Business Strategies for Creating Value

The Global Business Unit supports the global business operations of domestic and overseas customers by leveraging SMBC Group’s extensive global network and products and services in which we possess strengths.

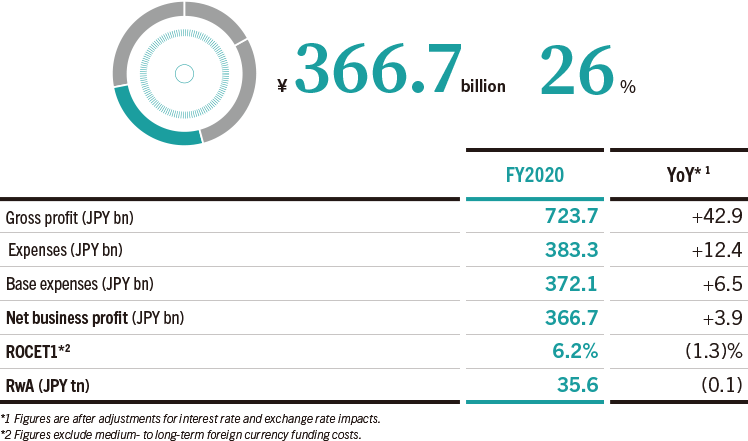

In FY2020, the COVID-19 pandemic became normalized throughout society. Despite the difficult operating environment seen centered on operations in Indonesia and aircraft businesses, the Global Business Unit achieved growth in consolidated net business profit through a concerted Group effort to meet customers’ funding needs and to flexibly implement the measures prescribed by the Medium-Term Management Plan in response to the changing operating environment. Thus, we feel that the unit achieved a high degree of success in the first year of the plan.

In FY2021, the second year of the Medium-Term Management Plan, we will maintain a consistent course with regard to implementing our priority measures. At the same time, we will seek to advance our business activities with an appropriately balanced focus on growth fields, such as sustainability and digital technologies, to accelerate our evolution to a global solution provider proficient at addressing customers’ management issues.

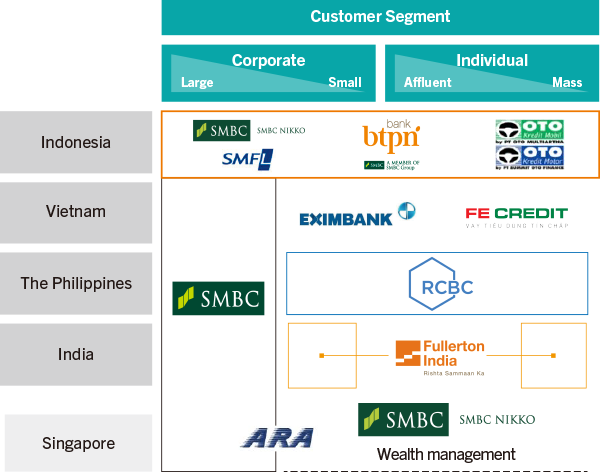

One specific area of focus will be bolstering overseas securities, a business where there is substantial room to grow from the perspectives of business lines and customer base expansion, in order to accelerate initiatives in our corporate investment banking business, which merges our banking business with our securities business. We thereby aim to enhance our ability to propose solutions in response to the various corporate events of customers. Meanwhile, we will work to develop foundations for medium- to long-term growth in Asia by advancing inorganic growth strategies in Vietnam, the Philippines, and India. The goal of these strategies will be to establish a franchise capable of providing a broad assortment of services to customers ranging from individuals to large corporations.

The Global Business Unit also recognizes that customers are ramping up climate change and other ESG initiatives. We are responding by augmenting our advisory functions for sustainability fields and boosting our capacity to provide solutions for issues faced in ESG strategies. At the same time, we are strategically developing digital businesses to address the rise in needs related to non-contact interactions seen amid the COVID-19 pandemic. Meanwhile, in the trade finance field, an area of strength for SMBC Group, we aim to develop digital platforms a step ahead of the competition to provide new settlement and finance methods.

Through these initiatives, we will advance a concerted Group effort to achieve sustainable growth in high-growth-potential overseas markets.

Contribution to Consolidated Net Business Profit (FY2020)

PRIORITY STRATEGY 1

Reinforcement of CIB Business

The Global Business Unit is accelerating initiatives in its corporate & investment banking business, which merges its banking business with its securities business.

Banks and securities are becoming increasingly linked on a global basis, and thus there has been a rise in opportunities to provide advisory services pertaining to cross-border M&A activities by Japanese and non-Japanese companies. By enhancing coordination in global sectors, we will leverage the strengths of our product capabilities and global network to better propose solutions in response to customers’ business portfolio reconstruction and other management issues.

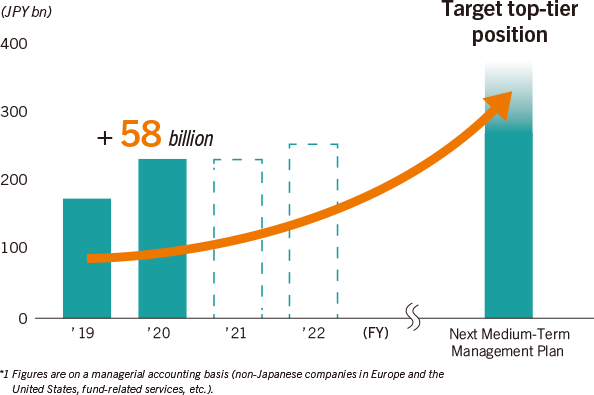

Furthermore, we are enhancing our overseas securities services, which have significant potential for growth, to strengthen core functions for making our corporate investment banking business more sophisticated. Particular areas of focus include developing bond sales and trading businesses and selectively expanding customer base in the United States to develop a stronger market presence.

Gross Profit in Corporate Investment Banking Business in Europe and the United States*1

PRIORITY STRATEGY 2

Initiatives in Growth Fields in Asia and Other Markets

In pursuit of medium- to long-term growth in Asia, the Global Business Unit is developing a financial franchise that supplies services to customers ranging from individuals to large corporations.

Our operations in Indonesia were impacted by the COVID-19 pandemic in FY2020. Regardless, there has been no change to our policy of developing growth foundations centered on Bank BTPN, and we are advancing our business in this country through means such as enhancing digital banking and approaching the middle-income demographic. In FY2021, we announced investments in non-banking companies in Vietnam and India and in a commercial banking company in the Philippines. Going forward, we will expand our platforms for operations targeting SMEs and for retail businesses.

Other initiatives included efforts to expand into new business areas such as asset management through investment in ARA Asset Management of Singapore, an increase in our stake in Ares Management Corporation in the United States, and other means.

Expansion of Financial Franchise in Asia

PRIORITY STRATEGY 3

Establishing Business Foundations That Meet the Needs of a Global Financial Group

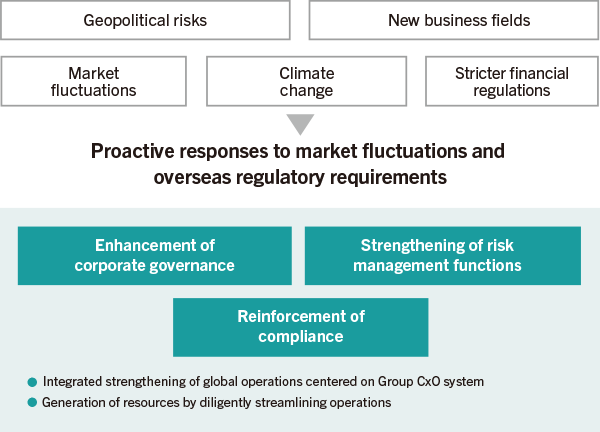

In response to market environment changes, rising geopolitical risks, and the implementation of stricter financial regulations, the Global Business Unit continues to prioritize the allocation of resources to areas such as corporate governance, risk management systems, and compliance. Efforts to support SMBC Group’s overseas businesses and achieve sustainable growth as a global financial group will require us to predict various risks and develop proactive management foundations on a group-wide basis to address these risks.

Furthermore, we will continue to diligently streamline our operations by utilizing digitalization, revising business promotion frameworks, and consolidating administrative functions so that we may secure resources that can be allocated to priority fields while increasing investments in new businesses.

Sustainability Initiatives

In response to the ever-changing circumstances surrounding climate change and other sustainability issues, the Global Business Unit is augmenting its solution providing capabilities to better address customers’ management issues.

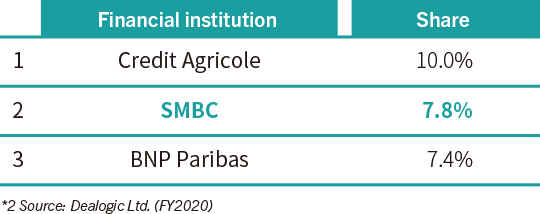

In FY2020, we accelerated our green finance initiative in Europe, the United States, and other overseas markets, thereby climbing to the No. 2 position in global league tables with regard to green loan amounts. At the same time, we took steps to enhance our proposal capabilities as a global solution provider. Specific areas targeted included advisory services pertaining to customers’ ESG strategies and disclosure as well as peripheral advisory services related to financing arrangement and asset portfolio reconstruction to incorporate decarbonization and energy transactions. As one such initiative, in February 2021 we provided a loan to the U.S. subsidiary of a Japanese company in the US$1,100 million financing bracket that receives preferential interest rates based on ESG ratings, a first for a Japanese bank. Looking ahead, we will accelerate our initiatives by taking part in various cutting-edge projects.

Moreover, through Bank BTPN, we began providing BTPN Wow!, a service that allows customers without bank accounts with Bank BTPN to perform banking transactions through messaging services. In addition, its subsidiary, Bank BTPN Syariah Tbk PT provides financing that conforms to the requirements of the Islamic faith primarily to low-income women. In these ways, we are working to provide financial services that can be used by a wide range of people.

Global League Table (Green Loan Amounts*2)