Business Strategies for Creating Value

The Global Markets Business Unit offers solutions through foreign exchange, derivatives, bonds, stocks, and other marketable financial products and also undertakes asset liability management (“ALM”) operations that comprehensively control balance sheet liquidity risks and interest rate risks.

The Global Markets Business Unit is, as market risk professionals, committed to enhancing risk-taking skills for our investment portfolio while continuously supplying customers with high levels of value. To support these efforts, we are focused on analyzing the various phenomena that occur throughout the world based on the Three "I" s of Insight, Imagination, and Intelligence in order to forecast the market trends that will emerge in the future or, in other words, discern the underlying essence of world affairs.

In FY2020, the COVID-19 pandemic had a massive impact on the flow of people and goods and on the market environment itself. In our portfolio management efforts, we assessed that market participants would be looking to transition from a phase of crisis response to a phase of preemptively acting in anticipation of future economic recovery. We responded by flexibly rebalancing our holdings of equities and bonds and thereby succeeded in generating a profit. At the same time, we maintained stable foreign currency funding to meet the funding needs of customers. In sales and trading, meanwhile, we sought to develop a full understanding of customer needs so that we could address these needs by providing the optimal solutions.

Currently, governments and central banks around the world are continuously providing economic support to an unprecedented degree, making the outlook pertaining to asset prices and inflation increasingly uncertain. In addition, customer needs are constantly growing more diverse, as indicated by the advancement of the digitalization trend and the growing interest in social issues. In FY2021, the second year of the Medium-Term Management Plan, we will need to keep demonstrating our true value by reading the market trends emerging to create solutions that customers choose. Accordingly, the Global Markets Business Unit will continue to dedicate ourselves to face the markets sincerely with an even greater commitment to contributing to the growth of customers and of SMBC Group.

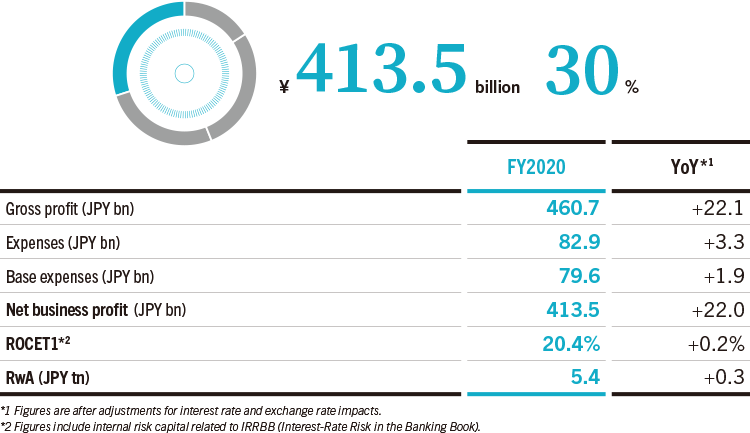

Contribution to Consolidated Net Business Profit (FY2020)

PRIORITY STRATEGY 1

Flexible Portfolio Management in Response to Market Changes

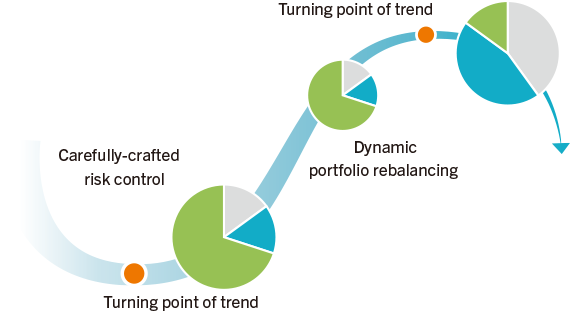

The strength of the Global Markets Business Unit lies in its ability to dynamically adjust its portfolio to maximize earnings by accurately capturing market trends through proactive observation of market fluctuations.

By making use of the Three "I" s, each unit employee collects and analyzes information with regard to various phenomena and thoroughly discusses these phenomena with others. Then, they make positions in accordance with the scenarios formulated through this work, after which they review the results and validity of these positions. The consistent application of this iterative process is the only way we can hone our ability to read the markets.

The Medium-Term Management Plan calls on us to enhance our portfolio management by branching out from managing assets mainly in developed countries to exploring new revenue sources through means such as dealing in a more diverse range of investment products and employing investment methods that take advantage of alternative data.

Overview of Portfolio Rebalancing

PRIORITY STRATEGY 2

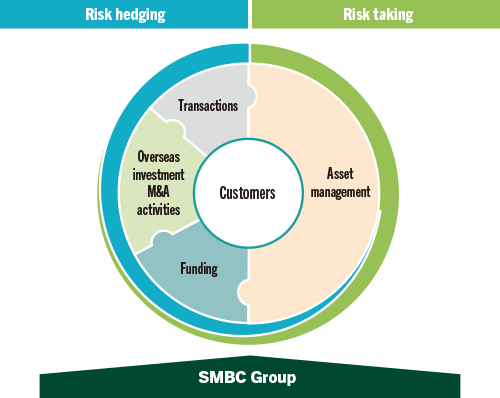

Enhancement of Solutions Provided through Marketable Financial Products

The Global Markets Business Unit is expanding its product lineup and enhancing coordination between domestic and overseas product sales teams in order to respond to the risk-hedging needs associated with customers’ businesses and balance sheets and the risk-taking needs related to customers’ asset management and investment activities. By visualizing what kind of market risks customers are facing, we continue to deliver solutions tailor-made to the circumstances of each customer. We are also developing and strengthening systems on a global basis for supplying various products based on customer needs. Furthermore, we are addressing the rise in electronic transactions by enhancing foreign exchange platforms to provide higher levels of convenience to customers.

PRIORITY STRATEGY 3

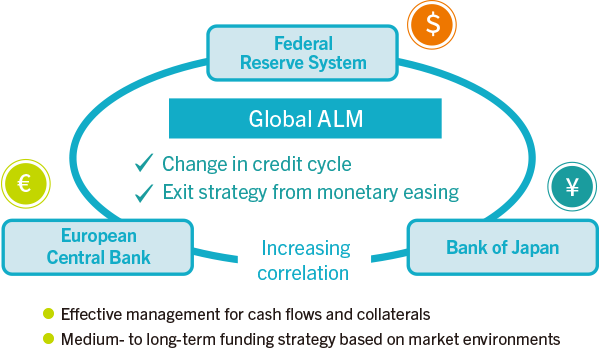

Development of Robust Foreign Currency Funding Base

The Global Markets Business Unit is taking steps for foreign currency funding to balance between ensuring stability and pursuing cost efficiency so that it can continue to support customers’ businesses through lending. For this purpose, we seek to expand our investor base and diversify funding methods. Initiatives toward these ends have included issuing foreign currency denominated covered bonds along with regular straight bonds and utilizing cross-currency repo transactions.* In addition, we make funding strategies by taking into account the structure of SMBC Group’s balance sheet and the market environments. Furthermore, we have integrated our ALM departments that were in charge of JPY and foreign currency to create a system for proactively responding to changes in various aspects of the global financial market, including financial regulations. This integration was conducted to facilitate effective balance sheet control from a long-term perspective.

- *Cross-currency repo transactions are forms of foreign currency funding backed by Japanese government bonds, etc.

Sustainability Initiatives

The Global Markets Business Unit regularly issues green bonds from which procured funds are only used for eco-friendly projects, such as renewable energy projects.

In October 2015, we became the first Japanese private financial institution to issue U.S. dollar-denominated green bonds. In the years that followed, we proceeded to expand the scope of investors served with our green bonds, becoming the first private company in Japan to issue green bonds for individual investors in December 2018 and then issuing green bonds through a public offering in the United States in January 2021. To date, we have floated five green bond issues in Japan and overseas, procuring a total of approximately US$2.5 billion. In these issues, we carefully explained our sustainability initiatives to investors to foster mutual understanding.

SMBC Group possesses a strong track record in project finance for domestic and overseas solar and wind power generation projects and other renewable energy projects. Going forward, we will seek to make greater contributions to market growth and to environmental preservation as Japan’s leading issuer of green bonds.