Ciconia Bioventures—Revolutionizing Japan’s Drug Discovery Ecosystem in the Quest for Global Leadership

Did you know that Japan was once a global leader in drug discovery? According to an Office of Pharmaceutical Industry Research report entitled “Nationality of Companies Developing Global Top-Selling Pharmaceuticals: 2022 Developments,” back in 2008, Japan was second only to the United States in terms of the number of drugs developed. But by 2022, Japan had dropped to sixth place, falling behind in vaccine and treatment development during the COVID pandemic.

The fall is attributable to the recent dramatic shift in the drug discovery landscape. Where drug discovery by startup firms is becoming increasingly common overseas, in Japan, academia has the technology to identify drug candidates, but all too often fails to take them through to commercialization.

This is where Ciconia Bioventures Inc. comes in. A new company born out of joint investment by pharma majors Takeda Pharmaceutical Company Limited ("Takeda”), Astellas Pharma Inc. (“Astellas”), and SMBC, with ambitions to overhaul Japan’s drug discovery ecosystem—the interconnected network of parties involved in the research, funding, and commercialization to support new drug development—and strengthen Japan’s competitive position again. Ciconia is betting on the power of AI and digital technology to reignite innovation. We sat down with Ciconia CEO Toshio Fujimoto to discuss the company’s mission and explore the motivations of the participating pharma and financial giants.

- The drug candidate gap in Japan’s discovery ecosystem

- Comprehensive startup support includes evaluation and incubation

- Joint investment from three companies with a shared determination to completely revolutionize the industry

- Assessing drug candidates toward the first spinout within two years

- To deliver new ‘made-in-Japan’ treatments as the ace in the hole for ecosystem innovation

The drug candidate gap in Japan’s discovery ecosystem

What’s the story behind Ciconia’s founding?

The key issue for Japan’s discovery ecosystem is the drug candidate gap-the difficulty of transforming early-stage academic research into viable drug candidates.

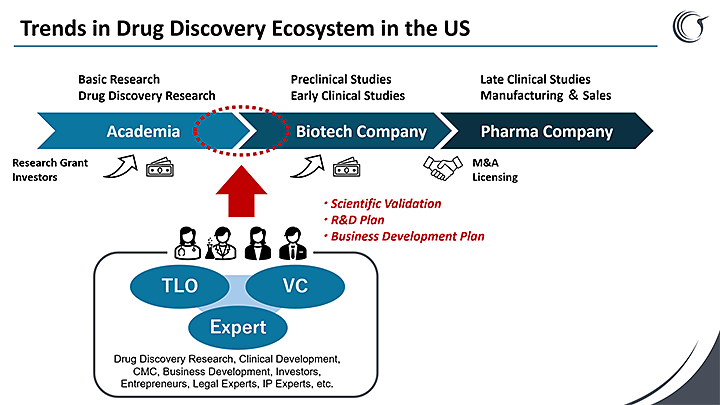

Traditionally, the industry has been driven by cash-rich pharma giants that handle the entire process from basic research to trials and sales. Today, the model is shifting to a division of labor whereby cutting-edge research born in academia is nurtured by startups, moves into the hands of larger firms through tie-ups or acquisition, and ultimately reaches patients in the form of a drug.

In the United States, it’s common for big pharmaceutical companies to partner with academic institutions that have brought drug candidates through to the development stage, or to buy up drug discovery startups when they reach that stage. In Japan, however, this rarely happens.

Why does Japan produce so few discovery startups? In short: our ecosystem.

The academic institutions and startups handling early-stage discovery lack funding and business knowhow, with many drug candidates never making it as far as commercialization. One major issue is the structural gap between researchers, who often lack a commercial perspective, and investors, who consequently find it hard to commit.

There’s also a vast difference in venture capital culture: while US VCs invest heavily in drug discovery from very early on, Japan’s startup funding is barely 10 percent of the US level. Given that difference in funding scale, it’s no wonder that such a massive R&D gap has also opened up.

That’s the very gap Ciconia was founded to bridge. Our goal is to provide comprehensive support for Japanese academia and discovery startups from an early stage, helping them to develop strategies and plans through to where they can secure funding and knowhow from VCs and pharma. We aim to nurture discovery startups to serve as a bridge across to the bigger pharma players, plugging the gap between research and the market.

Comprehensive startup support includes evaluation and incubation

What kind of support does Ciconia provide?

First, we assess the commercial viability of the drug candidates held by academic institutions and startups from a corporate perspective, using our own screening criteria. Then we help with the validation and R&D plans needed to meet VC and pharma investment standards.

Once experimental data are complete and research progresses to a level where funding becomes viable, we also provide business support, like company formation and Series A financing. After investment is secured, our involvement gradually tapers off, with the aim of transitioning each new venture into an independent operation.

Joint investment from three companies with a shared determination to completely revolutionize the industry

How did the joint investment by Takeda, Astellas, and SMBC come about?

We started looking at an incubation model around 2021. Initially, we planned to do it ourselves, but that would’ve pushed Takeda itself too much to the forefront. To truly catalyze change across Japan’s drug discovery ecosystem, we believed it was essential to collaborate with like-minded partners for a relatively neutral platform that encourages broad participation.

Another factor was that Takeda has never tried this kind of model for supporting early-stage drug discovery programs toward startup creation in Japan, so that presents a certain level of risk. And we also felt that rather than the project being constrained by one company’s focus area, it should be tackled from a broad-ranging perspective. So we decided to look for like-minded partners to share the risk and pursue broad collaboration in this development project.

We spoke to dozens of companies in search of partners who would share our vision, and Astellas and SMBC were quick to put up their hands.

Astellas has focused on open innovation since its founding, and we saw improvement of the drug discovery ecosystem as a priority issue for the pharmaceutical industry. We were particularly keen to support early-stage academic research, but we knew we couldn’t do it alone. When the Ciconia proposal came up, we knew immediately that we had to do it.

And when we found that not just Takeda but also SMBC-a player from an entirely different industry-was coming on board, it seemed that all the pieces were in place to tackle societal challenges from multiple angles. With that team, we thought, we might actually be able to change an industry that has been so resistant to change for so long.

SMBC started considering involvement right from the concept stage back in 2021, and we’ve had many discussions with Dr. Fujimoto. I’ve worked with clients in healthcare and pharmaceuticals industry for years myself, and I’ve seen firsthand how M&As and licensing deals between well-funded companies and academic and startups with promising drug candidates just fail to materialize.

It seemed to me that the Ciconia’s framework offered a promising solution, Through ongoing discussions, this initial impression turned into a strong conviction.

Given the groundbreaking nature of the project, it took a while to get the go-ahead within SMBC, but after full consideration of the banking business as well, we made the leap. The SMBC Group's dedication to addressing societal challenges played a crucial role in our decision to participate.

Assessing drug candidates toward the first spinout within two years

You only launched in August 2024, so it’s early days. Where are you up to as at May 2025?

We finished hiring our scientists in March 2025. Right now, we’re listing and evaluating potential drug candidates. Then we’ll begin providing concrete support, aiming to launch one or two research projects this year. The plan is to establish our first spinout within two years, setting in place a system that will enable us to form two or three spinouts a year after that.

It usually takes around ten years from basic research through to the trial stage. How will you realize a drug discovery cycle at such a fast pace?

The three investors along with leading companies in the various industries will share knowhow, taking a speed-first approach to development. Looking through to commercialization from the outset should enable us to launch spinouts apace.

We will also actively integrate AI and other cutting-edge technologies to boost efficiency. AI utilization is really picking up in early-stage drug discovery, with a growing number of companies bringing in AI for screening and candidate compound design. Ciconia will not just use AI in early-stage research but also employ it proactively across later phases based on rigorous validation of its effectiveness.

AI can also be leveraged in business development activities and prognostic valuation of an asset. Our digital experts are ready to provide mentoring to Ciconia in effectively integrating AI from an early stage.

Takeda is making extensive use of AI, including operating an AI-based system for consolidating and integrating information dispersed around the company. By combining that system with generative AI, we should also be able to do bulk data searches and extractions from the massive amount of experiment data accumulated within Takeda on early-stage drug candidates and projects that we discontinued or suspended, packaging up and handing over the data needed to nurture such projects at Ciconia.

To deliver new ‘made-in-Japan’ treatments as the ace in the hole for ecosystem innovation

Finally, what’s next for Ciconia and your respective companies?

A US firm called Flagship Pioneering explores research seeds and takes it through early-stage research, incubation, and all the way to commercialization. Based on basic research conducted by their large team of scientists, for as long as 20 years in some cases, on potentially world-changing technologies like mRNA, they have produced companies like Moderna, which succeeded in developing one of the first COVID-19 vaccines.

That’s our inspiration-we too want to nurture the actual research and create companies along the way. We want to identify potential breakthrough research early on and bring it to market, transforming Japan’s drug discovery.

If this project produces more drug discovery startups, It means more potential partnering opportunituties with Takeda in the future. We’re hoping that the project will both solve the long-term issues in Japan’s discovery ecosystem and strengthen Takeda’s presence.

To achieve that, we’ll work closely with our global R&D organization to provide rear support for Ciconia’s needs. Personally, I hope that Ciconia and the startups it produces will attract talent with big ambitions, becoming a launchpad for aspiring entrepreneurs to spread their wings globally.

We see Ciconia as our ace in the hole for disrupting the status quo in Japan. Together, we want to move ahead quickly to deliver new ‘made-in-Japan’ treatments for suffering patients.

We are confident to witness Ciconia becoming a leading incubator for early drug discovery programs in Japan, leveraging their distinguished scientists’ connoisseur in identifying assets and flexible decision-making to achieve rapid IND filings. This will make Ciconia the natural go-to place. We are committed to providing them with a variety of supports needed.

SMBC will leverage its financial expertise and extensive networks to proactively introduce the partners that Ciconia is seeking and provide growth support for the drug discovery startups fostered by Ciconia.

Through this project, we aim to gain a detailed understanding of the challenges facing the drug discovery ecosystem and explore new support measures beyond traditional financial services. We will consolidate the knowledge of the entire SMBC Group to achieve a deeper level of engagement.

-

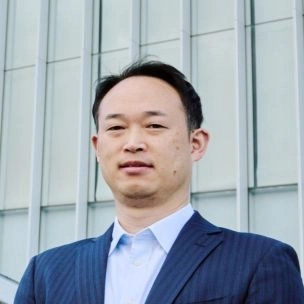

Representative Director and CEO, Ciconia Bioventures, Inc.

Toshio Fujimoto, MD

Graduated from the Kyoto University Faculty of Medicine. After completing residency at the Kyoto University Hospital and affiliated hospitals, he worked as a thoracic surgeon at the Ruardland Clinic and the University of Freiburg in Germany and the Mayo Clinic in the United States. Served as Vice President in Clinical Development and Medical Affairs at Eli Lilly Japan 2006–2017. Appointed GM of Takeda’s Shonan Health Innovation Park in 2017 and opened Shonan iPark in April 2018. Became CEO of iPark Institute in April 2023. Concurrently serving at Ciconia.

-

Head, Japan/APAC, Center for External Innovation, Takeda Pharmaceutical Company

Shogo Kato

Joined Takeda in 2008. In charge of development for clinical trials, development strategy, product introduction, and project management. Seconded to Boston in 2017 to handle global business development, leading business sales and spinouts. Back in Japan, he led contract negotiations for external partnerships in and beyond Japan. Currently oversees external R&D partnerships across Japan and the Asia Pacific region.

-

Associate Director, Japan/APAC, Center for External Innovation, Takeda Pharmaceutical Company

Jun Fujimoto, PhD

Joined Takeda in 2008. Spent nine years as a medicinal chemist, focusing on drug discovery research for metabolic disorder and oncology applications. Later involved in multiple business development projects with a research organization focus, including establishing spinouts in Japan, engaging in strategic partnerships with external organizations, and building a platform for early-stage collaboration with Japanese and South Korean venture companies.

-

Scouting & Transaction Lead, Corporate Development and Strategic Operations, Business Development, Astellas Pharma

Tomoko Kawashima, PhD

Joined Astellas in 2007, tackling discovery research in immunology and oncology as a pharmacology researcher. Assigned to the AK Project (Center for Innovation in Immunoregulative Technologies and Therapeutics, run by Astellas and Kyoto University) and took maternity leave twice before taking up her current position in 2022. Now primarily handles research partnerships with companies and research institutes in Japan and abroad.

-

Deputy Manager, Incubation Promotion, Business Development, Astellas Pharma

Naotoshi Kanemitsu, PhD, MBA

Joined Astellas (formerly Fujisawa Pharmaceutical) in 2004. Engaged in drug discovery research on diabetes, lifestyle diseases, and urological and renal diseases as a pharmacology researcher, going on to become a drug discovery project leader and manager for cancer, genetic disorders, and mitochondrial diseases in Astellas’ Development. Since 2022, responsible for cancer drug licensing and M&As as well as construction of Japan’s open innovation and drug discovery ecosystem.

-

Deputy General Manager, GIBC Group, Corporate Advisory Division, SMBC

Tomohide Sanpei

Joined SMBC in 2012. Worked in corporate sales before joining the Corporate Advisory Division to handle the pharmaceutical industry since 2014, tackling business strategy proposals on a sectoral axis. Currently pursuing business development that works together with customers to solve medium- and long-term industry issues.