SMBC Legal X transforms contract processing with its sights set on global markets and a trillion-yen market cap

With SMBC CLOUDSIGN coming out of the pandemic on a strong growth trajectory, SMBC Group next turned its eyes to contract lifecycle management (CLM), which leverages advanced technologies to streamline all stages of contract processing.*

The Group decided to make a full-scale entry into CLM territory by setting up the new entity SMBC Legal X with business partners including a major Japanese law firm and an innovative Indian legal tech company.

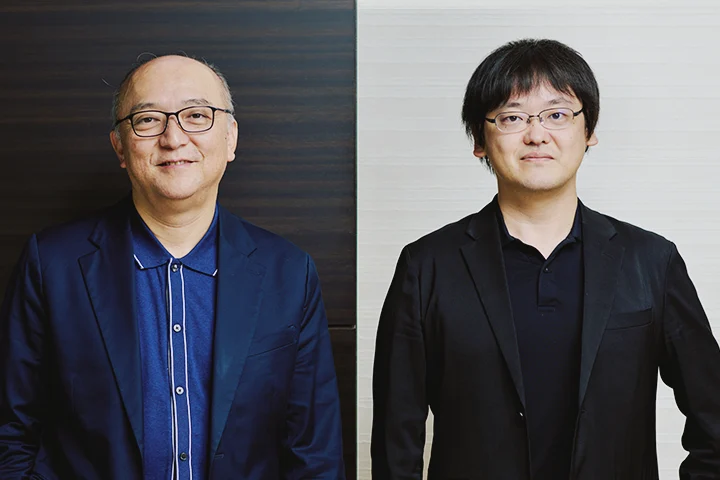

Here SMBC Group CDIO Akio Isowa and SMBC Legal X President and CEO Hideki Mishima discuss the full scope of that challenge.

* CLM: Methods and systems for optimizing all stages associated with contract management, from contract creation, conclusion, and administration to renewal or termination.

- From SMBC CLOUDSIGN to SMBC Legal X

- Moving into India with the best partner at the best moment

- Leading Japanese law firm goes all-in with first-ever capital tie-up

- Coexisting with the dramatically changing AI environment

- New SMBC Group corporate culture focuses on the offense

- Using trust and market capabilities to take on global markets and achieve a trillion-yen market cap

From SMBC CLOUDSIGN to SMBC Legal X

SMBC CLOUDSIGN launched its service just five years ago and is performing very well─so why a new firm now?

With SMBC CLOUDSIGN growing to the point where it was ready to go public, we revisited the medium-term strategy and thought about how to achieve exponential growth. Clearly, that would require expanding into new business areas and targeting global markets, and that’s what led to the establishment of the new company.

Around three years ago, then-Group CEO Jun Ohta, Group CDIO Katsunori Tanizaki and I decided that it was time to go all out. The idea then was to provide free-of-charge access to SMBC CLOUDSIGN for all SMBC business customers with a current account and to aim for global deployment. So we’ve long been planning and preparing for the global deployment of not just electronic contracts but the whole suite of CLM services.

That’s right. The free SMBC CLOUDSIGN access was realized really early on.

We gave the same function to Trunk, a comprehensive digital financial service for corporate customers, which saw an immediate expansion in our domestic scale. But we still hadn’t taken on global markets.

SMBC CLOUDSIGN has built up over 9,000 corporate customers. We wanted to continue with that while using the new company to target global markets for all contract-related processes─in other words, CLM.

So basically maintaining the SMBC CLOUDSIGN framework while expanding overseas to capture global markets upstream and downstream.

Moving into India with the best partner at the best moment

When you chose your business partners, what were the deciding factors?

First, because SMBC Group is focusing strongly on Asia, we chose a priority area aligned with that Group strategy. There’s a lot of competition in CLM markets in Europe and the United States, but uptake has been slow in most Asian countries─except Japan, which has really come on board with electronic contracts. This is due in part to our long history of using seals rather than written signatures, as well as the digital shift that occurred during the pandemic, and of course the stamp duty exemption given to electronic documents. E-contracts are still not really a thing yet in most emerging countries, though.

As we were exploring the possibilities, our eyes fell on India. Obviously, India has massive market potential, and it also happens to be right at a turning point in terms of legal tech. The shift to cashless payments and a digital economy is occurring at an astonishing rate, but physical documents are still the mainstream when it comes to law. We realized that this was a great opportunity to step in, just as India was beginning to develop its legal framework for digitization. As it also happened to be the perfect moment for SMBC Group to multi-franchise commercial banks in India, we decided that the market situation and the timing were both heavily in our favor.

Timing is really critical. Too early is bad, but so is too late. It’s lucky that I told you to go to India first to take a look around, huh!

Yes, that trip gave me a really good sense of how things stand. As they say, there’s nothing like seeing with your own eyes…[laughs]

When we were selecting partners, we actually benchmarked the services of various companies from India to the US and Europe, and out of everyone, it was the Indian CLM venture Volody that had the real standout product. Volody started out providing workflow systems before moving into legal tech, so its CLM process was absolutely seamless. And of course it had a home-court advantage in the Indian market. We were also impressed at the strength of the founder’s commitment and his willingness to join us in shouldering risk. We shook hands on the basis that, rather than a contractual relationship, ours would be a partnership where we shared both the risks and the rewards.

Our decision was also shaped by the fact that SMFG India Credit, the Group’s credit card company in India, was already using Volody.

That’s right. Access to an objective third-party opinion on Volody was confidence-inspiring.

We were also very lucky to be able to bring in our other global partner, LexisNexis─for two reasons. First, they have a massive legislation and law revision database, opening the way for joint development of products using that data. Second, they have great sales channels for global deployment. LexisNexis operates in 150 countries and is ranked number one globally in its field, so it has incredible connections with major law firms and the legal departments of major companies around the world. There’s no use having a great product if you can’t sell it, and we thought that being able to utilize the sales channels of both SMBC and LexisNexis would set us up perfectly for high-powered global expansion.

Leading Japanese law firm goes all-in with first-ever capital tie-up

We’re also thrilled to have Anderson Mori & Tomotsune (AMT) on board.

AMT is one of Japan’s top law firms, which means we’re getting top legal advice─really first-class legal knowledge─for all the work accompanying electronic contracts, from contract prep to analysis, administration, and storage. I should also mention that this too is not a contractual relationship. It’s actual revenue-sharing, with AMT’s commitment extending to taking on risk with us and participating in product development─even investing in the new company. This is such an unusual step for a law firm, and it actually marks Japan’s first capital and business partnership between a megabank and a major law firm.

Legal tech in a sense has the potential to take work away from law firms, which is why they are all moving very cautiously. AMT is fully cognizant of the situation, but decided that sooner or later someone was going to come in with legal tech, and in that case, seizing the lead themselves was the right move to make. But even if your starting point is digital technology, matters requiring face-to-face consultation will inevitably remain. I can’t imagine society ever reaching a point where lawyers are no longer needed.

Totally. The service we’re creating is essentially helping corporate customers to handle contract processing efficiently and appropriately, and it’s lawyers who provide the final assessment on legal points. High-level work will continue to require human skills.

We also have to remember that a lawyer’s assessment is not set in stone, but rather an opinion. That’s the case whether technology is involved or not.

Because assessments change over time and as the law itself changes.

Coexisting with the dramatically changing AI environment

How is AI used in your services?

SMBC Legal X intends to fully commit to generative AI. I’ve experienced two paradigm shifts in my career to date─the widespread adoption of broadband, followed by smartphones─and I believe that AI will bring about a third such shift. So I think GenAI will be an essential part of product development. At the same time, GenAI is evolving so quickly that everything can change in the space of months, which means almost zero predictability. Essentially, we have no choice but to make decisions that embrace unpredictability. For example, ChatGPT might be out in front at the moment, but it would not be at all surprising if another AI model had gained the advantage in three months’ time. When you have no idea what’s going to happen, I think the way to ensure that you can use the best AI model for your purpose is not to create your own systems to the greatest extent possible, but rather to approach development in a manner that enables you to respond flexibly to change.

The key is to keep a close eye on multiple algorithms and ensure that you can switch straight over to the best option at the time─like a power adaptor! Developing and refining an app only to find that you can’t use the latest technology actually presents the greater risk. In fact, it’s only been very recently that you’ve pivoted away from doing all our system development. I think that was a great decision!

That’s right. We spent about six months trying to develop our own algorithm, but the environment was just changing so rapidly that we realized we needed to revisit our development philosophy. And while we were creating our algorithm, GenAI evolved and surpassed what we’d achieved in some areas, meaning that our development method too would need a major overhaul. That was our pivotal moment.

When you’ve really refined something, it becomes psychologically difficult to just abandon it for something else. I’m impressed that you managed to change course so easily.

It was a critical lesson to learn. Yes, pivoting away from something in which you’ve invested time and money is mentally tough, but while you can put in the time and money and create something which is clearly a bit borderline, you can also change your development method and create something better and do it cheaper and faster. So it was an inevitable decision. We were also really blessed that SMBC chose to view this course of events as another learning experience.

Traditional banking culture makes it extremely difficult to admit that something that you made has failed. I think it was decision we were able to make because we are a digital subsidiary.

New SMBC Group corporate culture focuses on the offense

Is the corporate culture within SMBC Group changing?

I think there’s been a big change in the inhouse atmosphere─primarily, I suspect, due to the ripple effect on the organizational climate of the bank as a whole from digital subsidiaries taking on the challenge of various new business areas and projects.

Four years ago, if we’d started talking about working with AMT, people would have immediately opposed the idea because of the potential impact of our relations with other law firms and the reputational risk. I think we have a much better balance now, in that we’re thinking first about what we can do offensively and then considering our defense.

If you think too logically, everyone reaches the same conclusion and you end up with a red ocean situation. Big firms have a bad habit of implementing plans that they don’t even believe in themselves simply on the basis of market data, but you’re never going to win that way against someone with real faith in what they’re doing. In the end, victory will go to the party who can execute with personal accountability.

The more novel the new business is, the harder it becomes to provide evidence─you can only do that once the industry is established! In the midst of the current AI boom, the future is just too uncertain to predict. It’s fantastic that SMBC Group’s organizational structure for new business understands this and considers both the new business’s potential to contribute to the Group’s banking business and its potential to become the Group’s next business pillar.

Using trust and market capabilities to take on global markets and achieve a trillion-yen market cap

You’re aiming to be number one in the world. Do you have a specific time frame for that?

The plan is to use India as a foothold to take our first solid step within this financial year. I’m confident that we’re making rapid progress on systems development, adapting to local business practices and the local culture, and building sales channels, but the dizzying pace of change in the Indian environment at the moment could see us fall behind schedule. Given how the evolution of AI can turn everything upside down in a few months, I’m acutely aware that even delivery in six months’ time might be too slow.

There’s also no point making something great if it doesn’t sell, and that’s where marketing capabilities are absolutely critical. One advantage we enjoy over other ventures is that SMBC Group’s connections have established various channels in Japan and overseas, particularly in terms of reaching out to corporate majors. The SMBC brand also creates scale merit by facilitating sales cooperation with other partners, so we can build a whole range of sales channels. Looking long-term, I believe that what will set apart those businesses that remain standing amidst the rapid evolution of AI will be marketing capabilities, human and other relations included.

Sooner or later, the product will be commodified, and then it’s likely to come down to marketing capabilities. And in fact, when the bank introduces SMBC CLOUDSIGN to customers, they don’t choose it just on the basis of functionality and cost. SMBC CLOUDSIGN is a business model built on the relationships of trust established by SMBC Group as a whole.

I think that SMBC CLOUDSIGN was able to offer the services needed amid the shift away from using seals prompted by the pandemic. Initially, the biggest enemy of our business was vague concern about the safety of electronic contracts, but the fact that SMBC was using electronic contracts in its own business─for home loans, for example─put customers’ minds at ease and also, I believe, helped to grow the electronic contract market as a whole.

Because SMBC Legal X services are provided by a banking group that is built on trust, we continue to develop those services based on a careful assessment of risk and in consultation with lawyers. That’s why we can provide our services with confidence and commit to achieving our first goals of going public and achieving a market cap of one trillion yen. Then I want to use that track record to become a role model for new business development in Japan and contribute to Japan’s economic advance.

First let’s get you listed as soon as possible, and then aim for the stars!

-

Group CDIO and Senior Managing Corporate Executive Officer, Sumitomo Mitsui Financial Group

Akio Isowa

Joined Sumitomo Mitsui Banking Corporation in 1990 and worked in corporate affairs, legal affairs, management planning, and human resources before setting up the Retail Marketing Department and the Retail IT Strategy Department as general manager. Later, as general manager of the Transaction Business Division, he spearheaded product and sales planning for corporate settlements. In 2022, he became director of the Digital Solution Division. He took up his current post in 2023, in which capacity he is driving digital strategy promotion for SMBC Group.

-

President & CEO, SMBC Legal X, Inc.

President, SMBC CLOUDSIGN, Inc.Hideki Mishima

Joined Sumitomo Mitsui Banking Corporation (SMBC) in 2018 as a mid-career hire. In 2019, he launched SMBC CLOUDSIGN, Inc. and became the new company’s President and CEO. In 2023, he joined the Japan Association of Corporate Executives and was appointed Vice Chair of its Open Innovation Committee. He established SMBC Legal X, Inc. in 2025 as the company’s President and CEO. He is pushing forward with transforming and popularizing open innovation in Japan.