Equity Holdings

Policy for Equity Holdings

SMBC Group has set forth and officially announces its ”Policy for equity holdings” and “Standards for the rules for execution of voting rights concerning stocks of equity holdings” regarding Corporate Governance Code Principle 1-4, “Cross-Shareholdings.

1. Policy for equity holdings

- (1)In principle, SMBC Group does not hold the shares of other companies where “the rationale to hold” those shares cannot be recognized.

This policy is in place in order to maintain SMBC Group’s financial soundness taking into consideration the standards of globally operating financial institutions and our proactive response to global regulation. - (2)We determine “the rationale to hold” as a case where the shareholding will contribute to increasing SMBC Group’s corporate value over the medium to long term. We determine this with comprehensive consideration based on (a) the profitability - through an appropriate assessment and understanding of relevant factors, such as associated risks, costs and returns of the holding; (b) the objectives to hold - such as maintaining and strengthening our relationship, capital and business alliance, restructuring support, and (c)other relevant factors.

- (3)We examine "the rationale to hold" on a regular basis. We will sell them by taking into consideration various factors, such as market impact and the financial strategy of the issuers, where an appropriate rationale no longer exists. In the case that where we recognize there is good rationale for doing so, we will continue to hold shares.

2. Rules for Execution of Voting Rights concerning Stocks of Group Equity Holdings

SMBC Group’s standards for the rules for execution of voting rights concerning stocks of equity holdings are as follows.

- (1)In order to appropriately execute rights as a shareholder, we will, in principle, execute voting rights on all proposals as to equity holdings.

- (2)From the perspective of increasing the corporate value of the corporations in which we have equity holdings over the medium to long term, we will appropriately judge whether to vote for or against each individual proposal, taking into account the issuers’ management situation.

Especially, for listed companies, when proposals such as those listed below could affect corporate value over the medium to long term, we will judge the exercise of voting rights, through engagement with an issuer as needed. - Examples of proposals are as follows.

- ●Disposal of retained earnings (when the dividends are paid in deficit or when no dividends in surplus have been paid for a certain period of time)

- ●Appointment of directors or corporate auditors, payment of executive retirement benefits (when a corporate scandal has occurred, or ROE has continuously fallen below the standard for a certain period of time)

- ●Organization restructuring

- ●Takeover defense measure

- ●Offering of stocks

- (3)If there are any concerns about a conflict of interest occurring, we will implement appropriate measures in accordance with the Management Policy Concerning Conflicts of Interest.

Also, the Board of Directors confirms that the voting rights concerning stocks of equity holdings are appropriately exercised based on the above standards.

3. Examination of “the rationale to hold”

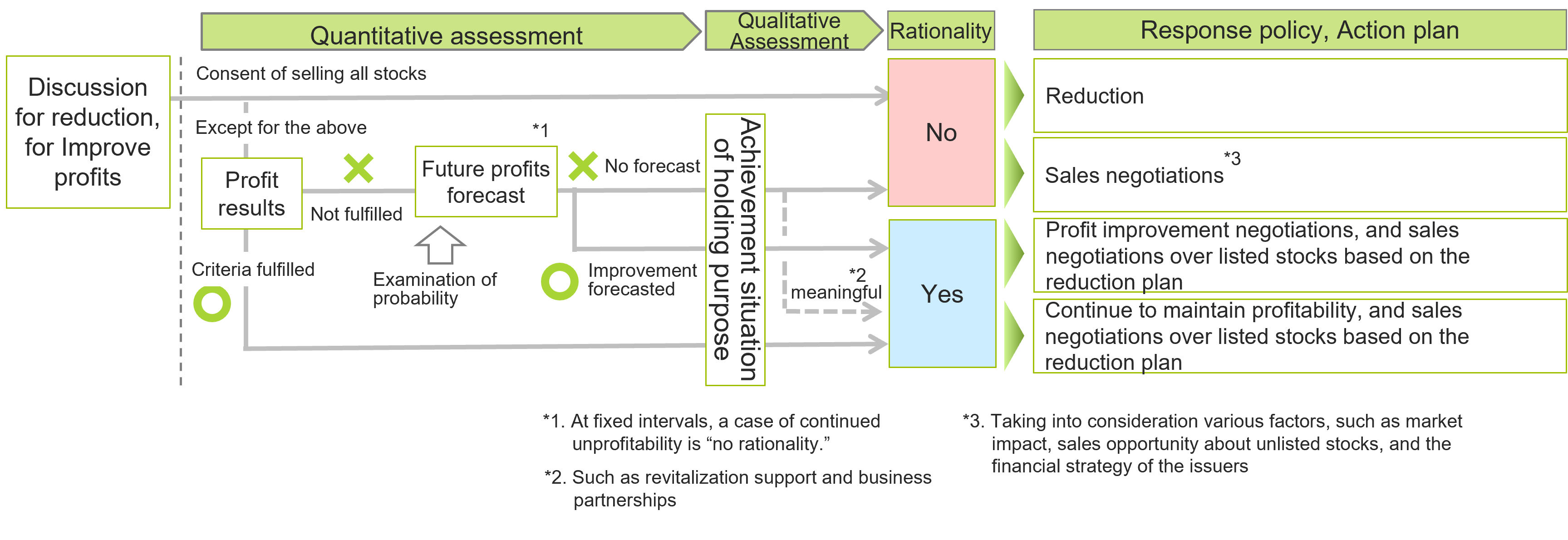

The examination process and examination results for ”the rationale to hold” concerning equity holdings are as follows.

Examination process

Profit indicators

We examine profitability using RARORA, and establish a profitability criteria that is set to a level higher than the capital cost of the company.

- ●RARORA(Risk Adjusted Return on Risk-weighted Asset)

RARORA = Profits after subtracting costs*1 ÷ (Credit risk assets + Share book value risk assets*2)

- *1Minus credit costs that accompany stock holdings and credit, financing costs, and expenses

Includes stock dividends, does not include profits or losses on sale or from valuation - *2Finalized Basel III basis

Also, we measure risk-adjusted return on capital (RAROC), however there are issues with the reliability of this indicator such as when risk assets increase or decrease due to fluctuations in stock prices, and therefore we currently use it as a reference value.

Examination Results

Regarding the examination of ”the rationale to hold” concerning equity holdings in fiscal 2024 (to which the stocks held as of March 31,2025 were subject), as a result of the Board of Directors examining all domestic listed stocks, the profitability criteria was found insufficient, with the number of companies at 9.1% and the book value balance at 8.7%, and ultimately stocks for which it was judged that there was no ”rationale to hold” had a book value balance of 16.2%.Regarding the breakdown of stocks judged without “rationale to hold”, approximately 8.6% are stocks with consent of selling all stocks, and approximately 7.6% are stocks found insufficient for the profitability criteria.

4. Reduction Plan for Equity Holdings

SMBC Group continuously makes efforts to reduce price fluctuation risks from the point of view of maintaining a foundation that can sufficiently demonstrate its financial intermediary function even in a stressful environment in which the prices of stocks drastically fall.

Since we achieved the initial plan to reduce 200 billion yen over three years from March 2023, 1.5 years ahead of schedule, in Nov 2024, we announced a plan to reduce our equity holdings by 600 billion yen (book value) over a five-year period starting from March 31, 2024. In this reduction plan, we reduced 249 billion yen totally.

Reduction plan

- ●We will aim to reduce the balance of equity holdings by 600 billion yen over the five years from March 31, 2024.

- ●With this plan, we will have achieved a cumulative reduction of over 90% since the establishment of SMBC, and the proportion of the market value of equity holdings is expected to reduce less than 20% of our consolidated net assets during the period of the next Medium-Term Management Plan.

Also, Sumitomo Mitsui Banking Corporation’s equity holdings of domestically listed companies were 858 issues as of March 31, 2024, however 250 issues were sold in FY 2024 (including partial sales), meaning that as of March 31, 2025, we held 777 issues.

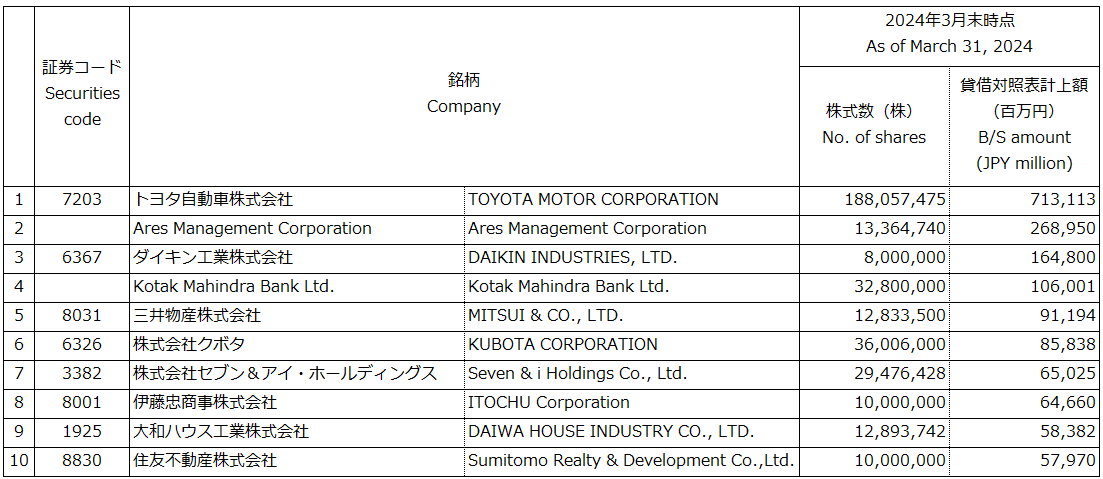

5. Status of Equity Holdings (individual issues)

The top 10 issues which Sumitomo Mitsui Banking Corporation holds as equity holdings are as follows:

Please refer to the excel linked below for the 60 issues of equity holdings disclosed in the Annual Securities Report.