Create Social Value / Pursue Economic Value

We will solve social issues through our business and pursue the achievement of both social value and economic value.

We will contribute to the realization of “rich lives” and “Fulfilled Growth” for customers as we aim to be the financial group that people trust most in times of need.

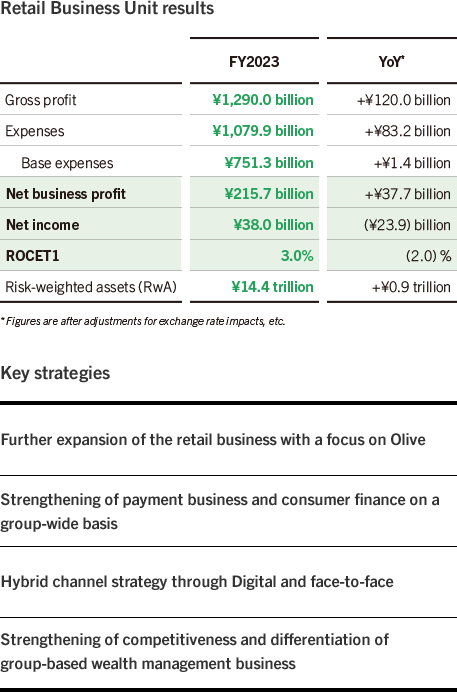

In the Retail Business Unit, top-class companies in their industries offer services that leverage the combined strength of the Group in key fields including the wealth management business, payment business, and consumer finance.

In FY2023, AM/foreign currency balance in the asset management business increased by ¥3.7 trillion to ¥17.2 trillion through integrated consulting by bank, securities firm, and trust company. In the payment business, sales handled increased by ¥4.6 trillion to ¥34.8 trillion, and in consumer finance, the finance balance increased by ¥0.2 trillion to ¥2.6 trillion amid recovery in consumption. Each of these businesses significantly expanded its results.

In FY2024 too, we will steadily enact measures in our major businesses to achieve our current Medium-Term Management Plan.

As we expect increased profitability from deposits due to higher interest rates, we will work to further expand our customer base and deposit balance through Olive, which has had a major social impact and for which we expect use to grow.

Our tackling of the Retail Business equates to creating social value and solving social issues associated with changes in Japan, such as the promotion of asset formation to boost asset management, the advance of a cashless society, and the arrival of the era of 100-year lifespans among the aging population. In the asset management business, we will back up healthy asset formation by individuals through the promotion of New Nippon Individual Savings Accounts (NISA) and finance/economics education seminars, while supporting the sustainable growth of Japan by supplying money to markets.

In the payment business, we will solve payment issues faced by businesses and consumers through “stera” and the new “V POINT” and, looking ahead to fully cashless payments at EXPO 2025 in Osaka, Kansai, will further raise the cashless ratio in Japan.

In the life shift business, we will eliminate the increasingly diverse concerns of elderly customers through our SMBC Elder Program and will solve social issues in the era of 100-year lifespans.

Through such efforts, we will contribute to “rich lives” for our customers and the realization of “Fulfilled Growth.”

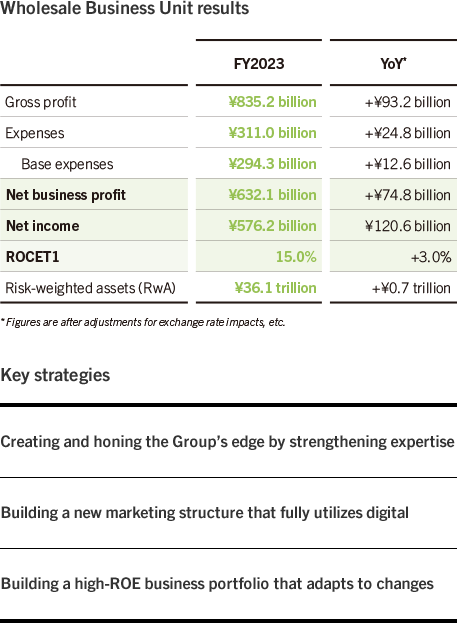

The Wholesale Business Unit contributes to Japan’s regrowth through the Group-wide provision of solutions that meet domestic companies’ diverse needs related to financing, asset management, payments, M&A advisory, leasing, and real estate brokerage services.

Under environmental changes on the scale of a paradigm shift, companies are ramping up their corporate actions. Amid this, we thoroughly addressed customers’ increasingly complex and sophisticated management issues to offer group-wide solutions, resulting in a significant increase in FY2023 profit. ROCET1 was also higher than initially planned due to our promotion of high value-added, highly profitable businesses such real estate and PE funds.

We expect that current environmental changes will continue to progress, and expect numerous business opportunities for SMBC Group. To maintain and increase our strong momentum, we will deepen cooperation within the Group as we aim to offer higher-value-added solutions to customers. In addition to aptly meeting diversifying needs for investment management and financing, we will strengthen our risk-taking in growth areas. We will steadily carry out the Medium-Term Management Plan that started in 2023 and build up medium- to long-term core businesses.

We believe that promoting business transformation for customers group-wide and driving Japan’s Regrowth will lead to the creation of social value. By supporting customers’ efforts to tackle issues such as decarbonization and transition and by solving issues through co-creation with customers, we will work to create social value for both customers and SMBC Group. Toward that end, we will engage in close dialogues with our customers on what social value means to them. We believe that such efforts will lead to sustainable growth for customers, and that the construction of ongoing relationships with those customers will allow us to also pursue economic value for SMBC Group. By orienting ourselves at an even higher level of inseparable social value and economic value, we will aim for even greater enhancement of our corporate value.

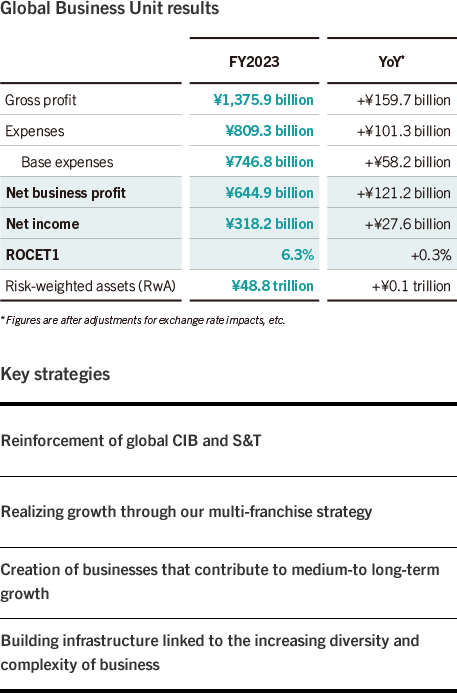

We will strengthen our extensive business portfolio, including global CIB and multi-franchise strategy, and invest resources in priority areas to lead the Group as a growth driver.

We aim to be a global solutions provider that contributes to both our domestic and overseas customers on group-wide basis.

The business environment remained volatile in FY2023 amid an environment of ongoing inflation and high interest rates in excess of expectations, along with the rise of geopolitical risks such as the prolonged Russia and Ukraine situation and destabilization in the Middle East. At the same time, as the first year of our Medium-Term Management Plan, we were able to lay a foundation for further growth in FY2023. Specifically, we steadily strengthened our Global CIB business by expanding our areas of collaboration with Jefferies and enhancing our securities products. In our U.S. business, key area of focus, we also opened the digital bank “Jenius Bank” in July 2023 and launched the retail business. In this way, we are capturing growth areas and steadily promoting business diversification. In our multi-franchise strategy, we successfully strengthened our platform in target countries. We made SMFG India Credit Company, a non-bank business with an extensive network of sites in suburban and agricultural areas of India, a wholly-owned subsidiary.

While making such efforts toward growth, we are also steadily advancing initiatives to prepare resources for growth accompanied by quality, including selling shares of U.S.-based freight car leasing company SMBC Rail Services and major Vietnamese commercial bank Eximbank as components of our portfolio review. Through such efforts, we achieved revenue, profit, and ROCET1 growth in FY2023, along with steady progress in infrastructure improvements that will lead to future growth. I feel that our efforts are yielding fruit.

To achieve growth in excess of initial plans, in FY2024 we will continue investing resources in priority areas and will agilely move forward with reviews of our business portfolio and business model in response to changes in the business environment. As our business scale expands, so do stakeholders’ expectations toward solutions to global social issues. To address issues including the environment, poverty and inequality, DE&I, and human rights, we aim to maximize our impacts on society by accumulating knowledge across the Group and collaborating to leverage that knowledge.

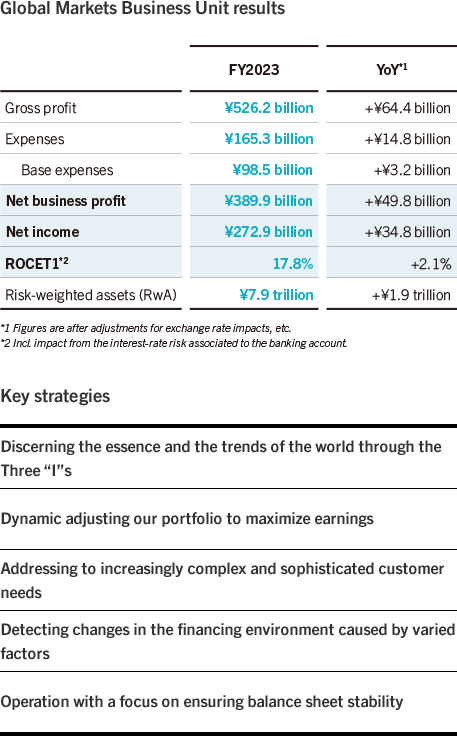

As market risk professionals, we aim to enhance our own risk-taking skills while continuously offering customers high added value.

The Global Markets Business Unit offers solutions through foreign exchange, derivatives, bonds, stocks, and other marketable financial products and also undertakes asset liability management (“ALM”) operations that comprehensively control balance sheet liquidity risks and market risks.

Our emphasis in this work is on analyzing the various phenomena that occur throughout the world based on the Three “I” s of Insight, Imagination, and Intelligence in order to forecast the market trends that will emerge in the future. In short, we emphasize the capacity to discern the underlying essence of world affairs.

Under paradigm shifts taking place against the backdrop of global fragmentation, everyone now faces a market environment of the like not seen for over three decades. Under a variety of scenarios, it is assumed that conventional ways of thinking will not hold. By adapting flexibly to this new environment and undertaking bold action with our gaze on the future, we will continue our unending evolution.

In FY2023, as the policy rate stopped rising in the U.S. and Europe while Japan steered its course toward the normalization of monetary policy, interest rates and stock prices fluctuated wildly in developed countries due to factors including market player expectation. Amid this, our portfolio management steadily captured investment opportunities while properly controlling risks, recording a profit as a result. We also supported customers’ funding needs through stable foreign currency funding and strengthened our S&T global collaboration to provide customers with optimal solutions.

We will actively engage in not only pursuing such economic value but also creating social value. In addition to GX support, as exemplified by the green bond issuances we have been offering, we will support “Fulfilled Growth” for customers and employees by undertaking initiatives in new fields including enhancement of financial literacy for society overall and revitalization of the asset management industry.