Exploring the Potential of the Indian Market and the Latest Fintech Trends with Ryu Muramatsu, Leading Japanese VC (Part 1)

Economic powerhouse India is growing so strongly that the International Monetary Fund’s April estimate suggests that it will become the fourth largest country in terms of nominal GDP, surpassing Japan. One of the key growth drivers is the emergence of Indian fintech companies.

In this interview, we delve into the world of Indian fintech with leading Japanese venture capitalist and GMO VenturePartners Director Ryu Muramatsu, who has focused on fintech- related investments in Japan, the United States, India, and Southeast Asia for over a decade now. Asking the questions is Mayoran Rajendra, who handles the SMBC Group’s development and rollout of digital solutions in the Asia-Pacific as Managing Director, Head of the Asia Innovation Centre (AIC) at SMBC’s Strategic Planning Department, Asia Pacific Division.

SERIES: Exploring the Potential of the Indian Market and the Latest Fintech Trends

- Exploring the Potential of the Indian Market and the Latest Fintech Trends with Ryu Muramatsu, Leading Japanese VC (Part 1)

- Exploring the Potential of the Indian Market and the Latest Fintech Trends with Ryu Muramatsu, Leading Japanese VC (Part 2)

Fintech trends seen from the investment frontlines

The Indian government has been actively promoting digital transformation (DX) for the last few years, setting in place a wealth of digital public infrastructure for use by individuals and the private sector. Examples include Aadhaar, a national ID system similar to Japan’s My Number scheme; DigiLocker, a cloud storage platform linked to Aadhaar where individuals can manage their documents; and an e-invoice authentication system that streamlines corporate tax returns.

Startups are flocking to utilize this new environment to launch new businesses. Having watched Asian economic trends for more than a decade now from your base in Singapore, what do you make of the changing fintech situation in India?

The pioneers of what would become fintech emerged in the late 1990s, before we even had the term fintech. Working as a venture capitalist in Silicon Valley, I watched the evolution of the internet open the way for online payment, online brokerage, and other new technology-based financial services.

When I moved to Singapore in around 2012, fintech was finally beginning to enter the international lexicon. Business-to-consumer (B2C) digital payment services were the mainstream, and GMO VenturePartners began working with GMO Payment Gateway on intensive investment in and tie-ups with fintech businesses providing payment processing services* in Asia (below, investment by the two companies is not differentiated).

* Payment processing services: Services such as the integration of sales and payment management and bundled introduction of a spectrum of payment services such as credit card payments and bank deposits, with payment processors interfacing between businesses and payment service providers.

Initially, we invested in Southeast Asian companies, but from around 2015, we also turned our eyes to India. The geographic proximity of Singapore to India made it easy to track developments there, and we could see that India was climbing on to a growth trajectory. Our initial foray into Indian investment focused on B2C payments. We selected Razorpay, which provides online payment processing services to participating small businesses and merchants, and Mobikwik, a mobile wallet business that provides consumers with services like smartphone payment, buy now pay later, and bill payment. Today Razorpay is one of India’s biggest unicorns.

Filling a massive credit gap with Indian B2B fintech

Back when we started investing in India, business-to-business (B2B) fintech companies were just beginning to gather momentum internationally. Previously, everyone knew that there was a huge B2B market out there, but it was tough to break into. Around 2015–2016, digitalization finally took off in the United States, starting with supply chain finance,* and fintech companies beginning to appear. We invested in two firms: Fundbox, which links into the accounting systems of small and medium enterprises (SMEs) to enable them to monetize their accounts receivable (as short-term loans), and Taulia, which provides a platform for early payment of accounts receivable and procurement of funds from multiple funders.

* Supply chain finance: Finance for commercial transactions between companies. It can take forms such as factoring (where a supplier sells its accounts receivable to meet its immediate cash needs) and reverse factoring (whereby a buyer defers payment of accounts payable).

New types of business often appear in the United States and gradually expand overseas over time. In this case, however, B2B fintech companies emerged in India at almost exactly the same time as in the United States and have achieved rapid growth.

Why did B2B fintech companies emerge in India with such a short time-lag, do you think?

I put it down to the credit gap—the huge gap between supply and massive capital demand.

The figure often bandied around in India is 60 trillion yen. Numerous reports have put combined consumer and corporate capital demand at 90 trillion yen, of which 60 trillion yen has yet to be supplied. Consumers are primarily looking to borrow for consumption purposes, but in the case of companies, the situation is even more serious. SMEs unable to grow their sales because of a capital shortfall number in the millions to tens of millions, leaving a market of unimaginable scale.

I often say at the office that India is currently experiencing the same kind of rapid economic growth that Japan enjoyed during its strong growth period. In fact, thanks to a population 10 times larger than Japan’s and the development of digital public infrastructure that has equipped India with devices, tools, and an Internet environment that did not exist in Japan back then, India’s actual economic growth surpasses Japan’s best years.

During Japan’s strong growth period, the country didn’t have enough money and had to borrow from the World Bank to build its bullet trains. India too has to cover its 60-trillion-yen shortfall from somewhere, and this has drawn attention to fintech companies that use digital technologies to provide highly convenient supply chain finance and payment services for B2B transactions as the means to do so.

The key to Indian market success for Japanese companies

Many Japanese companies accept that markets in India are growing and yet they hesitate to establish a presence there. While there are various reasons for this, from the many years that I’ve spent watching business in India, I believe that the decision to set up operations in India could be made much easier if Japanese firms knew about India’s advanced digital public infrastructure and fintech companies. What do you regard as key points in terms of Japanese companies succeeding in entering Indian markets?

I agree that making use of fintech companies is a critical point.

I just mentioned India’s explosive economic growth. Basically, there isn’t an Indian industry that isn’t seeing sales growth at the moment. Capital is in demand for the positive purpose of expanding sales. As long as there is sufficient supply, India’s economy should flourish. However, Japanese companies need to be cautious about credit.

In India, many companies operate based on mutual trust built up over time. For Japanese companies lacking local networks, setting up a business from scratch or trying to sell products and services in India from overseas can be a real struggle. That’s where utilizing digital public infrastructure and fintech companies becomes key.

Usually, companies earn trust face to face over time until they can finally engage in credit transactions. The whole process can be greatly expedited, however, by using the solutions offered by fintech companies to visualize the flow of money and goods, trading partner credibility, and other information. Local growth companies and overseas firms looking to expand their business in India are really making the most of these solutions. Despite the strong international reputation of fintech companies like Pine Labs, which supplies participating merchants with leading-edge retail transaction technologies, POS terminals, and financing services, and OfBusiness, which supplies raw materials and financing to manufacturing SMEs, they’re hardly known in Japan. Once information starts to reach Japan, it should reduce the obstacles to doing business in India and companies should be able to use fintech to cut what previously took 10 years back to two.

It’s also important to partner with emerging local players. Failures are often reported, but that doesn’t mean that you should give up. It’s near impossible to put together a business model alone in an environment where the cost structure and business practices are entirely different, and trying to develop business in the same way as you would in Japan will almost inevitably fail.

Speaking to fintech as my field of expertise, I think the best approach is to partner with companies that specialize in certain areas or layers. Rather than looking for a partner in the same industry, invite leading companies in forms of finance with a strong affinity with your company’s business model—companies specializing in supply chain finance, trade finance, or personal loans, for example—and you will greatly increase your probability of success in boosting sales.

Build a credit history by leveraging fintech to create data transparency

How do you see India’s fintech developing in the coming years? What impact do you think the spread of the fintech wave and fintech standards in India will have on Southeast Asia and Japan?

For payment processing services, for example, the one-percent service commission that can be charged in Japan tops out at 0.3 percent in Southeast Asia and 0.1 percent in India. Price competition is in fact so fierce that providers are conversely amazed that it’s possible to charge one percent in Japan. Indian fintech companies are also beginning to buy up Southeast Asian firms, including many of the firms that we invest in. This is a complete turnaround from the situation 10 years ago when we first set up shop in Singapore.

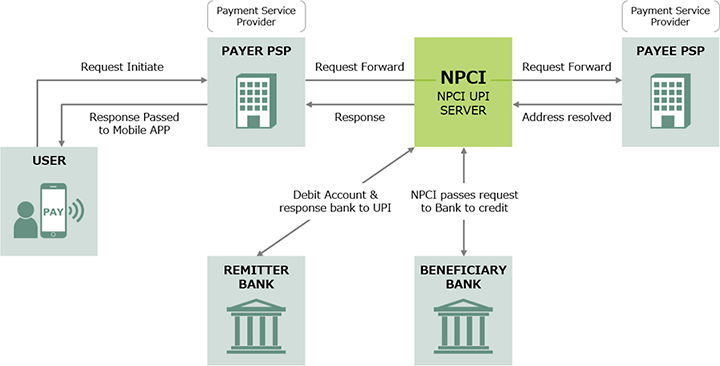

One easily understood example of DX is the Unified Payments Interface (UPI), an electronic payment and transfer platform introduced by the National Payments Corporation of India (NPCI) in 2016. UPI enables immediate money transfers as well as payments at participating merchants around the clock 365 days a year from a mobile device. Many Southeast Asian countries use it, so you’ll even see a UPI money transfer button right on the home page of a Singaporean bank’s app. The wave of India-developed standards is sweeping in.

Payment services seem to be extremely important not just as a means of making and receiving payments, but also for collecting the original data that informs credit decisions. That data becomes proof of a transaction while simultaneously helping to build trust. In other words, financing methods such as revenue-based lending based on sales information could become one means of resolving the massive credit gap.

With payment data creating invisible power everywhere, when we think about business supply chains, we should also think about how to leverage payment data for finance.

Absolutely. Visualizing as much data as possible—payment data included—is critical in terms of credit. Providing no data and claiming that you keep all your books on paper won’t create a digital data history. Data that is not digitally recognized might as well not exist. Data accumulated from years past becomes a credit history and provides the basis for credit, but if there is no such accumulation, you have to begin by building up that data from scratch.

Continued in Part 2

Next time, we discuss Indian fintech companies that have caught the eye of the SMBC Group.

SERIES: Exploring the Potential of the Indian Market and the Latest Fintech Trends

- Exploring the Potential of the Indian Market and the Latest Fintech Trends with Ryu Muramatsu, Leading Japanese VC (Part 1)

- Exploring the Potential of the Indian Market and the Latest Fintech Trends with Ryu Muramatsu, Leading Japanese VC (Part 2)

-

Founding Partner and Director

GMO VenturePartnersRyu Muramatsu

After graduating from Waseda University’s School of Political Science and Economics, Muramatsu entered JAFCO, where he handled the current GMO Internet Group and also worked at JAFCO’s Silicon Valley subsidiary. In 1999, after the GMO Internet Group went public, he founded and led the card payment processing service provider Payment One as its representative director. After Payment One’s merger with Card Commerce Services, the company was renamed GMO Payment Gateway. GMO Payment Gateway was listed on the Mothers market in 2005 and subsequently on the First Section of the Tokyo Stock Exchange. He currently serves as the company’s director and executive vice president. In 2005, Muramatsu founded GMO VenturePartners and became general partner. He has been based in Singapore since 2012.

-

Asia Innovation Centre

Strategic Planning Department, Asia Pacific Division

Sumitomo Mitsui Banking CorporationMayoran Rajendra

Received a master’s degree from the Department of Precision Mechanical Engineering within the University of Tokyo’s Graduate School of Engineering, where he engaged in joint research with RIKEN on surgical robots that can be used inside MRI scanners. Graduated in 2009 and joined GE Healthcare Japan. After working on MRI R&D as a product development engineer, he was selected for a leadership program for engineers and led manufacturing, IT, marketing, and supply chain related projects. He also led global development of new MRI products from Japan from 2013. Transferred to GE Japan in 2015, launched GE’s industrial IoT business in Japan, and worked on numerous IoT projects in the fields of power, aviation, and manufacturing as an industry pioneer. Since joining SMBC in August 2020, he has been leading digital strategy in the Asia-Pacific region from Singapore. He promotes investment in and collaboration with promising Asian startups through the SMBC Asia Rising Fund, a corporate venture capital fund established jointly with the Incubate Fund in 2023.