Customer-Oriented Initiatives

Basic Approach

“We grow and prosper together with our customers by providing them with services of greater value.” Making this commitment a component of “Our Mission,” we work toward the enhancement of Customer Experience (CX) and quality through collaboration among Group companies.

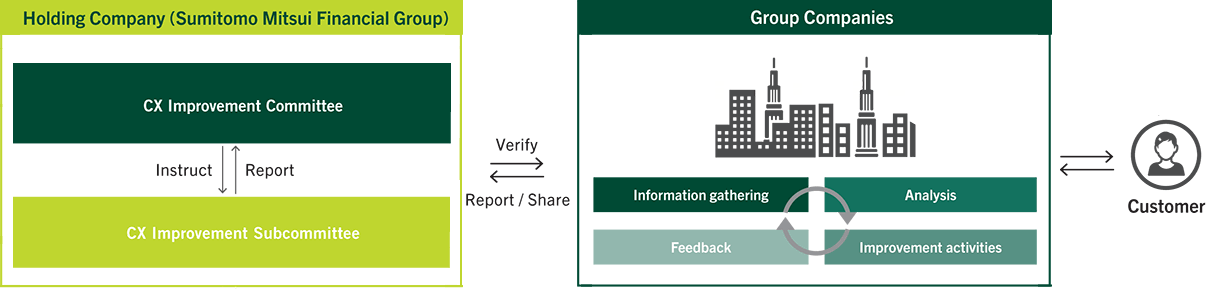

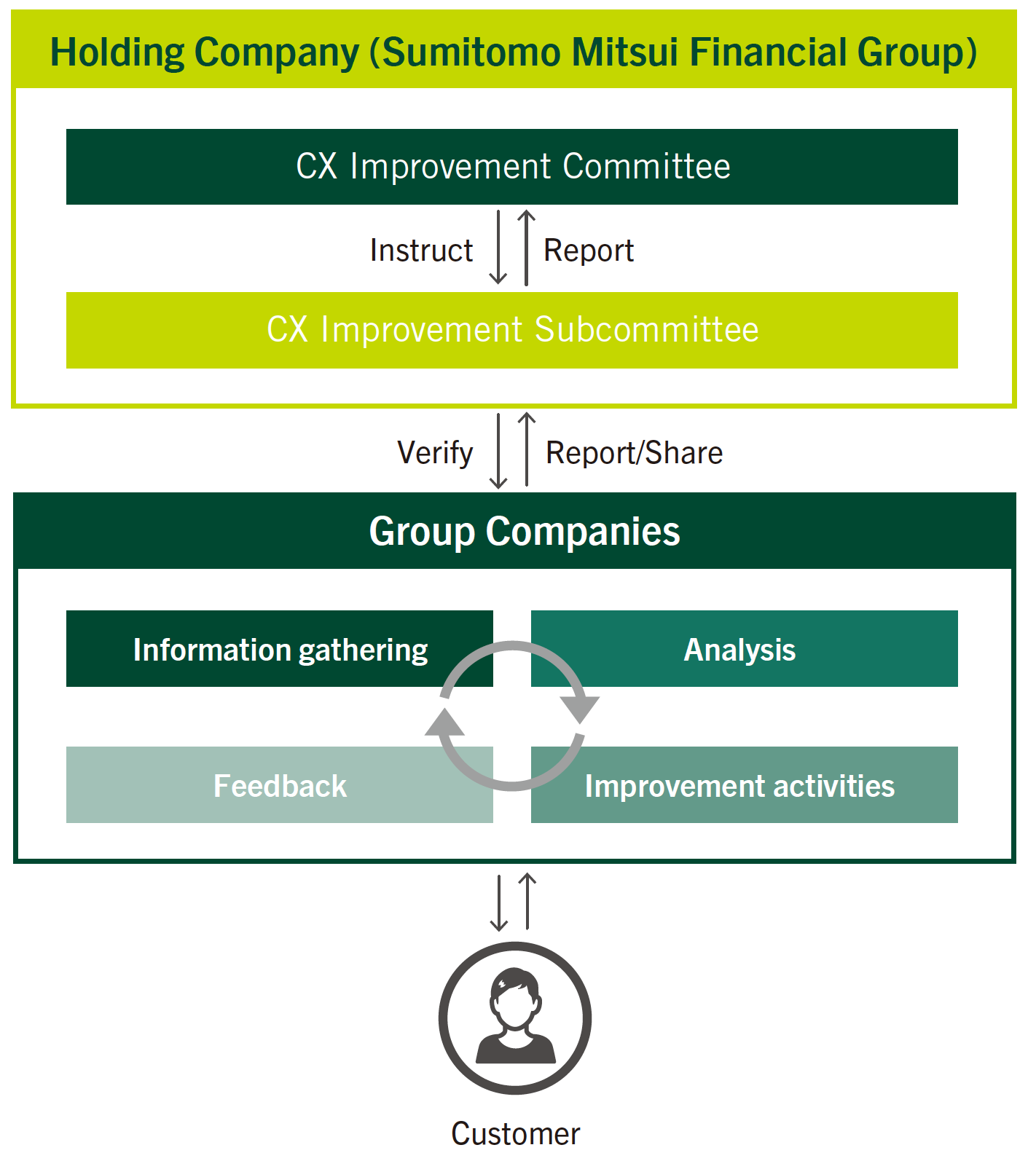

Promotion Structure

We have established the CX Improvement Subcommittee and the CX Improvement Committee as bodies through which we advance initiatives, reinforce management systems, and promote Group coordination related to customer-oriented business operation.

The CX Improvement Subcommittee invites external experts as advisors and engages in exchanges of opinions for further entrenchment of customer orientation. The CX Improvement Committee, which has members of the Group Management Committee as its members, deliberates on measures based on reports from the CX Improvement Subcommittee.

Incorporation of Customer Feedback into Management

Declaration of Compliance with ISO 10002

SMBC, SMBC Nikko Securities, and SMBC Consumer Finance have declared their intent to comply with the ISO 10002 (JIS Q 10002) international standard with regard to their processes for incorporating customer feedback into management.

Initiatives to Improve Product and Service Quality

To provide products and services grounded in a customer -oriented approach, SMBC Group always confirms that a customer need for the products and services exists, and that adequate assessments and responses to potential risks are taken during the planning and development stages. We also carry out periodic quality reviews of existing services. The CX Improvement Subcommittee, composed of external experts and heads of relevant departments, reviews and discusses the efforts of Group companies to improve the quality of products and services.

Customer-Oriented Business Conduct

Based on the “Principles for Customer-Oriented Business Conduct” guidelines on fiduciary duties released by the Financial Services Agency, SMBC Group has formulated its “Basic Policy for Customer-Oriented Business Conduct” and “Basic Policy for Customer-Oriented Business Conduct in the Retail Business Unit.”

Basic Policy for Customer-Oriented Business Conduct* (excerpt)

Initiatives for Promoting Customer-Oriented Business Conduct

SMBC Group will implement the following initiatives to

entrench the principles of customer-oriented business

conduct into its activities.

- 1.Provision of Products and Services that Meet the Best Interests of Customers

- 2.Easy-to-Understand Explanation of Important Information

- 3.Clarification of Fees

- 4.Management of Conflicts of Interests

- 5.Frameworks for Properly Motivating Employees

- 6.Ensuring a Framework to Provide Products and Services that Meet the Best Interests of Customers

Through such initiatives, SMBC Group aims to facilitate the shift from savings to asset formation in Japan. To facilitate customers’ understanding of SMBC Group’s initiatives, we will regularly disclose information on the status of initiatives under our basic policy. To achieve better business operation, we verify the status and outcomes of initiatives, undertake revisions as necessary, and disclose details.

- * Group companies subject to the basic policy:

Sumitomo Mitsui Banking Corporation, SMBC Trust Bank Ltd., SMBC Nikko Securities Inc., Sumitomo Mitsui DS Asset Management Company, Limited

See of the Appendix for more information on the “Basic Policy for Customer-Oriented Business Conduct.”

Policy on Specific Initiatives in the Retail Business Unit

Based on Sumitomo Mitsui Financial Group’s “Basic Policy for Customer-Oriented Business Conduct,” the Retail Business Unit further sets policy on specific initiatives for offering service as a retail company engaged in asset management and asset formation for retail customers. The Retail Business Unit acts under a Plan–Do–Check–Act (PDCA) cycle that entails disclosing specific “Integrity Indicators,” confirming and analyzing their status, and then utilizing them to improve business operation. Through these initiatives, we aim to deliver products and services that truly align with our customers’ needs, thereby realizing the best interests of each customer. By getting to know our customers well and ensuring they make informed decisions, we strive to provide personalized solutions tailored to each individual.

To help customers achieve a fulfilling and secure life, we are committed to adopting a customer-oriented performance evaluation system and enhancing the selection and introduction of appropriate products that serve their best interests.

Policy on Initiatives

- 1.Customer-Oriented Wealth Management Proposals

Based on Medium- to Long-Term Diversified Investment

With a focus on accurately addressing customers’ wealth management needs for asset protection and formation, we will offer customer-oriented wealth management proposals based on medium- to long-term diversified investment. Through this approach, we will focus on the customer-oriented provision of financial products. - 2.Improvement of our Products Lineup Based on

Customer- Oriented Business Conduct

We will enhance our product lineup through ongoing revisions, utilizing third-party evaluations of our products and Group companies’ products as necessary, to accurately address customers’ needs for asset protection or formation. We will also enhance the information we provide to customers and take steps to make it easy to understand. - 3.Enhancement of Customer-Oriented After-Sales Services

We will strive for attentive after-sales services to support long-term holding of our wealth management products with confidence. - 4.Improvement of Customer-Oriented Performance Evaluation Systems

We will improve our performance evaluation systems to encourage employees in carrying out effective customer- oriented sales activities. - 5.Initiatives for the Improvement of Consulting Capabilities

We will continuously enhance our consulting capabilities to ensure that we propose optimal solutions to customers’ wide-ranging needs.

Integrity Indicator*

- 1Increase in balance of investment assets

- 2Balance of investment trusts and fund wraps

- 3Number of customers holding wealth management products

- 4Sales ratio by wealth management product

- 5Investment trust cancellation rate

- 6Fund wrap contract and cancellation amounts

- 7Amount of fixed-term foreign currency deposits, foreign currency balance

- 8Number of investment trust and automatic foreign currency deposit accounts

- 9Investment trust and automatic foreign currency deposit amounts

- 10Number of NISA Accounts

- 11Lump-sum insurance product sales amounts by product

- 12Ratio of investment trust products of Group companies

- 13Investment trust (including fund wraps) sales (contract) amounts (by monthly payment type or other)

- 14Customer ratio by investment trust/fund wrap operation gain/loss

- 15Cost and return of top-ranked (by balance) investment trust products

- 16Risk and return of top-ranked (by balance) investment trust products

- 17Customer ratio by foreign currency-denominated insurance management rating

- 18Cost and return by foreign currency-denominated insurance products

- 19Status of FP qualification holding

- * As of June 2025

See SMBC Group Retail Business Unit’s “Policy on Initiatives for Customer-Oriented Business Conduct” for details.

For information on our customer satisfaction and quality improvement initiatives, please refer to the following link.