Initiatives to Realize Sustainability

Throughout its 400-year history, SMBC Group has continuously upheld its commitment to sustainability. We hereby declare that we will drive forward our efforts to make sustainability a reality.

SMBC Group’s Sustainability Management System

In April 2021, SMBC Group established the new position of Group CSuO. Under its guidance, the Corporate Sustainability Department plans and formulates group-wide sustainability measures, while the Sustainability Business Promotion Department functions as a hub for providing solutions on a global, group-wide basis.

The Corporate Sustainability Committee, which is chaired by the Group CEO, discusses matters pertaining to the spread of sustainability management throughout the Group as well as measures necessary for promoting sustainability. Moreover, we newly established the Sustainability Committee as an internal committee of the Board of Directors in July 2021. The Group CSuO and the Group CRO will periodically report to the Sustainability Committee and the Risk Committee. We are continuously enhancing our corporate governance and management frameworks.

Furthermore, SMBC Group has incorporated quantitative indicators related to environmental, social, and governance (ESG) initiatives into executive compensation schemes to accelerate sustainability management.

Message from Group CSuO

Preserving rich nature, eradicating poverty, and eliminating discrimination and prejudice–these are all goals that companies around the world are expected to work toward in their pursuit of sustainability. Instead, companies have generally prioritized short-term financial gains, resulting in the world we currently call home being plagued by various environmental and social issues: climate change and growing economic disparity, to name a few.

Meanwhile, SMBC Group has defined three materiality issues for practicing sustainability management: the “Environment,” “Community,” and “Next Generation.” In particular, we emphasize the ”Environment” as an irreplaceable asset shared between generations and the foundation of social sustainability. However, SMBC Group cannot protect the environment and realize a sustainable society on its own. We are therefore striving to fulfill our social mission as a globally active financial institution by engaging and acting with our customers and various other stakeholders in a joint effort to build a sustainable society and to hand it down to the next generation.

As the Group CSuO, I am committed to accelerating SMBC Group’s sustainability initiatives from various angles going forward.

Fumihiko ItoGroup CSuO

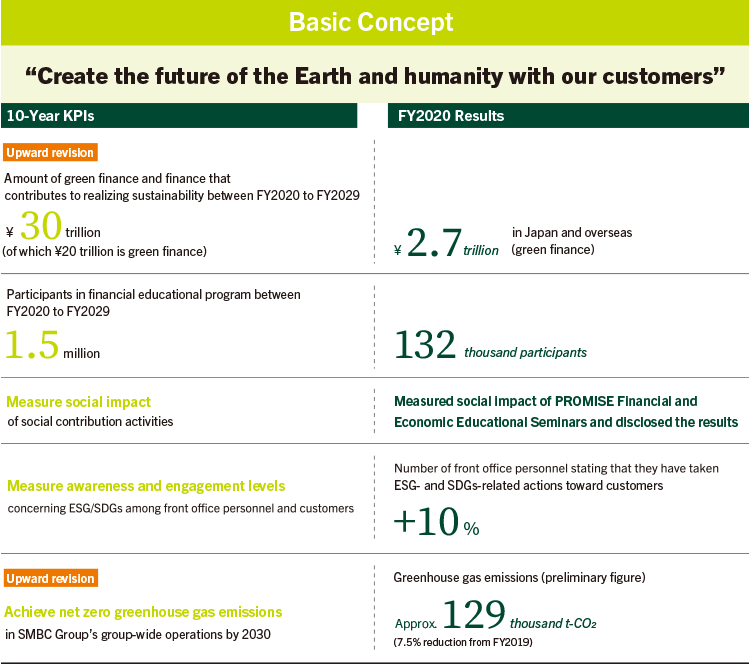

SMBC Group GREEN×GLOBE 2030

In April 2020, SMBC Group established “SMBC Group GREEN×GLOBE 2030," a ten-year plan that extends to 2030, based on the “SMBC Group Statement on Sustainability.”

“GREEN” represents SMBC Group’s corporate color and the environment, while “GLOBE” represents the Earth and a borderless world. The two terms are connected by an “×” to show the plan’s potential being measured in terms of multiplication rather than mere addition.

Moreover, in our aim to enhance our efforts addressing climate change, we upwardly revised our green finance and greenhouse gas (GHG) emissions reduction targets in May 2021.

Environment

Environmental Initiatives

The global environment is an important asset that is shared by all of humanity, regardless of region or age, and a healthy environment is prerequisite to the realization of a sustainable society. SMBC Group is earnestly engaging with climate change and various other environmental issues. By helping resolve such issues through our business, we aim to ensure that we can pass on a healthy environment to future generations.

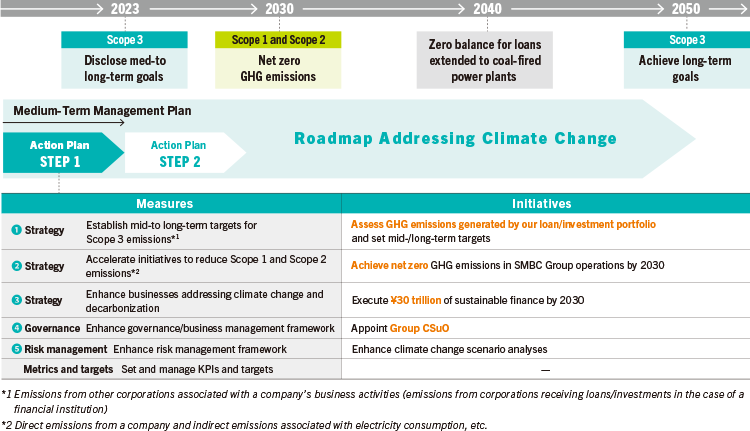

Efforts Addressing Climate Change

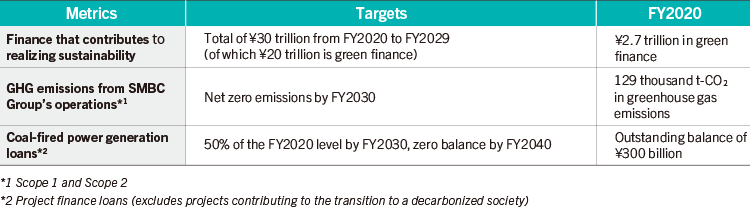

In order to reinforce our efforts addressing climate change, SMBC Group clarified its position on the issue and revealed its “Roadmap Addressing Climate Change” and “Action Plan STEP 1” in May 2021. The Roadmap Addressing Climate Change is a long-term action plan to contribute to a carbon-neutral society by 2050. Action Plan STEP 1 is a package of initiatives to be undertaken and executed during the current Medium-Term Management Plan. Major components of this action plan include the measurement of GHG emissions of SMBC Group’s loan/investment portfolio and the establishment of medium- to long-term targets to reduce such emissions toward 2030 and 2050. In addition, we have redefined our prior green finance target to finance contributing to sustainability while raising the target amount to ¥30 trillion in total.

SMBC Group endorses the government’s policy and strives to achieve greenhouse gas emissions reductions in line with the goals of the Paris Agreement. Moreover, we will support the activities of our clients contributing to the transition toward and realization of a decarbonized society.

Major Initiatives of Action Plan STEP 1

Measurement of GHGs Generated by Loan/Investment Portfolio and Establishment of Medium- to Long-Term Targets

To guide its long-term efforts addressing climate change leading up to 2050, SMBC Group will assess GHG emissions from its loan/investment portfolio (Scope 3) and set medium- to long-term targets. We will also need to enhance our engagement with customers in order to contribute to the realization of a decarbonized society together. We will first focus on business sectors with high GHG emissions (oil and gas, power), and then move on to other business sectors.

Acceleration of Initiatives to Reduce Group-Wide GHG Emissions

SMBC Group was pursuing a target to reduce SMBC's CO₂ emissions volumes by 30% from FY2018 levels by FY2029. However, we revised this target to further accelerate our initiatives. The new target is to achieve net zero GHG (Scope 1 and Scope 2) emissions in our group-wide operations by 2030. This goal will mainly be pursued by accelerating measures such as sourcing electricity from renewable energy.

Reinforcement of the Risk Management Framework

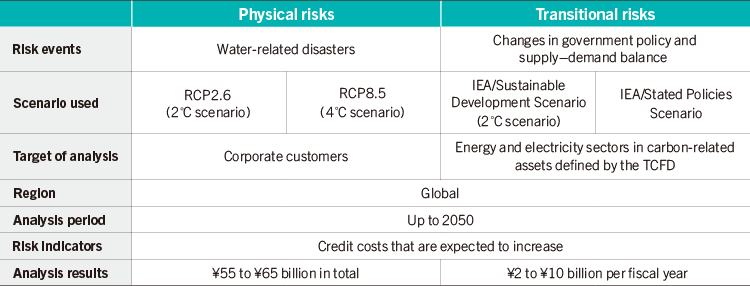

Since FY2019, SMBC Group has been performing climate change scenario analyses based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). In the past, we analyzed the financial impacts of transitional risks in the energy and electricity sectors based on scenarios presuming global warming of 2°C and 4°C above pre-industrial levels. Going forward, we will perform estimates and analyses based on a wider scope (including transportation and other sectors) and on the scenario presuming global warming of 1.5°C above pre-industrial levels.

In addition, we plan to develop monitoring systems for brownfield and greenfield assets while examining how best to classify and subdivide these assets based on domestic and overseas trends and at the requests of various authorities.

Response to Climate Change Based on the TCFD Recommendations

SMBC Group announced its support for the TCFD recommendations in December 2017, and is performing climate change scenario analyses based thereon. In addition, we are working together with customers to address the issues caused by climate change in order to realize a decarbonized society. Going forward, we will enhance the disclosure of information through our TCFD reports (next report scheduled to be published in September 2021).

Governance

Policies for promoting sustainability management and combating climate change are reflected in business strategies based on discussions by the Corporate Sustainability Committee, which is chaired by the Group CEO, and by the Management Committee. Regular reports regarding the implementation of these policies are made to the Board of Directors, while the Risk Committee, established within the Board of Directors, reports on climate change-related risks. In addition, in FY2021, we newly appointed a Group CSuO and established the Sustainability Committee, which oversees and provides advice regarding group-wide sustainability initiatives. We will continue to enhance our corporate governance and management frameworks going forward.

Strategy

SMBC Group has defined three materiality issues regarding its efforts to contribute to the resolution of social issues– “Environment,” “Community,” and “Next Generation.” We are providing finance that contributes to the goals of the Paris Agreement while also analyzing climate change risks to improve our climate change resilience.

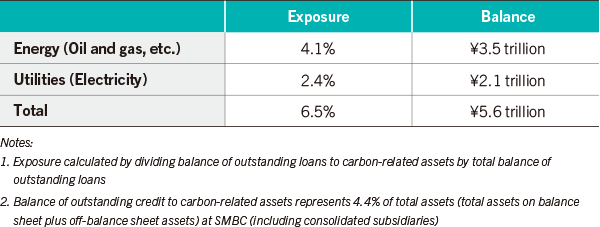

Climate-Related Risks

SMBC Group identifies the financial impacts of climate change by anticipating changes in the external and business environment due to the emergence of climate change-related issues and by identifying risk events based on various transmission channels. In addition, we calculate a portion of our loan portfolio comprising carbon-related assets based on the TCFD recommendations.

Exposure of Carbon-Related Assets (FY2020)

Scenario Analyses (SMBC)

We have begun to conduct scenario analyses on physical risks related to water damage and transitional risks of the energy and electricity sectors pertaining to SMBC. Going forward, we will perform estimates and analyses based on a wider scope (including transportation and other sectors) and on the scenario presuming global warming of 1.5°C above pre-industrial levels.

Climate-Related Opportunities

The transition toward a decarbonized society is expected to stimulate growth in the needs of climate change-related businesses as well as financing needs pertaining to these businesses. SMBC Group has set up a dedicated organization (Sustainable Business Promotion Department) to address customers’ sustainability-related issues and is reinforcing its global function on this front. Moreover, we conducted a total of ¥2.7 trillion of green finance in FY2020, and we continue to support the transition to a decarbonized society through the provision of our solutions.

Risk Management

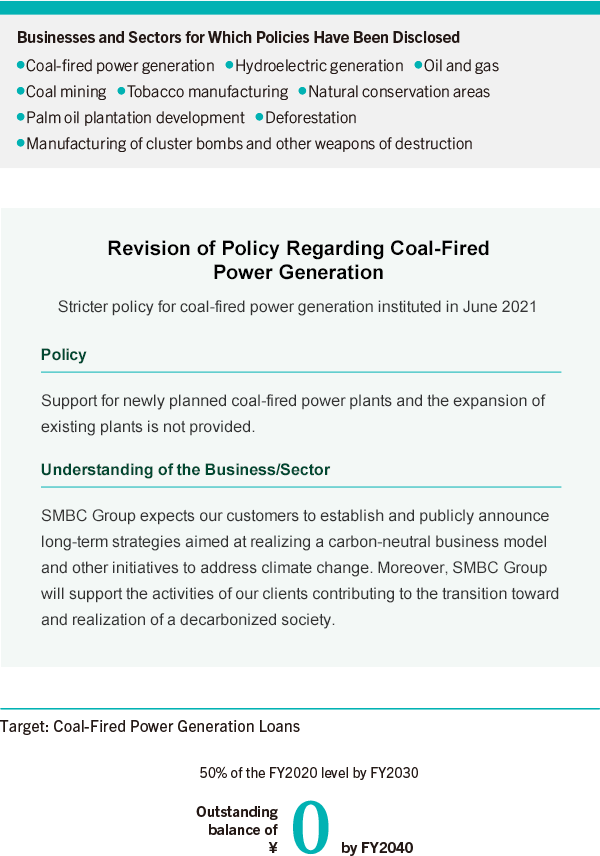

SMBC Group has positioned climate change among its Top Risks and is conducting stress test impact analyses with regard to this risk. Moreover, policies have been set for financing certain businesses and sectors, and we are expanding the scope of environmental and social risk analyses.

Metrics and Targets

Promotion of Sustainable Businesses

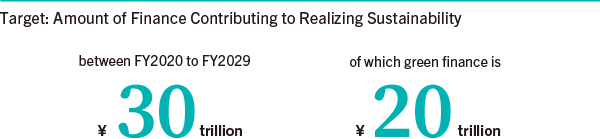

SMBC Group is committed to the resolution of environmental and social issues through its business. We are increasing green financing initiatives, which focus particularly on environmental fields. Our prior goal of conducting green finance amounting to ¥10 trillion by FY2030 has been replaced by a more ambitious target of conducting a total of ¥30 trillion of green finance and finance that contributes to the realization of sustainability (of which ¥20 trillion is green finance).

SMBC Group is ramping up support for customers contributing to the realization of a decarbonized society in various areas, including the 14 core fields in the Green Growth Strategy defined by the Japanese government in conjunction with its goal of achieving carbon neutrality by 2050. Specifically, all Group companies are providing support that capitalizes on the characteristics of their business–SMBC through financing and deposits, SMBC Nikko Securities through underwriting of ESG bonds, SMBC Trust Bank through contracting related to equipment and sites, Sumitomo Mitsui Finance and Leasing through equipment leasing and The Japan Research Institute, through consulting.

In addition, we are engaged in initiatives pertaining to the social implementation of hydrogen systems, which are anticipated to play a central role in realizing a decarbonized society, as well as to the creation of cutting-edge businesses in the field of agriculture. We are also emphasizing engagement with customers in providing solutions as a comprehensive financial group to support the resolution of customers’ sustainability issues.

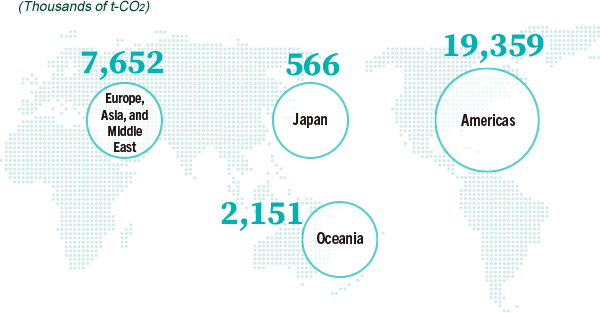

Contributed to Emissions Reductions Equivalent to 29,728 thousand of t-CO₂ through Renewable Energy Projects in FY2020 (17,643 thousand of t-CO₂ in FY2019)

Breakdown by Region

ESG-Minded Financing

SMBC Group has disclosed policies for businesses and sectors with a high risk of significantly impacting the environment or society. Major subsidiaries (SMBC, SMBC Trust Bank, Sumitomo Mitsui Finance and Leasing, and SMBC Nikko Securities) are introducing these policies according to their business.

Going forward, we will continue to engage with customers and various other stakeholders while constantly considering the need to revise our financing policies as necessitated by the operating environment.

Social

Community

As people live and the economy advances, communities to form connections between proponents in these areas and thereby encourage mutual support and enable each other to act in peace of mind are needed. SMBC Group continues to contribute to communities and society and to fulfill our social responsibility as an entity that acts as a member of these communities.

GREEN×GLOBE Partners

GREEN×GLOBE Partners is a community for facilitating cross-organizational action to address environmental and social issues that cannot be resolved by a single person or company. Based on the goal of spreading awareness and opportunities for the resolution of environmental and social issues, 163 companies and organizations*1 have joined the community since its establishment in July 2020.

Activities of this community include monthly events, distribution of exclusive articles on environmental and social issues and workshops for formulating ideas to address such issues and drive the creation of new businesses.

- *1As of June 30, 2021

GREEN×GLOBE Partners event

SMBC Elder Program

The SMBC Elder Program was established to provide financial and non-financial services that help to bring health, security, and meaning to the lives of senior citizens, and addresses diversified needs and lifestyles in Japan's rapidly aging society. This program is administered by dedicated concierges with a breadth of knowledge acquired through the gerontology certification program*2 and other venues. These concierges field consultations from customers and help address their concerns by proposing services and offering other forms of support.

Going forward, SMBC Group will continue to enhance its range of services in response to the needs of customers and society in order to help build a society that offers peace of mind for all and support the upcoming era of 100-year lives.

- *2Program designed to facilitate learning of the various issues faced in an aging society, including healthcare, nursing care, social security, and other matters pertaining to the mental and physical well-being of senior citizens

SMBC Elder Program Pamphlet

Next Generation

Ensuring the sustainability of our society and economy amid the changing social environment will require the cultivation of human resources who can support society with the necessary knowledge and technologies. SMBC Group is promoting sustainability by fostering the next-generation human resources and industries that will shape the society of the future together with us.

Financial Literacy Education

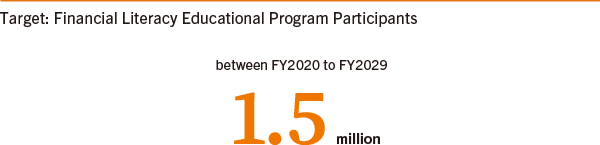

Capitalizing on the insight and expertise of Group companies, SMBC Group is providing financial literacy education.

In FY2020, we introduced online seminars as a new learning style for financial literacy educational activities in light of the COVID-19 pandemic. We offered various programs based on the requests of the applying schools, and financial literacy education was provided to approximately 132 thousand people through face-to-face lessons in FY2020, including. 60 thousand people via online seminars.

By providing financial literacy education to a wide range of age groups, from children to adults, SMBC Group will help to build a society in which people can live with peace of mind by acquiring accurate knowledge pertaining to finances.

Online seminar

Programs to Create and Support New Businesses

To support next-generation businesses, SMBC Group is advancing the “Mirai” program. Through this program, we solicit business plans from those aspiring to commercialize a certain new idea or technology. A wide range of opportunities is provided to individuals whose plans pass the judging process, including business development support from advisors, networking assistance, financial aid, and support for developing collaborative businesses with sponsors.

We are also developing open innovation centers to facilitate new business creation. In September 2017, we established “hoops link tokyo,” which was followed by “hoops link kobe,” opened in September 2020. Through coordination between these two centers, we are arranging a variety of events, including pitch events, meetups, and seminars for encouraging entrepreneurship.

By forging connections with various companies and investors, SMBC Group is helping customers grow and innovate while also contributing to the development of next-generation industries.

“Mirai” program

hoops link kobe