Response to climate change

Our approach against climate change

Climate change is one of the most important social issues that the world must urgently address. SMBC Group believes that contribution to decarbonization of the real economy is the biggest role that financial institutions should play in achieving net zero emissions. We aim to achieve this alongside SMBC Group’s own achievement of net zero. There is no single optimal path to decarbonization; the path varies by country and sector. Accordingly, rather than merely withdrawing funding from high-emission sectors, SMBC Group will support customers’ transitions and technological innovation with understanding of their individual circumstances. We engage in support that leverages our strengths, matched to customers’ strategies and needs.

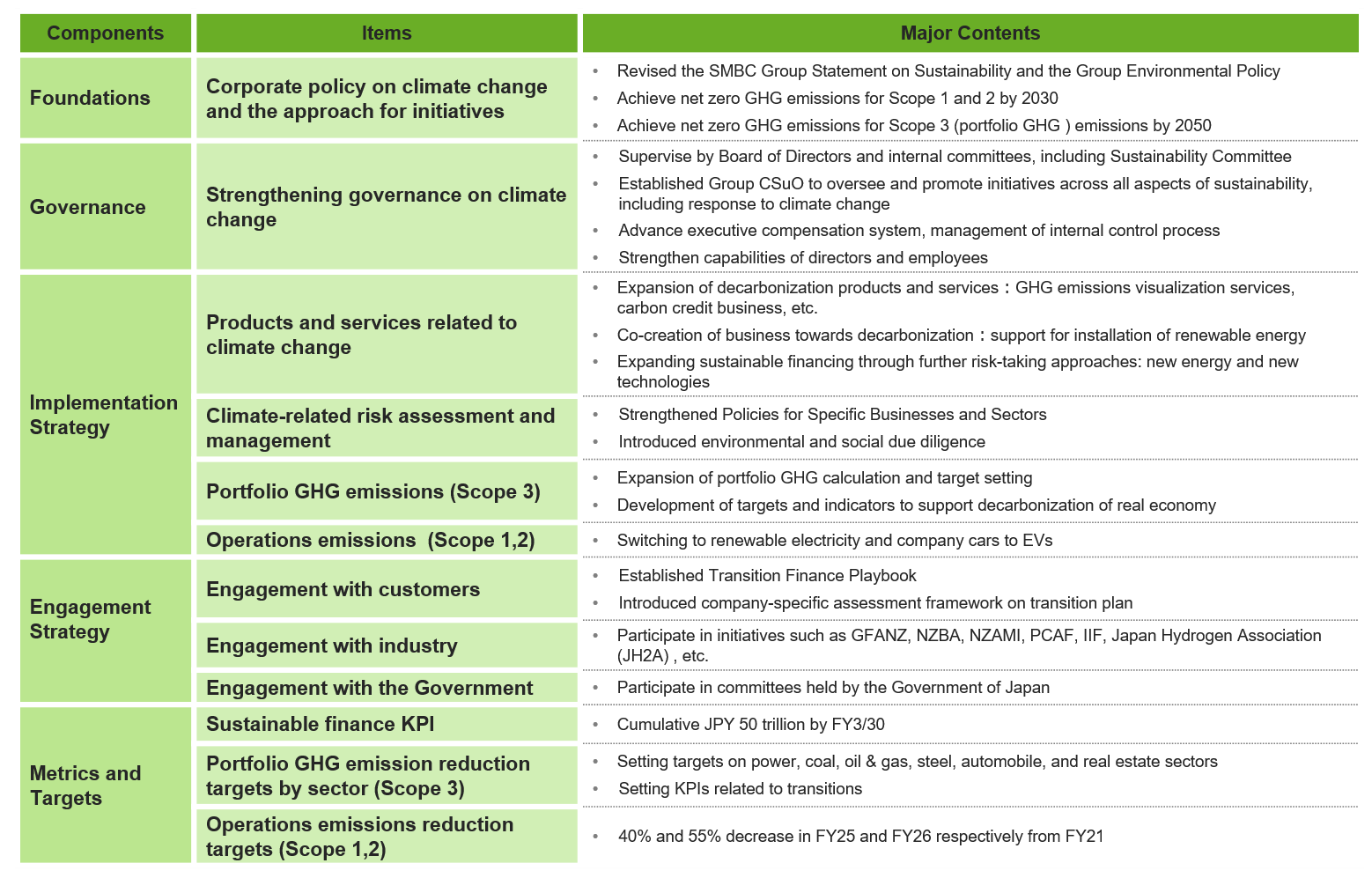

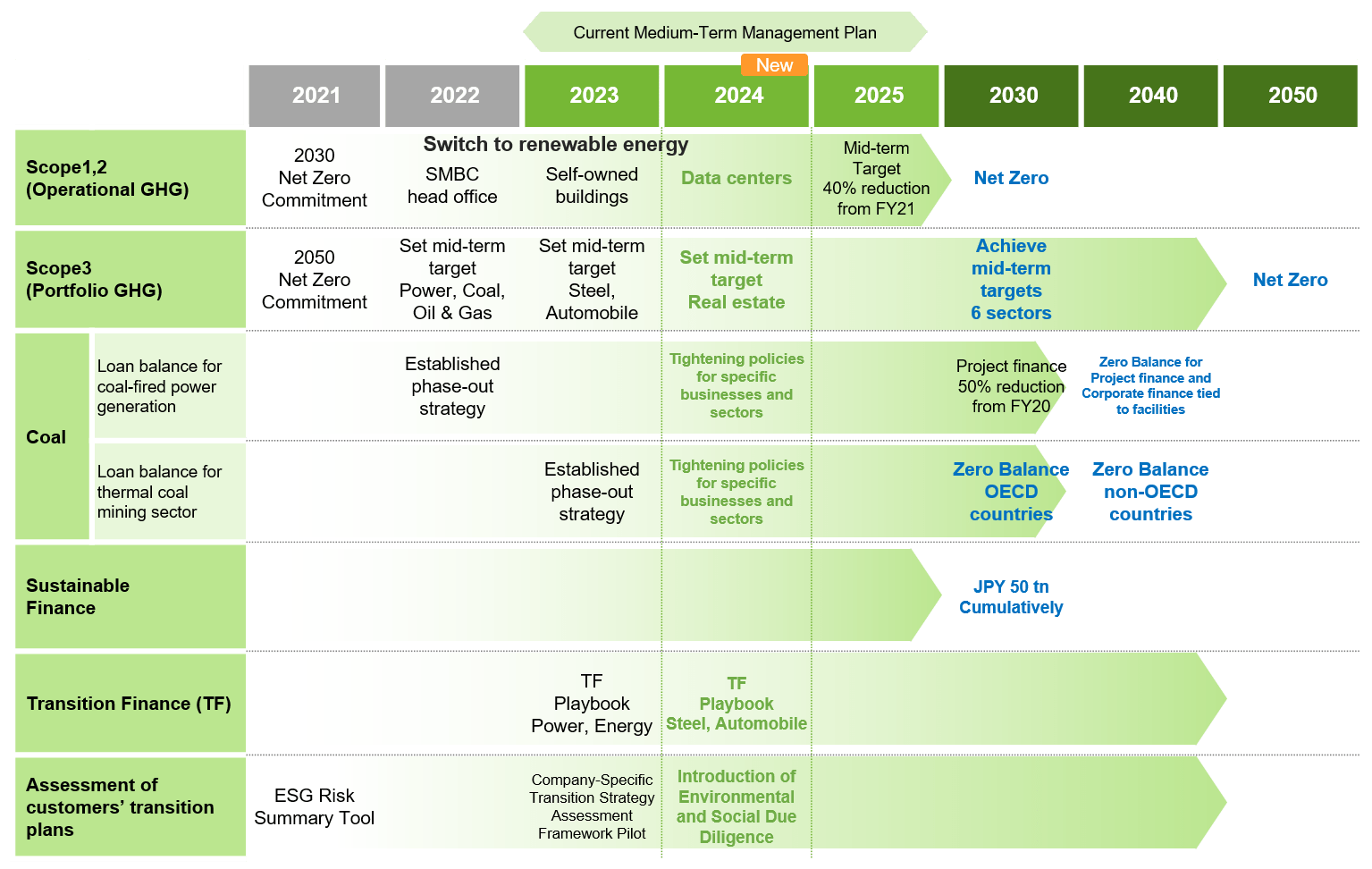

Transition Plan for achieving net zero in 2050

SMBC Group aims to achieve net zero for our own greenhouse gas emissions by 2030, and for our entire loan and investment portfolio by 2050. We have adopted the methodology in the GHG Protocol Corporate Standard and financial sector-specific programs*1 for our emissions accounting*2 and systemized the series of targets and actions in the "Transition Plan."

*1 The calculation of Category 15, Scope 3 emissions (financed emissions) is conducted with reference to the methodologies set out in The Global GHG Accounting & Reporting Standard for the Financial Industry and the Paris Agreement Capital Transition Assessment (PACTA) as discussed in our Sustainability Report 2024.

*2 We have also obtained limited assurance for our Scope 1 and Scope 2 Greenhouse Gas emissions from KPMG AZSA Sustainability Co., Ltd.

Summary of our Transition Plan for Achieving Net Zero

Overview of Initiatives Towards Achieving Net Zero

Sustained Efforts to Address Climate Change

SMBC Group outlines its approach to climate change initiatives in accordance with the four recommended components of international sustainability disclosure standards: governance, strategy, risk management, and metrics and targets. For more details, please refer to the "SMBC Group Sustainability Report."

* For details up to the fiscal year 2023, please refer to the "SMBC Group TCFD Report."

Management of Environmental Risks

SMBC Group appropriately manages its policies, portfolio management, and individual company and project management to achieve its net-zero targets. For more details, please refer to the "SMBC Group Sustainability Report."

Policies

<Policies for Specific Businesses and Sectors>

SMBC Group has established policies for Specific Businesses and Sectors that present significant potential impacts on the environment and society. In fiscal year 2023, we strengthened our policies regarding coal-fired power generation and thermal coal mining, and established new policies regarding the biomass power generation.

Coal-Fired Power Generation and Thermal Coal Mining

We are working to tighten our loan policies and to formulate phase-out strategies. Specifically, we have clearly stated that we will not support newly planned or expansion of projects . Additionally, we have set the following targets for reducing loan balances to zero:

(Coal-Fired Power Generation) Zero loan balance by the fiscal year 2040

(Thermal Coal Mining) Zero loan balance by the fiscal year 2030 in OECD countries and by the fiscal year 2040 in non-OECD countries

Biomass Energy Generation

In fiscal year 2023, we introduced a new policy for biomass power generation projects, requiring the confirmation of the use of sustainable biomass materials for the new construction and expansion of woody biomass energy generation plants.

Portfolio Management

<Risk Appetite Framework (RAF)>

In fiscal year 2023, we established a new climate-related category within our RAF, which is the framework for our group-wide risk management. Within this framework, we have set indicators related to Scope 3 emissions with a focus on sectors for which we have set mid-term reduction targets, and are raising the level of our management to achieve these targets.

Individual customer and project management

<Environmental and social risk assessment>

In our support for large-scale projects, we conduct environmental and social risk assessments and reflect the findings in our decisions on financing projects.

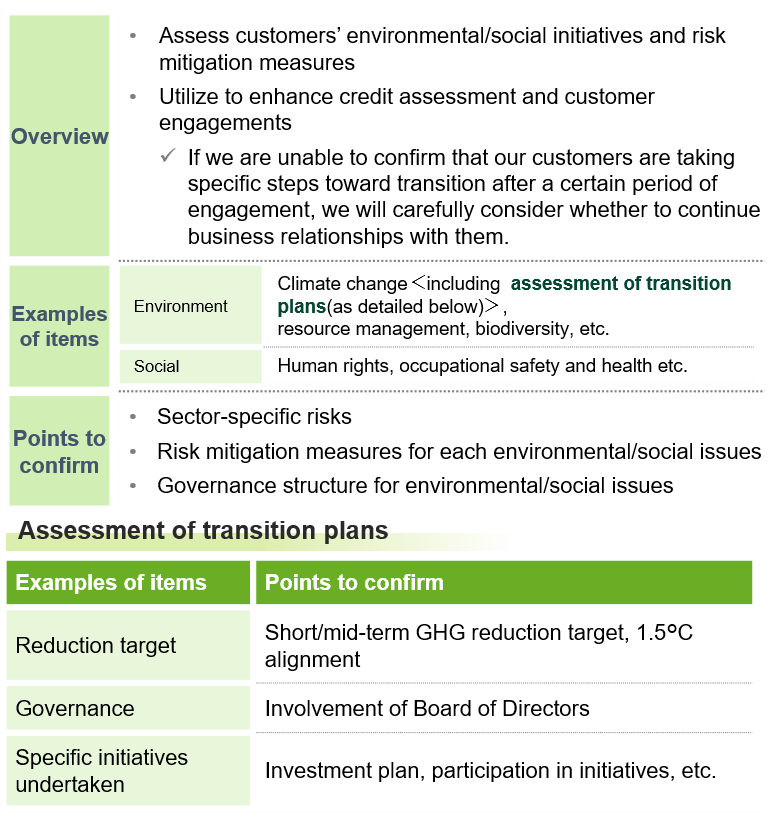

<Introduction of Environmental and Social Due Diligence>

As a part of SMBC’s efforts to assess the status of customers’ actions with regard to environmental and social risks, in fiscal year 2024 we introduced environmental and social due diligence that integrates past related efforts. We will use this screening to raise the level of our credit evaluations and in our engagement with customers.

Overview of Environmental and Social Due Diligence