes because a complete system is already in place. But even mechanisms that are rejected in Japan can find a home in places like Southeast Asia where they don’t have quite such robust systems in place. If a model that has succeeded elsewhere is reverse-imported back into Japan, it may well then succeed here too.

I tell my team to focus on “beyond” and “connect.” By “beyond” I mean thinking beyond existing walls and frameworks. “Connect” means linking various companies and services in some form. We’ve reached a point in history where clinging to old ways of thinking just won’t work.

Could you tell us about the future prospects for the SMBC Group?

SMBC Group has led the way in breaking free of the traditional image of a bank and transforming the business model. And we will continue to open up a new future that enriches society and human lives.

SERIES: Interview with Group CDIO Katsunori Tanizaki

- [Interview with Group CDIO: Part 1] “Our digital strategy is - having no digital strategy”

- [Interview with Group CDIO: Part 2] “Beyond & Connect”- Supporting the rapid commercialization of new digital businesses

-

Sumitomo Mitsui Banking Corporation Senior Managing Executive Officer and Group Chief Digital Innovation Officer

Katsunori Tanizaki

Graduated from The University of Tokyo Faculty of Law in 1982 and joined The Sumitomo Bank, Limited (now SMBC). Served as General Manager of the Global Investment Department and the IT Planning Department before becoming Group CIO in 2017 and then Group CDIO in 2018, driving digital strategy promotion for SMBC Group as a whole.

In 2022, he was selected as “Japan CDO of The Year 2022” by the CDO Club, a global community of C-suite digital leaders.