Exploring the Potential of the Indian Market and the Latest Fintech Trends with Ryu Muramatsu, Leading Japanese VC (Part 2)

In the first part of this article, we asked leading Japanese venture capitalist and GMO VenturePartners Director Ryu Muramatsu about the latest trends in India and tips for Japanese companies wanting to launch operations in India and elsewhere in Asia.

In this second part, he chats with SMBC Digital Strategy Department General Manager Keiji Matsunaga, the man in charge of the Asia-focused corporate venture capital fund that SMBC set up to invest in foreign companies, about the upsurge in supply chain finance* and Drip Capital, a leading India-US trade finance provider and a recent target of SMBC Group investment.

* Finance for commercial transactions between companies. It can take forms such as factoring (where a supplier sells its accounts receivable to meet its immediate cash needs) and reverse factoring (whereby a buyer defers payment of its accounts payable).

SERIES: Exploring the Potential of the Indian Market and the Latest Fintech Trends

- Exploring the Potential of the Indian Market and the Latest Fintech Trends with Ryu Muramatsu, Leading Japanese VC (Part 1)

- Exploring the Potential of the Indian Market and the Latest Fintech Trends with Ryu Muramatsu, Leading Japanese VC (Part 2)

Swiftly growing Indian fintech startup Drip Capital

The first part of this series touched on how important it is to use Indian fintech services when doing business in India as a means of accumulating day-to-day transaction data—the flow of money and goods—which creates a credit history that can help cut down the time previously required to engage in transactions.

One startup whose rapid growth has drawn attention recently even in the glittering world of Indian fintech companies is Drip Capital, a leading fintech platform providing comprehensive trade finance and facilitation solutions for small and medium enterprises (SMEs) in the US and India. Drip has facilitated over $6 billion in trade transactions for more than 9,000 customers across 100+ countries. GMO VenturePartners has invested in Drip Capital from the early days, and GMO Payment Gateway and SMBC too has decided to do so through its corporate venture capital fund. Remind us how you came across this exciting firm.

Our first point of contact was way back around 2016 at a pitch event in America. Two Wharton School alums from India were trying to start a purchase order finance (PO finance) business* in the States. This was right when GMO VenturePartners had turned its gaze to supply chain finance in America, and I saw potential in the founders, so I decided to invest.

* A service that connects sellers, buyers, and financial institutions online and converts purchase orders into electronically recorded monetary claims, opening the way for financing right from the time when a purchase order is issued or received.

As it happens, the business flopped, and one founder went back to India while the other stayed in the States—which in fact became a major factor behind the creation of today’s Drip Capital as a company assisting India-US trade. At the time, many Indian traders were struggling with financing and were unable to find a financing service that could solve their problem. The founder who went back to India was in talks with a client when the topic of India’s massive credit gap (the gap between capital supply and demand) came up, and it occurred to him that a framework like PO finance could be applied to India-US trade. The two founders respectively secured Indian sellers and US buyers and set up Drip Capital, which now of course has grown into a major service provider.

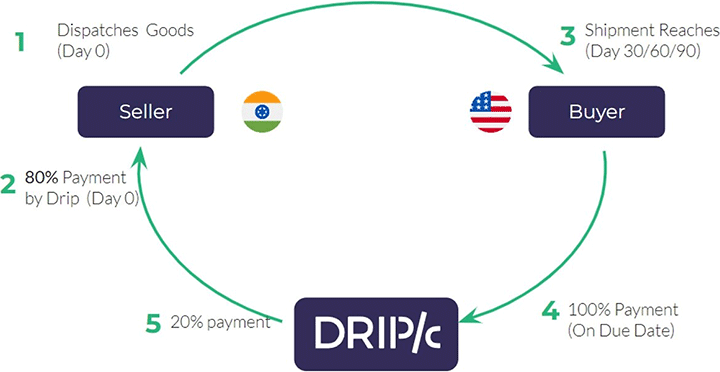

With the Drip model, the supplier fills in a two-minute application, Drip checks their eligibility, and the supplier receives finance within two days with no need for collateral or guarantees. It’s basically a receivables finance mechanism, whereby when a major firm buys products from a small or medium-sized supplier, Drip Capital purchases the receivables on a non-recourse* basis with no use of bank credit.

* A loan where the lender’s claim is limited to the cash flows from specified business and assets.

Drip spent two years developing its service, which was welcomed with open arms by the market and led the company’s growth to skyrocket. Many founders actually give up after two years—around two-thirds of founders receiving support from legendary US accelerator Y Combinator tend to bow out within that time. I really admire the way that Drip Capital hung in there, managing to receive Series A financing in its third year.

During the post-COVID “funding winter,” Drip slashed costs to put itself into the black. Even looking at other fintech firms, not many manage to produce an immediate profit through cost-cutting. One of the reasons that I invested in Drip Capital was because of those positive earnings. The firm seems to have a truly remarkable ability to adapt deftly to the times.

At GMO VenturePartners, we often say that there’s no right; we make it right. Drip is the epitome of that philosophy, charting its course with tenacity and flexibility to realize stellar success.

The three reasons why SMBC chose to invest in Drip Capital

In September 2024, SMBC too decided to use its corporate venture capital fund to invest in Drip Capital. There were three main reasons for that decision.

First, for the last three or four years, we have been developing services to support digitalization of supply chain management for corporate customers in Asia, India included, so we understood the potential customer needs and business opportunities in this area, and we had also conducted investigations of supply chain finance-related platforms and fintech firms in multiple areas.

Supply chain management is an area overflowing with information on commercial transactions, payments, and finance between multiple suppliers and distributors,* as well as on trade affairs and currency management through cross-border transactions. As such, we recognized that in terms of SMBC’s development of corporate digital solutions, supply chain management would be one of the areas where the realization of added value through digitalization would be most effective, and we’ve since been active in this area across Japan and Asia.

* Middlemen who deliver products from suppliers of product components and raw materials to the appropriate retailers and agents.

In fact, in addition to supplying dashboards that visualize the cash conversion cycle,*1 foreign exchange position by currency, and the collection status of receivables, etc., and developing accounting automation solutions and a fully-digital supply chain finance engine*2 as digital added-value services, SMBC engages in activities such as holding workshops supporting the organization of customers’ supply chain management workflows and data structures as a consulting function.

*1 A financial metric expressing how many days it takes a company to collect its accounts receivable after paying its accounts payable.

*2 This enables the process from the supplier submitting a finance application to receiving the cash to be completed digitally within 30 minutes for up to 200 applications a day.

We also recognized that in Asia in particular, the high-interest-rate environment has created a strong need for financial services that enable suppliers and other small and medium enterprises (SMEs) to procure funds at low interest rates. Moreover, with strong economic growth throughout the region driving business expansion, companies now face a chronic labor shortage, leading all companies—large and medium-ranked firms and SMEs, Japanese and non-Japanese companies alike—to focus on proactive utilization of highly convenient digital tools and platform services.

Second, we saw a lot of potential in India.

Why? Well, India has more government-backed digital public infrastructure in place than other Asian countries, and its economic and population growth rates are also particularly high even for Asia, leading to the emergence of far more players in the fintech space. We saw India as brimming with potential.

Market research through the corporate venture capital arm we launched in 2023 also confirmed for us the sheer momentum of India’s startups.

Drip Capital’s service area is currently primarily India-US trade, but we thought it also had huge potential for expansion into trade corridors* between Asian countries other than India, Japan included.

* Trade routes and economic corridors linking specific regions and countries for the purpose of facilitating the distribution of goods and services.

Third, the introduction to Drip came from you, who we all know to have an outstanding record as a venture capitalist.

Your detailed briefing on where Drip Capital’s business stands in India, the kind of value being generated by the firm’s team members and business model, and Drip’s growth prospects and reputation was definitely a factor in our decision to invest. We have to be cautious about investing in a country like India where we have limited experience with startup investment, but after conducting careful due diligence,* we decided that if Drip had the support of someone with your excellent track record in startup investment, it merited positive consideration.

* An investigation that a potential investor carries out on a target business or other investment opportunity to confirm the value and risks, etc.

In other words, it was the way that everything came together—our own history of working to support corporate customers’ supply chain digitalization; India’s strong economic growth and the momentum of its fintech startups; and the introduction from an experienced venture capitalist—that pushed us across the line on our Drip Capital investment.

Now is the moment for Japanese companies to invest in overseas startups

Given the up-and-coming status of India and its fintech market, what do you think that Japanese companies should be doing?

With Japan currently awash with cash, Japanese companies should actively invest in promising companies overseas. And when they invest, while it’s certainly important to consider whether the target service is something that can be brought to Japan—the inbound aspect—I think that companies also need to look at the outbound aspect, or what businesses to bring into their business portfolios in countries experiencing economic growth.

Now is also the perfect moment to invest in fintech companies. Fintech startups have been popping up all over the world, and they have mainly been funded by venture capitalists from various countries. Since the pandemic, however, most rapidly growing startups are being expected to shift to stable growth, so venture capitalists aren’t as interested any more. Thinking about who can fill that space, I think this is a big chance for Japanese businesses. Investing in a fintech company effectively means entering the money flow of the country from which that company operates, opening up chances for business expansion there.

My point is that these startups have already grown to a certain stage. It’s tricky deciding to invest in companies while they’re in the midst of rapid growth because their future prospects are actually a bit opaque at that stage, but once they move on to a stable growth trajectory, the investment decision becomes much easier. I think that this stable growth is likely to continue for the next two or three years, after which they could well enter another rapid growth phase, so companies that invest at this stage should do very well.

One priority issue in the SMBC Group’s Medium-Term Management Plan 2023-2025 is Japan’s regrowth. Japan’s slowing economic growth rate and aging population are causing it to start to fall behind the United States, Europe, and Asia in terms of technology as well.

As a commercial bank that is effectively part of Japan’s social infrastructure, we believe that we can identify what is happening in countries with booming economies and what players are growing their business with technology, then communicate this information to our corporate customers in Japan. Reducing information asymmetry in this regard should help Japan’s regrowth.

At the same time, I believe that we too need to change. Having observed the sheer pace of advance overseas from our Singapore operation, in my current position as the officer helming the Group’s digital strategy, I want to use our engagement with Drip Capital and other startups to review SMBC’s own culture, business model, and operations model and achieve further digital transformation. I want the SMBC Group to continuously initiate action that will support Japan’s regrowth.

SERIES: Exploring the Potential of the Indian Market and the Latest Fintech Trends

- Exploring the Potential of the Indian Market and the Latest Fintech Trends with Ryu Muramatsu, Leading Japanese VC (Part 1)

- Exploring the Potential of the Indian Market and the Latest Fintech Trends with Ryu Muramatsu, Leading Japanese VC (Part 2)

-

Founding Partner and Director

GMO VenturePartnersRyu Muramatsu

After graduating from Waseda University’s School of Political Science and Economics, Muramatsu entered JAFCO, where he handled the current GMO Internet Group and also worked at JAFCO’s Silicon Valley subsidiary. In 1999, after the GMO Internet Group went public, he founded and led the card payment processing service provider Payment One as its representative director. After Payment One’s merger with Card Commerce Services, the company was renamed GMO Payment Gateway. GMO Payment Gateway was listed on the Mothers market in 2005 and subsequently on the First Section of the Tokyo Stock Exchange. He currently serves as the company’s director and executive vice president. In 2005, Muramatsu founded GMO VenturePartners and became general partner. He has been based in Singapore since 2012.

-

General Manager

Digital Strategy Department, Sumitomo Mitsui Banking CorporationKeiji Matsunaga

Joined SMBC in 1998. After working in wholesale banking business planning, management planning, and other departments in Japan and overseas, he became head of SMBC’s Asia Innovation Centre in Singapore in 2021, working to use digital technology to create business for clients in the APAC region and upgrade internal infrastructure. In 2024, he took up his current position as general manager of the Digital Strategy Department, where he is in charge of digital strategic planning and management for the SMBC Group and operation of its corporate venture capital fund. A graduate from the University of Tokyo, he also earned an MBA from Carnegie Mellon University.