FY2020 Social Impact Assessment Report

In FY2020, we conducted a social impact assessment to visualize the social impact of the Promise Financial and Economic Education Seminar. The Seminar is at the core of SMBC Group's social contribution activities, and cumulative total participants reached 1,000,000 in February 2020. This assessment was conducted based on an awareness that corporations have become required to bring about social impact through their business activities. This assessment is the first assessment of the social impact of financial and economic education at a financial institution in Japan.

Through this assessment, we will fulfill our duty for stakeholder accountability about the project outcomes while also working to make a more effective program structure and improvements to the program based on the proposals and insights gained.

- FY2020 Social Impact Assessment Report of Promise Financial and Economic Education Seminar(Japanese only) (3,241KB)

- FY2020 Social Impact Assessment Report of Promise Financial and Economic Education Seminar(Appendix)(Japanese only) (321KB)

1. Assessment summary

- ●In December 2020, we conducted a social impact assessment concerning the Promise Financial and Economic Education Seminar at a private high school in Nagoya. The subjects for assessment were 160 first-year students, 131 second-year students, and 74 third-year students. For the first-year students, we conducted a comparison before and after they took the seminar.

- ●We conducted a quantitative analysis using surveys and qualitative analysis using interviews. Interviews were held before and after the seminar with four first-year students.

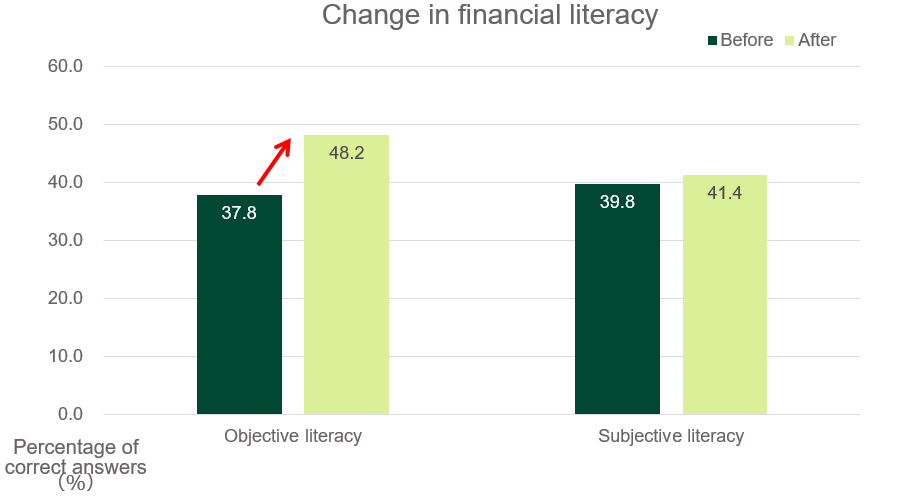

- ●For objective financial literacy, after the seminar there was a significant improvement in scores across all first-year students, improving from 37.8% to 48.2%.

- ●First-year student scores after the seminar increased across all categories of the financial literacy map, and scores were higher than the student scores in the 2019 Financial Literacy Survey in the categories of Life Planning, Basics of Financial Transactions, Basics of Finance and Economy, Loans and Credit, Insurance, and Wealth Building.

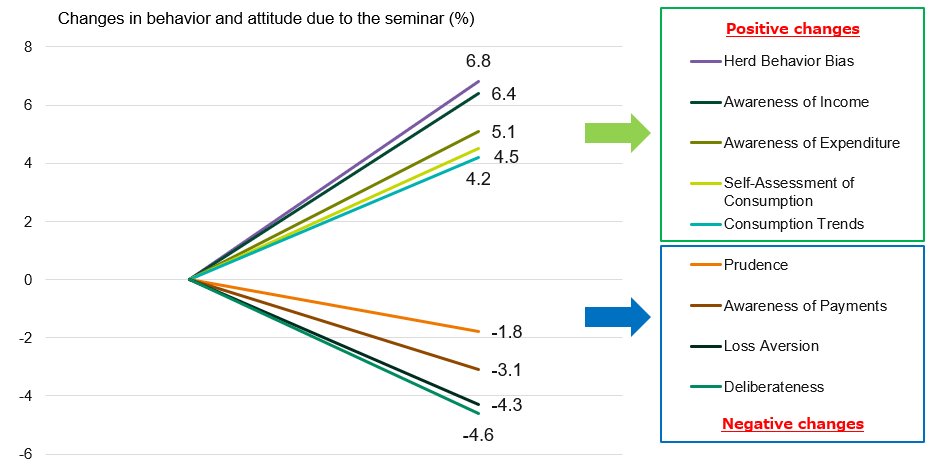

- ●Positive changes were observed after the seminar in the behaviors and attitudes of Awareness of Income, Awareness of Expenditure, Herd Behavior Bias, Consumption Trends, and Self-Assessment of Consumption. On the other hand, negative changes were observed after the seminar in the behaviors and attitudes of Prudence, Deliberateness, Loss Aversion, and Awareness of Payments. It is likely that one reason for this is the change of the self-assessment criteria in the post-seminar review.

- ●When we interviewed students regarding their interest in financial and economic education before the seminar, all students were not particularly interested. However, after taking the seminar, the students were interested in specific topics such as taxation and investing. High school students being interested in new fields and topics they were not interested in until now is considered to be one of the social impacts of this program.

- ●The provision of regular seminars and the multilayering of content could be effective in maintaining and improving financial literacy, and the implementation of ongoing social impact assessments and establishment of control groups is desirable for more detailed analysis.

2. Overview of the subject project

- Project name

- Promise Financial and Economic Education Seminar

- Project developer

- SMBC CONSUMER FINANCE CO., LTD.

- Project contents

- Supporting students and local people responsible for the future to acquire accurate knowledge concerning money so that they can make appropriate decisions by holding free financial and economic education seminars at the customer service plazas or local schools.

- Achievements

- Cumulative total participants Approx. 1,010,000 people(FY2011 to FY2020)

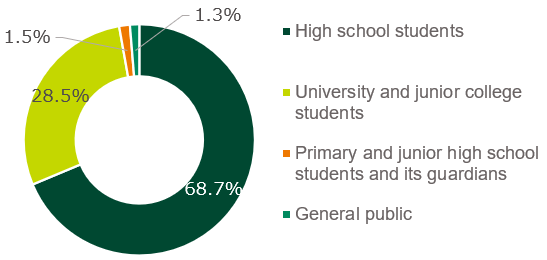

[Demographics of participants]

SMBCCF : Initiatives for Financial and Economic Education (Japanese only)

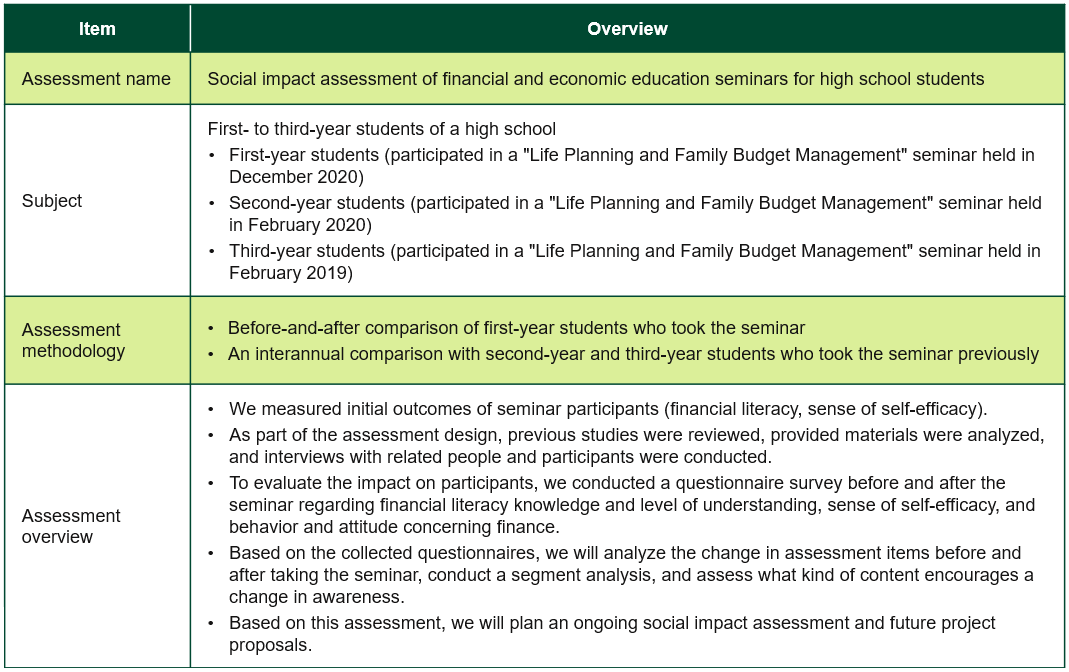

3.Overview of the Social Impact Assessment

- ●The social impact brought about by financial and economic education

- ・The expected social impact is as listed below (1. to 3. are from the report of the Study Group on Financial Education)

- 1.Improvement in life skills and realization of prudent household finances

- 2.Improvement in the quality of financial services

- 3.Supply risk money necessary for economic growth by changing the structure of Japan's wealth building

- 4.Improvement in response to and prevention of financial trouble

- ●Anticipated logic models

- ・From previous studies and the program's materials, logic models that show the expected social impact of financial and economic education anticipate the below.

- ●Overview of implementation

- ・This assessment estimates the program's overall social impact by conducting a survey of high school students, which were the largest demographic of program participants.

4.Main results of the analysis of the Social Impact Assessment

- ●Changes in financial literacy that occur as a result of take the seminar

- ・For objective financial literacy (financial literacy map categories), after taking the seminar, there was a significant improvement in scores across all first-year students, improving from 37.8% to 48.2%.

- [Changes in behavior and attitude (first-year students, before and after)]

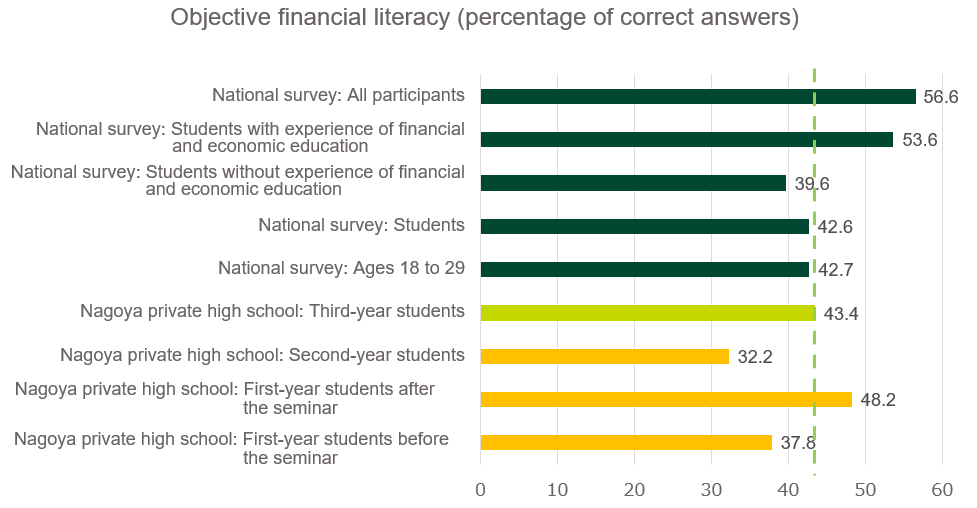

- ●Comparison to the national financial literacy survey

- ・For objective financial literacy, compared to the student scores in the Financial Literacy Survey 2019 (The Central Council for Financial Services Information*), the first-year student scores after taking the seminar are significantly higher. The third-year students who took the seminar two years ago also maintained high scores.

*An organization that engages in a wide range of public relations activities related to finance from a neutral and fair standpoint in cooperation with the Japanese government, the Bank of Japan, and other organizations.

The Central Council for Financial Services Information

- ・As the students in the above survey are university and junior college students over 18 years of age, it can be said that taking the Promise Financial and Economic Education Seminar is beneficial for improving objective financial literacy.

- [Comparison with the national survey in objective financial literacy]

- ・For objective financial literacy, compared to the student scores in the Financial Literacy Survey 2019 (The Central Council for Financial Services Information*), the first-year student scores after taking the seminar are significantly higher. The third-year students who took the seminar two years ago also maintained high scores.

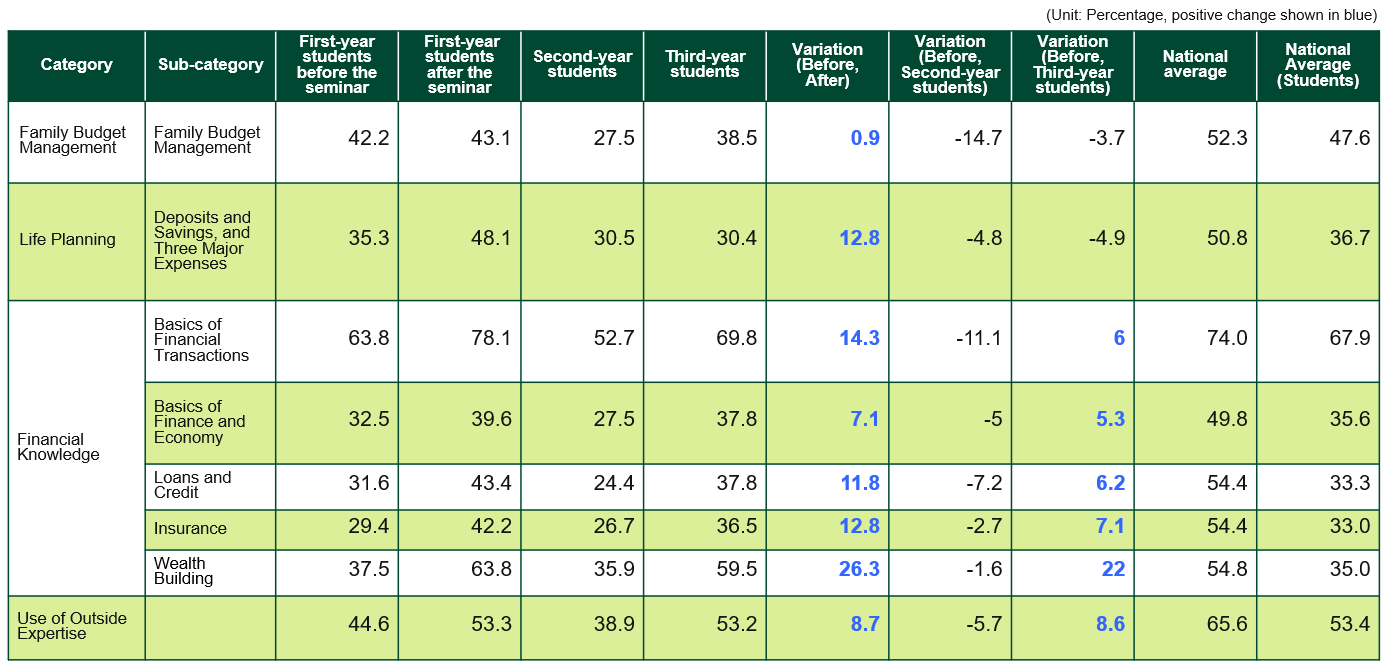

- ●Change in each item of the financial literacy map

- ・The first-year students' score after taking the seminar improved in all categories compared to their score before taking the seminar, and in the categories of Life Planning, Basics of Financial Transactions, Basics of Finance and Economy, Loans and Credit, Insurance, and Wealth Building, scores were higher than the student scores in the Financial Literacy Survey 2019 (Central Council for Financial Services Information).

- ・In the categories of Financial Knowledge and Use of Outside Expertise, third-year students maintained higher scores than the first-year student scores before taking the seminar, and for Financial Knowledge, their scores were higher than the national student score. However, in the categories of Family Budget Management, Life Planning, and Use of Outside Expertise, they were lower than the national student score.

- [Score comparison for each item in the financial literacy map]

- ●Changes in behavior and attitude due to taking the seminar

- ・Of behavior and attitude, positive changes were observed after the seminar for Awareness of Income, Awareness of Expenditure, Consumption Trends, Herd Behavior Bias, and Self-Assessment of Consumption. Negative changes were observed after the seminar for Prudence, Deliberateness, Loss Aversion, and Awareness of Payments.

- [Changes in behavior and attitude (first-year students, before and after)]

- ●Summary of interviews

- ・After taking the seminar, high school students being interested in new fields and topics they were not interested in until now is considered to be one of the social impacts of this program.

- ・In particular, becoming interested in specific topics such as taxation and investment is considered a positive finding.

*The green dotted line shows the score of the third-year students, which even two years after taking the seminar, is still above the national average score of untrained students.

5.Considerations

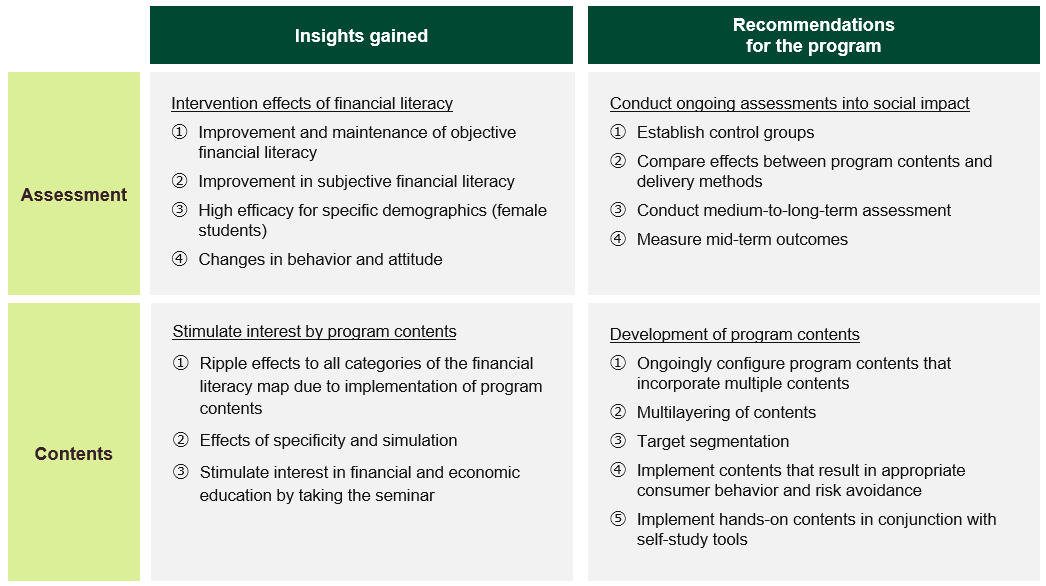

- ●This Social Impact Assessment observed that financial literacy improves by taking the Promise Financial and Economic Education Seminar, and initial outcomes assumed in the logic model was verified.

- ●To further enhance the program's social impact, it might be effective to conduct further review and improvement of contents going forward and conduct ongoing assessment of social impact such as establishing control groups and conducting medium-to-long-term assessment.

- [Recommendations for the program and insights gained from this Social Impact Assessment]