Corporate Governance

Basic Approach

We position "Our Mission" as the universal philosophy underpinning the management of SMBC Group and as the foundation for all of our corporate activities. To achieve the approach outlined in "Our Mission," we consider the strengthening and enhancement of corporate governance a top-priority issue as we pursue effective corporate governance.

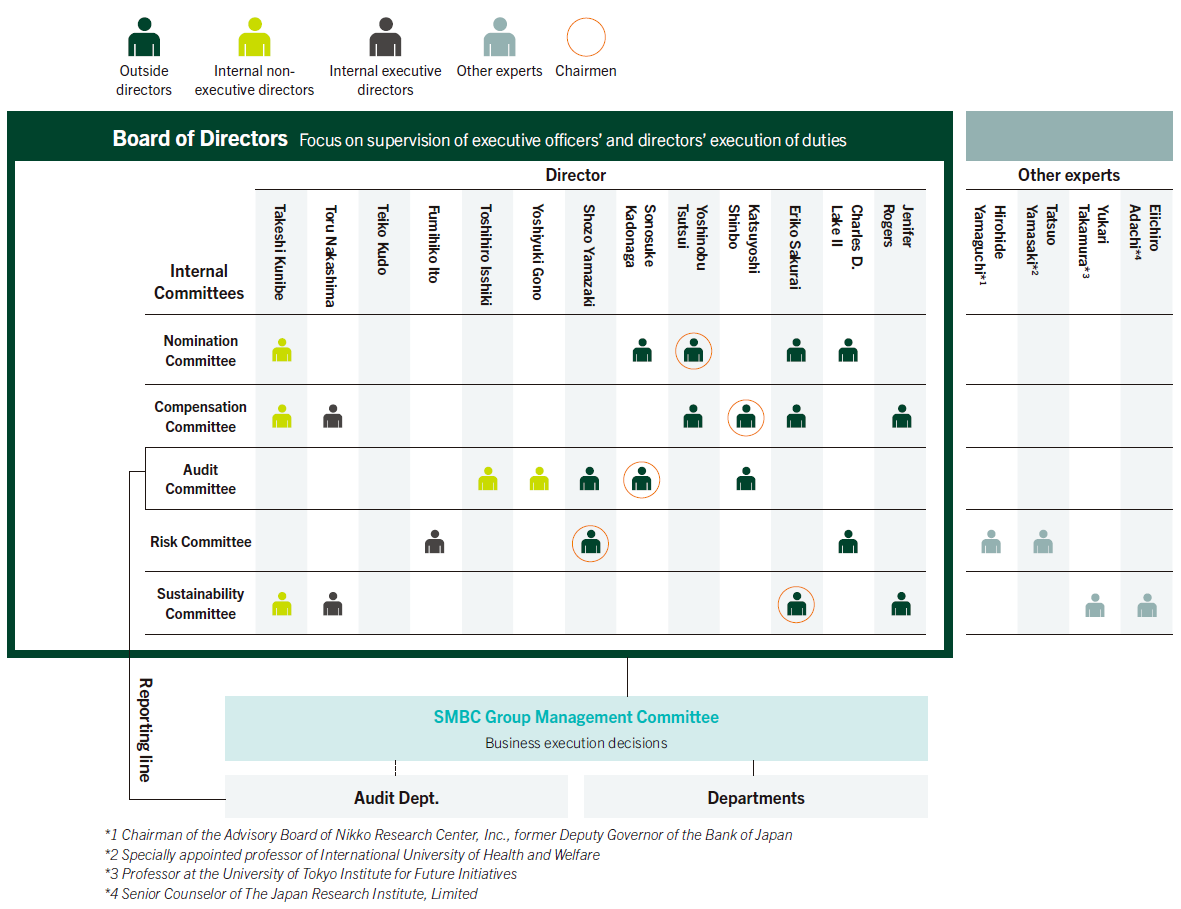

Sumitomo Mitsui Financial Group’s Corporate Governance System

SMFG Group employs the Company with Three Committees structure. This structure was adopted in order to build a corporate governance system that is globally recognized and is aligned with international banking regulations and supervision requirements, as well as to achieve enhanced oversight of the exercise of duties by the Board of Directors and to expedite the exercise of duties. Core subsidiaries SMBC and SMBC Nikko Securities employ the Company with Audit and Supervisory Committee system described in the Companies Act.

Through the implementation of effective corporate governance systems, we aim to prevent corporate misconduct while also achieving ongoing growth and medium- to long-term improvements in corporate value. We realize that there is no perfect form for corporate governance structures. Accordingly, we will continue working toward the strengthening and enhancement of corporate governance in order to realize higher levels of effectiveness.

- *1:Hirohide Yamaguchi (Chairman of the Advisory Board of Nikko Research Center, former Deputy Governor of the Bank of Japan) and Tatsuo Yamasaki (Specially appointed professor of International University of Health and Welfare) serve as members of the Risk Committee in the capacity of external experts.

- *2:Yukari Takamura (Professor at the University of Tokyo Institute for Future Initiatives) and Eiichiro Adachi (Japan Research Institute) serve as members of the Sustainability Committee in the capacity of experts.

As of June 2025

Role of the Board of Directors

The Board of Directors of the Company is primarily responsible for making decisions on basic management policies and other matters that are within its legally mandated scope of authority, as well as overseeing the exercise of duties of executive officers and directors. Authority for decisions on execution of work other than decisions legally required of the Board of Directors will, in principle, be delegated to executive officers. The purpose of this delegation is to enhance the oversight function of the Board of Directors and to expedite the exercise of duties.

The Board of Directors works toward the realization of “Our Mission” and the long-term growth of corporate value and the common interests of the shareholders. Any action that may impede those objectives will be addressed with impartial decisions and response measures.

The Board of Directors is also responsible for establishing an environment that supports appropriate risk taking by executive officers. It is developing systems for ensuring the appropriateness of SMBC Group’s business operations pursuant to the Companies Act and other relevant legislation in order to maintain sound management.' Another responsibility of the Board of Directors is exercising highly effective oversight of executive officers from an independent and objective standpoint. Accordingly, the Board of Directors endeavors to appropriately evaluate company performance and to reflect these evaluations in its assessment of executive officers.

Examples of matters discussed by the Board of Directors

- ●Progress of the Medium-Term Management Plan and business plans

- ●Global strategy/Inorganic strategy

- ●Digitalization initiatives

- ●Human resources initiatives (Human capital investment)

- ●System strategy policy, cybersecurity, and data governance

- ●Global compliance

- ●Policy for equity holdings

- ●Focused supervision of SMBC Nikko Securities in light of the administrative action taken by the Financial Services Agency

- ●Initiatives to create social value (including sustainability promotion)

- ●Capital policy (ROE and PBR improvement)

- ●Response to geopolitical risks/Response to trends in the financial markets

Initiatives for Improving Corporate Governance

| 2002 |

|

|---|---|

| 2005 |

|

| 2006 |

|

| 2010 |

|

| 2015 |

|

| 2016 |

|

| 2017 |

|

| 2019 |

|

| 2020 |

|

| 2021 |

|

| 2023 |

|

| 2024 |

|

Composition of the Board of Directors

The Board of Directors is composed of directors of varied backgrounds and diverse expertise, experience, genders, and nationalities.

As of June 27, 2025, the Board of Directors is composed of 13 members. A majority of these, seven directors, are outside directors. The chairman of the Board of Sumitomo Mitsui Financial Group, who does not have business execution responsibilities, serves as the chairman of the Board of Directors. This membership ensures an objective stance toward supervision of the exercise of duties by executive officers and directors.

Outside directors serve as chairmen and members of the Company’s legally mandated and voluntarily established committees. When necessary, outside directors request reports on compliance, risk management, and other matters from relevant departments to promote appropriate coordination and supervision.

Skills Matrix of Directors

Directors have been selected for their knowledge and experience in corporate management, finance, global business, legal affairs/risk management, financial accounting, IT/DX, sustainability, and other areas in order to exercise sufficient supervisory functions as a Board of Directors of a global financial group, expected to contribute to the further development of SMBC Group.

- *1:◎indicates Chairman

- *2:The items listed in “Skills Matrix of Directors” are areas particularly expected of the relevant directors and do not represent the entirety of the knowledge and experience possessed by the directors.

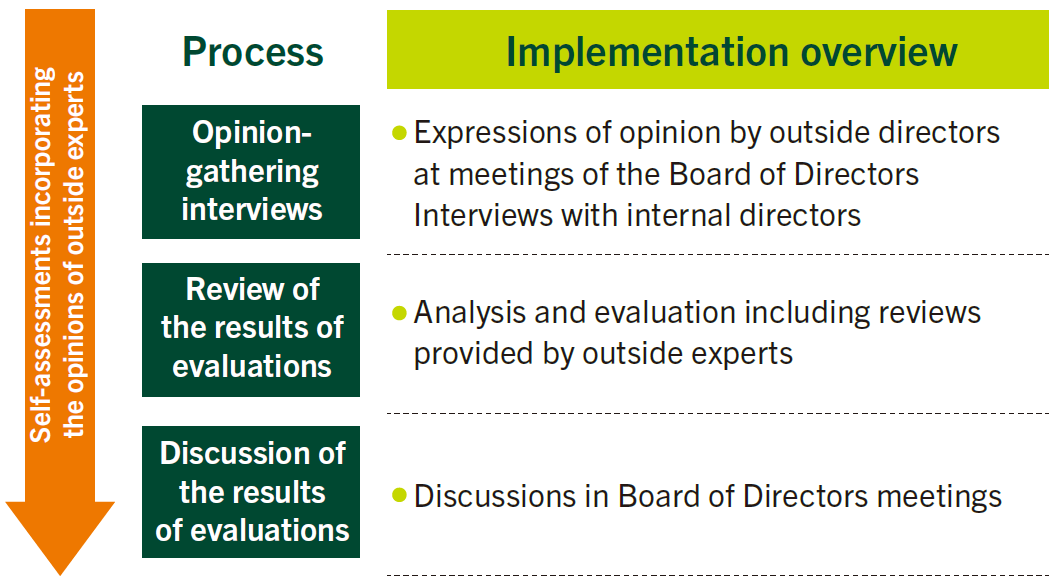

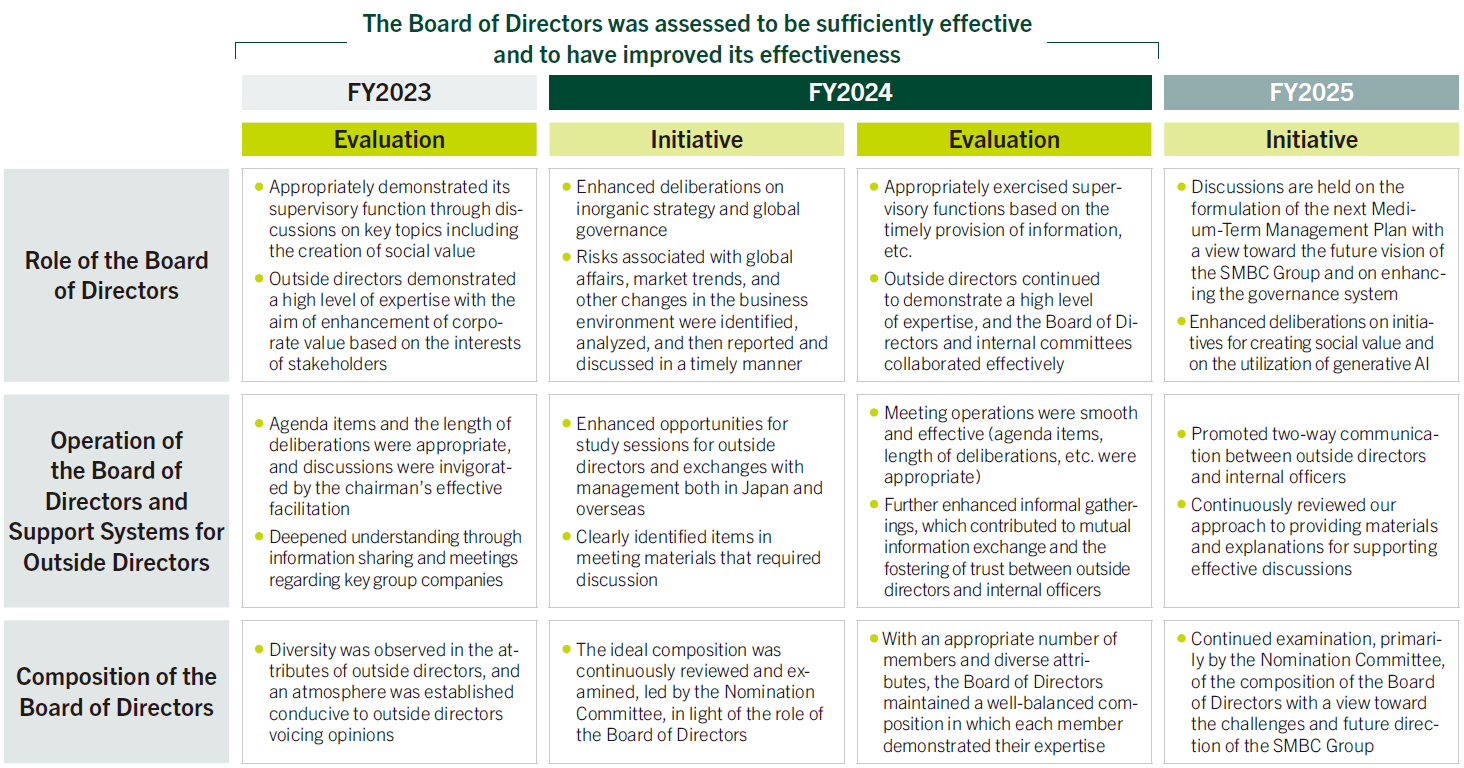

Evaluation of the Effectiveness of the Board of Directors

The “SMFG Corporate Governance Guideline” contains provisions on evaluating the effectiveness of the Board of Directors. In accordance with these provisions, the Board of Directors conducts annual analysis and evaluation to determine whether it is executing its duties in line with the guideline, and discloses the findings of these.

In FY2024, the evaluation focused on the role of the Board of Directors, operation of the Board of Directors and support systems for outside directors, and composition of the Board of Directors, for which provisions exist in Japan’s Corporate Governance Code and the “SMFG Corporate Governance Guideline.” All five outside directors were asked for their opinions regarding these areas at meetings of the Board of Directors held in April and May 2025, with interviews of internal directors conducted thereafter. Discussions were held at Board of Directors’ meetings in June based on the findings of these interviews with internal directors, after which analyses and evaluations were carried out to determine whether the Board of Directors is executing its duties in line with the “SMFG Corporate Governance Guideline.” Reviews by knowledgeable experts from developed nations are received at each stage of the evaluation process.

Overview of Results of Evaluation of the Effectiveness of the Board of Directors

In FY2024, the Board of Directors was assessed to be sufficiently effective and to have improved its effectiveness, as a result of efforts to raise the level and effectiveness of deliberations at Board of Directors meetings following appropriate actions taken in response to the findings of the previous effectiveness evaluation. Based on the results of the latest effectiveness evaluation, along with diverse opinions by directors and recommendations by external experts gathered through the series of processes, the Board of Directors is working to further enhance its effectiveness by promoting mutual understanding between outside directors and internal officers and employees and by discussing fundamental issues aimed at enhancing corporate value.

PDCA Cycle for the Evaluation of the Effectiveness of the Board of Directors

Activities of Internal Committees (FY2024)

| Main role | Number of meetings (average attendance rate) |

Activities | |

|---|---|---|---|

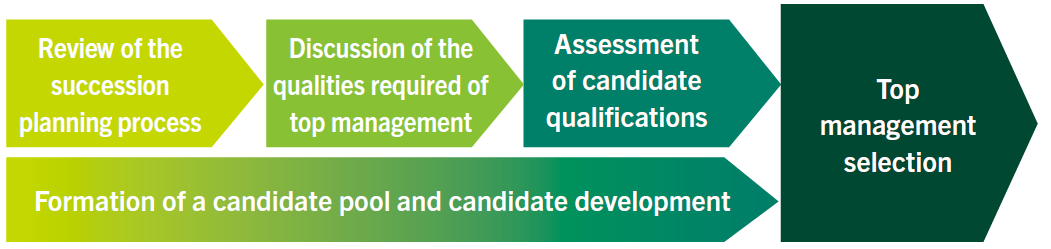

| Nomination Committee | The Nominating Committee is responsible for preparing proposals regarding the appointment and dismissal of directors to be submitted to the general meeting of shareholders. The committee deliberates on matters including those related to future top management selection and personnel decisions pertaining to officers of major subsidiaries. |

4 meetings (100%) |

|

| Compensation Committee | The Compensation Committee is responsible for setting policies for determining the compensation of directors,corporate executive officers and executive officers of the Company as well as individual remuneration for directors and corporate executive officers of the Company.The committee also deliberates on policies for setting the compensation of the executive officers of major subsidiaries and the individual remuneration for executive officers of the Company. |

7 meetings (100%) |

|

| Audit Committee | The Audit Committee is responsible for auditing the execution of duties by directors and executive officers of the Company, preparing audit reports, and determining the content of proposals related to the accounting auditor to be submitted to the general meeting of shareholders. |

14 meetings (99%) |

|

| Risk Committee | The Risk Committee is responsible for deliberation on important matters relating to risk management, including environmental and risk awareness, operation of the Risk Appetite Framework, and implementation of risk management systems, and provides counsel to the Board of Directors on these matters. |

4 meetings (100%) |

|

| Sustainability Committee | The Sustainability Committee is responsible for deliberating on the progress of measures to create social value, domestic and overseas conditions surrounding sustainability, and other important matters. It reports to and advises the Board of Directors. |

2 meetings (100%) |

|

Support Systems for Outside Directors

The Company recognizes that outside directors

require an in-depth understanding of the Group’s

business operations and business activities.

Accordingly, we continually endeavor to supply

outside directors with the business activity information

and insights that are necessary to supervise

management while also providing them with

the opportunities needed to fulfill their roles.

In FY2024, we carried out the initiatives

indicated

at right.

Outside directors visit Group company location in New York

Outside directors visit Sumitomo Mitsui DS Asset Management

- ●Participation in meetings of general managers of core Group companies and other executive team meetings, tours of domestic and overseas bases of Group companies, and discussions with officers at overseas bases and presidents of Group companies for facilitating a greater understanding of business operations and business activities

- ●Informal meetings between outside directors and relevant departments on topics including the revision of SMBC’s personnel system and the businesses of Group companies

- ●Explanatory sessions on Board of Directors’ meeting agenda items prior to board meetings to assist in the understanding of items

- ●Study sessions led by external experts on sustainability, data governance, and Central Bank Digital Currencies

- ●Timely and effective provision of information on the proceedings of internal meetings, etc. to outside directors

- ●Outside directors-only meetings

Outside Director Independence Standards

In order to be classified as independent, an outside director of the Company must not fall under, or have recently fallen under, any of the following categories:

| 1. Major business partner |

|

|---|---|

| 2. Specialist |

|

| 3. Donations |

A person who has received donations or other payments from the Company or SMBC averaging more than ¥10 million per year or 2% of the recipient’s annual revenue, whichever is greater, over the last three years, or an executive director, officer, or other person engaged in the execution of business of an entity which has received the same |

| 4. Major shareholder |

A major shareholder of the Company or an executive director, officer, or other person engaged in the execution of business of a major shareholder (including anyone who has been a major shareholder, or an executive director, officer, or other person engaged in the execution of business of a major shareholder, within the last three years) |

| 5. Close relative |

A close relative of any person (excluding non-material personnel) who falls under any of the following:

|

See Reference 6 in “SMFG Corporate Governance Guideline” for details.

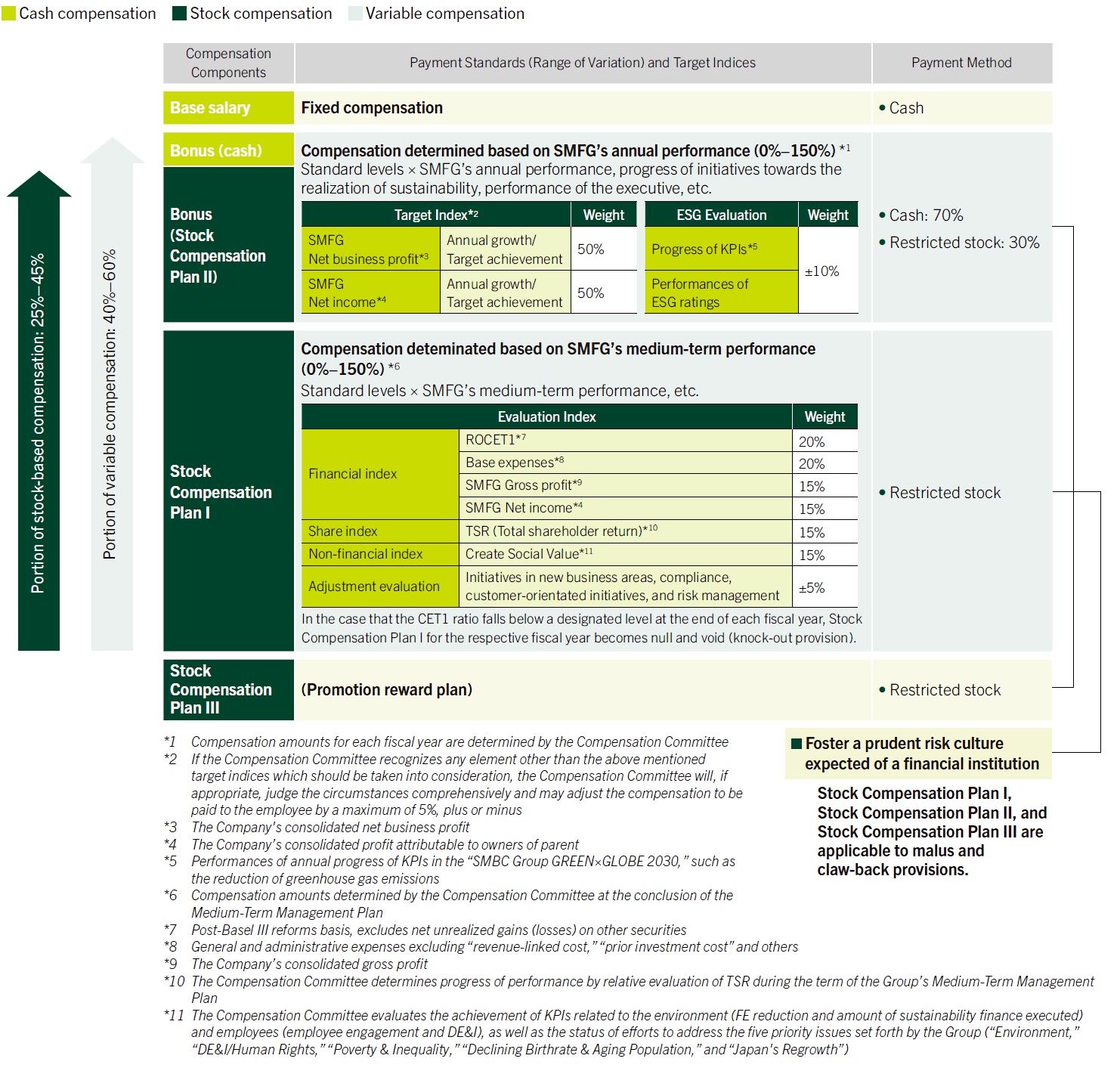

Compensation Program

To facilitate the fulfillment of Our Mission and the realization of Our Vision, SMBC Group’s medium- to long-term vision, we developed a compensation program for Directors, Corporate Executive Officers and Executive Officers (the “Executives”) and introduced Stock Compensation Plans as a part of Executives’ compensation programs, for the purpose of:

- ●Providing appropriately functioning incentives for Executives, strengthening linkage with our short-, medium-, and long-term performance, and

- ●Further aligning the interests of Executives with those of shareholders, by increasing the weight of stock compensation and enhancing the shareholding of our Executives.

Executive Compensation Structure

In principle, executive compensation consists of base salary, bonuses and stock compensation. The performance- linked portion, which fluctuates with the business environment and performance, accounts for approximately 40% to 60% of total compensation, depending on position. Executive compensation and levels are determined by the Compensation Committee based on third-party surveys of manager compensation, economic and social trends, and the operating environment.

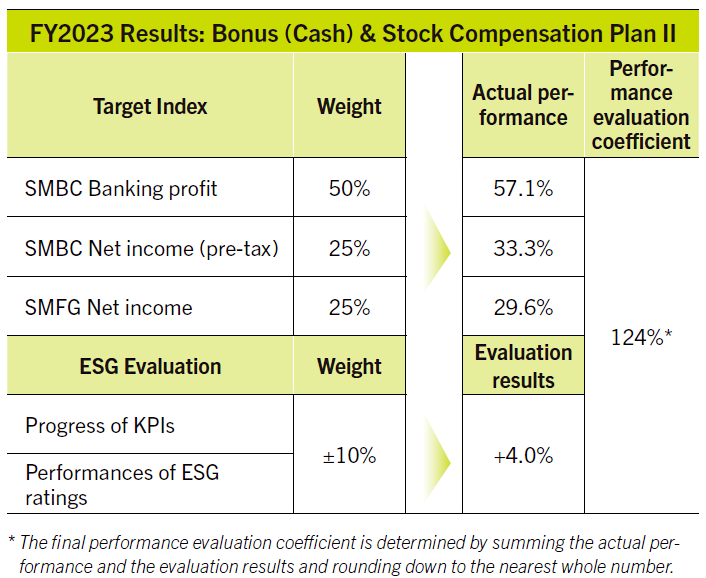

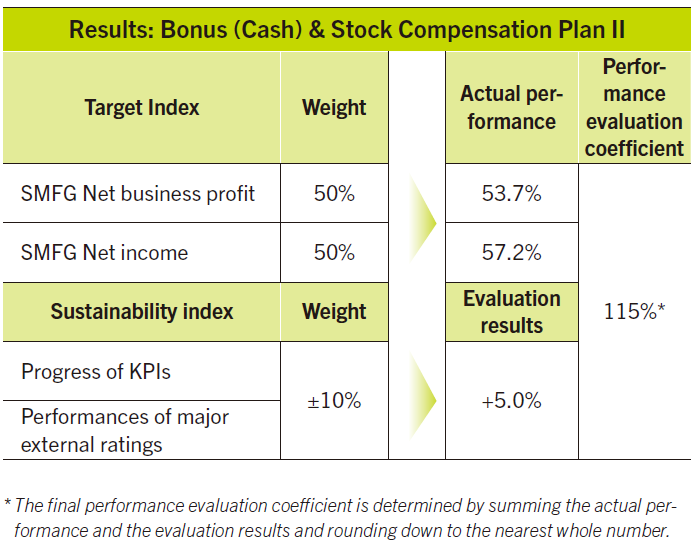

Annual Performance-Linked Compensation

Bonuses (cash) and Stock-Compensation Plan II are paid as annual performance-linked incentives. “SMFG Net Income,” which expresses the final outcome of SMBC Group management, and “SMFG Net Business Profit,” which indicates the profitability of SMBC Group, were adopted as FY2024 performance indexes. These enhance the connection between performance and executive compensation, ensuring that compensation functions as an appropriate incentive for performance. The performance evaluation coefficient of the annual performance-linked compensation is determined by the Compensation Committee each year. The data for FY2024 is provided below.

Medium-Term Performance-Linked Compensation

Stock Compensation Plan I is paid as medium-term performance-linked compensation. In order to improve accountability incentives for our medium- and long-term performance and to increase shareholder value, in addition to financial indexes such as ROCET1 and Base expenses, we have adopted TSR as a share index and Create Social Value as a non-financial index. Also, adjustment evaluation including initiatives in new business areas and compliance, customer- orientated initiatives, and risk management are considered to determine the medium-term performance- linked compensation.

Evaluation of efforts to create social value

We are incorporating an indicator evaluating efforts to create social value into executive compensation with the aim of further increasing our executives’ commitment to achieving a sustainable society.

From FY2022, the Compensation Committee will judge performances of annual progress of KPIs related to sustainability, such as the reduction of greenhouse gas emissions and performances of major external ratings. These performances will be reflected in annual performance-linked incentive by a maximum of 10%, plus or minus.

Create social value has been incorporated in the evaluation index of the medium-term performance-linked compensation since FY2023 as a non-financial index. Specifically, the Compensation Committee evaluates the KPI achievement rate for environmental and employee-related initiatives, as well as efforts to address the five materialities set by SMBC Group.

Ensuring Robust Business Operations

We have also introduced provisions for malus (forfeiture) of restricted stock and the claw-back of vested stock allocated under the Stock Compensation Plans in the event of incidents occurring such as material revisions to financial statements or material damage to the reputation of the Group.

We are working to restrain excessive risk-taking and foster a prudent risk culture expected of a financial institution.

For further details on our corporate governance and our Policy regarding equity holdings, please refer to the following link.

- Corporate Governance: SMBC Group Annual Report 2025

- Securities Report"Yuka Shoken Hokokusho":Status of Corporate Governance P95-P144(Japanese only)

- Corporate Governance Guideline

- Corporate Governance Report (Japanese only)

For details about SMFG's organization management structure, please see the following link.

For details about Equity Holdings, please see the following link.