Note:Departments and posts are as of the time of the interview

(May 2019)

In February 2019, BTPN Syariah joined SMBC Group through the merger process of PT Bank BTPN Tbk, the parent bank of BTPN Syariah, and PT Bank Sumitomo Mitsui Indonesia.

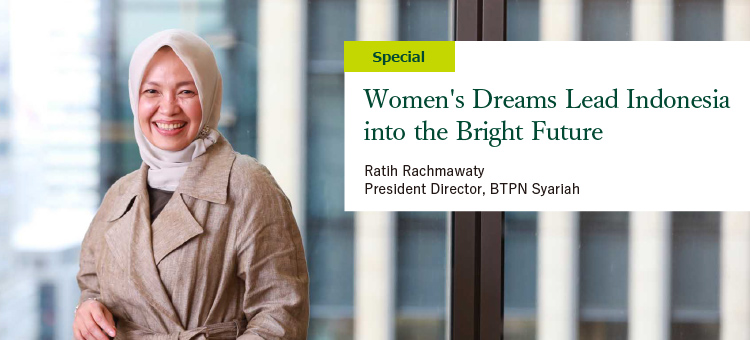

In this interview, Ratih Rachmawaty, President Director of BTPN Syariah, walks you through the company's unique business model and the philosophy behind it, as well as her personal vision as a female leader.

A bank especially

for productive low-income women

I have been in the banking business for 24 years and had fortunate opportunities to visit banks around the world, such as in Peru, Mexico, Bangladesh, and India to learn the proven business model of microfinancing. Indonesia is home to 265 million people and 114 banks. However, before our business was established in 2010 as Syariah Business Unit of BTPN, there was no bank serving micro business owners―the bottom of the socio-economical pyramid. We call this segment “productive low-income” who are living on 1.5 dollars a day per person. About 70% of people in this segment have never borrowed from banks due to the complex procedure, lack of collateral, distance from the bank, and so on. For the same reasons, banks typically consider them not bankable.

The question here is “which one should change first?” We knew that it would be faster to create a bank specifically for the productive low-income segment, rather than just waiting for them to be bankable. This paradigm shift was needed to dispel the myth about the “unbankable” segment. Against this backdrop, we started our business aiming for the best financial inclusion to empower the bottom of the pyramid and make a difference in the lives of millions of people.

Our basic philosophy is to empower women to empower society from the bottom up. Research conducted around the world states that the first entry point is always the mothers when exploring the potential of the most economically marginalized segment in society. This is because mothers generally seek a better life for their families when they get additional income. Their focus is on healthier food, more decent housing, and higher education for their children, which will become a driving force of local economic growth. Therefore, as bankers, we decided to provide loans for micro businesses run by these mothers.

Engaging customers

in the one and

only approach

Our unique loan system does not require any collateral or security; all they need is to meet up with our field officers every two weeks. By doing so, we can determine if the person possesses the character that deserves getting a loan. We have over 10,000 field officers engaging micro business owners and all of them are trained female high school graduates. Their most important job is to ask the mothers’ dreams and help nurture them. Normal banks would ask the customers about their collateral, financial records, certificates, etc. in their screening process. But for our customers, the only thing you can validate is their dream. Our field officer asks, “what is your dream?” And mothers would answer, for example, “I would like to give a better education for my children.” Then the officer continues the dialogue until they find out the optimal approach to achieving their dream.

We believe that poverty comes from people's mindset and set the four key characteristics required for success: Courage, Discipline, Hard Work, Solidarity. These are the characteristics that keep you moving on. People who lack those characteristics cannot make their lives better and often remain poor. In order to cultivate these four characteristics, we provide our own Empowerment Program, where we offer the customers not only working capital but also training on various entrepreneurial skills such as financial literacy and product marketing. As most of our customers have no formal education, we need to invent more a creative teaching method that is easy to understand. For example, we are using four colored envelopes to teach practical cash management. Each day, they need to put money for their daily meals in the first one; then the money to pay loan installments in the second one; then daily working capital in the third one; and finally the remaining in the fourth one as savings. The order of the four envelopes indicates the order of priority. In this way, they can learn how to ensure they have income every day and to give their daily meals top priority so that their family won’t starve. If they manage to keep some money left over in the fourth envelope, the money will eventually make their dreams come true.

Hopes and ambitions for the future

Doing business is the same as life; it has many ups and downs. Our program is designed to inspire the mother entrepreneurs to cherish their dream even when they are down, always being courageous and working as hard as possible.

Since its initiation, our program has made the path clear for Indonesian women to build their business success and increase their income. As a result, a greater number of mothers are now able to pursue their dreams, send their children to school, and gain opportunities to participate in society. We have many inspiring stories where passionate women succeed in improving their overall quality of life.

As a woman and a mother of two children, it is my honor to participate in nurturing the dreams of mothers across Indonesia. I strongly believe that empowering women leads to the empowerment of the families, and eventually the entire society. Being a senior officer at BTPN Syariah, I hope to serve as a role model myself for my children and the next generation of female leaders.

Women’s empowerment is a key factor of its business model, yet BTPN Syariah also remains true to the principle of the banking business; the pursuit of profit. Being considered as one of the most profitable banks in Indonesia, the company proves that a bank can enhance both performance and social welfare at the same time. Going forward, as part of SMBC’s mid- to long-term growth strategy to seize the opportunities in emerging Asian markets, BTPN Syariah will utilize the group synergy to expand its business model throughout and beyond the country.

About BTPN Syariah

As part of the group’s growth strategy in Asian markets, BTPN Syariah is playing a key role in diversifying the group’s service portfolio in Indonesia to cater to broader customer needs, with a special emphasis on the empowerment of local women.

Key figures

-

Active customers

-

Employees

-

Of the subdistricts in Indonesia served

*As of December 31,2018