GFTN Group CEO Sopnendu Mohanty x SMBC Group’s Akio Isowa: How AI is Transforming the Future of Finance (GFTN Forum Japan 2025 Report)

Even amidst the numerous finance-related events held in March 2025 as part of the Financial Services Agency’s Japan Fintech Week, the highly international GFTN Forum Japan (GFJ) 2025 managed to be a real standout.

The forum was organized by the Global Finance & Technology Network (GFTN), which organizes and operates the Singapore Fintech Festival—the world’s largest fintech event, initially launched ten years ago in 2016, by the Monetary Authority of Singapore (MAS). We chatted with GFTN Group CEO and former MAS Chief Fintech Officer Sopnendu Mohanty and Sumitomo Mitsui Financial Group (referred to collectively below as SMBC Group) Chief Digital Innovation Officer and Senior Managing Executive Officer Akio Isowa about one key focus at GFJ 2025: how AI is transforming the future of finance.

Japan’s biggest global fintech event

GFJ 2025 took place on March 3-6 during Japan Fintech Week. Could you give us a quick rundown of the event?

GFJ 2025 was the biggest event in the Financial Services Agency’s Japan Fintech Week, with many international participants and exhibitors among our 132 partners and 5,600-plus participants. Taking the theme of “Building Financial Corridors,” this year’s GFJ provided a platform linking financial centers in Japan to other regions across the globe.

One GFJ focus this year was AI-driven financial transformation, so we asked Mr. Isowa to take the stage as SMBC Group CDIO to tell us about the impact of generative AI (genAI) on the finance space, SMBC Group’s own genAI initiatives, and how genAI is transforming the future of finance.

How genAI is transforming the future of finance

So, Mr. Isowa, could you please recap what you said at GFJ about SMBC Group’s genAI initiatives?

Actually, I might start with our AI efforts over the last decade or so.

Looking back 11 years from now, in 2014 we introduced Watson, an IBM computer system that applies machine learning to open domain question answering, and started using it to enhance the quality and efficiency of customer service responses at our call centers. Not only did we hugely increase the quality of our customer service responses, but our operator retention rates and job satisfaction figures improved dramatically even as we cut costs.

Three years later, we expanded RPA use across SMBC as a whole to begin optimizing our business processes.

In 2023, SMBC led the Japanese banking world in providing all our staff with access to our genAI-powered assistant SMBC-GAI so that they could try it for themselves. In other words, rather than restricting initial use to a few select personnel at head office, we saw great value in having all SMBC staff engage with cutting-edge technology.

Because we created that environment, our employees now use genAI on a daily basis, which is really helping with business process optimization and problem-solving. The greatest lesson was that staff began to understand from their own experience where genAI is useful and when they should use it.

I think it’s absolutely critical that companies—and especially big companies like ours—invest in this kind of company-wide technological understanding and adaptation.

What insights have initiatives like these given you into the potential and future of AI?

I’ve been talking about the greater efficiencies achieved through AI use, but I think there’s a lot more potential there for adding value. Rather than just enhancing the efficiency of individual business processes, I think AI could well help us resolve deep-seated organizational issues.

There are unfortunately cases where our vertical organizational structure and siloed work practices prevent us from maximizing our added value for customers. For example, we currently propose solutions to customers on a department-specific basis. I believe that we could use AI to realize end-to-end solutions that maximize our added value for customers while still remaining in compliance with the various types of rules.

I also think that our vertical organizational structure itself could be changed. Our current structure is necessarily optimized within human cognitive limits. However, genAI-driven organization-building could take us beyond those limits to create an organization where we can truly maximize added value, opening the way for huge productivity advances.

My personal view is that in the future when quite a few cases like this have emerged and we have deep AI penetration, we will all have our own personalized AI agents and AI avatars that will do our work for us.

Mr. Mohanty, how does GFTN as GFJ organizer view the impact and potential of genAI and other new technologies in the world of finance?

AI is addressed as a key theme in the international fora that GFTN organizes. AI has immeasurable potential to transform the global finance sector, and most financial institutions are already using conversational AI (chatbots) and genAI to streamline operations and increase productivity. The next major innovation is expected to be agentic AI. Agentic AI will have the capability to make decisions based on predefined rules and experiential learning without needing continuous improvement by and input from users, bringing within reach AI-driven added value maximization beyond human cognitive limits.

In Japan—as is indeed the global trend—new AI ecosystems are emerging on the back of major investment not just by fintech firms but in a whole range of industries. All kinds of companies are actively incorporating AI into their existing business lines so as to automate their business processes, streamline workflows, and realize overall productivity gains.

Investment and the desire for efficiency and innovation might have prompted worldwide AI deployment, but it’s vital that this is properly balanced with the regulations needed to protect users and maintain market stability. Governments will need to proceed carefully in this area, and discussion of innovation and regulation will be critical. Innovation should be encouraged through appropriate regulation. From my own experience working at a regulatory authority, I am painfully aware of both the importance and the difficulty of finding a balanced regulatory approach that encourages innovation while at the same time protecting users—or, in other words, protecting the human element that technology cannot replace.

Risks and returns: The role of financial institutions

So you’re saying that because the impact of genAI is so great, it has to be pursued with full heed to governance. To help us understand the governmental/administrative perspective, could you tell us what MAS sees as the risks of genAI utilization and how it proposes dealing with these?

Governance is absolutely critical with genAI as with other technologies. The complexity of genAI could lead to opaque decision-making particularly in regard to credit rating. It could also create vulnerabilities like AI disinformation and synthetic identity fraud, as well as threatening data transparency, market robustness, and cybersecurity.

We at GFTN support the cooperative regulatory framework and FEAT (Fairness, Ethics, Accountability, and Transparency) principles adopted by MAS. We see these principles as consistent with our own strong commitment to AI governance.

Regulatory approaches differ by country—the risk-based approach in the EU’s AI Act and US sector-specific guidance, for example—but I believe that the governance priority should be on context-sensitive policies that balance innovation with appropriate safety measures.

GFTN is using engagement with our international networks to promote the importance of ongoing dialogue and standards harmonized between industry and regulatory authorities. I am convinced that through cooperation, we can achieve responsible use of genAI and bring about major advances in the fintech ecosystem.

For us too, analyzing and hedging against risk is a vital part of pursuing our various AI-based projects. We want to expand our role as a financial institution to also become a global solution provider in the AI space, while maintaining a focus on responsible AI.

Mention genAI utilization, and someone will raise the hallucination risk. But I’m actually not that worried about AI calculation accuracy, because AI utilization risk can be controlled through the right design.

Precise and nuanced answers are critical to the customer experience. We need to take great care in the design process so that AI answers will reflect our organizational values and culture.

SMBC Group is engaged in joint experiments with our customers to improve our model. We’re still in the process of perfecting it, using trial and error to ensure that we can properly control risk.

I have to say that I view the need to discuss risk from such an early stage as the flip side of huge public expectations for and interest in genAI.

The genAI-powered future: Unlocking borders

Thank you. As you say, there seems to be absolutely no doubt from both a public and global perspective that genAI is an extremely powerful tool. Mr. Isowa, you said in your keynote speech that genAI utilization has the potential to unlock borders and pave the way for cross-border cooperation and collaboration. Please share your thoughts on how that cooperation and collaboration might play out between SMBC Group and Japan’s private sector on the one hand and overseas companies, and particularly startups, on the other.

Collaboration with overseas startups is very much SMBC Group’s current focus.

In 2023, we set up the corporate venture capital firm SMBC Asia Rising Fund (ARF) in Singapore for the purpose of collaboration between promising overseas startups and SMBC Group companies in Asia and elsewhere.

CEOs from up-and-coming ARF-backed startups were up on stage at The Founders Peak at this year’s GFJ thanks to the ARF’s outreach. The ARF’s CVC investment also helps startups with their PR and enhances their value. And of course collaboration between SMBC offshore operations and these startups is also expected to add more value for both parties. The aim of this exercise for us is overseas expansion and further business growth.

As I said in my GFJ keynote, genAI when used well can be an extremely powerful tool. At the same time, genAI alone will not unlock the necessary potential to grow our business and achieve major offshore expansion. The key to that potential will be local partners. We want to work with startups in Singapore and elsewhere in Asia to drive growth in Japan and Asia.

The governments of Japan and Singapore are currently collaborating in areas from finance and digital technologies to innovation, research, and sustainability. Through their strategic partnership, our countries are utilizing their respective strengths to promote technological advance, support startups, enhance digital connectivity, and address global sustainability and climate change challenges. This partnership continues to evolve, and I believe that both countries have cemented their position as leaders in regional innovation and digital economy.

Japan’s Financial Services Agency and the Monetary Authority of Singapore established a formal fintech cooperation framework in 2017. Through this initiative, they have been able to introduce fintech firms to each other’s markets, promote regulatory guidance, and exchange information on financial innovation, minimizing barriers and encouraging cross-border fintech growth. The framework embodies both countries’ commitment to fostering innovation while maintaining strong financial and economic ties.

The next step was taken in July 2021 when Singapore and Japan signed a Memorandum of Cooperation (MOC) on Digital Economy, AI, Cybersecurity, and ICT. This agreement formalized both countries’ joint efforts to share best practices, harmonize rules, and support digital trade and interoperability initiatives. The MOC aims to strengthen digitalization and AI partnership and promote bilateral digital connectivity and trade growth.

The Japan-Singapore Economic Dialogue that took place in April 2024 focused on startup ecosystems, open innovation, digital economy, supply chain resilience, and decarbonization. It established the Japan-Singapore Co-Creation Platform, which links companies, universities, and research institutions to promote joint technology research and commercialization. NUS Enterprise’s BLOCK71 Network is currently operating in Tokyo and Nagoya, propelling cross-border deep tech innovation and startup connection. Partnerships with Japanese universities and companies provide capital, mentorship, and market access to startups from both countries.

This deepening cooperative relationship is strengthening economic ties and serving as a benchmark for regional cooperation, opening the way for Japan and Singapore to shape the future together in terms of innovation, digitalization, and sustainable growth in Asia.

Alongside the significance of intergovernmental partnership, we believe that private sector-level collaboration too is extremely important, which is why GFTN encourages public-private dialogue through fora like the GFJ. When a major financial institution with global reach like SMBC Group joins that dialogue, it has a huge impact. I look forward to continuing to work together to develop growth promotion mechanisms in Japan and Asia.

You’ve really painted a bright future with growing opportunities for collaboration—and a greater degree of collaboration—among companies at all layers and stages. The GFJ is already marked on next year’s calendar, and I can’t wait to see how that future will have unfolded by then. Thank you both for your time today.

It would certainly be great to create global business together. Let’s do this!

-

Group Chief Executive Officer, Global Finance & Technology Network (GFTN)

Sopnendu Mohanty

Sopnendu Mohanty is the Co-Founder and Group CEO of the Global Finance & Technology Network GFTN. He served at the Monetary Authority of Singapore (MAS) as its first Chief Fintech Officer for nearly a decade, establishing Singapore on the global map as a leading center for innovation in the financial sector and a dynamic hub for fintech development. He continues to advise MAS on technology and innovation.

-

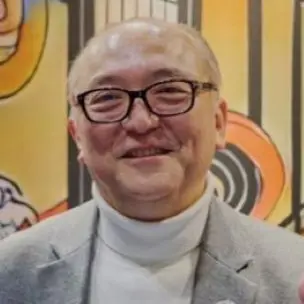

Group CDIO and Senior Managing Corporate Executive Officer, Sumitomo Mitsui Financial Group

Akio Isowa

Joined Sumitomo Mitsui Banking Corporation in 1990 and worked in corporate affairs, legal affairs, management planning, and human resources before setting up the Retail Marketing Department and the Retail IT Strategy Department as general manager. Later, as general manager of the Transaction Business Division, he spearheaded product and sales planning for corporate settlements. In 2022, he became director of the Digital Solution Division. He took up his current post in 2023, in which capacity he is driving digital strategy promotion for SMBC Group.