Sustainability Policies & Promotion System

As part of our commitment to realizing a sustainable society, our group has formulated " SMBC Group Statement on Sustainability," which articulates our foundational approach. This declaration explicitly states that we will engage and act together with customers and other stakeholders to contribute to the transformation into a better society.

SMBC Group Statement on Sustainability

Throughout its 400-year history, SMBC Group has continuously upheld its commitment to sustainability. We hereby declare that we will drive forward our efforts to make sustainability a reality. SMBC Group defines sustainability as “creating a society in which today’s generation can enjoy economic prosperity and well-being, and pass it on to future generations.”

Understanding of the Present Situation and Our Role

SMBC Group recognizes that society is presently facing immense challenges, and that urgent and bold actions and transformation are required to transition to a sustainable and resilient world. Based on this understanding, SMBC Group aims to realize Sustainable Development Goals (“SDGs”) as set forth by the United Nations for sustainable development and to resolve social issues. As a financial institution, we will engage and act together with customers and other stakeholders to contribute to the global transformation into a better society.

SMBC Group Sustainability Promotion System

Under the guidance of the Group CSO (Chief Strategy Officer, a member of the board) and the Group CSuO (Chief Sustainability Officer) who oversees and promotes our sustainability-related initiatives groupwide, the Sustainability Division has been established to consolidate functions and knowledge at the group level, and is responsible for the planning and promotion of both corporate and business initiatives. The Corporate Sustainability Committee, which is chaired by the Group CEO, discusses matters pertaining to the spread of sustainability management throughout the Group as well as measures necessary for promoting sustainability. Moreover, we have established the Sustainability Committee as an internal committee of the Board of Directors. The Group CSuO and the Group CRO (Chief Risk Officer) will periodically report to the Sustainability Committee and the Risk Committee. We are continuously enhancing our corporate governance and management frameworks. Furthermore, SMBC Group has incorporated indicators related to sustainability initiatives into executive compensation schemes to accelerate sustainability management.

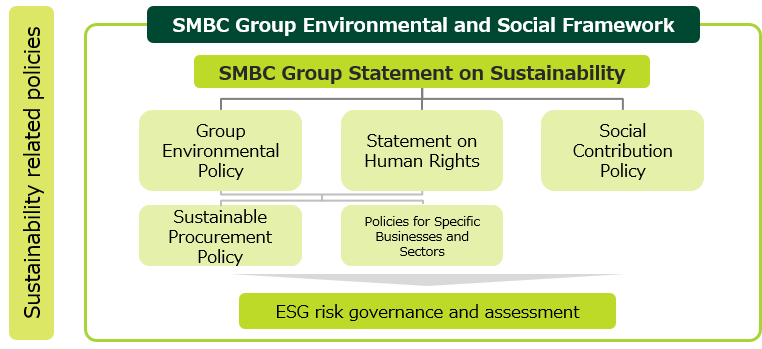

SMBC Group Environmental and Social Framework

SMBC Group has established the “SMBC Group Environmental and Social Framework” in order to articulate its comprehensive stance to the environment and society and contributing to the realization of a sustainable society.

The framework unifies the Group's internal policies and rules regarding the environment and society, and was established and announced after deliberation by the Management Committee. It will be proactively reviewed on an ongoing basis in light of the revision or abolition of specific policies, rules, or procedures, deliberations by the Sustainability Committee or other bodies, changes in the external environment surrounding the Group's business activities, and the results of regular reviews conducted (once a year, in principle) as part of internal audit.

Stances/approaches expressed in this framework are those of the Group as a whole, and group companies implement this framework in line with each of their businesses.

Governance Structure and Approach to sustainability Risks

Governance Structure

SMBC Group has established the Sustainability Committee, an internal committee of the Board of Directors, as a supervisory body and the Sustainability Promotion Committee as an executive body to manage our sustainability initiatives and to deliberate on responses to environmental and social issues. The Sustainability Committee deliberates on matters related to the progress of the Group's sustainability promotion measures, matters related to domestic and overseas trends surrounding sustainability, and other important matters related to sustainability. It reports and provides advices to the Board of Directors on a regular basis. The Sustainability Promotion Committee, meanwhile, deliberates and decides on plans to realize sustainability. These plans are put together in a groupwide basis by the Corporate Sustainability Department of SMFG.

In addition, the Risk Committee, which is an internal committee of the Board of Directors, acknowledges the environment and risks surrounding the Group, and discusses matters related to the handling of risk appetite, matters related to the implementation structure for risk management, and other important matters related to risk management, as well as giving advices to the Board of Directors. Regarding climate change issues, the Sustainability Committee deliberates on the formulation and progress of overall climate change countermeasures. At the Risk Committee, meanwhile, the Group CRO (Chief Risk Officer) regularly reports on the awareness of environment and risks, risk appetite in connection with climate change issues, and the execution of risk management measures related to climate change countermeasures. The Risk Committee deliberates on these matters and provides advices to the Board of Directors.

For specific transactions with substantial environmental and social risks that would likely impact enterprise value adversely or result in a loss of trust in SMBC Group, a body in which Management Committee officers participate, from the perspective of complex risk management, discusses whether to proceed with the transaction as necessary.

Due Diligence

In SMBC Group’s Group Credit Policy, which contains overall financing policy, guidelines and rules, the Group declares not to extend any credit considered problematic in terms of public responsibility, or which may have a negative impact on the environment.

Sumitomo Mitsui Banking Corporation, which handles the Group's core credit operations, obtains non-financial information from customers and utilizes it qualitatively in credit operation, as explained below. Moreover, by conducting environmental and social risk assessments on specific transactions, it properly identifies environmental and social risks and manages them through periodic monitoring.

Understanding non-financial information

At Sumitomo Mitsui Banking Corporation, we recognize our customers' environmental and social impacts from their business activities by understanding not only their financial information, but also non-financial information represented by sustainability, by engaging in dialogues with them. With respect to businesses and sectors that are likely to have an impact on environmental and social risks, we find out about their GHG emissions and what they are doing to address environmental and social risks such as climate change risks, and employ this information as a qualitative factor in credit operation. This non-financial information is updated regularly through monitoring.

In parallel to this, environmental and social risk assessments are also conducted, making our due diligence even more sophisticated and broad reaching.

By gathering non-financial information, we will deepen the quality of engagements with customers concerning sustainability risks, actively support their environmental and social efforts, and work together to address risks that are a cause for concern.

Environmental and social risk assessment

For large-scale projects which may potentially exert a major impact on the environment and society, Sumitomo Mitsui Banking Corporation will conduct appropriate environmental and social risk assessments by performing due diligence in the Sustainability Planning Department.

Through this, we expect project companies to conduct activities for environmental and social consideration, including climate change and human rights, such as addressing the TCFD Recommendations and respecting the FPIC (free, prior and informed consent) of local residents.

For further details about Environmental and Social Responsibility for Large-scale Developemt Projects, please refer to the following link.

Policies for Specific Businesses and Sectors

SMBC Group has introduced policies for businesses and sectors which are likely to have significant impacts on the environment and society. These policies are independently determined in relation to risk management. They are rolled out to SMBC Group companies, including Sumitomo Mitsui Banking Corporation, SMBC Trust Bank, Sumitomo Mitsui Finance and Leasing Company and SMBC Nikko Securities, in line with their businesses, and to enhance their risk management system continuously. The application of this Policy remains subject to compliance with local legal requirements.

Cross-sectoral and Cross-business Policies

SMBC Group will not provide support that falls into the following categories:

- ●Support that may breach social norms such as laws and regulations

- ●Support considered problematic in terms of public responsibility

- ●Support in conflict with public order and morals

- ●Support that may have significant negative impacts on the environment

- ●Support for new projects that are perceived to have a significant negative impact on wetlands specified in the Ramsar Convention and/or UNESCO-designated World Natural Heritage sites

- ●Support for projects that are recognized to involve child labor, forced labor and/or human trafficking

Policies by businesses and sectors

1. Coal-Fired Power Generation

- (Policy)

-

SMBC Group prohibits provision of the following support, excepting support provided to the activities of our customers that are contributing to the transition toward and realization of a decarbonized society:

- ●Support for newly planned coal-fired power plants and the expansion of existing plants

- ●Support for coal-fired power plants with maturity exceeding the end of FY2040

- ●Support for companies whose main business is coal-fired power generation and that do not have any existing transactions, including but not limited to lending, with SMBC Group

- (Understanding of the Business/Sector)

- SMBC Group expects our customers in the Coal-Fired Power Generation sector to establish and publicly announce long-term strategies aimed at realizing decarbonization and other initiatives to address climate change. SMBC Group understands that the provision of additional support to such plants toward decarbonization, such as for Managed Phase Out (MPO) and Carbon Capture, Usage and Storage (CCUS) is needed. SMBC Group will support the activities of our customers contributing to the transition toward and realization of a decarbonized society.

2. Biomass Energy Generation

- (Policy)

-

SMBC Group will support the new construction and expansion of woody biomass energy generation plants*1 only if it is confirmed that the plants use sustainable combustion materials*2.

Moreover, SMBC Group will conduct an environmental and social risk assessment in the case of transactions that are linked to biomass energy generation plants in order to confirm that consideration is given to environmental and social factors such as GHG emissions reduction.

- *1 The term “woody biomass energy generation plants” includes both single fired and co-fired plants.

- *2 The term “sustainable combustion materials” means no logging of primeval forests and/or human rights violations are recognized to have occurred in the production of the materials.

- (Understanding of the Business/Sector)

- SMBC Group will support the activities of our customers that are contributing to the transition toward and realization of a decarbonized society, including biomass energy generation. At the same time, it is important to confirm that no logging of primeval forests and/or human rights violations are occurring in the process of producing combustion materials.

3. Hydroelectric Power Generation

- (Policy)

- For cases in which financing is used for hydroelectric power generation projects, SMBC Group is careful to ascertain the implementation of appropriate measures to mitigate impacts on biodiversity and local communities caused by resettlement, and conducts environmental and social risk assessments whenever we are considering providing support.

- (Understanding of the Business/Sector)

- As the transition to a decarbonized society progresses, hydroelectric power generation will play a greater role in power supply (assuming the absence of drought). However, there is a possibility that dam construction may have significant adverse impacts on biodiversity and local communities. It is particularly important to consider resettlement, loss of livelihood and biodiversity impacts along with hydrological changes such as changes in water flows.

4. Oil and Gas

- (Policy)

-

Environmental and social risk assessment is to be conducted for the following businesses and sectors whenever we are considering providing support. After identifying and evaluating environmental and social risks, appropriate measures should be considered.

-

(1)Oil Sands

Oil sands (tar sands) have relatively high carbon intensity and large environmental impacts are associated with their development. As such, SMBC Group conducts environmental and social risk assessments with a particular focus on soil and water pollution caused by wastewater, deforestation, efforts to conserve biodiversity and considerations for indigenous communities whenever we are considering providing support. -

(2)Shale Oil and Shale Gas

The use of hydraulic fracturing methods during shale oil and shale gas development is believed to cause groundwater contamination and induce earthquakes. SMBC Group carefully monitors whether appropriate mitigation measures have been implemented for these issues, and conducts environmental and social risk assessments whenever we are considering providing support. -

(3)Oil and Gas Mining Projects in the Arctic

The Arctic Circle (an area north of the 66º33’ latitude) is home to both rare ecosystems and indigenous people with a unique culture. For mining projects in this region, SMBC Group conducts environmental and social risk assessments with a particular focus not only on considerations for the environment and indigenous communities but also on measures to conserve biodiversity whenever we are considering providing support. -

(4)Oil and Gas Pipelines

Pipelines are expected to have a wide range of environmental impacts due to deforestation and the potential for oil spills, as well as social impacts on indigenous communities, not only at the time of construction but also post-completion. SMBC Group carefully ascertains whether appropriate mitigation measures have been implemented for these issues and then conducts environmental and social risk assessments whenever we are considering providing support. - (Understanding of the Business/Sector)

-

Oil and gas help contribute to a stable energy supply. However, as the transition to a decarbonized society progresses, consideration must be given to stranded asset risk, mitigation of environmental impacts, and local communities. SMBC Group expects our customers in the oil and gas sector to establish and publicly announce long-term strategies aimed at realizing decarbonization and other initiatives to address climate change. Moreover, SMBC Group will support the activities of our customers that are contributing to the transition toward and realization of a decarbonized society.

5. Mining

(1)Mining (General)

- (Policy)

-

For cases in which financing is used for new mining and the expansion of existing mining projects, SMBC Group conducts environmental and social risk assessments with a particular focus on considerations for environment and indigenous communities, measures to conserve biodiversity, and the elimination of forced labor and child labor whenever considering providing support.

- (Understanding of the Business/Sector)

-

While mineral resources are essential raw materials for industrial activities, consideration for issues such as the impact on indigenous communities, human rights issues like forced labor and child labor, and the impact on biodiversity from mining activities is crucial.

(2)Mining (Coal)

- (Policy)

-

SMBC Group prohibits provision of the following support, excepting support provided for the activities of our customers that are contributing to fossil fuel conversion:

- ●Support for newly planned and expansions of thermal coal mining projects using the Mountain Top Removal (MTR) method

- ●Support for newly planned and expansions of thermal coal mining projects

- ●Support for newly planned and the expansion of infrastructure developments that are dedicated to the aforementioned projects

- ●Support for companies whose main businesses are thermal coal mining or associated infrastructure development that do not have any existing transactions, including but not limited to lending, with SMBC Group

- ●Support for thermal coal mining sector with maturity exceeding the end of FY2030 in OECD countries and the end of FY2040 in non-OECD countries

- (Understanding of the Business/Sector)

-

In addition to the risks of stranded assets associated with the transition to a decarbonized society, it is important to consider human rights with respect to the elimination of forced labor and child labor in coal mining as well as biodiversity issues associated with mining.

SMBC Group expects our customers in coal mining sector to establish and publicly announce long-term strategies aimed at decarbonization and other initiatives to address climate change, such as business related to fossil fuel conversion. SMBC Group will support the activities of our customers that are contributing to fossil fuel conversion.

6. Tobacco Manufacturing

- (Policy)

-

With regard to support for tobacco manufacturers, SMBC Group will confirm that particular issues are being addressed including health hazards and human rights considerations such as forced labor and child labor.

- (Understanding of the Business/Sector)

-

Smoking can cause health hazards, such as lung cancer and respiratory dysfunction. In addition, in relation to the cultivation of leaf tobacco (a raw material of cigarettes), it is important to address human rights considerations to eliminate forced labor and child labor.

7. Palm Oil Plantation Development

- (Policy)

-

For palm oil plantation development projects, we ascertain whether or not they have received certification by the Roundtable on Sustainable Palm Oil (RSPO), which is given for palm oil produced with environmental and social consideration. Support is only provided after confirming that forest resources and biodiversity are conserved when new plantations are developed and that no human rights violations, such as child labor, are occurring. For customers that are yet to be certified, obtaining certification is encouraged and supported, and submission of a plan to acquire certification is required.

For customers who have no plans to acquire RSPO certification, we encourage them to rethink their position and require actions amounting to the same standard as required for RSPO certification.

In addition, we require our business partners to publicly declare their compliance with NDPE (No Deforestation, No Peat, No Exploitation). We also encourage them to enhance their supply chain management and improve traceability to obtain RSPO certification and comply with NDPE through their supply chain.

8. Deforestation

- (Policy)

-

For any business involving deforestation, we provide support only after having ascertained the absence of illegal deforestation or burning, as per the laws and regulations of the relevant country, and the absence of forced/child labor violations.

We also require operators engaged in such business, especially large-scale farm *1 development projects, to publicly declare their compliance with NDPE.

*1 Farm of 10,000 ha or more (e.g. used in cultivation of soybeans, natural rubber, coffee, etc. or as grazing land for livestock)

When supporting forest management*2 projects in countries other than high-income OECD member countries, we require them to obtain FSC (Forest Stewardship Council) certification or PEFC (Programme for the Endorsement of Forest Certification Scheme) certification, and to declare NDPE compliance. If certification is yet to be acquired, we encourage and support its acquisition, and request submission of a plan to do so. We also encourage business operators to enhance their supply chain management and improve traceability to obtain such certification and comply with NDPE through their supply chain.

*2 Forest management refers to the business of nurturing and managing forests, which involves felling trees for the purpose of harvest and sale. This policy does not apply to the felling of trees (thinning) for forest conservation purpose in absence of an intention to harvest and sell.

In addition, when considering support for any large-scale project including but not limited to the above, we unfailingly conduct environmental and social risk assessments, while closely monitoring the applicant’s activities regarding the following points: impact on virgin forests and ecosystems; mitigation measures for the foregoing; inclusion of peatland development; consideration for workers and local residents, etc.

9. Manufacturing of Cluster Bombs and Other Weapons of Destruction

- (Policy)

-

Cluster bombs are considered inhumane and SMBC Group prohibits the provision of support to cluster bomb manufacturers accordingly. In addition, SMBC Group prohibits the provision of support to the manufacturing of other weapons of destruction, including nuclear, biological and chemical weapons and anti-personnel mines.

List of Policies and Statements

Sustainability

Environment

Social

Governance

- Corporate Governance Guideline

- SMFG Executive Compensation Policy

- Principles of Action on Compliance and Risk

- Policies and Measures for Anti-Money Laundering (AML), Countering the Financing of Terrorism (CFT) and Adhering to Economic Sanctions Regulations

- Privacy Policy

- SMFG Group Policies for Anti-Bribery Compliance and Ethics

- Group Tax Policy

- Disclosure Policy

- Cyber Security Management Statement