BTPN was established in 1958 to handle the pensions of retired military personnel. BTPN focused on providing financial education and services to retirees, micro-, small, and medium-enterprises, and people residing in rural areas who did not possess a bank account. Through such efforts, BTPN deepened its footprint in Indonesia as a commercial bank with a robust presence in the mass market segment.

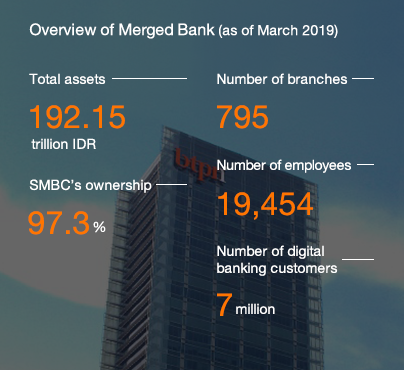

BTPN also developed a reputation as one of Indonesia’s most innovative banks. While Indonesia’s population exceeds 260 million, an estimated 50% of its adult population does not possess a bank account. Given such an environment, BTPN was quick to focus on expanding its digital services in line with the rapid spread of mobile phones and smartphones, launching its mobile banking service “BTPN Wow!” in 2015. The aim of BTPN Wow! is to provide affordable, safe, and convenient financial services to the many people who do not possess a bank account. The number of BTPN Wow! users have now exceeded 6 million. “Jenius,” a mobile banking service for smartphones that targets the middle-class, was launched in 2016. The number of Jenius users exceeded 1 million by the end of the service’s second year.