How to Collaborate Successfully with the World’s Hottest Startups: SMBC Group Receives a Plug and Play Corporate Innovation Award

With operations in Japan, the United States, and elsewhere in the world, SMBC Group has established an office in Silicon Valley, from where it is working with Plug and Play, one of the world’s largest startup accelerator and venture capital firm, to identify potential projects to undertake with the world’s hottest startups. One example of a business growing out of this initiative is the carbon visualization tool for big companies and global companies which the Group developed with US firm Persefoni.

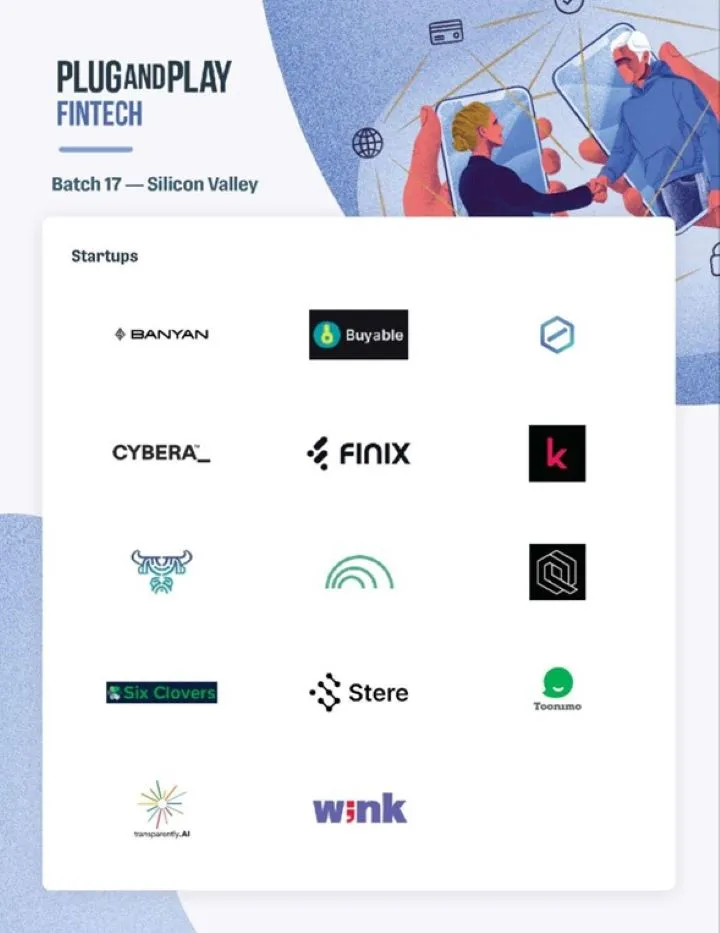

Plug and Play’s Silicon Valley Summit June 2023 (held June 6–8, 2023) presented SMBC Group with a Corporate Innovation Award in recognition of the Group’s strong track record of collaboration with startups.

How does SMBC Group approach collaboration with startups and what’s the outlook for future collaborative projects? Drawing on an interview with Hiroki Tamura, who heads SMBC Group’s Silicon Valley Digital Innovation Lab, and comments by SMBC Group and JRI America Executive Director Yoichi Taya at a panel discussion, we uncovered the secrets of collaborative success.

Partnering with startups to provide services that meet the needs of the time

What kind of event is Plug and Play’s Silicon Valley Summit?

Plug and Play holds two big events every year: the Summer Summit and the Winter Summit. A vast number of exceptional startups come along, and the presentations and lectures, etc., are a great way to learn about specific initiatives. The summits are the perfect opportunity for us to grasp trends in the various industries along with the latest topics.

What did SMBC Group do to receive a Corporate Innovation Award this year?

I think Plug and Play valued the fact that, rather than just gathering information, we identified those startups suited to SMBC Group needs and then meet with them, often going on to implement PoCs.

Startups want partners who will look into the nuts and bolts of their business and move forward with PoCs and the introduction of their products. Plug and Play sees that SMBC Group approach meets these startup needs.

Why is SMBC Group so proactive on partnership with startups?

The list of new issues facing companies just continues to grow, and some can only be resolved with new solutions. We feel that the speed and flexibility with which startups are able to move to meet corporate needs positions them best to provide these new solutions. We believe that partnering with startups will boost the speed and quality of SMBC Group projects.

Our recent partnership with Persefoni is great examples of consultation with startups enabling the Group to make rapid progress on issues of interest. In some cases, we have also used the knowledge and experience built up through the partnership to put our heads together on the creation of new services.

PoCs with startups, the key to collaborative success

Can you give us an idea of the work flow and time frame when the Group sets up services and businesses with startups?

Before the pandemic, SMBC Silicon Valley Digital Innovation Lab established an Intensive Research Program—a long-term assignment program—to realize ongoing innovation, and this has now been operating for five years.

The program has three stages. First, we ask SMBC Group business departments about their DX needs. Second, we break those needs down to a specific and granular level and communicate the necessary requirements in detail to the Plug and Play team. Third, the Plug and Play team sends us a list of candidate startups that meet our requirements which we carefully scrutinize before interviewing the most promising firms.

Under the program, we send employees from the relevant Group business departments over to Silicon Valley for three-month stints. This element of the program stalled during the pandemic, but thanks to a rock-solid research model, we were able to keep amassing information and pressing forward with innovation.

How do you decide on business use cases?

We come up with the use cases ourselves based on the requests from business departments. Determining use cases aligned with business development needs and issues increases the likelihood of implementation. That’s why we put so much emphasis on delving deeply into business department needs on a routine basis. The actual issues faced by business departments are an important resource for us in terms of generating innovation.

What metrics are most important to you when implementing PoCs?

When we implement PoCs, we always set specific KPIs* and check whether the solution meets our requirements. For one cybersecurity solution that I was in charge of, we chose functionality and response accuracy as KPIs. Other KPIs included financial checks, ease of use, level of support, and degree of penetration into the Japanese market.

Setting specific KPIs is useful not just for assessing the actual solution but also for expanding the use case. We explain the KPIs to the startup before the PoC and gain their understanding. If the startup is able to meet our KPIs, we can proceed to the next stage. If it can’t, we can also give the startup feedback.

* Key Performance Indicator: A quantifiable indicator of progress toward a set goal

As a financial group, securing compliance and security is obviously imperative. How do you deal with the barrier of the many differences in standards between startups and financial groups?

We only implement a PoC once we have communicated our compliance requirements to the startup and made sure that we’re absolutely on the same page.

Aiming to build relationships of trust with new partners

What role do you want the Silicon Valley Lab to play in pursing collaboration with startups?

The greatest merits in setting up the Silicon Valley Lab are that it makes startups and venture capital firms aware of SMBC Group’s existence and facilitates building relationships of trust with new partners. It also enables us to reach startups that we wouldn’t have been able to find ourselves.

I feel that SMBC Group as a whole has an environment that is open to the new, but the various departments don’t always make sufficient use of new options. I believe that the Silicon Valley Lab’s role is to refashion new discoveries, provide support for their introduction, and suggest ways of proposing them to customers.

What kind of startups did you meet at the June summit? And what kind of startups are you hoping to collaborate with in the future?

Well, for example, we spoke directly with someone from a biometric authentication startup that has experience partnering with financial institutions. We’ve trialed and actually used biometric authentication ourselves, but a number of issues have made it difficult to proceed. At the same time, technologies and environments change, so I’m hopeful that the problems we’ve experienced might be resolved through this new conversation.

Then, to give an example of a future partnership that we’d like to consider, there’s a firm that makes a device that produces aromas. We think there are possibilities there for using the startup’s technology in advertisements, games, Web3, VR, and the metaverse.

What does the Silicon Valley Lab view as the latest developments and technological trends?

One recent example is the hot topic of AI use in advertising, with attention focused on AI-based ad evaluation and automatic distribution, as well as image creation by generative AI. In relation to energy, standouts include carbon absorption technologies and zero carbon technologies. In the world of fintech, there are a growing number of banking business support services and services that compile data from multiple banks and display it in a coherent form.

As far as overall trends go, I have the impression that a growing number of new services are using generative AI.

Could you give some examples of projects and ideas responding to corporate needs in terms of resolving social issues and achieving the SDGs—environmental issues, labor shortages, women’s participation, and the like?

For the SDGs as a whole, I think companies need some help with the governance portion—cybersecurity, for example. Financial institutions are actively engaged in developing new cybersecurity approaches, and SMBC Group too is working with a startup that deals with cyberattacks so as to strengthen the Group’s cybersecurity. I would like to use that knowhow to develop services that strengthen customers’ corporate governance, cybersecurity included.

The labor shortage issue is something that SMBC Group itself is struggling with. We are working to introduce more automation and reviewing current operations, and I would like to pass on any successes we have to customers as SMBC Group services.

Strengthening ties between Japan and Silicon Valley

The Plug and Play Silicon Valley Summit June 2023 drew the largest number of participants since the pandemic. More than 3,000 people gathered from countries as diverse as Japan, South Korea, Germany, Sweden, and Saudi Arabia, with over 130 startups pitching their wares.

The topics that attracted the greatest interest were generative AI, semiconductors, and cybersecurity. Plug and Play founder Saeed Amidi noted that banks and the financial services industry can halve costs and time by using AI. AI utilization requires greater computing and storage capacity, as well as high-performance semiconductors and advanced cybersecurity.

Saeed suggested that now that the pandemic is winding down, ties between Silicon Valley and Japan should be strengthened. Plug and Play is actively working to increase the number of Japanese startups operating in Silicon Valley.

Saeed said that SMBC Group was given the Corporate Innovation Award for the way in which it has proactively implemented PoCs and realized partnerships with startups in various fields, as well as for speaking up in the media and at events promoting and raising awareness about innovation.

-

Executive Director & DGM, Silicon Valley Digital Innovation Lab

Hiroki Tamura

Sumitomo Mitsui Financial Group and Sumitomo Mitsui Banking Corporation Joined SMBC in 2016 after working at a foreign-affiliated financial institution and a mobile app payment company. Pursued service development incorporating the latest technologies in multiple projects. Joined the Silicon Valley Digital Innovation Lab in 2022 and became executive director in 2023.

-

Sumitomo Mitsui Financial Group and JRI America Executive Director

Yoichi Taya

Joined the Japan Research Institute, Limited in 2006. After gaining work experience as a research fellow in JRI’s research division and in project management for bank and credit card infrastructure system development, he took up his current position at the Silicon Valley Digital Innovation Lab in 2019, where he is engaged in R&D work.