Message from Group CFO

In FY2023, under the Medium-Term Management Plan, dubbed the “Plan for Fulfilled Growth,” SMBC Group carried out various initiatives to realize “Growth with Quality.” From the perspective of transforming our business portfolio, we implemented measures to reduce low growth/profit assets, as well as assets for which the significance of holding them had decreased due to changes in the business environment. At the same time, we accelerated our strategies for growth by making sure we allocated the necessary management resources to key strategic areas. Furthermore, to push forward efforts to shift management resources toward initiatives aimed at enhancing ROE and controlling cost, we conducted our operations with an even greater focus on capital efficiency and worked to enhance our business management.

In FY2024, we will aim for even greater heights by continuing to balance our strategies for growth and sound financial/capital management.

Overview of FY2023

FY2023 started under challenging circumstances with uncertainties in markets arising from the bankruptcies of financial institutions in the U.S. and concerns regarding a slowdown in the global economy. However, Japan’s economy experienced a turnaround and overseas economies proved to be more resilient than anticipated. In such an environment, in Japan we expanded our retail client base through Olive while also capturing opportunities arising from the funding needs resulting from revitalized corporate activities. Outside of Japan, we steadily carried out our Multi-Franchise Strategy in Asia and strengthened our CIB business via the partnership with Jefferies, a major investment bank in the U.S.

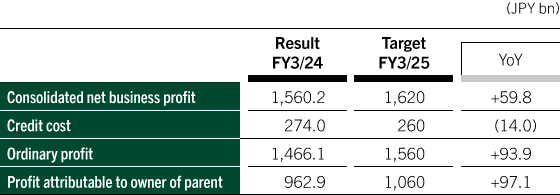

As a result, all of our Business Units produced solid growth, and combined with the positive environmental factors, such as the yen’s depreciation, rising stock markets, and plateauing of high interest rates in the U.S., we were able to generate consolidated net business profit of ¥1.5602 trillion, a year-on-year increase of ¥283.8 billion. This is a record figure for SMBC Group. Furthermore, we increased our target profit attributable to owners of parent during the fiscal year by ¥100 billion from the initial target of ¥820 billion and achieved a record figure of ¥962.9 billion, while proactively preparing for risks. I believe this proves that our core earning power is unquestionably improving.

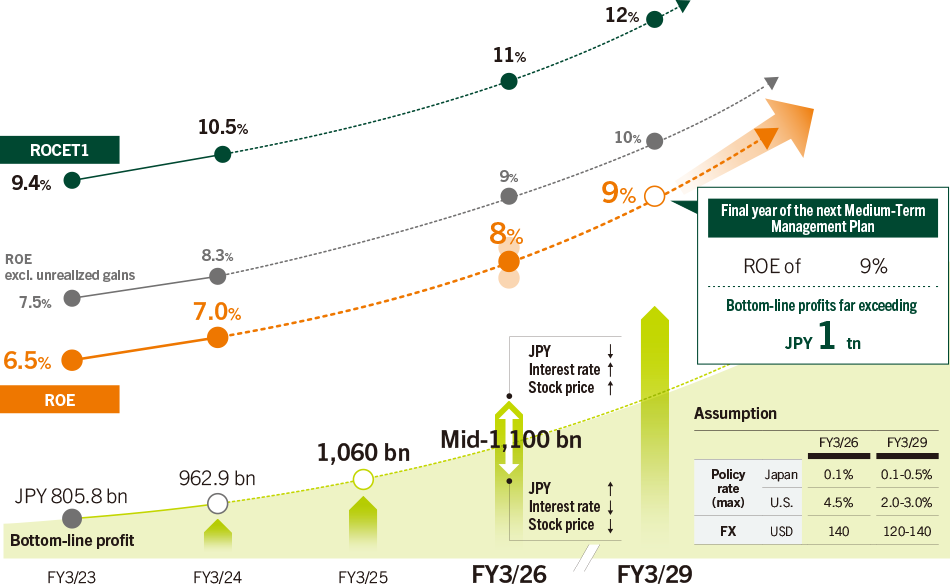

In addition, our ROE has improved due to the reduction in our equity holdings at a level which greatly exceeded our initial target and the reorganization of our business portfolio, including the sale of our U.S. freight car leasing business. FY2023 marked a strong start to the Medium-Term Management Plan.

Financial Targets for FY2024 and Financial Results to Achieve in Five Years Time

Our FY2024 targets for consolidated net business profit and profit attributable to owners of parent are ¥1.62 trillion and ¥1.06 trillion, respectively. If we are successful in our efforts, this will be the first time SMBC Group’s profit attributable to owners of parent exceeds the ¥1 trillion mark.

While we must continue to pay careful attention to volatility in the financial/economic environments and rising geopolitical risks, based on our desire to accurately communicate our goals in response to the feedback we have received from investors, we have set our financial targets for FY2024 with a mindset that we will proactively pursue upside opportunities under the assumption that the current robust business environment will continue. With the goal of achieving our financial targets, we will steadily carry out the various initiatives established under the Medium-Term Management Plan and further enhance our earning power while at the same time continuing to proactively address any applicable risk factors.

In addition, we are further raising our target of improving ROE given our current financial results and business environment, which is also a key theme in our Plan. Specifically speaking, we will aim to accomplish an ROE target of 8%, a target which was planned to be set for the final year of the next Medium-Term Management Plan, by FY2025, the final year of the current Plan. For FY2028, the final year of the next Plan, we will strive to achieve an ROE of 9%. As for profit attributable to owners of parent, the numerator of ROE, we will aim to achieve the mid- ¥1.1 trillion range by FY2025 and will strive to significantly exceed ¥1 trillion by FY2028.

Enhancing Corporate Value

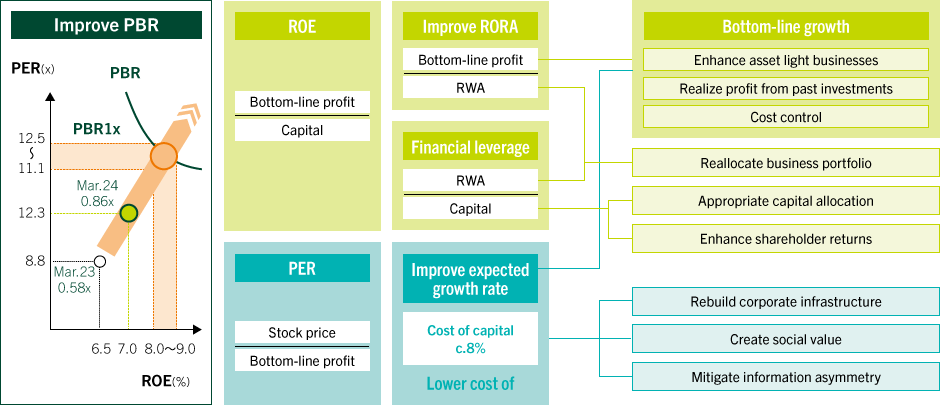

Increasing SMBC Group’s corporate value is one of our most important responsibilities. We will increase ROE by improving our Return on Risk-Weighted Assets (RORA) and controlling our financial leverage, while at the same time raising our PER by increasing our expected growth rate and controlling capital cost. Through such efforts, we will aim for a minimum PBR of one, with the intention to go even higher.

(1) ROE Focused Business Operations

To improve our ROE, we need to grow bottom-line profit, the numerator, while also controlling risk-weighted assets and applying our capital more efficiently by undertaking the dynamic reallocation of our business portfolio and optimizing capital allocation.

First, for growing bottom-line profit, we will focus on enhancing asset-light businesses which do not rely on our balance sheet, realizing the upside of existing growth investments, and controlling costs.

To enhance our asset-light businesses, on the domestic front we will expand and strengthen our finance/commission-based income while also acquiring liquid deposits by expanding our customer touchpoints and our customer base through a hybrid strategy which combines Olive and STOREs. In our wealth management business, we will increase assets under management by leveraging SMBC Group’s comprehensive capabilities by establishing a Group-wide control tower function that covers the entire value chain, from investment to consulting, so that we are able to capture the increasing opportunities arising from the growing trend of “from savings to asset formation.” For our overseas business, we will strengthen our CIB business by expanding collaborations with Jefferies to build a steady track record of collaborated deals.

In terms of our Multi-Franchise Strategy in Asia, we have reached the phase in which we must realize the benefits of the growth investments we have made so far. In the four target countries of the Strategy (India, Indonesia, Vietnam, and the Philippines) we will focus on the Post-Merger Integration(PMI)of our partner firms and strive to become a top-tier financial institution which has a firmly embedded, long-term presence in the respective countries.

In terms of cost control, the environment is becoming more challenging due to the yen’s depreciation and inflation, but there is no change in our policy of controlling our costs in a disciplined manner. To accelerate our business growth by allocating the necessary capital and expenses, we have increased the budgeted base-expense for the three-year period covered by the Medium-Term Management Plan from ¥130 billion to ¥160 billion. We are working on the reform of our domestic banking branches, consolidating shared Group functions, and applying AI to increase productivity and have also increased our planned cost reductions by ¥30 billion. Through such efforts, we plan to keep net base expenses flat over the Medium-Term Management Plan. In addition, we will carefully study the benefits of the allocated expenses to ensure that they lead to future top-line growth.

Regarding transforming our business portfolio and realizing the optimal allocation of capital, we will spread the mindset of improving ROE to all corners of SMBC Group and accelerate the reduction of equity holdings and low-profit assets. We will concentrate the resources that have been secured through these initiatives in strategic areas with growth potential (business with large and mid-sized corporations that will benefit from Japan’s regrowth, etc.) and strive to grow our business by proactively engaging in healthy risk-taking.

(2) Enhancing Our Expected Growth Rate and Controlling Capital Cost

Regarding enhancing our expected growth rate, a component of PER, we will focus on the payment business, Multi-Franchise Strategy in Asia, overseas CIB business, and other businesses where we can expect medium- to long-term growth while at the same time carefully explaining the progress and results of our respective initiatives and profit level goals to investors.

Regarding capital cost, we recognized it is approximately 8%, yet we are aware that market expectations are of an even higher level. We will address this gap by rebuilding our corporate infrastructure and creating social value.

To build robust corporate infrastructure, it is vital that we build stable IT infrastructure, promote Human Capital Management, and enhance our compliance/governance capabilities. For IT investment, we have increased the three-year budget of the Medium-Term Management Plan from ¥650 billion to ¥750 billion. We will proactively work to develop and adopt generative AI and other new technologies, while also making sure that we engage in the necessary investments for growth to develop new businesses and allocate the necessary resources to stabilize our IT systems. Investments in human capital for FY2024 at Sumitomo Mitsui Banking Corporation are expected to increase by 7% on a year-on-year basis. We will maximize our human resources by allocating resources to growth areas and securing personnel with the necessary expertise, strengthening training programs, and improving DE&I throughout our organization.

Create Social Value is also an initiative that contributes to the control of capital cost. The Medium-Term Management Plan has positioned Create Social Value as one of the key pillars of our business strategy, and we have established “Environment,” “DE&I/Human Rights,” “Poverty & Inequality,” “Declining Birthrate & Aging Population,” and “Japan’s Regrowth” as our materiality. In FY2024, we will further develop the necessary frameworks and have set an expense budget of ¥10 billion and an investment budget of ¥40 billion. By continuing to allocate a portion of our profit to initiatives to create social value, we will create a virtuous cycle with the pursuit of economic value.

Furthermore, we will consider enhancing our information disclosure, including our non-financial initiatives, to reduce the asymmetry of information through productive communications with investors.

Capital Policy

Basic Capital Policy

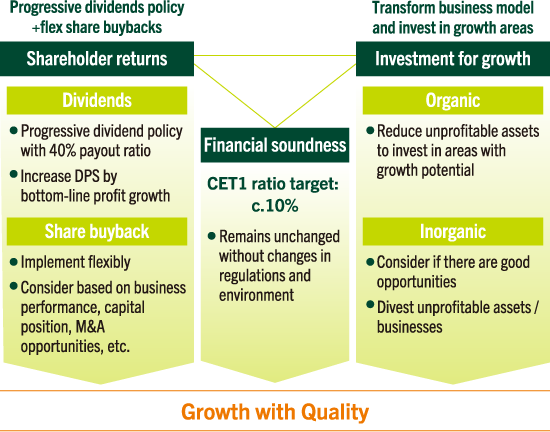

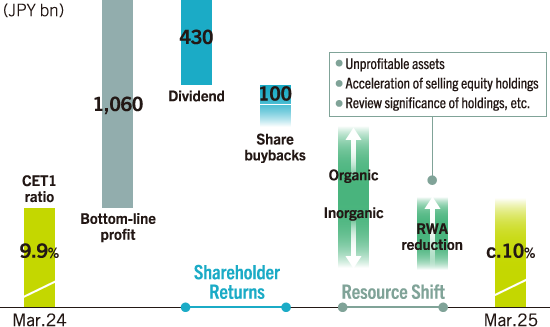

We will balance strengthening shareholder returns and investing for growth while maintaining financial soundness. Our Common Equity Tier 1 (CET1) ratio target, an indicator of financial soundness, has been set at 10%. Please note that this figure has been calculated taking into account the full implementation of Basel III reforms and excludes net unrealized gains on other securities. Achieving a 10% CET1 ratio will provide us with a buffer of 2% as it allows us to maintain the required 8% ratio under a variety of stress scenarios. The optimal allocation of capital is not only a key point in differentiating SMBC Group from our competitors in this robust business environment, but it is also an important factor in improving our ROE. Our CET1 ratio was 9.9% as of the end of March 2024, well within our target range, and we will continue to allocate our capital in a flexible and effective manner.

Enhancing Shareholder Returns

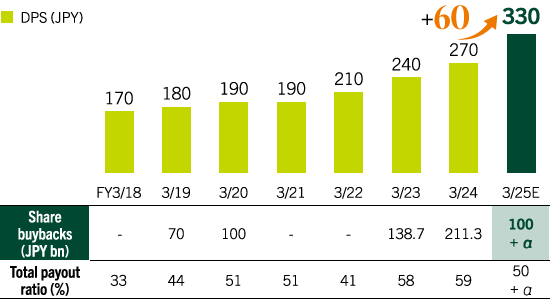

Dividends are our principal approach to shareholder returns. We will maintain a dividend payout ratio of 40% and continue to pursue a progressive dividend policy, which is to at least maintain, if not increase, dividend payments. Furthermore, we will increase our dividend payout by growing our bottom-line profit. Our dividend forecast for FY2024 is ¥330, a year-on-year increase of ¥60, SMBC Group’s largest annual dividend increase to date. In May 2024, we announced a share buyback program of ¥100 billion. We will consider additional share buybacks during the fiscal year based on our progress toward our financial targets, the status of our capital, opportunities for investment for growth, SMBC Group’s share price, and various other factors.

Investment for Growth

For our investment for growth, we will pay careful attention to capital efficiency, and focus on allocating assets to strategic areas that we expect to undergo high levels of growth. There is no change in our inorganic strategy’s two investment targets: “Investments with high capital/asset efficiencies” and “Investments that contribute to build a business platform to realize medium- to long-term growth.” In FY2023, we deepened our partnership with Jefferies and built up a healthy track record of successful collaborations. Regarding our Multi-Franchise Strategy in Asia, we built the foundations of our growth in the four target countries and will focus on PMI going forward. We will proactively pursue opportunities that will allow us to invest in the further growth of these platforms.

Reducing Equity Holdings

In the Medium-Term Management Plan, we set a goal to reduce our equity holdings by ¥200 billion over the Plan’s three years. In FY2023, the first year of the Plan, we succeeded in reducing our equity holdings by ¥134 billion. In FY2024, we will maintain this momentum and strive to reduce our equity holding by a minimum of ¥100 billion with the intention of achieving the Plan’s reduction target during the fiscal year. In addition, we will launch discussions regarding a plan to further reduce our equity holdings and make an official announcement during FY2024.

Furthermore, we will accelerate the pace of our reduction efforts so that we can reduce the market value of equity holdings to consolidated net assets ratio to below 20%, even though stock markets remain elevated.

Communicating with Stakeholders

Engaging in constructive discussions with investors and other stakeholders is an important mission for me as Group CFO because it provides me with the opportunity to identify matters that our stakeholders are interested in. The feedback I receive is shared with the Board of Directors and senior management team, and the Medium-Term Management Plan reflects this feedback. We also updated our strategies and disclosures based on the opinions, etc., we have received since the official release of the Plan. In addition, we will continue to expand and strengthen our initiatives aimed at creating social value by enhancing our disclosure concerning natural capital, human rights, climate change, and other non-financial information.

We will realize the sustainable growth of SMBC Group’s corporate value as a result of engaging in mutual communication and the proactive, timely disclosure in an easy-to-understand manner of topics in which stakeholders have a strong interest.