Multi-Franchise Strategy that Supports Future Growth

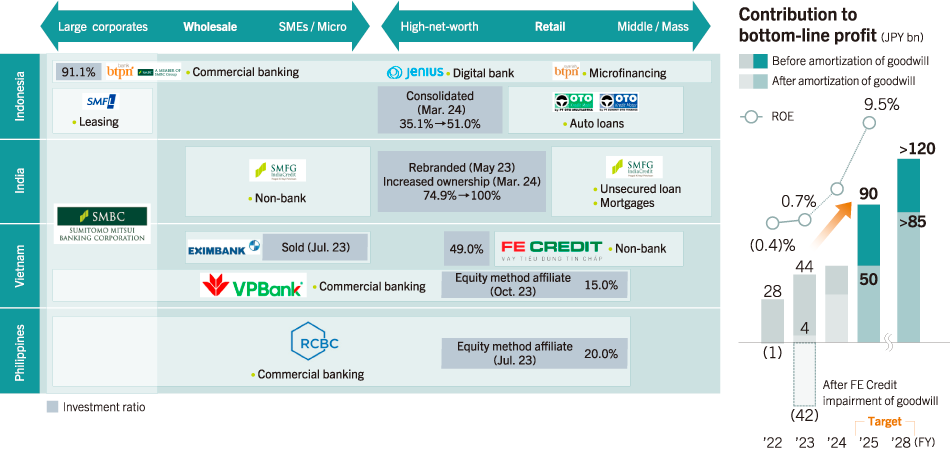

SMBC Group has set out a “multi-franchise strategy” targeting India, Indonesia, Vietnam, and the Philippines. We aim to create a “second and third SMBC Group” by developing full-line banking services, including retail operations, in emerging Asian countries where high growth is expected.

Under our previous Medium-Term Management Plan, we invested in and acquired partner companies overseas and laid a foundation for growth in all of the target countries. To solidly harvest the fruits of future growth, under our current Medium-Term Management Plan we will draft and implement appropriate strategies rooted in local areas.

To accelerate the realization of our multi-franchise strategy, in FY2023 we brought Fullerton India under the SMFG brand through a change of name to SMFG India Credit Company, and made the company a wholly owned subsidiary through additional investment. We made RCBC in the Philippines and VPBank in Vietnam equity-method affiliates through additional investment, and made auto loan company OTO/SOF in Indonesia a consolidated subsidiary.

We will continue to focus on post-merger integration (PMI) to draw out the countries’ high growth potential. In business aspects, we will go beyond one-on-one collaboration between SMBC Group and investee companies to further tackle the creation of synergies by means including SMBC Group financing support and two-way customer referrals, collaboration on products for which Sumitomo Mitsui Banking Corporation enjoys global strengths, and knowledge sharing and human resource development support.

In the area of governance, we dig deeply into local companies’ management and build governance structures through the dispatch of personnel from Sumitomo Mitsui Banking Corporation and through participation in companies’ Boards of Directors. We also introduce global standards while respecting local legal systems and business customs.

Through such measures, we will pursue sustainable growth and further contributions to profit. Under our multi-franchise strategy, we will tackle the creation of value by supporting social self-sufficiency and promotion of financial inclusion for the poor in emerging countries through microfinance, financial education, and other means.

India

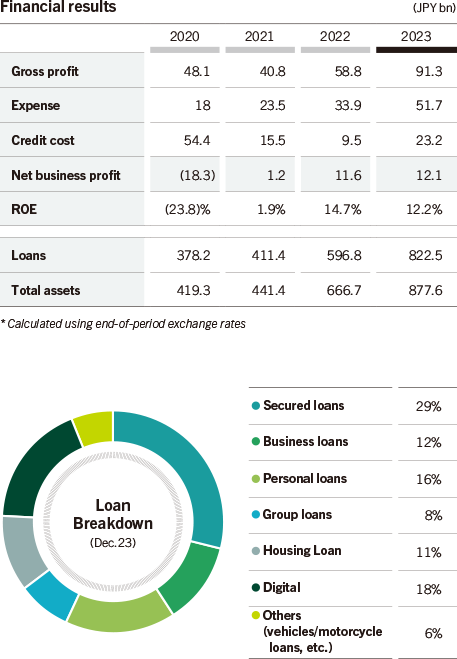

SMBC Group operates SMBC branches in India, offering wholesale banking services with focus on large corporates. India became the world's largest population in 2023 and expected to achieve average annual GDP growth of about 7% through 2030. India is expected to be the world’s 3rd largest economy in 2028 SMFG India Credit Company Limited (“SMICC”) is a non-banking financial company (“NBFC”), having a subsidiary Home Finance Company, and provides financial services to small and medium-sized enterprises and individuals. SMBC Group made SMICC a consolidated subsidiary in 2021 and a wholly owned subsidiary in 2024 to capture opportunities for growth in small and medium-sized enterprises, retail markets, and expand our business in India. SMBC Group will contribute to further advancement of financial industry in India through this action, while working on building the platform of a full-line financial service that includes retail business.

The article in next page features a dialogue between Shantanu Mitra, SMICC CEO, and Takeshi Kimoto, Head of Asia Business Development Division, about SMICC's strengths, future business prospects in India and collaboration with SMBC Group.

Shantanu:India's economy has made a strong recovery from COVID-19, and high economic growth is expected from here on. We believe that non-banks will play a major role in supporting the small and medium-sized enterprises and individual consumers driving this economic growth.

India is a diverse nation comprising 28 states and 8 union territories, each of which embraces different cultures and languages. SMICC is one of the top 10 diversified NBFCs in India. It has been operating for more than 15 years and has specific business models designed to serve rural and urban retail consumers, small businesses and affordable home loan seekers. As a non-bank, SMICC plays an important role that supplement the country's network of banks in addressing the diversity of regions and in making financial services available to all.

SMICC provides financial services in the four segments of urban, rural, digital, and home finance, with about 70% of our branches located in cities with a population of less than 100K. Our strength lies in establishing a business model with deep local roots. SMICC also places a strong focus on training of employees and providing fast and seamless credit closely aligned with customers in semi-urban and rural areas. Through many years of lending experience rooted in local communities, we have built unique knowledge and know-how while differentiating ourselves from our competitors.

Kimoto:Rising income and consumption among individuals and business expansion by small and medium-sized enterprises are expected to drive the growth of India's economy. In this context, SMICC aims to serve customers across all of India, including rural areas, and through this, SMBC Group also aspires to grow alongside India. To achieve this, SMBC group will support the enhancement of SMICC’s funding capabilities and leverage the Group's customer base to promote SMICC's financial services to increase our competitiveness in India. In doing so, we recognize that one sector with particularly high growth potential in India is digital business, an area in which SMICC is also active. What are your thoughts on the growth potential of the digital field in India?

Shantanu:Digitalization is progressing steadily in India across sectors and specifically in financial services. A trigger for this was the identity verification system introduced by the government in 2009, under which every citizen is issued a unique ID. Building on the foundation of this system, the digitalization of economic activity has made great progress, and cashless payments have become widespread. Supported by this, digital lending in India is expected to keep on growing.

SMICC actively promotes collaboration with reputed financial technology companies. Drawing on customer databases aggregated by partner companies, we can now more easily acquire new customers and provide loan services. We are putting the digital solutions of financial technology companies to good use in offering our financial services to a wide range of customers.

Kimoto:As you suggest, it is very good that people in areas where financial services have not been readily available are now able to tap into those services through the use of digital and technology. SMBC Group's Medium-Term Management Plan includes "Poverty & Inequality" among the materialities that we need to proactively address. SMICC's services can be seen as truly supporting financial inclusion. SMBC Group, too, hopes to contribute to solving social issues by working with SMICC to enhance the convenience of digital platforms and provide microfinance to rural areas.

Shantanu:I appreciate you saying that. We also recognize the improvement of financial literacy, the employment of women, and the solving of environmental and social issues as important parts of our mission as a company. I think that these are shared in part with the material issues that the SMBC Group plans to address. As one of our social contribution initiatives, we supports health maintenance for cattle to stabilize the income and improve the lives of families engaged in dairy farming. We are also making efforts in the creation of employment opportunities for women in rural areas and contribute to the mission of elimination of poverty and inequality. Solutions to environmental issues, such as mangrove tree planting, are another area of focus for us. We are convinced that every such effort will contribute to our vision - Create Social Value.

“Pashu Vikas Day” cattle healthcare event in agricultural areas of India

Kimoto:In 2024, SMBC established "social deposits," by which funds deposited by customers are allocated to projects that address social issues, such as projects to improve health care or reduce poverty. Although we have just begun with these efforts, we believe that including such activities of SMICC will help in realizing Create Social Value on a global scale. As such, we will continue exploring new opportunities to offer support in our collaboration with SMICC.

Shantanu:I am pleased that SMBC Group and SMICC are able to have synergies in the creation of social value as well as in the pursuit of economic value, supporting the advancement of the financial industry in India. In terms of economic value, we intend to leverage SMBC Group's customer base to advance solutions such as supply chain finance to corporate customers that have supply chains in India. Overall, we plan to double our loan assets over the next three years and raise our ROE from about 12% in FY2023 to over 18% in FY2024.

SMICC follows a very customer-centric approach. The products cater to the unique needs of the respective customer segment. The branch network and the distribution channels are also aligned to the customer segment. We plan to continue to expand our network of branches and be present in every local market relevant to lending business.

Kimoto:Through regular communication with SMICC's leadership team, we share insights gained domestically and internationally and seek best practices, which I feel has deepened our group collaboration over the years. SMBC Group will continue accelerating our collaboration with SMICC as we aim for realization of growth with quality. In the area of contribution to profit (before amortization of goodwill) from multi-franchise partner companies in Asia, we aim to achieve ¥120 billion by FY2028. SMICC is expected to play a central role in this effort, contributing 30-40% to the goal. Toward the achievement of this target, SMBC Group will proactively collaborate as both a shareholder and a business partner.

Message from Co-Head of

Message from Co-Head of

Asia Pacific Division

Rajeev KannanManaging Executive Officer

Co-Head of Asia Pacific Division

Chairman of the Board of SMICC

SMBC Group’s Business Strategy in Asia Pacific

SMBC Group operates an extensive network of branches, bank subsidiaries and securities and leasing entities in Asia Pacific. In the last five years, we doubled our region’s top line by leveraging our network and providing value-added solutions to our corporate and institutional clients. By deepening client relationships and enhancing sector expertise, we increased both lending and non-lending revenue in Asia Pacific, the fastest-growing region globally.

As a market leader in ESG, we are dedicated to helping our clients achieve their sustainability goals while expanding our green finance portfolio. Data and digital innovation remain as key drivers for enhancing operational efficiency and client engagement across our operations. We are committed to fostering economic stability and environmental sustainability for both today’s and future generations.

Through our investments into our multi-franchise entities in India, Indonesia, Vietnam and Philippines, we have expanded our customer base to retail and SME segments and enhanced solutions for our core clients. We anticipate increased collaboration and synergies across our internal ecosystem enabling swift market expansion, ROE-accretive growth and meaningful social value creation ahead.

Collaboration between SMBC’s Branches and Multi-Franchise Entities

Our aim is to build a more granular support system for our customers seeking to expand their business in Asia Pacific. By strengthening cooperation with our multi-franchise entities, we will have an expanded service offering including supply chain financing for our corporate clients, pay-roll management, dealer, equipment and vehicle financing.

Recognizing the importance of innovation, we launched the Asia Rising Fund to provide early-stage funding to regional ventures and catalyze collaborations with our multi-franchise entities. This drives digital innovation and supports the financial sector’s growth in the region.

Message as Chairman of the Board of SMICC

As a young banking professional in India before joining SMBC in 1997, I am proud to be part of the Group’s development in Asia Pacific. I am also excited by SMBC Group’s growth aspirations in India, driven by economic factors like a growing middle class and expanding trade and investment flows.

Having completed 100% acquisition of shares in March 2024, SMICC along with the branch banking platform will be our twin engines of growth in India. As a provider of loan and credit services for retail, housing and SME segments, SMICC aspires to become one of the top NBFCs in India.

In mid-2024, SMICC launched its new brand campaign “Pragati hi Aapki Nayi Shakti Hai” (progress is your new power) emphasizing their commitment to empower progress seekers. This resonates with SMICC’s philosophy of supporting aspirations in rural and urban communities through various loan options to support their advancement.

Vietnam

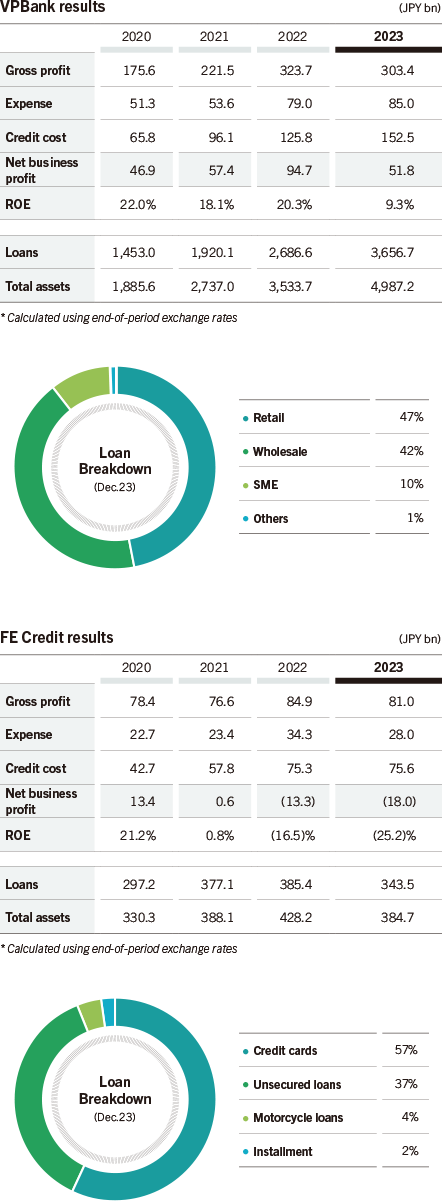

In Vietnam, we made FE Credit’s parent company VPBank an equity-method affiliate in October 2023 through a 15% investment.

FE Credit is an equity-method affiliate in which we invested in October 2021. The firm’s credit-related expenses increased and its new lending decreased under economic slowdown in Vietnam, but SMBC Group is providing ongoing support by strengthening cooperation with FE Credit’s parent company VPBank. We will continue to strengthen financing capabilities by drawing on the creditworthiness of SMBC Group and to strengthen governance through personnel support, and will work with VPBank to support reinforcement of FE Credit’s management foundation.

We have introduced VPBank to SMBC's customers that are Japanese multinationals doing businesses in Vietnam. We provide customers with services unique to local financial institutions, such as supply chain finance and dealer finance, and support the expansion of VPBank’s business.

We will continue to deepen collaboration between SMBC Group and both VPBank and FE Credit, with the aim of strengthening our business foundation and expanding our presence in Vietnam.

Indonesia

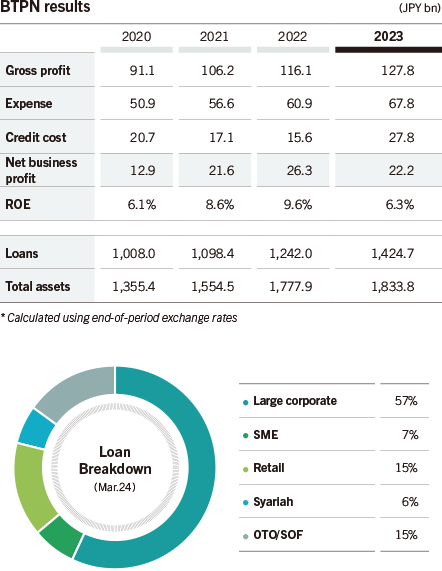

In Indonesia, we made Bank BTPN, the foothold for our multi-franchise strategy, an equity-method affiliate in 2013. In 2019, we made Bank BTPN a consolidated subsidiary through merger with Bank Sumitomo Mitsui Indonesia, which has strengths in the wholesale business, and thereby created a full-line commercial bank. It has since grown to the 10th largest bank in Indonesia, with total assets approaching ¥2 trillion.

We are currently accelerating digital strategies including our digital banking service “Jenius” and our digital service for SME customers “TouchBiz.” In March 2024, we made auto loan company OTO/SOF a consolidated subsidiary and will also strengthen the retail business through joint financing, mutual customer referrals, and other means with OTO/SOF.

We will expand business in other countries by deploying our multi-franchise strategy know-how gained in Indonesia, including know-how of processes for enhancing governance structure and the supply chain business drawing on the corporate customer base of SMBC Group.

The Philippines

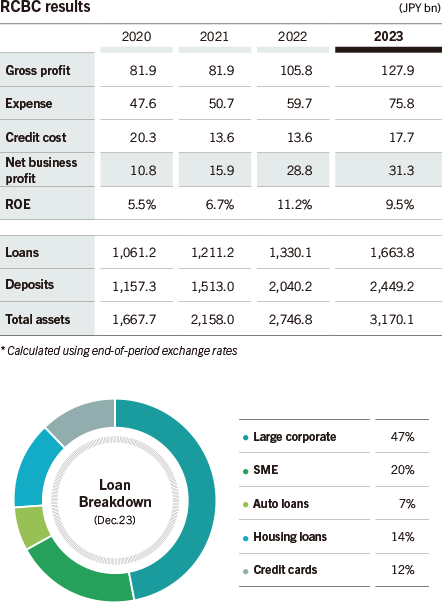

We made our first investment in RCBC in the Philippines in 2021, followed by additional investment in July 2023 that made the company an equity-method affiliate. The capital increase and financing support by SMBC Group have yielded fruit. RCBC’s lending balance increased steadily in FY2023, achieving revenue and profit growth.

We are meeting a wide range of needs through cooperation with RCBC, including the proposal of solutions involving RCBC to SMBC Group customers that require local financial services in the Philippines.

As an example, RCBC has introduced captive finance campaigns and residual value-based auto loans planned and developed with SMBC Group, and is steadily growing its number of contracts.

Together with SMBC Group, we are also undertaking social contribution activities such as financial literacy enhancement programs for the employees of business partners.

We will continue invigorating collaboration with SMBC Group to further expand our presence in the Philippines.