Forged through more than six months of coordination, the contractual law covered bonds were an amalgamation of the high-level expertise of SMBC Group in the areas of banking, securities, and trusts. Covered bonds have a history of more than 250 years in Europe, and there have been attempts to introduce these bonds into Japan for over a decade. However, the issuance of such bonds in Japan was deemed to be impossible due to the legal restrictions. It was the passion of the team to overcome these restrictions and realize the issuance of covered bonds in Japan that drove this undertaking to success. This accomplishment made waves throughout the market and legal community in Japan and overseas, with some going as far as to compare this innovative idea with the egg of Columbus. We hope that this Aaa-rated scheme of foreign currency funding will find a wider range of use throughout the market as a low-cost, stress-resistant foreign currency funding method and come to contribute to the stabilization of the foreign currency funding of Japanese financial institutions going forward.

SMBC Group Annual Report 2019

Special Feature:

Issuance of Japan’s First Contractual Law Covered Bonds

SMBC has succeeded in issuing Japan’s first contractual law covered bonds. In this section, we will explain the background and the significance behind the arrangement and issuance of these covered bonds, which entailed overcoming the challenges presented by a lack of legal frameworks in Japan in comparison with Europe.

Realization of a New Method of Foreign Currency Funding

The prolongation of low interest rates in Japan is placing downward pressure on the profitability of domestic businesses. This situation has prompted SMBC to bolster its overseas operations, causing the balance of outstanding loans overseas to quadruple over the past decade and climb above ¥20 trillion. In response to this increase in foreign currency-denominated assets, SMBC ramped up its foreign currency funding by working to increase customer deposits and issuing senior unsecured bonds. We also looked to diversify our foreign currency funding methods through the issuance of Australian dollar-denominated bonds and green bonds as part of our efforts to realize stability in foreign currency funding.

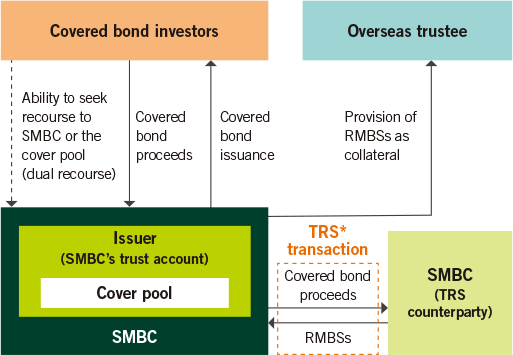

The issuance of covered bonds was one new initiative that drew our attention in this undertaking. Covered bonds are a type of secured corporate bond originating in Europe that are generally issued with collateral provided in the form of a pool of housing loans and other low-risk assets (cover pool). Should the issuer default, investors are able to seek recourse to the issuer and are given priority access to recourse to the cover pool above other creditors. This dual recourse framework is a major characteristic of covered bonds. These bonds also feature other investor protection provisions, such as requirements that the issuer maintain an amount of collateral in excess of the outstanding principal amount of the bonds. These bonds are commonly issued overseas, with legal frameworks pertaining to covered bonds in place in various European and other countries. However, such frameworks do not exist in Japan, and there are no prior cases of covered bonds being issued in this country. It was against this backdrop that SMBC sought to arrange and issue covered bonds as a new method of foreign currency funding.

Goals of Covered Bond Issuance

SMBC turned its attention to covered bonds with two main goals. The first goal was to realize a foreign currency funding method that is highly viable under extraordinary circumstances, such as those of high market volatility. In Europe, the financial crises seen in the 2000s and forward underscored the importance of covered bonds as a viable foreign currency funding method for use when conditions are extreme, spurring an increase in the utilization of such bonds. The worldwide balance of outstanding covered bonds stood at €2.5 trillion, and the total amount of covered bonds issued in 2017 climbed as high as €445.0 billion.

The second goal was to diversify our investor base. Until now, attracting central banks, government institutions, and other such investors into our conventional senior unsecured bonds has proven difficult. This difficulty arises from the tendency of such investors to only invest in highly rated bonds, such as government bonds and the bonds of government agencies. The ratings assigned by rating agencies display the reliability of bonds. Our senior unsecured bonds will never be able to exceed the ratings of Japanese government bonds. Covered bonds, however, can achieve ratings that are higher than those of Japanese government bonds, thereby enabling us to expand our investor base.

Creation of Revolutionary Scheme for Issuance

The greatest obstacle to arranging covered bonds in Japan was the establishment of a dual recourse framework. In Europe, there are legal frameworks in place ensuring that the cover pool is not affected by bankruptcy proceedings (separation of cover pool from bankruptcy). The legal frameworks in Japan, however, were thought to obstruct the development of dual recourse frameworks.

Breaking away from such preconceptions, we made it possible to realize the separation of the cover pool from bankruptcy through the use of a revolutionary scheme that uses the close-out netting principle by applying the Japanese Netting Act of Specified Financial Transactions Conducted by Financial Institutions should the issuer default. However, the ability to fulfill the necessary requirement to issue covered bonds did not guarantee that there would be demand for this product from investors. SMBC’s covered bonds differ from conventional covered bonds in their application of the aforementioned Netting Act and in their use of residential mortgage-backed securities (“RMBS”s) for the cover pool. In light of these differences, it was unclear whether investors would welcome these bonds. For this reason, we took steps to gather input from a wide range of investors, including central banks, government institutions, asset managers, and banks, and ongoing discussions were held on how to reflect this input into the structure. This process led us to judge that investors would be receptive toward the following structure, which was then used to issue Japan’s first contractual law covered bond.

Total return swap, a derivative transaction in which the principal is swapped together with the economic gains (losses) of an asset

Low-Cost Foreign Currency Funding from a Wide Range of Investors

SMBC’s euro-denominated contractual law covered bonds received a rating of Aaa from Moody’s Investors Service, Inc., which exceeded the rating therefrom of A1 assigned to Japanese government bonds. SMBC Group thus gained a method of foreign currency funding at interest rates that are lower by 0.35% compared to the rate of the euro-denominated senior unsecured bonds issued in July 2018.

Our contractual law covered bonds were issued in late October 2018, at the same time as the slump in the senior unsecured bonds market that followed market volatility stemming from the downgrading of Italian government bonds and the trade friction between China and the United States. These covered bonds exhibited their viability as a foreign currency funding method under extraordinary circumstances as we were able to raise a sufficient amount of foreign currency funding, despite the adverse market conditions.

Of the investors that purchased SMBC’s covered bonds, 42% were fixed income asset managers. The next largest group was comprised of central banks and official institutions, which accounted for 22% of all investors, a substantially higher level than would have been seen for our conventional senior unsecured bonds. This figure is evidence that these bonds have enabled us to incorporate a group of new investors into our investor base that was previously out of reach. In this manner, the contractual law covered bonds achieved their initial goal by making large contributions to the expansion of our investor base.

Amalgamation of SMBC Group’s High-Level Expertise