Business Strategies for Creating Value

The Wholesale Business Unit contributes to the development of the Japanese economy by providing financial solutions that respond to the diverse needs of domestic companies in relation to financing, investment management, M&A advisory, and leases through a united Group effort.

Faced with Japan’s negative interest rate policy and a continuously challenging operating environment, the Wholesale Business Unit mustered the collective strength of SMBC Group to deliver sophisticated solutions and carry out operations with an extensive focus on profitability. It was thereby able to maintain high levels of asset efficiency.

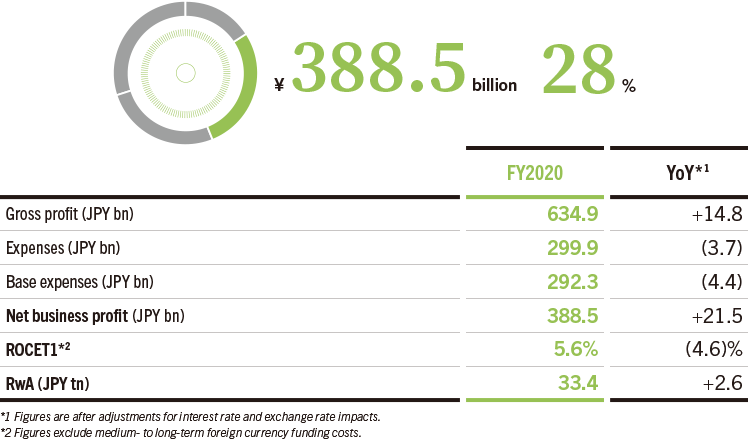

In FY2020, our focus was supporting the business continuity of customers and providing smooth funding support in response to the COVID-19 pandemic. At the same time, we addressed, as a united group, the rapid changes in customers’ management issues and needs seen amid the transformation of social structures. Our approach entailed supplying an array of solutions for business reorganization alongside the solutions of its cashless and payment service businesses and real estate businesses. We were thereby able to bring a number of proposals and projects to fruition. As a result, all Group companies in the Wholesale Business Unit achieved their net business profit targets while the unit as a whole posted consolidated net business profit of ¥388.5 billion, an increase of ¥21.5 billion year on year.

In FY2021, the second year of the Medium-Term Management Plan, the Wholesale Business Unit will bolster coordination among domestic and overseas bases and Group companies to exercise the strength of our group-based comprehensive solutions to the greatest extent possible. At the same time, we will increase the degree to which management resources are allocated to growth fields. Social structures and trends are changing rapidly as the COVID-19 pandemic accelerates digitalization and cashless payment trends and the move to transition to a carbon-neutral society advances. Such changes are causing customers’ management issues to become more complex and sophisticated. Fully committed to addressing these issues, SMBC is ramping up efforts to create new businesses together with customers. Going forward, we will further bolster our strengths, including our keen ability to make proposals, speed, and pioneering spirit, to provide high-value-added solutions through coordination between front-office service and headquarter divisions and thereby contribute to the growth of customers and of the Japanese economy.

Contribution to Consolidated Net Business Profit (FY2020)

PRIORITY STRATEGY 1

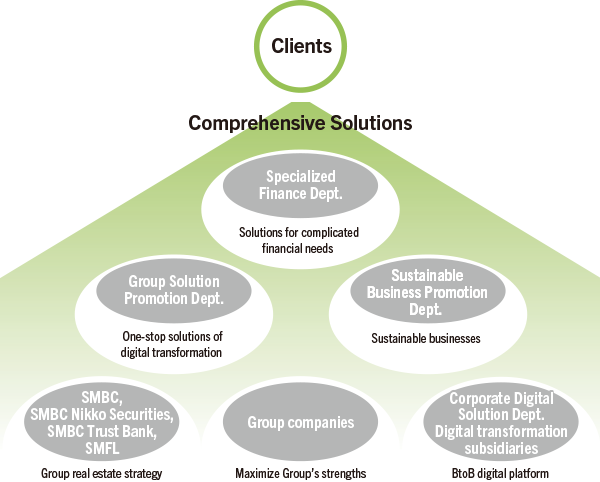

Group-Based Comprehensive Solutions

Social structures and trends are changing rapidly due to the COVID-19 pandemic and the move to transition to a carbon-neutral society, and thus we are bolstering our ability to respond to the massive changes seen in customers’ management issues and in social issues. As part of this process, we will unite our front-office and solution providing departments to provide comprehensive solutions while proactively allocating management resources to expanding business areas so that we can grow together with customers.

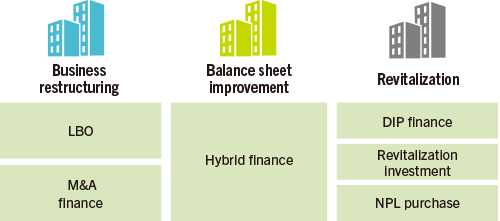

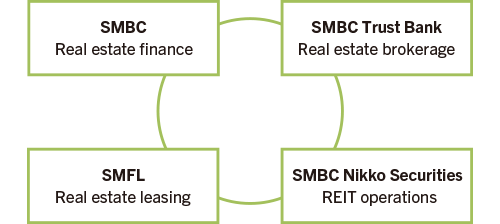

In addition, we are enhancing our sector approach through coordination between domestic and overseas bases and Group companies to cater to the needs of large corporations active on the global stage. To this end, we are developing systems for delivering swift and high-quality proposals in response to increasingly complex and sophisticated management issues pertaining to such matters as business portfolio revision and global M&A activities. We also seek to address the business reorganization, finance improvement, and corporate revitalization needs of customers that are becoming increasingly common amid the COVID-19 pandemic. In catering to these needs, we will supply hybrid finance, corporate revitalization investment, and other solutions based on customers’ circumstances and needs. Promoted on a group-wide basis, these solutions will be offered through the Specialized Finance Department, which was established in April 2021. Meanwhile, we will allocate management resources to real estate businesses while bolstering coordination among Group companies to enhance efforts to propose solutions to customers utilizing real estate through a group-wide approach.

Solutions for Complicated Financial Needs

SMBC Group Real Estate Businesses

PRIORITY STRATEGY 2

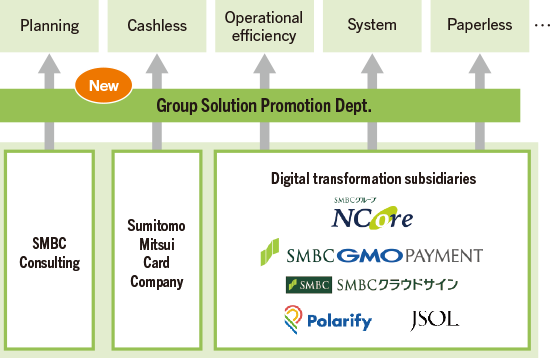

Corporate Digital Solutions

SMBC Group's efforts to utilize digital technologies go beyond the conventional aims of improving operational efficiency; we are increasingly looking to develop new businesses and transform existing businesses to address digital innovation and digital transformation needs. For the purpose of addressing the diversifying needs of customers, the Group Solution Promotion Department was established to help provide one-stop services of the Group companies' digital solutions. Through this new department, we will propose solutions tailor-made to the complex digital needs of customers.

Meanwhile, PlariTown, the corporate digital solution platform launched in FY2020 will be a central component in our efforts to supply various financial and non-financial solutions together with external partners. This is the approach through which we will work to support the digitalization of mid-sized corporations and SMEs and to create new business opportunities.

Sustainability Initiatives

In addition to its prior renewable energy project finance initiatives, the Wholesale Business Unit is promoting engagement with customers through the Sustainable Business Promotion Department, which was established in April 2020 as part of its focus on co-creating businesses to facilitate sustainability-related business reorganizations and the development of sustainable social foundations.

We used around ¥1 trillion to conduct such sustainability-related financing in Japan during FY2020. In addition, we established the GREEN×GLOBE Partners (Japanese Only) community to work toward resolutions to environmental and social issues together with customers. Moreover, we began offering green deposits in April 2021. Money in these deposits is only lent to eligible green projects related to the environment, particularly renewable energy, in order to provide opportunities for customers to utilize their assets for ESG purposes.

community to work toward resolutions to environmental and social issues together with customers. Moreover, we began offering green deposits in April 2021. Money in these deposits is only lent to eligible green projects related to the environment, particularly renewable energy, in order to provide opportunities for customers to utilize their assets for ESG purposes.

Going forward, the Wholesale Business Unit will continue to contribute to the realization of a sustainable society by supporting customers in resolving sustainability-related management issues, such as those pertaining to the fight against climate change and the transition to a carbon-neutral society.