Business Strategies for Creating Value

The top-class companies in the banking, securities, credit card, and consumer finance industries that comprise the Retail Business Unit are addressing the financial needs of all individual customers through services capitalizing on the Group’s comprehensive strength, striving to develop the most trusted and No. 1 Japanese retail finance business.

The Retail Business Unit possesses the No.1 business foundation in Japan in its principal business areas, including wealth management, payment service, and consumer finance businesses, backed by high-quality, face-to-face consulting capabilities and advanced payment and finance products and services.

Customer behavior is undergoing substantial change amid various megatrends affecting financial services for individuals. These trends include the normalization of cashless payments and the move toward performing all banking processes digitally witnessed amid the COVID-19 pandemic as well as the rise in concerns for health seen among senior citizens and for asset building seen among younger generations in light of the upcoming era in which people consistently live to 100. Against that backdrop, SMBC Group was swift in implementing measures to address changing customer needs in FY2020. Specific measures included focusing on digital and remote operations and introducing reservation systems at all branches.

In FY2021, the Retail Business Unit will advance the measures put forth by the Medium-Term Management Plan, namely allocating resources to growth markets, reviewing business processes to reform cost structures, and exploring new businesses utilizing digital and IT technologies, and we are committed to maximizing the success of these measures. At the same time, we will ramp up group-wide cost structure reforms in pursuit of sustainable growth.

In the wealth management business, we will facilitate the growth of the domestic economy by supplying funds to the market while supporting healthy individual asset building to help address people’s post-retirement concerns. At the same time, we will look to capitalize on the business opportunities presented by the overarching shift from saving to asset formation and investment. As for the payment service business, we provide services that are highly convenient for users and business operators alike in response to the increasingly rapid trend toward cashless payments. A unique function of banks, which are charged with protecting customers’ precious assets, is to ensure the smooth transfer of wealth between generations. Recognizing the responsibility this entails, SMBC strives to supply high-value-added services that go beyond the scope of traditional financial institutions to address the diversifying concerns of senior citizens.

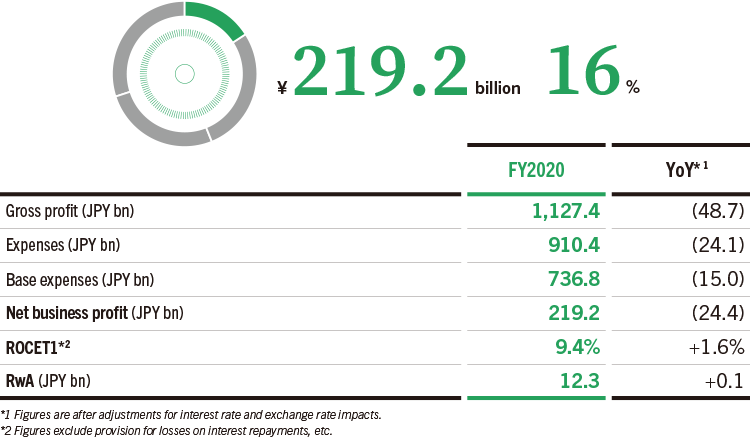

Contribution to Consolidated Net Business Profit (FY2020)

PRIORITY STRATEGY 1

Sustainable Growth in Wealth Management Business

SMBC Group is accelerating sustainable growth through a concerted group-wide effort. We are focused on consolidating assets from other companies and banks on a group-wide basis by practicing a clear division of duties between SMBC, SMBC Nikko Securities, and SMBC Trust Bank in accordance with customer needs and by strengthening systems for intra-Group coordination. For affluent business owners and other individuals, we are enhancing the lineup of products and services offered under the SMBC Private Wealth brand. We are also approaching such customers through a coordinated effort that takes advantage of the strengths of Group companies, thereby aiming to achieve sustainable growth through reliable earnings. Furthermore, we are introducing products that accommodate wide-ranging inheritance needs to bolster our group-wide response capabilities and thus grow transactions among the next-generation of customers.

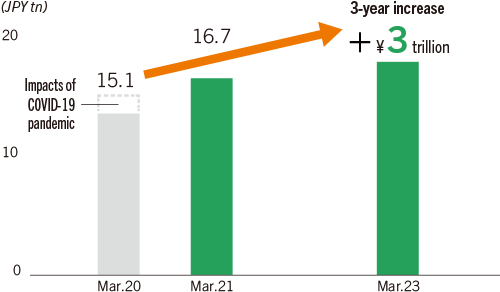

Balance of Fee-Based AUM

PRIORITY STRATEGY 2

Pursuit of No. 1 Position in Payment Service Business

The COVID-19 pandemic triggered the acceleration of the trend toward cashless payments and digitalization. SMBC Group will respond to this trend by delivering even more convenient services. For users, we will continue to enhance our products and services in order to improve convenience and grow our customer base. For business operators, we seek to expand our market share as well as the scope of our business by introducing affordable subscription models for cashless payment terminals and content while also increasing the viability of our products through collaboration with external partners.

As for consumer finance businesses, we aim to provide highly convenient services by improving the user interface and experience of our apps based on rising digitalization needs and by utilizing Group expertise to bolster product lineups.

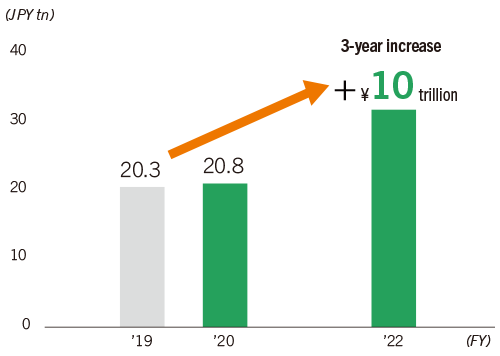

Sales Handled

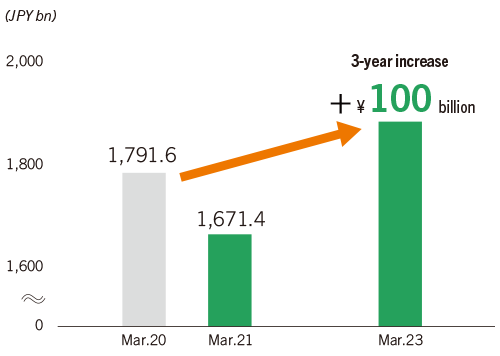

Consumer Loan Balance

PRIORITY STRATEGY 3

Reinforcement of Consulting Businesses through Branch Reorganizations

SMBC is overhauling its SMBC app and other digital infrastructure to expand the range of processes that can be performed entirely online digitally and remotely and to enhance video chat functions. We thereby aim to improve convenience for customers while heightening operational efficiency. At the same time, we will continue efforts to boost the competitiveness of our physical branch network, seeking to raise customer satisfaction by using branches as venues for supplying local customers with the type of consulting services only possible at manned branches. Group companies, meanwhile, are coordinating to develop joint branches to supply a full lineup of services on a one-stop basis in order to improve customer convenience while also increasing the efficiency of branch operations.

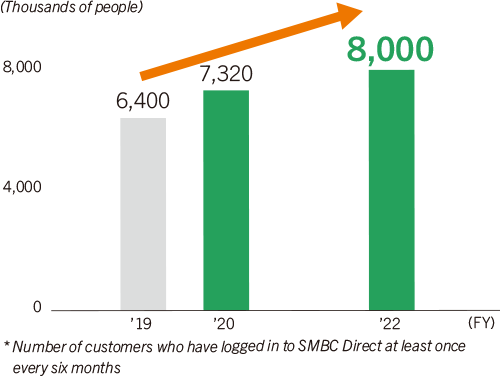

Number of “SMBC Direct” Users*

Sustainability Initiatives

The SMBC Elder Program was launched in April 2021 to support customers as they live longer and to accommodate the diversifying lifestyles among individuals in rapidly aging Japan. Capitalizing on the transactional relationships we have built with individual and corporate customers thus far and the trust earned from these customers, we will provide financial services as well as non-financial services that support health, security, and meaningful lifestyles to help build a society offering peace of mind for all.

We also look to support the realization of a sustainable society. To this end, we offer wealth management products that select investees based on their environmental, social, and governance (ESG) initiatives as well as products focused on companies committed to contributing to society. As we move forward, we will continue to expand our range of products to address a diverse range of customer needs.

SMBC Group is also improving the convenience of its internet banking services and encouraging customers to switch to online passbooks in order to cut back on the amount of paper used for such passbooks.

SMBC Group will continue to work toward sustainability through the services it provides to customers going forward.

Pamphlet for promoting the switch to online passbooks